There are many different concepts in trading and it can be difficult for a beginner to understand all the nuances. knowing the best lot size, for example, is a basic element if you want to set up a strategy.

Key Takeaways

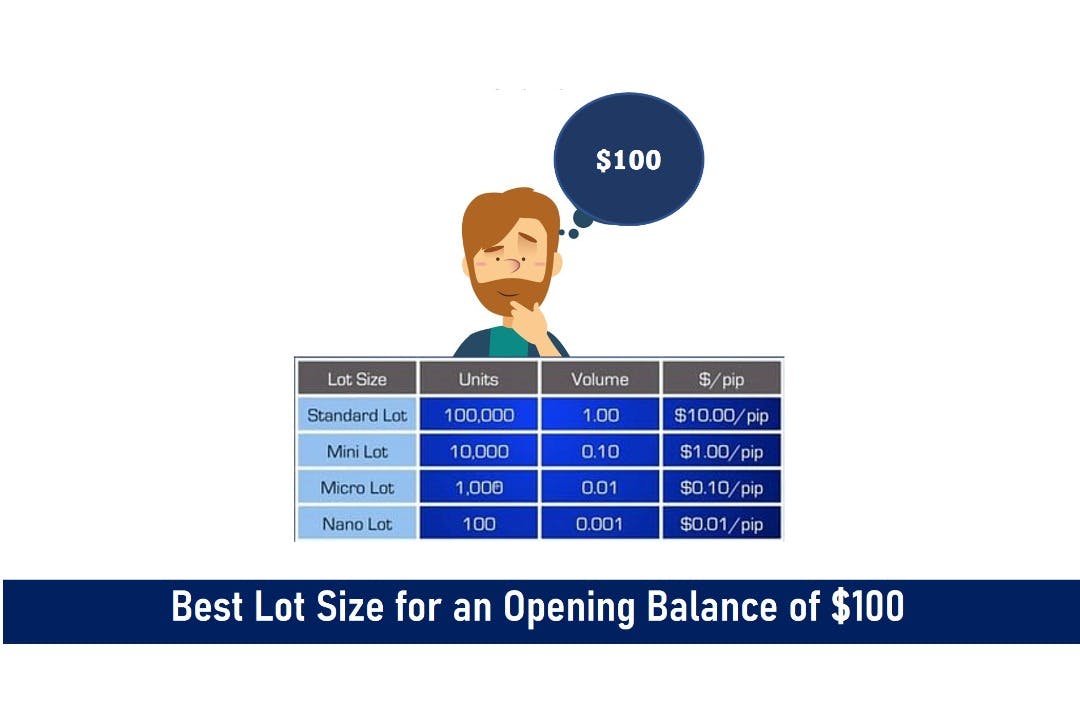

•The best lot size for 100$ is 0.01 lot.

•The value of a PIP is always calculated in the quoted currency.

•The larger your position amount, the greater the value of a pip will be on your trade.

Some terminologies you need to know

1. Losses and Profits on Forex

Surely you have heard of pips and lots before, but are you familiar with these terms? What is their significance? What is the value of a pip and a lot?

If you don’t know how to respond, then what follows is for you.

To be able to trade on Forex, it is essential to master these concepts.

They will allow you to calculate your profits and losses but also to correctly set your protective stops (Stop Loss) even if today with the evolution of trading platforms, with a simple manual gesture you can place your Stop Loss, Take Profit and Breakeven.

SEE ALSO: Best Lot Size for an Opening Balance of $500

2. What is a “PIP”?

A pip is the smallest unit of change in an exchange rate. As you may have noticed, currency pairs are quoted to 4 decimal places most of the time.

One pip is the last decimal place. If the EUR / USD goes from 1.4018 to 1.4019, it means that the euro has appreciated by one pip against the dollar.

One pip is then equal to 0.0001 (1pip = 0.0001). On the other hand on the USD / JPY, the pip does not correspond to the same amount since the quotation is only made in two decimal places. One pip is therefore equal to 0.01 (1pip = 0.01).

As you can see, the amount of a pip depends on the currency pair you are trading.

This is the basis for calculating your Forex gain or loss.

Now that you know the meaning of a pip, we can proceed to calculate its value.

The value of a PIP is equal to: PIP (in decimal) / exchange rate X the size of the position traded.

SEE ALSO: Beginners – Forex Lots and Pips Simplified.

SEE ALSO: How To Use A Forex Lot Size Calculator Like A Pro

Let’s take an example:

On the USD / JPY, a pip is worth 0.01 since the quotation is made in 2 decimal places.

Suppose the USD / JPY quotes 90.68, and we trade with a position of 100,000

Value of one pip (JPY) = 100,000 * 0.01 = 1,000 JPY

The value of a pip is always calculated in the quoted currency (here it is the JPY) to then be converted into the base currency of your account (the EUR).

To find out the dollar amount, all you have to do is do the following:

Value of one pip (USD) = 1000 / 90.68 = 11.03 USD

To calculate the value of a pip directly in USD, you have to do the following calculation: 0.01 / 90.68 * 100,000 = 11.03 USD.

Value of one pip (EUR) = 11.03 / 1.4018 = 7.86 EUR (if EUR / USD is quoted 1.4018).

Let’s take another example on EUR / USD. The smallest unit of measurement is 0.0001 since the dimension is made in 4 decimal places.

Suppose the EUR / USD quotes 1.4018 and we trade with a position of 100,000.

Value of one pip (USD) = 100,000 * 0.0001 = 10 USD

The value of a PIP is always calculated in the quoted currency (here it is the USD) to then be converted into the base currency of your account (the EUR).

To find out the amount in euros, all you have to do is do the following:

Value of one pip (EUR) = 10 / 1.4018 = 7.13 EUR

To calculate the value of a pip directly in EUR, you have to do the following calculation: 0.0001 / 1.4018 * 100,000 = 7.13 EUR.

The value of a pip therefore evolves according to the price of the currency pair being traded.

SEE ALSO: 6 Psychological Pitfalls of Trading the Forex Market

SEE ALSO: Manual Trading Vs Automated Trading – Which Is Better

3. What is a “Lot”?

In Forex, position amounts are expressed in lots. It is the unit of investment in the market. The value of a lot, its standard size is 100,000, but some Brokers make a Lot at 10,000.

But, depending on the type of account you open with your broker, you will be able to deal with lower position amounts such as 1000 or 0.01 lot. 1000 is the minimum position size to trade in forex. It sounds like a lot to you, but don’t panic.

Indeed, the value of a lot is related to the value of a pip which, as you now know, is a very small unit of quotation. It is therefore necessary to deal with large position amounts to make your gains and losses meaningful. The larger your position amount, the greater the value of a pip will be on your trade.

Let’s take an example: You decide to trade with a position of 0.1 lot (or 10,000 EUR) on EUR / USD, which is quoted at 1.4018.

Value of one pip = (0.0001 / 1.4018) * 10,000 EUR = 0.7133 EUR

This means that if the EUR / USD takes or loses a pip, you win or lose depending on the direction of your position 0.7133 EUR.

You can therefore calculate your gains or losses in advance on each trade and thus control your risk.

You can also fix your gain or loss in the currency won or lost on the trade (i.e. the counter-currency – right currency) and then reconvert at the end of your trade in the base currency of your account. This operation is carried out automatically by your broker on your trading account throughout the duration of the trade.

Best Lot Size for an Opening Balance of $100

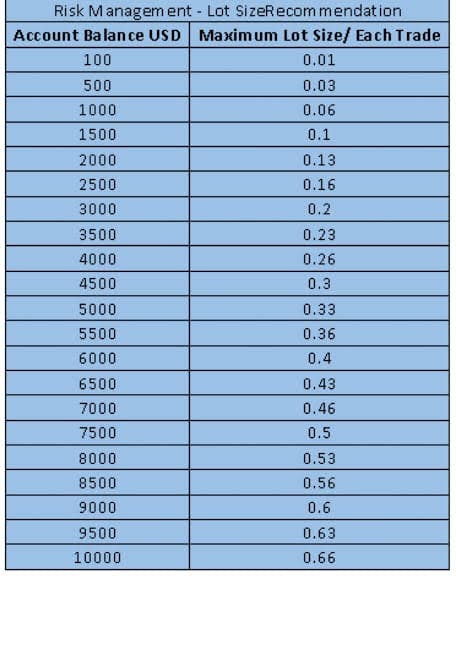

What lot size is good for $100 forex? Answer: If you have only 100 dollars capital, you cannot expect your lot size to be more than 0.10. It is better if you put the lot size 0.01, the lowest one.

Frequently Asked Questions (FAQ)

1. What is the Best Leverage and Lot Size for my $100 Trading Account?

Maximum leverage of 1:500

2. What Does 1.00 Lot Size Mean?

100,000 Units

3. How Many Dollars is 100 Pips?

100 pips would equal a $10.00 USD profit. (It could also equal a loss of the same amount.)

SEE ALSO: How To Install The Expert Advisor In MT4

Final Thoughts

The key to success as a trader isn’t just knowing when to buy or close a position. It may also be relevant to know the size of each position.

This is why it is relevant to fully understand the definition of a “lot” to ensure your success in the trading world.

Read More