Margin trading and leverage are similar but not the same. Many investors often find it difficult to clearly differentiate between these two trading terms.

Let’s examine these trading terms and differentiate them one after the other…

What is Margin Trading?

Margin trading means using borrowed funds from a broker to trade positions beyond the size of your capital.

Margin is a loan that enables investors to take arbitrage opportunities on a financial asset.

What is Leverage?

Leverage is an investment technique of increasing the ability to purchase more assets using borrowed funds from a broker.

These terms are closely related and seem to work hand-in-hand.

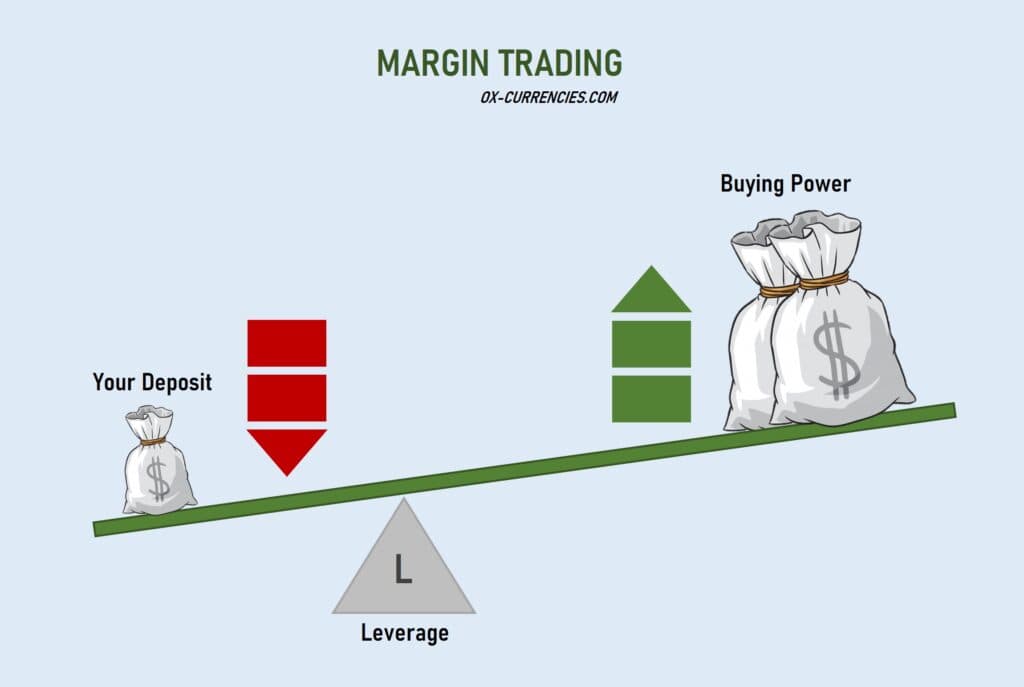

The image below show the relationship between Margin trading and Leverage.

From the diagram above, the act of applying leverage to get more buying power from your broker is Margin trading.

Margin trading was introduced to enable investors take opportunities with borrowed funds from their brokers.

Most brokers now used the “Margin trading” incentive to entice new traders. The risks to margin trading…if used excessively or without proper risk management may expose an investor to losses.

Let’s take a look at other terms in margin trading you need to know.

What is a Margin Call?

A Margin Call is a notification from a broker to an investor on low balances below the minimum margin requirements. In a nutshell, the investor’s trading account balance is running low.

This message urges the trader or investor to deposit money in his trading account to continue trading.

This happens when a trader’s margin goes below the maintenance margin, at this level the trader cannot maintain his open positions.

When the margin goes below a set percentage or threshold, the broker will notify the trader to either deposit funds or close existing positions (this is also known as liquidation).

If the trader fails to deposit funds to the tune of the margin level, the broker will liquidate the trader’s position(s).

How Does a Margin Call Occur?

A Margin call occurs when the value of the equity in that account drops below the required maintenance margin.

Example

Assuming the maintenance margin requirement with your broker is 25%. You have $5000 worth of financial assets (currencies, securities) in your trading account and you purchased $3000 on margin and $2000 with cash. If the value of your assets drops by 25% in the course of trading, the value of your account will be $3750.

Since the amount you borrowed was $3000, your equity will be $750 (20%) which is lower than the margin requirement of 25%.

Maintenance Margin

The minimum amount of money that must be kept in a trader’s account to keep his positions opened is known as the maintenance margin.

If your trader provides this incentive, it’s important to know how to find a healthy margin level to trade.

You should be able to calculate an ideal margin level depending on your account size and type.

SEE ALSO: 5 Pitfalls to Margin Trading on a Low Capital

Used Margin

The total sum locked up by a broker to keep a position opened is known as used margin while the funds left available to open more positions are the available equity.

How To Calculate Margin Level

Margin level = (Equity/Used Margin) x 100

Let’s look at the illustration below.

Example

The first step, the investor must deposit into the margin account. This deposit varies from broker one broker to another.

If a trader puts $2000 in a forex account and opens two positions. If the broker requires $500 to keep the two positions open, the margin level will be

($2000 / $500) x 100 = 400%.

When the margin level drops to 100% it means that no further trade positions can be opened.

Once the margin level drops to below 100% the account gets margin called.

How to Cover a Margin Call

When funding your account, deposit an amount equal to or more than the maintenance margin requirement.

If liquidation becomes your only option, you have to sell to cover the call amount or margin call divided by the minimum margin requirement.

Example

Assuming a margin call gap of $150.

$150/25% (Margin call requirement) = $600

To maintain the minimum margin requirement, you will need to sell or offset your assets worth $600 or deposit $150 worth of cash within a stipulated number of days.

What is a Leverage

Leverage involves using borrowed capital to increase the potential return on investment. In forex, leverage is applied in multiples.

To use leverage and maintain a leveraged position, an investor is mandated to put a part of their trades value as a deposit known as margin.

Leverage is represented as the ratio of the money you invested and the money you trade with, for example, 100:1 or 500:1 (leverage ratio). Check out these ECN brokers that offer good trading leverage

Leverage is usually given in amounts as determined by each broker based on their internal policies; the common leverages are 50:1,100:1, 200:1, and 400:1.

Let’s look at them more closely…

• 50:1- For every $1 you deposit in your account, you can place a trade up to $50.

For example, if you deposit $100 in your trading account, you can place trades worth $5000 on the market.

• 100:1- For every $1 you deposit in your account, you can place a trade up to $100.

For example, if you deposit $100 in your trading account, you can place trades up to $10,000. This leverage ratio is usually offered on standard lot accounts.

• 200:1- For every $1 you deposit in your trading account, you can place a trade up to $200. A deposit of $100 in your trading account means you can trade with a leveraged sum of $20,000 in trades. This leverage is offered on mini lots.

• 400:1- For every $1 you deposit in your account, you can place trades up to $4000.

Difference Between Margin Trading And Leverage

Margin trading and leveraging are very similar, but a few things set them apart.

We will be highlighting a few of these differences below.

| S/N | Margin Trading | Leverage |

| 1 | Margin trading is the amount of money required to open a position. | Leverage is the multiplier to the deposited equity offered by the broker. |

| 2 | The amount of margin available to trade is determined by the margin rate requirement. | Leverages are fixed percentages that are allowed based on a trader’s equity. |

| 3 | Margin is used to create leverage | Leverage helps a trader to trade bigger positions whilst using a margin account. |

| 4 | Margin is expressed as a percentage of the equity in a trader’s account. | Leverage is the ratio between the amount of money a trader has and the amount he can trade with. |

| 5 | Margin enables you to open a position | Leverage increases your purchasing power in that position. |

How Much Leverage is Advisable?

As much as using leverage increases potential profits on trades it also exposes the trader to bigger losses if your trade goes against you.

Leverage is to be used with caution as this incentive on your trading account could blow up your account faster than you think.

The bottom line is to know your risk tolerance level and trade with caution.

Most traders advise sticking to much smaller leverage, instead take it in multiple of smaller lots.

Leverage of 10:1 or 20:1 seems to be low risk with lesser returns. So, it depends on the lot size you’re trading and how much risk you can handle.

Final Thoughts

Margin trading and leverage increase profit potentials. When used wrongly, it could lead to losses.

Apply these trading tools with proper risk management.

Read More