FXTM Broker Review – All the Facts 2022

Overview FXTM Broker Review 2023

Forex Time (FXTM) has been on the trading and investment scene since 2011 with over 2 million people trading financial instruments on its platform.

As an award-winning broker with tailormade solutions for every client, FXTM has broadened its reach to cater for every unique trading need.

FXTM’s dynamic innovation in technology gives it clients one of the best trading platforms online offering remarkable order execution speed.

Named as one of the world’s fastest growing brokers, FXTM has made impressive leaps, winning 33 numerous awards from 2013-2019. A few to mention are:

2013: Best Forex Newcomer (World Finance).

2015: Most Trusted Forex Broker Dubai.

2017: Best Customer Service Global (World Finance)

2019: Best Investment Brokers (FXDailyInfo)

Regulation

FXTM brand is authorized and regulated in various jurisdictions.

- ForexTime Limited (www.forextime.com/eu) is regulated by the Cyprus Securities and Exchange Commission with CIF license number 185/12, licensed by the Financial Sector Conduct Authority (FSCA) of South Africa, with FSP No. 46614.

- The company is also registered with the Financial Conduct Authority of the UK with number 600475.

- The office is at 35, Lamprou Konstantara, FXTM Tower, Kato Polemidia, 4156, Limassol, Cyprus.

- Exinity Limited (www.forextime.com) is regulated by the Financial Services Commission of the Republic of Mauritius with an Investment Dealer License bearing license number C113012295 and it is situated at 5th Floor, 355 NEX Tower, Rue du Savoir, Cybercity, Ebene 72201, Mauritius.

- Forextime UK Limited is authorised and regulated by the Financial Conduct Authority, firm reference number 777911 and is situated at 88 Wood Street, EC2V 7QR, London, UK.

Tradable Assets

Trade over 250 financial instruments on FXTM across 7 unique accounts types offering diverse benefits.

Currency pairs (FX trading)

CFDs on Commodities

CFDs on Indices

Stock CFDs

Crypto CFDs

Spot Metals

Stock Trading

Contract Specifications

Minimum Deposit

The minimum deposit on FXTM starts from $10 for the Cent Account and extends to $25,000 for the FXTM Pro account. See the Standard accounts and ECN accounts overview for more information.

Standard Accounts

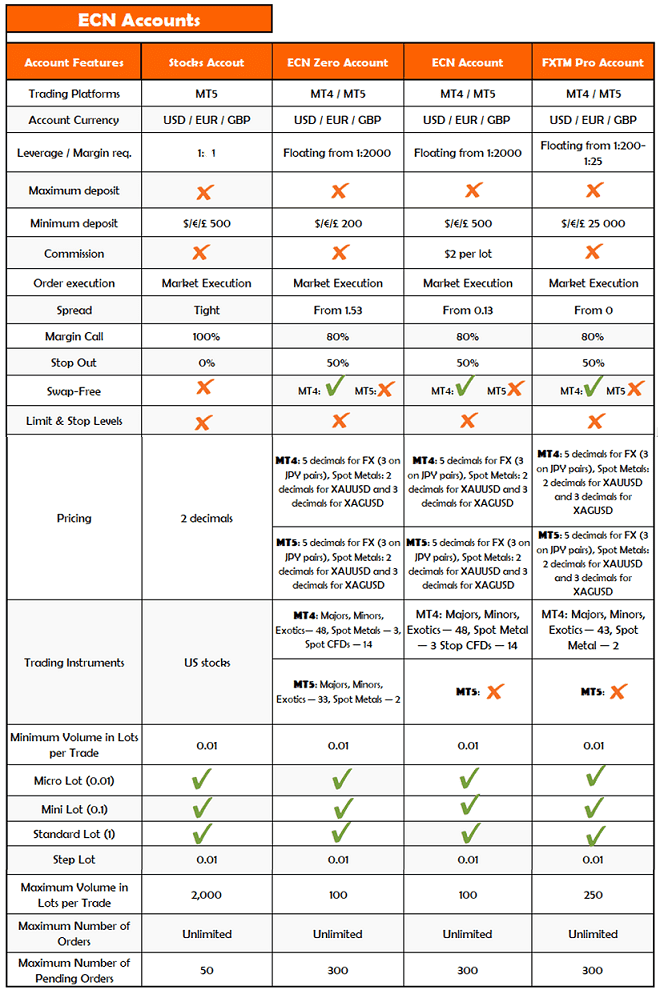

ECN Accounts

Stock Account MT5: $500

ECN Zero Account MT4, MT5: $200

ECN Account MT4: $500

FXTM Pro Account: $25,000

Trading Accounts

Demo account

It is recommended that new traders practice with a Demo account, before proceeding to a live account. FXTM is dedicated to providing an ultimate trading experience on its platform, allowing users to turn market opportunities into profit.

What to expect trading FXTM Demo account

- Trade risk free – the money you’re trading with on a demo account is virtual

- Access the markets and practice trading under real market conditions

- Experiment with different trading strategies and put them to the test

- Become familiar with your trading platform

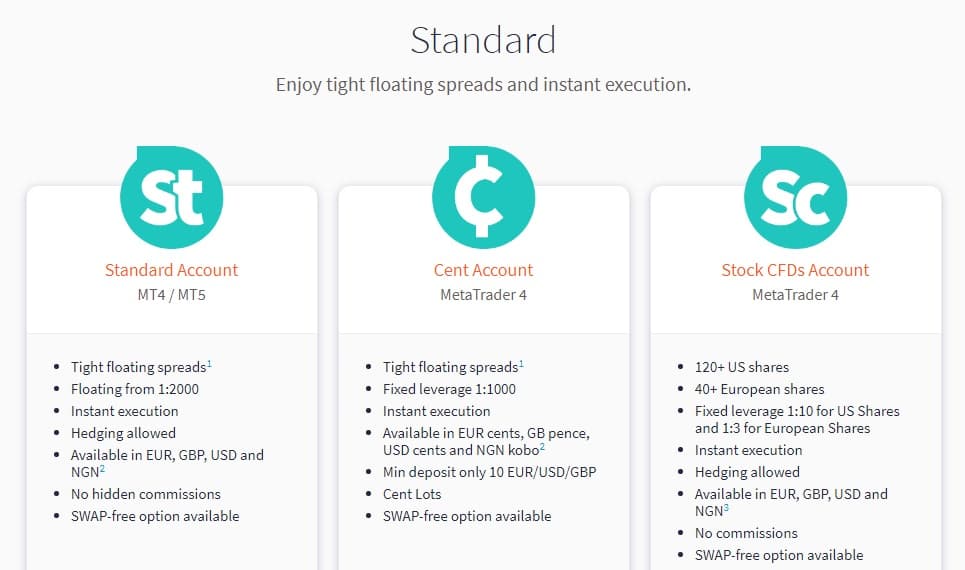

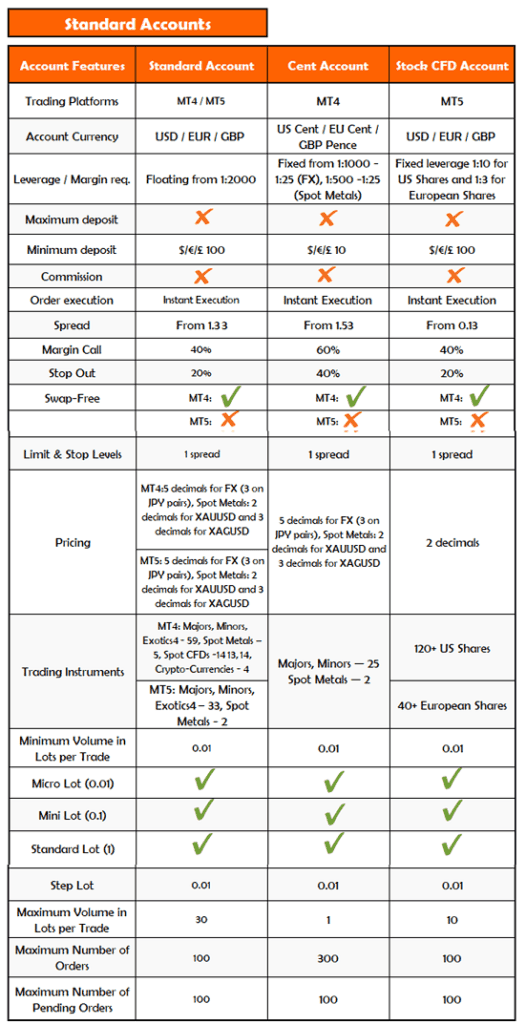

Standard Accounts Overview

Standard Account (Classic Forex Account)

key features

- Spreads may increase during specific periods of the day depending on the market conditions.

- Exotic pairs are not available for swap-free accounts.

- For Spot Indices and Spot Commodities on Standard MT4 Account: the Maximum volume per trade is 5 lots; the maximum volume of all orders for Spot Indices is 15 lots and 50 for Spot Commodities.

- Commissions for cryptocurrencies depend on the Account’s currency: 15 USD/lot, 12.5 EUR/lot, 11.5 GBP/lot or 5,400 NGN/lot for the round turn.

Cent Account

As the name implies, all deposits are converted to cents. Deposit $5 and your account will have a balance of 500 cents, deposit $10 and they will be reflected as 1000 cents. There are no major differences in the structure of traditional accounts and cent accounts; the main element which distinguishes the two is that regardless of how much money you deposit, your balance will always appear in cents.

Key features

- .With a minimum deposit of only $10, the Cent Account provides quick and easy access to the markets and live trading.

- Traders can test their Expert Advisors without spending large sums of money to do so.

- Cent accounts are ideal for newbies – they give a taste of forex trading with real funds and insight to the psychology behind the experience, with a much lower risk.

- The advantages of a Cent Account help create more windows of opportunity in a simpler trading environment

Stock CFDs Account

Trade Stock CFDs exclusively on FXTM’s Stock CFDs Account. With some of the biggest US and European public companies to choose from (in terms of their market cap), you can potentially boost your portfolio by taking advantage of our competitive trading conditions.

Why open a Stock CFDs Account?

- Trade CFDs on some of the biggest US and European shares

- Enjoy a real-time (derived) feed from NASDAQ and NYSE for US Shares

- Receive dividend adjustments

- No Commissions

- A SWAP-free option is available

- Trade from your MT4 trading platform

The Stocks Account and Stock CFDs Account are not available to residents of Iran

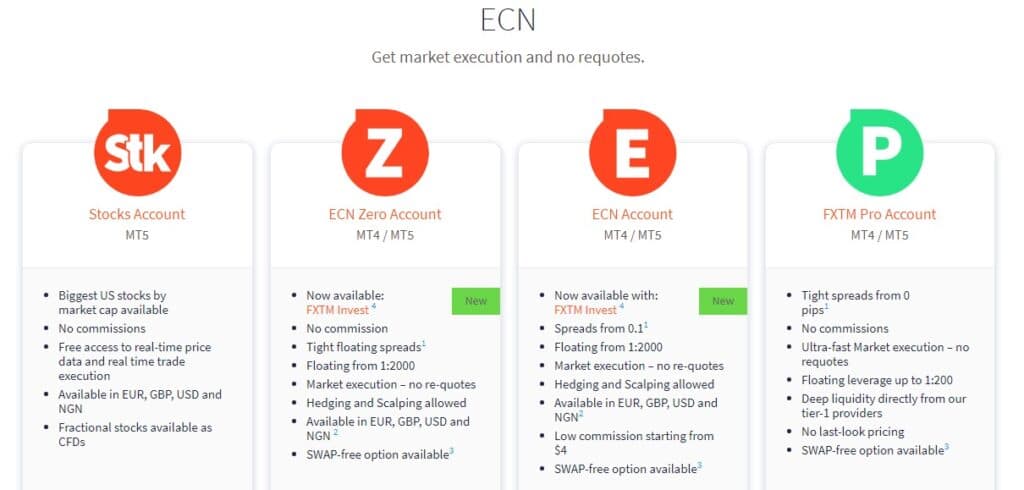

ECN Accounts Overview

Stocks Account

Buy, sell and hold stocks from Facebook, Apple, Microsoft and other highly valued US companies with the FXTM Stocks account. Expand your portfolio by investing in the stock market, with no commission fees, no dealing charges and free access to real time price data. The Stocks account also offers real time trade execution to help you make the most of your investment.

With a minimum deposit of just $500, choose to trade as little as one share or build an entire stocks portfolio on one of the most popular trading platforms in the world, MetaTrader.

The Stocks Account and Stock CFDs Account are not available to residents of Iran.

ECN Zero Account

This is a new one from FXTM with superior features of its traditional ECN account — without the commission charges on its MT4 platform only. With a minimum deposit of $200, you can enjoy huge benefits from no commission charges.

Key Features

- No commission

- Tight floating spreads

- Floating from 1:2000

- Market execution – no re-quotes

- Hedging and Scalping allowed

- Available in EUR, GBP, USD and NGN

ECN Account

What does ECN stand for? Electronic Communication Network. What’s the secret? Like much of the forex market mechanisms today, an ECN is an automated component of trading, since it connects traders to liquidity providers such as banks, brokerages and other traders round the world and eliminates the role of the traditional middleman.

Traders get access to different prices from a variety of market participants directly on their trading platforms and are shown the best bid and ask prices available in the market.

The matching and execution of orders ensues automatically and in this way the trader can always be sure that the broker they are using does not have any dealing desk involvement against them or the trade is processed on an STP (straight through process) basis. For each transaction, traders are charged a small fee by the broker.

Benefits of an ECN Account

- Full transparency since the broker directly connects your orders to other market participants

- NDD (No Dealing Desk) technology ensures that there will be no re-quotes

- Very low or even no spreads during times of high market volatility

- The best bid and ask prices available since a variety of market participants are involved

- The high price volatility makes for a great environment for scalping

- Trading is facilitated not only during, but outside market hours.

FXTM Pro Account

Ideal for trading professionals, institutional traders and hedge fund managers alike, the FXTM Pro account is designed to satisfy the needs of the most demanding trader. Get the most out of your strategy with the ultimate trading conditions. No table-accordion commissions, no requotes and no compromises.

Professional traders can take advantage of the deep liquidity they offer directly from their tier-1 providers and enjoy spreads starting from 0 pips, no last look pricing with no requotes and the freedom to use any and all trading strategies without limitations.

Trading Platform

MetaTrader 4

MetaTrader 5

FXTM Trader

What the MetaTrader 4 platform offers

- Easy-to-read, interactive charts

- Monitor and analyse the markets in real-time

- Access to more than 30 technical indicators

- Nine different timeframes to choose from

- Identify market trends and signals for entry and exit points

- A powerful security system and multi-device functionality

- Trade with complete confidence at a time that suits you

What the MetaTrader 5 platform offers

- More balance transaction types compared to MT4

- A total of 44 analytical objects and unlimited number of charts

- An integrated economic calendar and email system

- Multi-threaded strategy tester

- Fund transfer process between accounts

- A system of alerts to keep up to date with all the latest market events

- Embedded MQL5 community for traders to chat and network with peers and share tips and strategies.

FXTM Trader

- Open, close and modify positions in seconds.

- Trade across multiple devices – open a position on your desktop and close it from your mobile.

- Enjoy state-of-the-art charting tools and popular indicators to fully inform your trade.

- No extra trading platform downloads necessary: FXTM Trader has its own built-in trading platform technology, so you can start trading in just a few taps.

- Track your open and closed positions at a glance.

- Enable 1-click trading for even quicker buying and selling action.

Technical Analysis

FXTM’s market analysis is fairly robust, but it is contents are focused on new traders with little trading experience. Expert traders may used content as a refresher.

Tutorial videos and webinars

Forex trading strategies

Market analysis videos

Economic calendar

Forex news timeline

CFD Trading

Ebooks

Forex trading calculators and tools.

See more tools

Personal Account Manager

With an effective customer support 24/5, personal account managers are not assigned to trading accounts. You however can get answers quickly to questions by checking the FAQ page.

If your question is much more specific, you can email support or contact them via live chat.

Training and Education

FXTM’s comprehensive guide was tailored to help new and intermediate traders with the basics of trading. With user-friendly and easy to read manuals, users can easily understand on their own. More experienced traders may use its guide to refresh their knowledge.

Forex Trading Signals

FXTM Trading Signals have been carefully designed by our talented team of market experts to interpret movements of key assets based on pricing data.

By factoring in alternative scenarios, popular technical indicators and more, this tool will take your trading to the next level.

Popular Technical Indicators

Choice of 4 Take-Profit Levels

Explore Different Scenarios

Protective Stop Loss Recommendations

Daily updates before EU and US markets open

Social Trading

FXTM has one thing going for it. Its pool of strategy managers mainly from Asia and the UK. FXTM Invest allows you to automatically copy trades from more experienced traders.

You only pay the Strategy Manager a fee when you make a profit, so it is in their interest to continually refine and improve their strategy for the greatest results.

Steps to copy trade

- Choose a Strategy Manager

- Make a deposit

- Automatically copy the Strategy Manager’s trades

- Cash in when they profit

- Share a percentage with the Strategy Manager

Final Thoughts

If you’re looking for an investment broker where you can trade passively or copy trade (Strategy manager), FXTM is worthy of consideration.

With a High leverage of 2000:1 and minimum opening deposit flexibility starting at $10, FXTM gives traders suppleness to take on more risks as much as they can handle. The stock account at a minimum of $500 is fair compared to some other brokers that start at $10,000.

Trading can only be effective and enjoyable on a fast speed execution platform which FXTM provides through its infallible MT4, MT5 and Its FXTM Trader on desktop and mobile.

Though no personal account managers attached to client accounts, its customer service is responsive and effective.

Pros & Cons

PROS

- Standard and ECN accounts start at $10 and $200 respectively.

- Top tier FCA regulations.

- Trading Platforms, MT4, MT5, FXTM Trader.

- Innovative technology and cutting-edge trading features.

- High leverage position up to 2000:1.

- No commissions expect the ECN Account.

- Negative balance protection.

- Clarity on all Trading account features.

- 250+ Assets, Currencies, CFDs, Cryptocurrencies.

- Excellent copy trading platform and strategy managers

- Responsive customer support 24/5.

CONS

- Financial information not publicly available

- Does not hold a banking license.

- Training and educational materials not ideal for experts.

FXTM Broker Review

9.5

Pros

- Standard and ECN accounts start at $10 and $200 respectively.

- Top tier FCA regulations.

- High leverage position up to 2000:1.

- Trading Platforms, MT4, MT5, FXTM Trader.

- Negative balance protection.

Cons

- Financial information not publicly available

- Does not hold a banking license.

- Training and educational materials not ideal for experts.

MINIMUM DEPOSIT OF $10

9/10

MAX LEVERAGE & SPREAD

10/10

PAYMENT AND WITHDRAWALS

10/10

TRADING SOFTWARE - WEB & MOBILE APP

9/10

CUSTOMER SERVICE

9/10

Read More