Price action trading strategy is popular among the trading community and it’s best suited for short-term day traders.

Scalpers use price action trading style to buy or sell currency and hold it for a very short period with the intention of a quick exit for profit. A large number of trades is just the way scalpers get by, relying on price action for making a profit.

Price action trading also offers dynamic trading patterns as each trader interprets market movement in different ways. This, therefore, means that every trader can define his/her strategy and follow it.

What is Price Action in Forex Trading?

Price action is a trading technique of simply analysing the price movement of a security, in this case, a currency pair, and make informed decisions on actual activities of the chart.

Price action ignores fundamental analysis and technical indicators while depending solely on current market data.

Price action requires a lot of intuition and experience because a trader will have to rely on a currency pair support and resistance happening in real-time and make his decision.

The whole essence of the price action technic of trading is to generate quick profit over a short period.

Why is Price Action Preferred by Day Traders?

As we’ve established that technical analysis involves the use of charts and other technical indicators to trade the forex market, price action trading is more of a quick fix for scalpers.

A scalper can analyze the five-minute chart for a potential market breakout, He sees that the market is trending outside the support or resistance level with a high volume.

Depending on what side of the curve the trader is, he takes a short position after the currency trends below the support level or he takes a long position if the currency trends above the resistance level.

Understanding price action is critical to technical analysis because it gives a trader who has master this technique an edge to make on the spot decisions about the market and trade likewise.

Price action also sharpens the mind of a trader because he has to think and act quickly on his toes, and not to rely solely on historical trading data.

SEE ALSO: 5 Best Scalping Forex Robots for MT4

Technical Tools for Price Action Trading

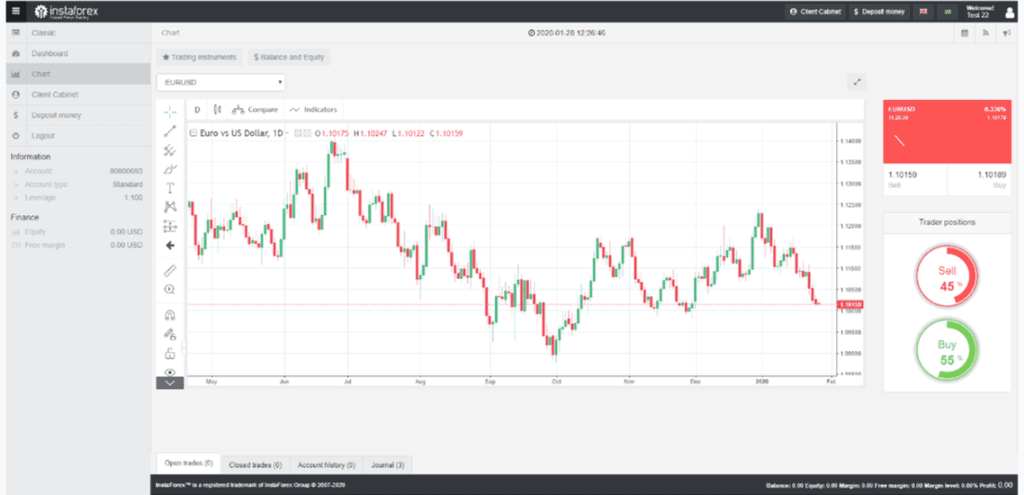

Technical tools for price action trading is no different from tools used by day traders in general. Trend lines on charts, bars, candlesticks, and some recent price data are deployed for price action trading.

In addition to these tools, a lot of logic and intuition goes with price action trading. No matter how much the market breaks out, for instance, two traders would interpret it differently and decide on how best to trade.

SEE ALSO: What is Technical Analysis and Why is it Critical to Forex Trading?

How to Trade Using Price Action Strategy

Since traders would decide differently on the his trading strategies, there are similar patterns most traders will take into consideration.

Price action trading steps:

- Identifying when the market is on a bullish run or bear. The trader should test the volatility of the currency pair and decide entry and exit points.

- Decide ahead on stop-loss levels. Many traders ignore stop-losses because there are scalpers. Mark your stop-loss levels before initiating a trade.

- Protect your account with trailing stops of about 15%-20% which lowers your down movements and substantially increases your risk-adjusted returns.

- Follow the market trend and identify opportunities. Never trade against the tide or curve. If the market is trending upwards, it signals a good time to buy and follow along as the curve continues in its part.

- Look out for breakout opportunities and take them when they do appear.

SEE ALSO: How to Correct Trading Losses and Become a Better Forex Trader

Final Thoughts

In addition to the use of a defined trading strategy, technical tools, intuition, and some dose of luck, the Price trading strategy builds confidence in traders that have mastered it.

It should also be noted that price action trading comes with its associated risks as well.

Swift market entry and exits are usually mentally tasking and require a high level of discipline and risk management.

Image Credit: Business vector created by freepik – www.freepik.com

Read More