What is Hedging in Forex Trading?

Hedging in Forex is a trading technique of taking one or more positions (above or below the initial entry point) in a currency pair to protect initiated trades from adverse price movements.

Hedging is a short-term protection strategy that covers a trader’s opened positions just in case the market swings in the opposite direction.

A trader can hedge by buying short or long simultaneously in the same currency pair.

For instance, a trader can go short on the AUD/USD and simultaneously go long on the EUR/USD since both markets present different volatile trends.

There are instances where a trader opens multiple positions in more than one currency pair, this is known as the “Multiple Hedging” strategy. We shall discuss this much later.

What hedging does essentially is to reduce the risk of loss in case the market losses in either direction by taking a position at both ends of the market at the same time.

Types of Hedging Strategies for Currency Trading

There are three strategies for hedging in forex trading.

Simple Forex Hedging Technique

The first strategy for hedging is to hold a short and long position of a chosen currency pair at the same time. This strategy is known also as a “Perfect hedge”.

For example: Let’s assume a bullish trend in the London session. A trader buys the EUR/USD currency pair at $1.2557. He then takes another position on the same currency pair at $1.2563 as the market support intensifies.

Let’s also assume that the EUR/USD breaks through a series of support levels and gets to a high of $1.2569 on the 15 min chart and then reverses. The trader now has an opportunity to sell.

SEE ALSO: Support and Resistance in Forex Trading – Simplified

The trader can reduce his risk on the EUR/USD by hedging (selling short) at a spread of $0.0006 and $0.0012 respectively as the market trends downwards.

This way he has hedged against losing on the EUR/USD since the market had gone against him.

Multiple Forex Hedging Technique

The second hedging technique is the Multiple Forex Hedging strategy.

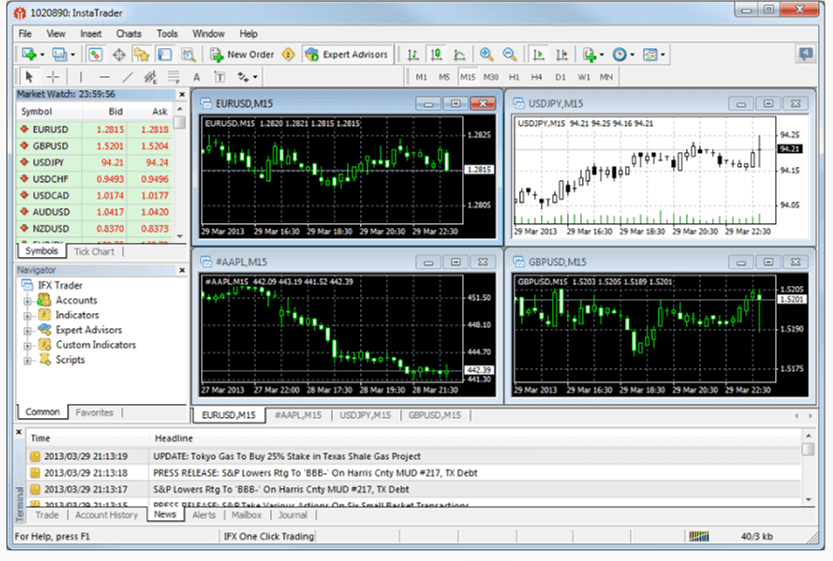

Multiple Forex Hedging entails opening more than one position on two different currency pairs. Usually, the USD/JPY currency chart and the AUD/USD currency chart are inversely correlated in terms of volatility.

The USD/JPY is highly unpredictable and can make sharp leaps during trading sessions.

The AUD/USD often referred to as the “Aussie” and “Kiwi” are known for their calm flow and mid volatility. This behavior makes it easy to read and follow.

A trader may decide to short on the USD/JPY and long on the AUD/USD for the reason of volatility and inverse market behavior. So, a trader could open a “Buy” on both currency pairs (short and long) to hedge losing if any goes south.

The simple forex hedging strategy can be applied simultaneously on two different charts which now translates to multiple hedging.

As easy as this technique may seem, it takes practice and understanding the behavior of currency pairs to hedge correctly.

SEE ALSO: 7 Best Currency Pairs to Trade for Beginners

Hedging through Forex Options

The third strategy for hedging in forex trading is to hedge through Forex options.

It is a very popular way of reducing your exposure in trading. Forex options give the trader the right but not the obligation to exchange a currency.

Forex options involve selling Calls in a short position or buying Puts in a long position.

The use of Forex options is referred to as an “imperfect hedge” because itreduces some of the risks but not all in trading a currency pair.

This means that a trader who is in a long position can buy Call options or sell Put option contracts on a currency pair.

This move can drastically reduce downside risks by allowing you to pay for the cost of the option only.

For example, A trader decides to go long on the GBP/USD at $1.3388 where he opens a trade. As the market continues in a mild uptrend, he knows it’s not guaranteed and decides to hedge the GBP/USD with a Put option at $1.3381 on one-month expiry date.

If at the end of the one-month expiry date, the GBP/USD falls below $1.3381, the trader would have lost money in the long position but will still have the option in the money and reduced exposure.

If the GBP/USD had continued in the upward trend, then the trader could as well allow the option to expire and pay only the premium.

SEE ALSO: Best Volatility Indicators You Should Consider in Forex

Pros of Using Hedging Currency Trading

- It can be used to protect trading accounts and limit losses.

- It’s a good way to venture into more than one market and profit at the same time.

- Enables traders to trade on any market trend irrespective of the unpredictability of the currency pair.

- It boosts liquidity as more investors open positions across multiple classes of assets (Stocks, Commodities, Oil, Precious Metals).

- It is still one of the easiest and most used forex stop-loss trading strategies.

Cons of Using Hedging Currency Trading

- It can be tough sometimes for traders to keep track of all opened trades at the same time and therefore could result in mistakes.

- Traders tend to abuse the hedging strategy by taking excessive risks.

- Due to multiple positions opened, losses can also multiply on losing currency pairs.

- No one single method to hedge and so, traders will arrive at different results.

Final Thoughts

Hedging in Forex can be tricky if you’re not experienced using it. However, a few advanced traders use it. It’s possible to learn and use it.

Before you go full-on hedging, you have to test out your trading strategies first to see if you can implement it efficiently. It’s advised to try hedging first with a demo account before proceeding to a live account when you feel confident.

We wish you a successful trading!

Image credit: Business vector created by starline – www.freepik.com

Read More