Overview – XM Broker Review 2023

XM Global Limited has a very impressive resume, outshining some of the industry pioneers. Since it was founded in 2009, XM has grown to a large and well-established international investment firm and has become a true industry leader.

XM is currently built of more than 450 professionals with long-year experience in the financial industry.

Its extensive experience combined with support for well over 30 languages, makes XM the broker of choice for traders of all levels, anywhere. The XM website is equipped with resources to equip traders realize their investment goals. Its registered address is at No. 5 Cork Street, Belize City, Belize, CA.

XM’s Global Leadership & Trader Education: Unlocking Success with Live Webinars and Training Programs”

One unique quality that keeps XM going is the unveiling of the faces of brilliant leaders behind the company. The management makes effort to connect with traders all over the world having visited over 120 countries.

From the series of live webinars, trainings and other educational materials, there is no doubt that XM have hosted hundreds of seminars around the world to educate traders, enabling them to make better trading decisions. To continuously boost commitment of traders, they now organize daily live webinars for new and professional traders.

Regulation

XM is regulated in the UK and other international bodies.

- Trading Point Holdings Ltd is the holding company of Trading Point of Financial Instruments Limited, XM Global Limited, Trading Point of Financial Instruments UK Limited, Trading Point of Financial Instruments Pty Ltd, and Trading Point MENA Limited.

- Trading Point of Financial Instruments Limited is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) (license number 120/10).

- XM Global Limited is authorized and regulated by the International Financial Services Commission (IFSC) (license number IFSC/60/354/TS/19).

- Trading Point of Financial Instruments UK Limited is authorized and regulated by the Financial Conduct Authority (FRN: 705428).

- Trading Point of Financial Instruments Pty Ltd is authorized and regulated by the Australian Securities and Investment Commission (AFSL 443670).

- Trading Point MENA Limited is authorized and regulated by the Dubai Financial Services Authority (DFSA) (reference no. F003484).

Tradable Assets

6 Asset Classes – 16 Trading Platforms – Over 1000 Instruments.

XM over 1000 instruments spreads across:

Forex trading

Stock CFDs

Commodities

Equity Indices

Precious Metals

Energies

Shares.

Minimum Deposit

XM Global offers 5 types of trading accounts with various minimum deposit requirements.

Micro Account: $5 minimum

Standard Account: $5 minimum

XM Ultra Low Account: $50 minimum

Shares Account: $10,000 minimum

Islamic Account: $5-$50 minimum

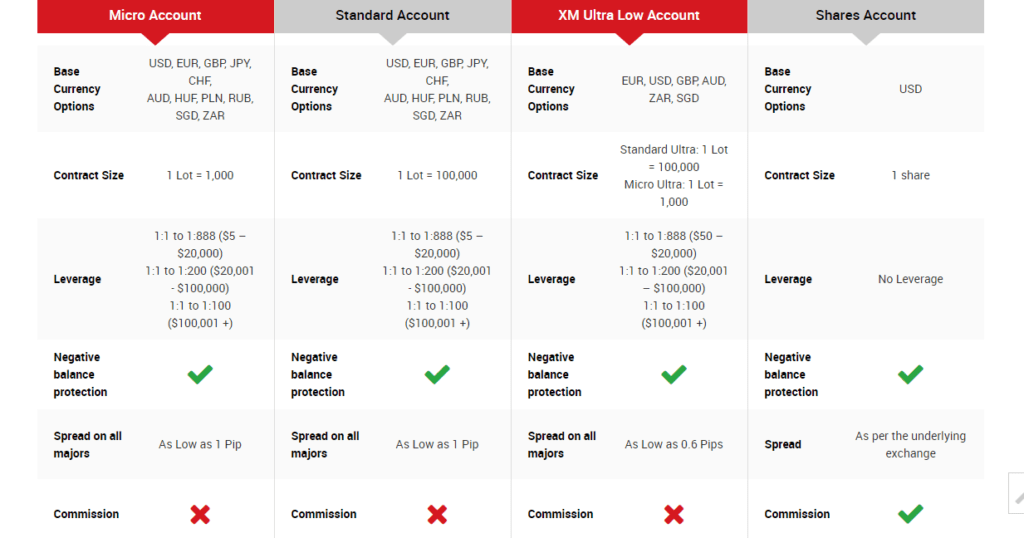

Trading Accounts

XM trading account packages are clearly displayed on its website. It’s display format is transparent, revealing important trading information that some other broker companies may choose to be passive about. No investor would like a hidden charge rearing up its head at the start or end of his trade.

XM offers 4 account types.

Micro Account: $5 minimum

Standard Account: $5 minimum

XM Ultra Low Account: $50 minimum

Shares Account: $10,000 minimum

Islamic Account $5-$50 minimum (On Request)

Demo Account

With a $100,000 virtual deposit, you can trade with virtual money, without exposure to any financial risk. Once you have tested your trading strategies, learned about market moves and how to place orders, you can take the next step to open a trading account with real money.

Micro Account

$5 is the minimum to open a Micro Account and you can trade these currencies (USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, ZAR).

Contract size: 1 Lot = 1000

Leverage:

1:1 to 1:888 ($5 – $20,000)

1:1 to 1:200 ($20,001 – $100,000)

1:1 to 1:100 ($100,001 +)

Spread: As low as 1pip

Minimum trading volume: 0.01 Lots (MT4), 0.1 Lots (MT5)

Standard Account

$5 is the minimum required to create a Standard Account.

Currencies:

USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, ZAR

Contract size: 1 Lot = 100,000

Leverage:

1:1 to 1:888 ($5 – $20,000)

1:1 to 1:200 ($20,001 – $100,000)

1:1 to 1:100 ($100,001 +)

Spread: As low as 1pip

Minimum trading volume: 0.01 Lots

XM Ultra Low Account

$50 is the minimum required to create an XM Ultra Low Account.

Currencies:

EUR, USD, GBP, AUD, ZAR, SGD

Contract size:

Standard Ultra: 1 Lot = 100,000

Micro Ultra: 1 Lot = 1,000

Leverage:

1:1 to 1:888 ($50 – $20,000)

1:1 to 1:200 ($20,001 – $100,000)

1:1 to 1:100 ($100,001 +)

Spread: As Low as 0.6 Pips

Minimum trading volume:

Standard Ultra: 0.01 Lots

Micro Ultra: 0.1 Lots

See more on XM Ultra Low Account

Shares Account

$10,000 is the minimum required to create a Shares Account and you can trade only the USD.

Contract size: 1 Shares

Leverage: No leverage

Spread: Applicable to the underlying instrument

Minimum trading volume: 1 Lots

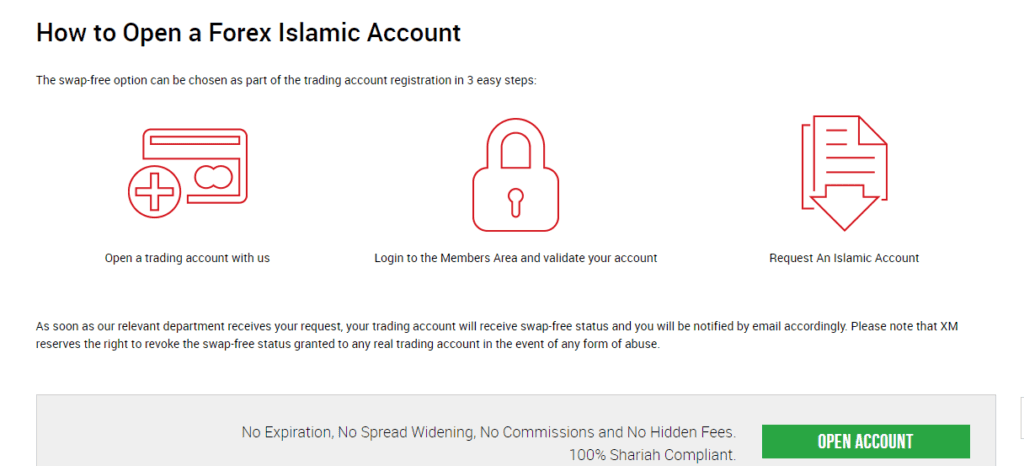

Islamic Account

In line with the Shariah law, Forex Islamic accounts are also known as swap-free accounts as they imply no swap or rollover interest on overnight positions, which is against Islamic faith.

Features of XM’s Islamic Account

All you need to do is to create any of the 3 accounts (Micro, Standard, XM Ultra Low Accounts) which have Islamic accounts privileges and contact customer service.

Languages

XM communicates with its clients effectively in over 25 languages including, English, French, Spanish, German, Arabic, Portuguese, Zulu, Vietnamese, Thai, Malay, Indonesian, Chinese and more.

Currency Pairs

Currencies are divided into two main sorts – Major currencies and minor ones. The major currencies are derived from the most powerful economies around the globe – the US, Japan, the UK, the Euro Zone, Canada, Australia, Switzerland and New Zealand. Together with the other currencies they create Forex pairs.

Max Leverage & Spread

Deposit & Withdrawals

Depositing money

Funding your account with XM Global is pretty straightforward. These payment means are available to choose from:

Withdrawing money

By regulation, the standard withdrawal process from your trading account is to withdraw through the same means you deposited or funded your account. Debit, Credit card or Wire transfer.

Trading Platform

XM has one of the best and technologically advanced platforms. The organization seems to keep up with the needs of traders around the world. Its versatile trading platform spans across PC, Mac, Tablets and Mobile, providing the standard MT4, MT5 and XM WebTrader.

You may want to know the uniqueness of the MetaTrader 4 and 5 platforms and why you should pick one over the other.

MetaTrader 4 (MT4)

XM pioneered the offering of the MT4 platform with trading execution quality in mind. Trading on MT4 comes with no requotes, no rejections, and flexible leverage ranging from 1:1 – to 888:1.

MetaTrader 5 (MT5)

The XM MT5 offers all the pioneering features that the XM MT4 has to offer, with the addition of 300 stocks (shares) CFDs, making it the ideal multi-asset platform. Trade forex, stocks, gold, oil, equity indices and cryptocurrencies from 1 platform with no rejections, no re-quotes and flexible leverage from 1:1 to 888:1.

Technical Analysis

This is another amazing feature XM has created for its traders.

Instead of sourcing for technical information from multiple sources, XM is an All-in-One platform for all your trading needs.

Its research unit creates relevant technical analysis that equip traders with the right information they need to make informed decisions.

You can also takes advantage of XM Trading tools such as the Forex Calculator, Margin Calculator, Pip Value Calculator.

Personal Account Manager

Opening an account with XM grants you the privilege of having a Personal Account Manager that supports you through your trading journey.

Isn’t that awesome having someone look over your shoulders in business.

You can engage 1-on-1, chat over Skype, send questions and receive answers via emails with your assigned manager.

This is the Human Touch to XM Global and this goes a long way in boosting the image of the organization and further strengthening its relationship with its traders and investors.

Regulators always encourage transparency in business which improves customer experience and ratings. This perhaps may be the reason for its numerous awards since 2009.

Training and Education

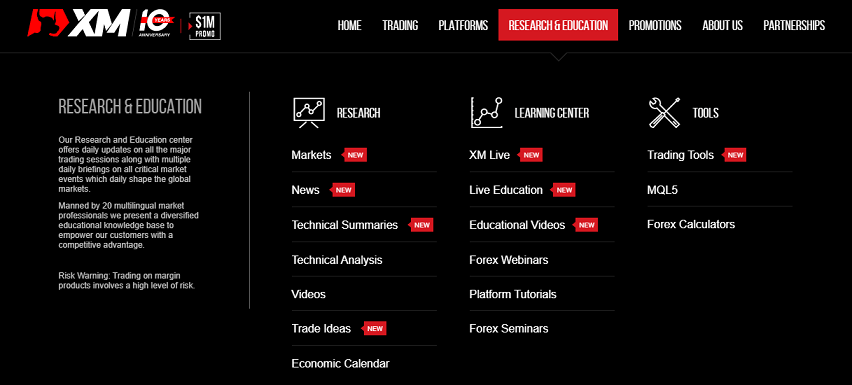

XM Research and Education center section unveils its readiness to train new traders and further develop professional traders.

Across the 3 broad categories, its team create quality content frequently on the market.

XM has also introduced a daily LIVE Webinar where experts discuss latest trends, updates and training. Join Webinar, Forex trading, Live Education.

Forex Trading Signals

Join XM MQL5 vibrant community and get direct access to tested and high performing Forex signals that have been verified for up to a month. So, you’re sure of subscribing to market signals that are relevant to current trades.

Getting started…

- Visit and register with the MQL5 community.

- Deposit some funds to your MQL5 account if you wish to purchase any paid products (Optional).

- Launch your XM MT4/MT5 platform and access the MQL5 Market by clicking on the “Market” tab of the Toolbox window.

- Enter your registration details in the XM MT4/MT5 Terminal by navigating to “Tools” on the main menu, selecting “Options” and then clicking on the “Community” tab.

- From the “Terminal” area click on the “Signals” tab to review the large number of options available.

Social Trading

Joining XM MQL5 will give you access to interact with other traders in the community where ideas are shared and questions get answers with clarifications. Copy trading is kind of passive on XM, not certain this feature exists on the platform.

Pros & Cons

PROS

- Micro, Standard Account starts at $5.

- Local and International regulations.

- Trading Platforms, MT4, MT5, XM WebTrader.

- Innovative technology and cutting-edge trading features.

- Wide leverage position up to 888:1.

- No limits on commissions.

- Clarity on all Trading account features.

- Personal account manager on all accounts.

- 1000+ Assets, Currencies, CFDs, Cryptocurrencies.

- Broad video tutorials, charts, trading advice, trading tools and interactive content.

- Responsive customer support 24/5.

CONS

- Passive copy-trading features.

- Shares account minimum deposit is relatively high at $10,000

XM Broker Review

9.8

Pros

- Micro, Standard Account starts at $5.

- Local and International regulations.

- Trading Platforms, MT4, MT5, XM WebTrader.

- Wide leverage position up to 888:1.

- Clarity on all Trading account features.

Cons

- Passive copy-trading features.

- Shares account minimum deposit is relatively high at $10,000

MINIMUM DEPOSIT OF $5-$10,000

9/10

MAX LEVERAGE & SPREAD - 888:1

10/10

PAYMENT AND WITHDRAWALS

10/10

TRADING SOFTWARE, MT4, MT5, WEBTRADER.

10/10

CUSTOMER SERVICE

9/10

Read More