Previously, individuals couldn’t trade foreign exchange markets (forex) due to the size of capital required, it was exclusively reserved for banks and other big financial institutions.

It was impossible to trade the forex market without having equity running into millions of dollars.

But that has changed, individuals and smaller firms can now invest in the forex market because of the leverage that margin trading provides.

What Is Margin Trading?

Margin trading or using margins to trade is the leverage provided by a broker for a trader to trade with. It is also the money that a trader puts forward to open a trade.

Margin trading increases the position size of a trader by giving leverage to trade larger positions to make more profits.

For a trader to be able to use margin, a part of the trader’s deposits are held up by his broker to keep a position(s) open.

This held-up equity serves as a form of collateral known as used margin.

While the funds left available to open more positions is the available equity.

The leverage available to traders depends on the broker as well as the regulating body.

Before signing up with a broker, it’s best to examine your brokers terms & conditions. Find out more about margin trading offers.

To get the best from your broker, visit 5 Tips for Choosing a Reputable Forex Broker

Example 1

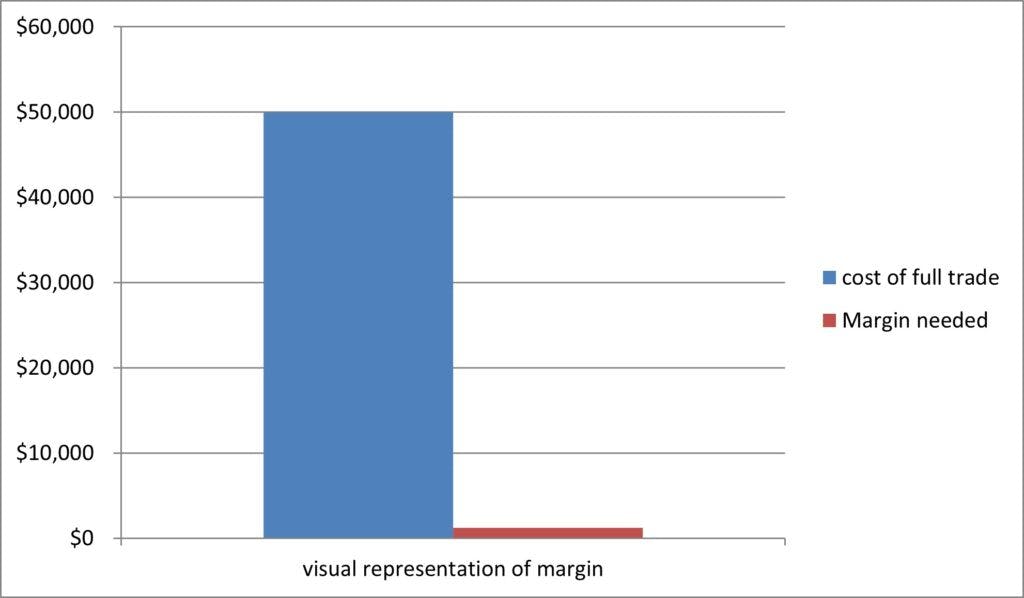

If a forex broker is offering a margin rate of 2.5% and a trader wants to open a trading position of $50,000, he only needs a deposit of $ 1,250 to enter into the trade.

The leverage on the trade will be 25:1.

What Is Margin Level In Forex Trading?

Margin level is the ratio of available equity to the used margin multiplied by 100.

Margin level can be calculated using the used margin as well as the available equity.

Margin level = (Equity/Used Margin) x 100

How Does Margin Trading Work?

Let’s take a look at the illustration below…

Example 2

If a trader deposits $5,000 into his forex trading account, and he opens two trading positions, with the broker requiring a margin of $1,250 to keep his two positions open, therefore, the used margin will be $1250.

To be able to know the cash available to trade with(available equity), the forex trader has to calculate his margin level. His margin level therefore will be (5000/1250) x 100 = 400%.

When Can a Trader No Longer Open More Positions?

A trader can no longer open more positions when the margin level gets to 100% because all available margin has been used by the trader.

From the example above, a trader can keep his trading positions open if he maintains a margin level between 400% and 100% (this is known as the maintenance margin).

What Happens When Margin Level Falls Below 100%?

Once a trader’s margin level, falls below 100%, the broker issues a call or message informing the trader to deposit funds to keep his position open, this call/message is known as the margin call.

If the trader is not able to deposit funds into his trading account, some or all of his positions get liquidated (closed).

Traders need to avoid margin calls by constantly calculating the margin level to know if running trades are still healthy, or perhaps managing his trades by the use of stop lose order to minimize loses would be the better option.

What Relationship Does Margin Trading have with Leverage?

It is important to know the relationship between forex margin and leverage, as these two concepts are interrelated, yet they have some differences.

Margin is the amount of trade deposit needed to open trading positions and to keep them open.

While leverage is the facility that enables the trader to trade far bigger positions with a small initial deposit. Simply put, the margin is needed to make use of leverage.

| S/N | MARGIN TRADING | LEVERAGE |

| 1 | Margin is the amount of money required to open a position. | Leverage is the multiplier to the deposited equity offered by the broker. |

| 2 | The amount of margin available to trade is determined by the margin rate requirement. | Leverages are fixed percentages that are allowed based on a trader’s equity. |

| 3 | Margin is used to create leverage | Leverage helps a trader to trade bigger positions whilst using a margin account. |

| 4 | Margin is expressed as a percentage of the equity in a trader’s account. | Leverage is the ratio between the amount of money a trader has and the amount he can trade with. |

| 5 | Margin enables you to open a position | Leverage increases your purchasing power in that position. |

SEE ALSO: Trend Trading: The 4 Most Common Indicators and How to Use them Effectively

Calculating Forex Margin for Different Currency Pairs

While most brokers provide margin calculators for their traders, some others do not, therefore it is important to know how to manually calculate margin.

The calculating margin for forex can be a bit difficult if you are trying to calculate for a currency pair in which the base currency nor the quote currency are in the currency that your account is denominated in.

To know more about best currency pairs to trade, visit 7 Best Currency Pairs to Trade for Beginners.

Example 3

If you want to trade AUS/JPY, while your trading account is denominated in USD if you take a position to buy 10,000 units of AUS/JPY, this means that you are buying AUS against the equivalent YEN.

While it may seem that you are exchanging YEN for AUS, but the reality is that you are buying AUS with USD.

In this scenario, the margin requirement will be calculated based on USD requirements.

We will explain the calculation with the formula below:

Margin requirement = ([{base currency} / {account currency}] x Units) / leverage

Let’s apply this formula to a calculation. If you are purchasing on margin, one standard lot (100,000) units of AUS/JPY and your broker’s margin is 20x for your account, while the conversion price on this pair is $1.9023.

We have- 100,000 units /20 x 1.9023. This amounts to $9,511.5 which is the required margin to execute this trade.

Final Thoughts

The use of margin in forex trading is very important as the use of leverage enables opening larger trading positions.

Despite this traders who make use of margin must know that their losses can be magnified while trading on margin, which is why it is important to understand margin trading fully before starting to trade with margin.

Image credit: Money vector created by pch.vector – www.freepik.com

Read More