There are no less than 180 currencies in the world. The logical thing is that there would be the same number as countries but that does not have to be the case.

Tradable currency pairs are quotations for two or more different currencies. It is the amount you would pay in one currency for a unit of another currency. For instance, when a trader is quoted EUR/USD 1.13 it means that the trader can exchange 1 Euro and receive 1.13 US Dollars.

On the one hand we have countries that have a common currency, such as the European Union and the euro, and on the other hand we have currencies that are legal tender but are not used.

Key Takeaways

•The best currency pair to trade is the almighty EURUSD.

•USDJPY has its strongest moves in the New York and Tokyo sessions.

•Many traders prefer GBPUSD to EURUSD or USDJPY.

Therefore, removing the special currencies in the end we would have 130 currencies.

But not everything ends there, because within those 130 we have currencies such as the Cuban peso or the North Korean won, which in practice are currencies that are not traded, and that in no way will you be able to operate in Forex.

In fact, in Forex there are much less than 130 currencies that you will be able to use to trade.

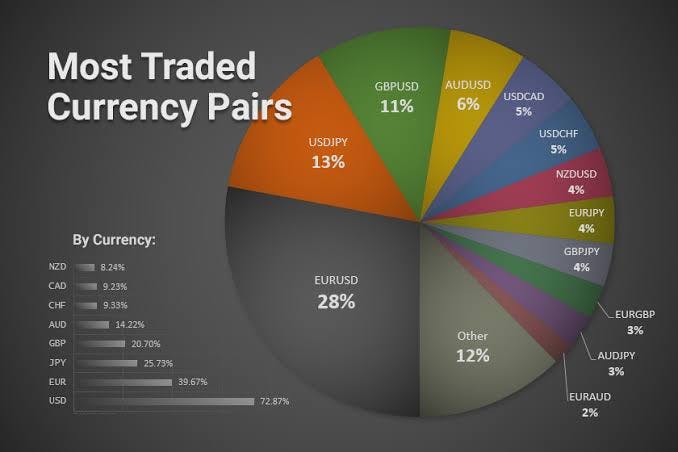

The best currency pairs to trade are the ones we have on this list, and of course the first is the almighty EURUSD, possibly the most traded asset in the world. Let’s see the best Forex pairs:

1. EURUSD

The pair of the dollar and the euro reflect the trade of the two largest country in the western world, and they reflect the enormous volume of transactions that occur between European economies such as Germany, France, Italy, Spain, and the Netherlands with the United States.

That is why this is the most important and most-traded currency pair in the world by far.

That is why the EURUSD is the pair in which we will find the highest liquidity and lower spreads when trading, making the pair the cheapest to trade. Hence, it is the undisputed favorite for short-term speculators, due to the importance that low costs have for them.

2. USDJPY

The so-called Gopher is the second most traded pair in the world and reflects the enormous volume of transactions between these two gigantic capitalist economies.

This is a pair that dominates the markets of Japan, which has been considered the largest Forex retail market in the world for many years.

This is a volatility pair similar to the EURUSD and of course it has its strongest moves in the New York and Tokyo sessions.

3. GBPUSD – Cable

The one known by cable is the British currency pair, which is one of the most surprising in the world, since it has a greater participation in the Forex market than it would be due to the size of the economy.

This is so because the Forex market shows us that the currencies that are traded in these international markets are not necessarily those of the largest economies, such as China or India, but of those economies with more international relations and a more advanced trading regime.

In this sense, London continues to play an essential role in world financial markets, being a crucial hub in investment movements worldwide.

It is a pair with a lot of volatility in the European and American sessions. Many traders prefer it to EURUSD or USDJPY.

However, it must be taken into account that the spread is usually higher than that of these pairs, which adds an extra cost to trading. Still, it is usually a pair with low spreads compared to the rest.

4. AUDUSD – Aussie

The Australian currency pair is another that trades very strongly in international markets.

In this case we are facing a pair highly sensitive to the cycles of raw materials and the economic cycle of China.

This means that it tends to have a somewhat higher volatility than other pairs, at least from a relative point of view (%), not a total one (pips), since it is a pair with a low “price”.

Being closely related to raw materials, it is a pair that usually behaves well when there are positive markets for the previous ones, and vice versa when there are falls in prices.

SEE ALSO: How to Reduce Your Risk Exposure by Hedging a Currency Pair

5. USDCAD – Loonie

The pair known as Loonie is the one that represents the trade between the two neighbors of North America.

Like the AUDUSD pair, it is quite influenced by the cycles of commodities, but in this case we are facing a pair with less volatility.

This is so because it is a phenomenon that usually occurs between pairs of neighboring countries, which for one reason or another have more similar economic cycles.

An example of the latter can also be seen in the EURGBP, which is an important pair in Europe but with less volatility than the EURUSD.

In my case it is a pair that I try to avoid, especially in short-term or intraday trading, mostly because there are other better pairs.

The spreads are usually quite interesting and it is a pair that presents good opportunities for swing trading or long-term trading.

6. USDCHF – Swiss

The pair of the Swiss franc and the dollar is a classic of the currency markets.

This is the most exaggerated case of how a small economy can have such a large share in a market like Forex.

As in the previous cases, this is so because here what counts is the tradition, transparency and security of the Swiss capital markets, and that is why world operators trust their capital in this country and currency.

The same cannot be said for other currencies of larger but less secure economies such as the Turkish lira or the Brazilian real.

7. Other Important Pairs

•NZDUSD: it is the younger sister of AUDUSD, a pair with which it shares many characteristics, since they are quite similar in their movements, but still behave independently. An interesting pair, no doubt

•EURGBP: pair with a lot of volume in Europe and very popular with many traders

•EURJPY: pair that has gained popularity over the years and sometimes offers more volatility than the USDJPY

•EURCHF: popular pair for carry trading that in the past brought huge disruptions with the Forex Black Thursday. Unless you know what you do, it is better to avoid it

•GBPJPY: well-known pair in Fofex’s speculative markets and widely used by Anglo-Saxon traders. Pair with a lot of volatility and high movements in pips, due to the high relative price.

USDCNY is an increasingly popular pair offered by many brokers. However, this does not make it attractive for trading in the retail Forex market.

If we look at the currencies of the major pairs, these are economies with little intervention, or at least with fairly clear private property rules.

The same cannot be said of countries like China, which, although they are committed to private property (especially national), still do not guarantee the freedom to invest and divest for foreign agents.

Recommended Brokers

In our opinion, AvaTrade and XM are one of the best online brokers in the forex market. Indeed, it meets essential security and regulatory standards, which are one of the most important criteria for choosing a broker.

Then, it offers a very diverse and complete range of financial products, making it possible to diversify its portfolio.

We can also talk about its responsive customer service, its competitive prices, or its advanced online training. So, in our opinion, it is a safe bet for novices and experts alike.

Frequently Asked Questions (FAQS)

1. What is the most traded currency pair?

EURUSD

2. Why is EURUSD the most traded pair?

The EUR/USD pair has become the most widely-traded pair in the world because it represents a combination of two of the biggest economies in the world

3. Can Forex be predicted?

Predicting the direction of the forex market is not easy but traders have more tools and resources at their disposal than ever before. There’s a saying, “don’t predict the market, react to it.”

Final Thoughts

There are some traders who decide to trade only in a specific currency pair that they study in depth and try to know well. This is a personal decision but in my opinion I don’t see much sense in limiting yourself to just one pair and ignoring the opportunities that present themselves in others.

Your goal should be to have your own trading system that is profitable and consistent. Spot strong trade setups and ignore those that are not and may be at higher risk.

Read More