Several commercial data points are issued from nations all over the World, and these fiscal reports have an influence on financial markets, from commodities to stocks to currencies and bonds.

With new economic events and data releases, a structured data bulletin called an Economic Calendar was introduced.

What is the Economic Calendar?

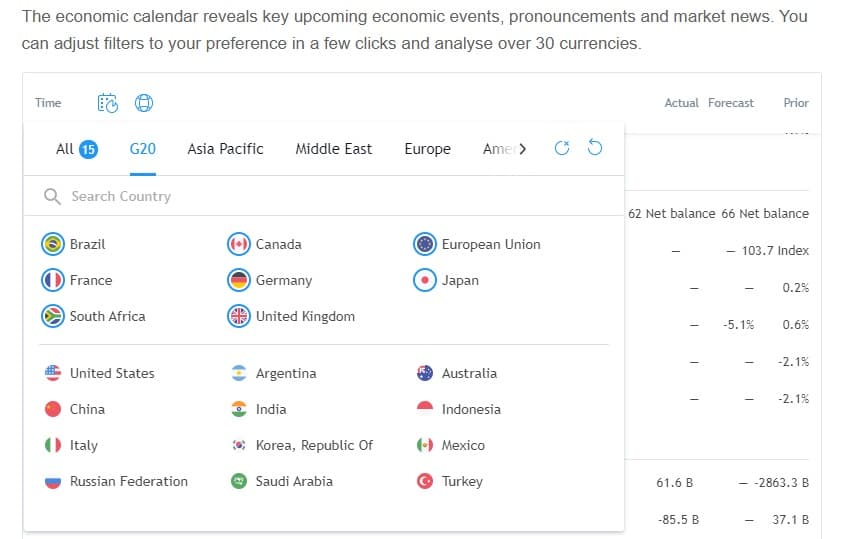

An Economic Calendar is usually a free online bulletin that compiles global news and economic data from all over the world in a schedule for the benefit of all financial stakeholders.

Economic data relating to the economy, new GDP growth rates, interest rate decisions, non-farm payroll, money supply, Federal government budget are just a few items you’ll find in an Economic Calendar.

Economic Calendars are beneficial to everyone. Once you trade the international financial markets either in currencies, cryptos, stocks, gold, oil, commodities and more, you need an Economic Calendar for proper fundamental analysis.

Without a functional economic calendar, a trader or investor could be taken off guard by an unexpected market move. For instance, manufacturing data is crucial for the stock market and particular commodities like crude oil. A pragmatic manufacturing data report can improve markets, while a bad report can cause quick sell-offs.

Before we delve into the details of an Economic Calendar, Let’s highlight the primary purposes of an Economic Calendar.

Primary Purposes of an Economic Calendar

- An Economic Calendar is primarily an economic forecasting tool.

- It’s a central point for relevant economic policies affecting financial instruments.

- It enables traders and investors to make an informed decision based on a combination of fundamental and sentimental analysis.

Before opening positions in financial instruments, it’s expected that you take a peek at the Economic Calendar. Unfortunately, many investors and traders ignore this free tool.

For Forex traders, an Economic Calendar hints at a trader on the mood of the economy and its likely impact on the prices of currencies in the forex market.

An experienced trader will use the data derived from an Economic Calendar to his advantage. This will help him/her know when to trade and when to remain passive.

With an Economic Calendar, you’re hinted also at periods to witness market volatility.

SEE ALSO: Best Volatility Indicators You Should Consider in Forex

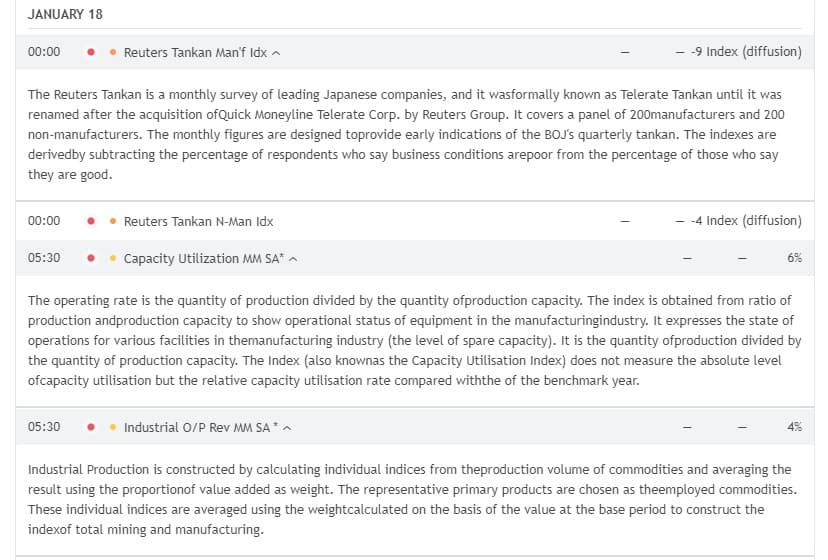

To trade forex with an economic calendar, obtain all the necessary information on anticipated market-moving data. For instance, trading the GBP/JPY requires you lookout for economic data regarding these two big economies that could influence the prices of this currency pair.

The image below shows the forecast on the Japanese Manufacturer’s Index, Capacity Utilization, and the Industrial Production Indices.

The Japanese economy is at the forefront, leading in technology and business leadership.

Its remarkable exploits in electronics and automobiles have a record-breaking result. However, Japan is plagued with an aging population that overall leads to a drop in its overall effectiveness. With a fall in manufacturing and exports, the Japanese Yen weakens.

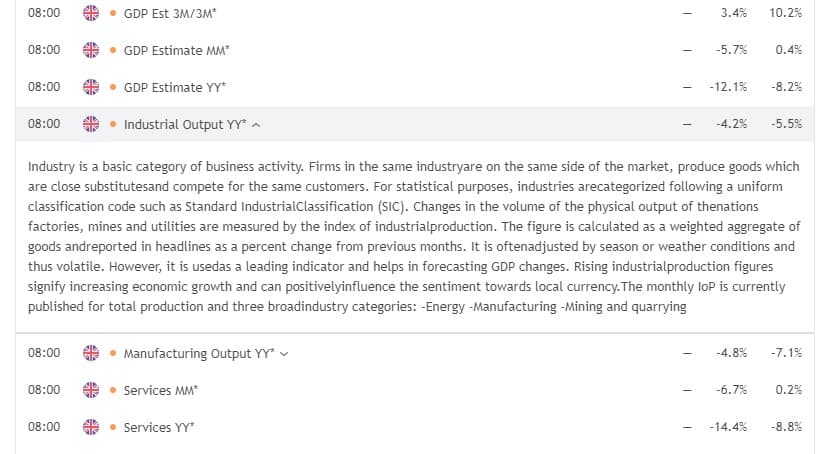

The same approach goes for the United Kingdom (UK) economy, you have to search for economic news and events that could influence the demand for the Pounds Sterling (GBP)

Below is a forecast for the UK economy from an Economic Calendar

The Economic Calendar says that the Industrial and Manufacturing Output Year-on-Year (YY) should drop by 4.2% and 4.8% signaling a likely drop in exports as well.

When economic data is released, you should analyze further if the data released will move the market and your next move. It’s important to note that not all data released should spark action.

Now, let’s examine the best ways of trading Forex using an Economic Calendar.

1. Get Market Sentiments with Economic Indicators

In as much as an Economic Calendar includes the numbers from the last release, traders can obtain a few ideas about the movement of economic indicators.

For example, if the newest Eurozone inflation forecast was released at 0.7%, with its last release at 1.2%. This then indicates that HICP is not only very low than ECB’s aim of ‘close to 2%’, but is in recent times moving even further away from that mark. So, we might deduce that this is going to mount a lot of pressure on the EURO.

Other indicators include the Wholesale Price Index for certain countries, inflation rates for influential economies, Composite, Price, and Manufacturing Index, Foreign Exchange Flows, Service Sector Growth, and more.

2. Consensus of Forecasts

An Economic Calendar also displays the aggregate of forecasts, which is the market supposition.

For example, if there is a forthcoming occasion risk of the Reserve Bank of Australia interest rate agreement. It is predicted to remain at 0.25%. If the RBA hikes the rate unannounced to 0.50%, that would go beyond the market predictions and can be more positive for the Australian dollar.

At the same time, a rate slash to 0% would be negative for AUD, and it is going to disappoint the market suppositions. So, if a trader anticipates this outcome, then there is the possibility of opening long EUR/AUD, short AUD/USD, and related positions.

3. Identify Periods when Not to Trade

An Economic Calendar is a free tool for fundamental analysis and this tool does well to assist traders in spotting times when to avoid trading.

At the time of major announcements, the Forex market becomes less liquid and a lot more volatile.

Therefore, a few seasoned traders take a peek at the Economic Calendar, exit their positions before any news releases come out. They chill and observe the major forex pairs for a while and, thereafter continue trading.

However, in this case, stop-loss orders are crucial to reduce losses if the market likely moves in the opposite direction. As we have observed from experience.

Predicting the direction of currencies can be very difficult, and in those times, stop-loss orders are a trader’s best bet.

4. Buy or Sell Approach

This way downplays the essentiality of the body of the release and just captures the volatility caused by a key event in the Economic Calendar. Most times, we see traders’ opening orders above & below present prices to access the market at the time the news announcement is on.

5. Laying an Ambush (Waiting)

As soon as the market rally resulting from the news simmers, you can either continue from the last trend or begin a new trend geared by the current market information.

Lastly, the other option available is to avoiding trading at unpredictable news hours. This is wise trading.

Advantages of Using an Economic Calendar to Trade

- It notifies traders about (time & date) and economic fundamental news will be released. It’s up to the trader to decide on how to use and interpret the news.

- Stakeholders are briefed about the time and country a national holiday is commemorated e.g. a Bank holiday in the United States.

- It categorizes basic news according to its significance, displaying a systematic prediction of the report. Once a piece of news is released and the market is influenced, it aids in analyzing the effect of the fundamental factor on an investor’s judgment.

Our Thoughts

When using fundamental analysis, you analyze reversal patterns of the graphical analysis (head, pin bars, shoulders, and rising wedge) and set the targets to be exact i.e. the support & resistance levels.

SEE ALSO: Support and Resistance in Forex Trading – Simplified

You use technical instruments such as oscillators, trend indicators, and watch the predictions when trading on news releases, as it does not always end up as expected because traders may misinterpret the news.

It is preferable not to aim for high pips. When the target level is reached, it is advisable to exit positions and use a trailing stop.

It is mandatory to have faith in yourself, practice with a virtual & cent account, garner experience, and not shy away from taking risks.

Conclusion

The Forex market sometimes acts in denial of economic releases. Economic news is not a guarantee that the market will gain a pip.

However, traders should never ignore fundamental analysis which Economic Calendars are strong tools for carrying out analysis.

Market participants await expected news and therefore movements that ensue can be quite calm, if expected, or voracious if conflicting with former expectations. That’s why it is so crucial to add an Economic Calendar to your trading toolbox.

If you’d like to know how to trade with an Economic Calendar or trade with announcements to revamp your strategy, be patient, and start at first with a virtual account.

Constant practice will enable you master your trades and assist you in learning how this information affects the prices of currencies & other financial instruments.

Read More