It’s normal to get panicky when the market moves against your position and you start losing money…

In the business of trading any financial instrument, “the dip” happens and will mean different things to different people.

But where is the borderline, how do we calm our nerves and think straight?

Of course, trading without a strategy is one major cause of panic, which results in taking wrong decisions.

Simply put, panic selling is a widespread reaction to a piece of news or event leading to investors taking action on a wider scale by selling a losing position on a stock, currency, or cryptocurrency.

When investors join the bandwagon without technically investigating to know why prices are dropping rapidly, their panic-selling buttons just got triggered.

Earlier in the year, Elon Musk made a pronouncement about Tesla’s halt on the acceptance of Bitcoin, also China’s crackdown on miners, and a temporary ban on crypto mining due to power shortages in Iran led to the nosedive of the Alpha coin (Bitcoin). Many other Altcoins followed the same downward path and lost value as selling sentiments surged.

SEE ALSO: The 5 Best Altcoins with Great Upside Potentials

SEE ALSO: 3 Clever Ways to Trade Altcoins for Profit

Many crypto enthusiasts held to their guns, ignoring the dip, and cheered on as Bitcoin settled in between $30k- $35k per coin with the hope that it could get back to the glorious days that got it to a peak of $63k per coin in April.

As holding on to your position may sound nerve-wracking, many believe in the comeback of Bitcoin as the coin struggles to regain its true value amid external suppressing influences and propaganda.

Holding on to your position could be darn courageous especially if you’re trading with a long-term strategy.

On the flip side…

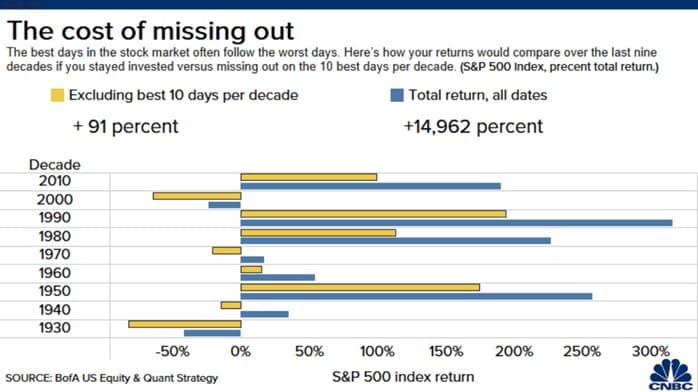

CNBC in a publication with the caption below shared its views on long-term investing and panic selling.

Bank of America found out that if an investor missed out on S&P 500’s, 10 best days each decade, the total returns would be 91%, far low below the 14,962% return for investors that held steady throughout the up and downs.

The “Cost of Missing Out”…

It’s understandable to argue that the stock market is less volatile than the cryptocurrency market, which is true, but a few principles could be juxtaposed in both markets.

But, it’s, however, worrying that cryptocurrencies have shown a very low correlation to economic data and fundamentals leaving only crypto-specific news to drive them.

Price swings in the cryptocurrency market are swift, deep, and crushing. Price swings for stocks are less crushing, deep (depending on company stock quality), and are largely driven by economic factors and corporate pronouncements.

The essence of this piece to not to encourage complacency or docility in trading & investment but to stay proactive and act based on applying the right information.

How to Avoid Panic Selling in the Cryptocurrency Dip

1. Define your investing strategy

With no regulators or governments regulating the price of cryptocurrencies, defining your entry and exit strategies are just about the best way to thrive in this market.

The same applies to swing trading or scalping, every move must be timed. If you’re going long or short, you must have put this into perspective to avoid selling at every market dip.

An infallible strategy is developed on information and proper risk management. So, you must decide all the components of your investing strategy by defining the following.

• Capital to invest

• Timing, long or short

• Target exit prices

• Stop-loss points or numbers

Now. with the swift movement in prices, automated tools can help you track all these and possibly automate the process of charting, stop-loss, price alert notifications, and more.

In addition, defining your strategy also entails drawing a line between “Fear” and “Greed”.

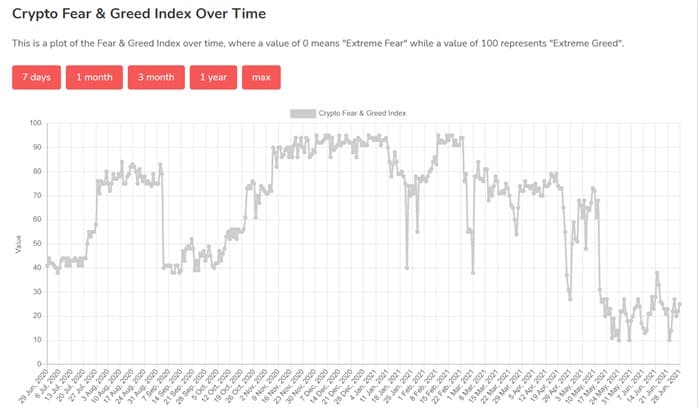

The graph below shows the Crypto Fear & Greed Index for one year.

Crypto Fear & Greed Index

The index reveals extreme greed at high levels for one year which is usually an investing trait of crypto-freaks.

Rationally, an investor should take profit at the incline and when prices simmer, then take profits in bits until fully sold out.

2. Use Data and the Right Investing Tools

Of course, everyone knows data is “key” to profitable investing…

Data is required, and more data.

But, using data correctly is yet another context to examine. Crypto-investing is one of the most developed markets with tools to aid its investors in decision-making.

What are these tools and where do you find them. Below are just a few important ones you need.

• Crypto News – Cointelegraph and Coindesk

• Crypto Charting tools & Widgets – Ox-Currencies

• Crypto Calculators & Converters – Ox-Currencies

• Crypto Prices – Ox-Currencies

• Crypto Screeners – TradingView

• Crypto Exchanges – Coinbase, Paxful, Changelly, Kraken, Binance,

Selecting the right tools and deploying them properly is one way to avoid panic when prices are not going the way you want.

SEE ALSO: ADA Staking: the Ultimate Guide to Cardano Staking

SEE ALSO: Top 11 Best Cardano (ADA) Wallets for Staking & Storage

3. Introduce Cryptocurrency AI Trading Software or Bots

It’s no news that the influx of bots has taken over most aspects of trading especially for markets like cryptocurrencies that trade 24/7.

Introducing Artificial Intelligence trading is another interesting way of getting your trades executed.

With sentiments and emotion out of the picture, in this case, these trading bots can be automated to buy and sell at your preferred price.

With a set price to enter, stop loss, and exit price or percentage, there is no panic selling for AI trading bots.

The good part is that some AI trading bots are free to use.

However, note that AI trading bots are not humans and will never fully take the intuitive role of human beings, so it’s advised to use these AI trading software with caution and not to overly rely on them.

Final Thoughts

Investing and trading experience also has their part to play in avoiding panic selling.

When an investor understands the seasons and trends in a market, he /she know when to get in and get out.

A new investor or trader can master the market within 6 – 12 months to be able to predict the market with some level of accuracy.

SEE ALSO: Are NFTs a True Store of Value?

Read More