Take profit order (TPO) is a kind of limit order that details the specific price at which to exit an open position and receive returns.

If the price of the asset does not near the limit price, the Take Profit order will not be executed.

Many traders combine TPO with Sell limit orders (SLO) to oversee their open trades. If the asset goes to the TPO, the take-profit order is executed and the trade is exited for a profit.

If the asset drops to the SLO point, the stop-loss order is executed and the trade is exited for a loss. What happens when the trader uses a TPO is that he/she need not bother about executing a trade themselves or second-guessing their moves.

On the flip side, Take Profit order is executed at the best plausible price irrespective of the substantive asset’s behavior. The stock can start to breakout more, but the take-profit order might be affected at the very start of the breakout, leading to increased opportunity costs.

Take Profit orders are mostly employed by short-term investors to reduce trading risks. This is so that they can close a trade once their estimated profit mark and not experience a probable future downtrend while trading.

Investors with a long-term plan will not go for such orders as it dips into their gains. TPO is mostly put at levels that are determined by other types of technical analysis including support & resistance levels, chart pattern analysis, or employing money management strategies like the Kelly Criterion.

SEE ALSO: 3 Types of Forex Orders and How to Use Them

SEE ALSO: How To Use A Forex Lot Size Calculator Like A Pro

How a Take-Profit Order Operates

When using a Take Profit order, day traders set a price at which they’ll like to trade an asset, the price which is one adequately beyond the price on which the asset was purchased to guarantee that traders will realize gains on the trade.

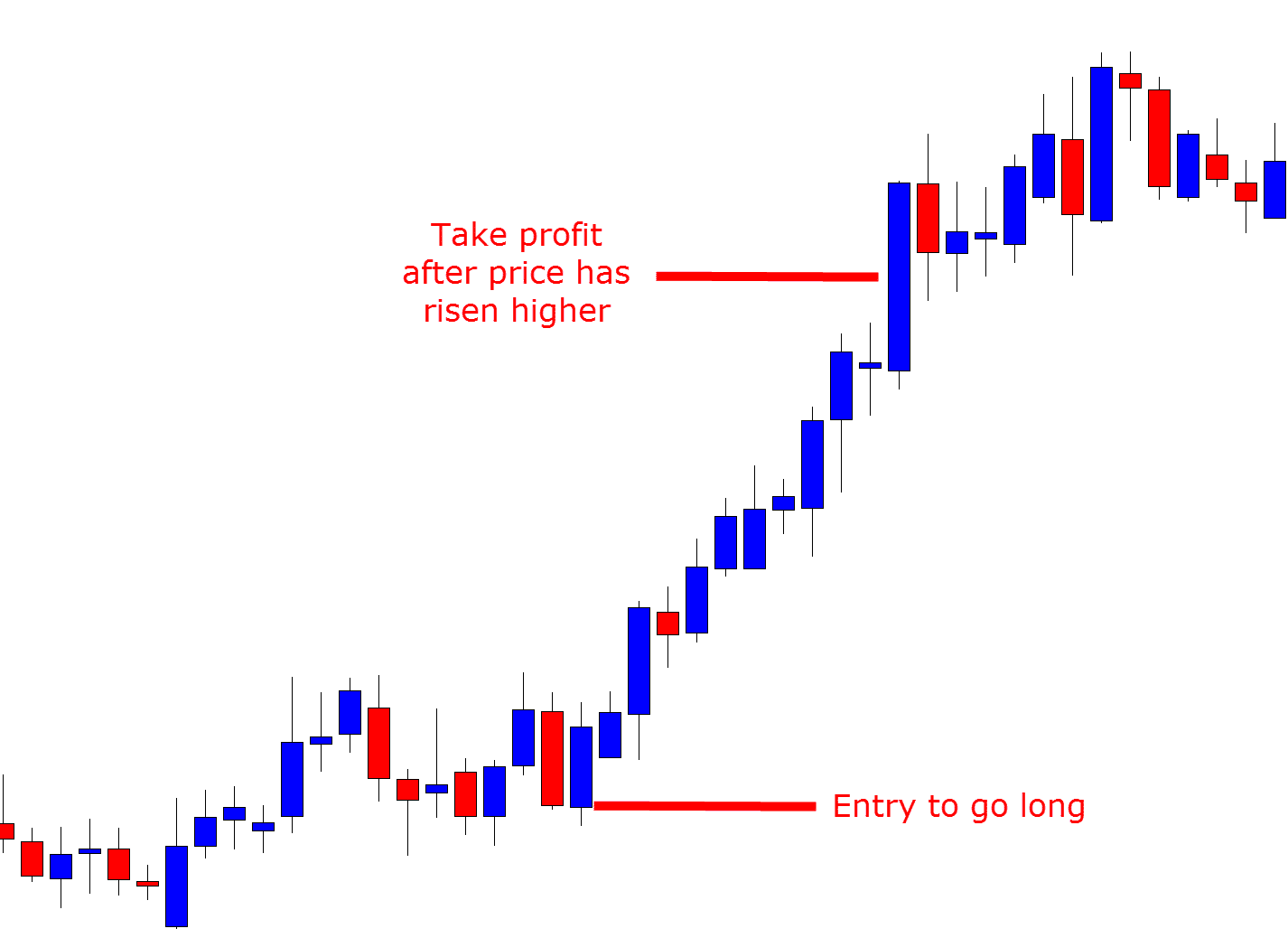

Let’s see the chart below.

From the chart, the trader forecasts a gain in the currency pair and enters the trade at the low point on the candle stick. He has already predetermined his exit point or the point he will take profit as the price trends higher.

Immediately the TPO point is attained, the order is executed and the trade holds at the current market value of that day. If the point is not hit, the trade will not be made and the trader keeps his security at hand.

A take-profit order allows traders to lessen their risk or exposure while trading assets by closing the trade once the market creates a good price for investors and does not keep trades open beyond then.

Executing a TPO demands a technical analysis of the asset’s value and the possible direction of the market. A few methods for estimating an ideal TPO includes:

A daily/weekly pivot point, chart pattern analysis, etc.

A take-profit order is an automated closing strategy that relies on a gain or loss computation instead of an emotional resolve to trade or hold.

SEE ALSO: How to Reduce Your Risk Exposure by Hedging a Currency Pair

SEE ALSO: 5 Best Ways To Trade Forex With An Economic Calendar

Example of a Take Profit Order

Assume that an investor finds an inclined triangle chart pattern and creates a buy position. If the stock experiences a fall-out, the investor anticipates that it will hike to 15% from its present rate. If the stock does not fall-out, the trader would prefer to close the position at once and proceed to the next opportunity.

The trader may place a TPO that is 15% more than the market price to sell automatically as soon as the stock gets to that level. On the other hand, they might set a sell limit order which is 5% less than the present market price.

The merging of the TPO and SLO gives a 5:15 risk-to-profit ratio, which is good if the possibility of meeting every outcome is equal, or if the probability is disrupted towards the fall-out scenario.

By setting the TPO, the investor need not worry about meticulously monitoring the stock all through the day or doubting themselves concerning how to increase the stock might go post-breakout.

A well-laid-out risk-to-profit ratio is provided and the investor expects in mind before placing the trade.

Does a Trader Really Need a Take Profit order?

What happens is that traders with a short-term plan find take profit orders helpful as using them enables day traders to come off the market once they get to their estimated profit of the day.

Mostly, the shorter a trader’s plan is, the more a TPO is offered to such trader. A short-term trader that does not set a profit limit may realize quickly that the profits made are lost if there’s no basic understanding of when to close their position.

SEE ALSO: Top 10 Best Forex Signals for New Traders

SEE ALSO: Best Forex Signal Provider 2021 – DDMarkets Forex Signals

Several indicators can help traders spot trends while trading forex and decide if a take-profit order is good at that time. An indicator that is good for newbie traders is ADX (average directional index). The Average Directional Index amplifies how solid a trend in value is from 0 to 100.

The more fragile a trend is, the greater the probability to change.

Values above 40 imply a trend is solid and a TPO should not be placed

Values less than 20 denotes that a trend is fragile, thus it may be a good time to execute TPO.

Pros & Cons of Take Profit Orders

All traders will like to trade at a different risk level and every one of them has particular goals and timeframes they wish to take when trading. Knowing the pros and cons of a Take Profit order will assist with spotting the trading strategy that is right for you.

| PROS | CONS |

| Makes sure traders receive profit A take-profit order is placed to guarantee that a day trader realizes income from his trading efforts | Long-term will not find Take Profit order good TPO is a short-term plan to ensure that you realize a substantial amount of profit earnestly. They are not good for long-term investors that can afford to monitor more hikes and drops in the market to realize greater profit upon completing the trade |

| Reduces risk A Take Profit order allows you to benefit from a sudden hike in the market instead of probably losing the opportunity to sell at a time when gains can be made | Can’t leverage with trends TPO will not allow you to benefit from extended trends and the traders who set profit limits are normally frustrated when they spot a reliable trend and exit too quickly |

| Eliminates doubt Take-profit order allows traders to know the right time to buy/sell while trading. The trade is executed immediately without the need to doubt the decision | You can choose not to place them Having a TPorder already in mind does not automatically mean the sale will occur. If the market never hikes to the take-profit limit set, you might still need to sell at a loss |

Final Thoughts

Take-profit orders are crucial in the forex market as they assist with lessening your risk while trading. They also come in when placing your trades especially if you’re on a busy schedule.

If you happen to have just started trading, we advise that you find time to understand take-profit orders and try them out. A virtual account, a.k.a free account, help you with testing TPO out at various trading platforms.

To set a Take Profit order, one of the finest approaches is to employ your risk-reward ratio. For instance, if you’re risking only 5% of your holding, you can execute your take-profit 5% above the present price.

In this instance, if the stock is selling for $20, you can place the Take Profit order at $21.

Read More