Bitcoin’s Fall and Recent Outlook on Crypto

With Bitcoin’s recent fall from a high of $63k/BTC in April 2021, many investors considered alternative market strategies to recoup their already losing stake in Bitcoin and other Altcoins they already hold.

A question in the mind of many investors were…How far down could Bitcoin go before deciding to trigger the “Buy” button?

Bloomberg’s analysts predicted that Bitcoin would experience major gains in 2021 from its recent Crypto Outlook where they weighed the performance of Bitcoin and other altcoins in the coming months.

They were optimistic that Bitcoin could get to the $100,000 mark as against a fallback to $20,000.

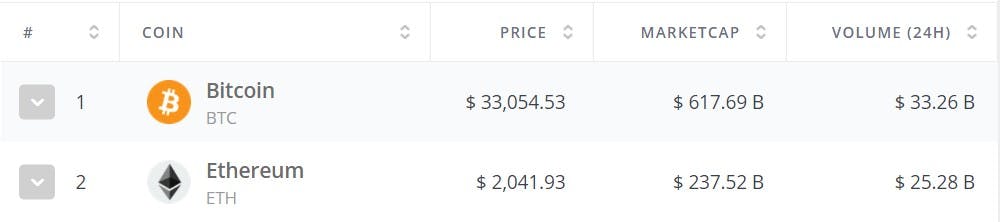

While Bitcoin rests within the $35k/BTC range, Ethereum is inching toward Bitcoin in market capitalization as its market volume closely matches the Alpha coin.

A few promising altcoins are becoming the toast of new investors who may want to take advantage of the losing streak.

And, of course, the high price tag of Bitcoin created opportunities for first-time investors to consider Ethereum, Cardano, Dogecoin, Tether, Ripple, and other lower cap altcoins.

So, investing in Ethereum for instance with a lower price tag enabled investors enjoy the same market sentiments Bitcoin got as both coins are correlated in terms of market trend.

The chart below shows Bitcoin and Ethereum’s market movement for the last year.

The chart above reveals very identical price patterns as Ethereum leverages Bitcoin’s market dominance.

When the bear takes over, what are the best strategies for buying the dip for any coin?

Before we delve into these strategies, cryptocurrencies are very volatile assets and should be traded with caution.

Tested Ways of Buying the Dip

The first strategy for “buying the dip” in a crypto market…

Analyze the Coin’s Market Capitalization and Market Volume

Many investors focus on price which is normally the first consideration in terms of affordability.

The second step is studying the 52 weeks highs and lows to gauge the maximum and minimum prices it has ever attained…but many investors stop analysing at this point.

Market Capitalization and Market Volume are usually ignored.

Asides from the market price per coin, market capitalization, and market volume are important metrics to look at when buying the dip.

Let’s explore what these two metrics mean…

Market capitalization in the cryptocurrency market reveals the total dollar value of all coins that have been mined since the coin was created. This further explains how liquid the coin is in the market.

Market volume in crypto means the total number or transaction value a coin saw in dollars within the last 24 hours.

For example, if Cardano saw $1.88B worth of transactions in the last 24 hours, this means that that value of transactions that passed through all the global cryptocurrency exchanges within the last 24 hours was worth $1.88B.

Market cap and volume indicate the level of activity of that asset which could signal a healthy or weak investor sentiment.

Secondly, these metrics indicate how much more the price will face resistance or gain support on the lines of the chart.

When the market volume/ supply in the last 24 hours is in red or negative, this shows that the market interplay on the coin is weakening. So, it’s vital to check the trend to see if the market volume has been on a constant decline before taking a decision.

While guessing the likelihood of prices surging or dipping, consider other available market metric from your service provider. There are free market analysis tools you can use to your advantage.

Study The Side of The Market You’re In

Every investor should understand and time the market properly.

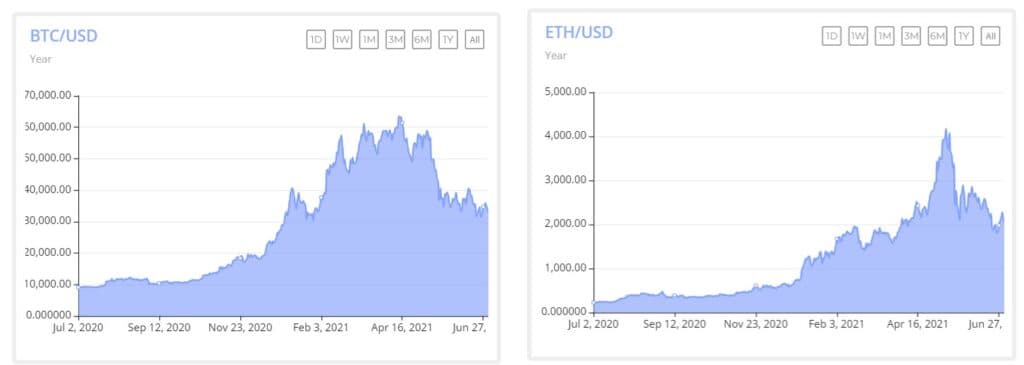

There are the “early entrants” and “late entrants” in all market conditions.

Let’s consider the bear or losing market which is our focus.

Early entrants in a bear market are investors that entered the market when prices of crypto began to dip.

This will mean that they will have to endure the fall, wait longer until the prices begin to rise again. The ills of this and perhaps as a result of poor timing of the market could lead to a loss in time value of money.

For example. After the fall of Bitcoin from $63k/BTC on April 13, an investor who bought Bitcoin at $60k/BTC on April 17, with the expectation that Bitcoin would rise afterward would have to wait longer to breakeven and make a decent margin.

The Ethereum one-day chart below illustrates further what it means to buy the dip…

So, you should know where you are and consider whether you’re entering when prices just began to dip.

Late entrants in a bear market is the better side to be. It takes patience, proper analysis of trends, and some dose of luck.

Buying the dip at this point when prices settle and have lost momentum to fall further is perfect.

But, how many investors can find that “sweet spot”?

This now leads to the third strategy.

Wait Until Prices Settle or Simmers

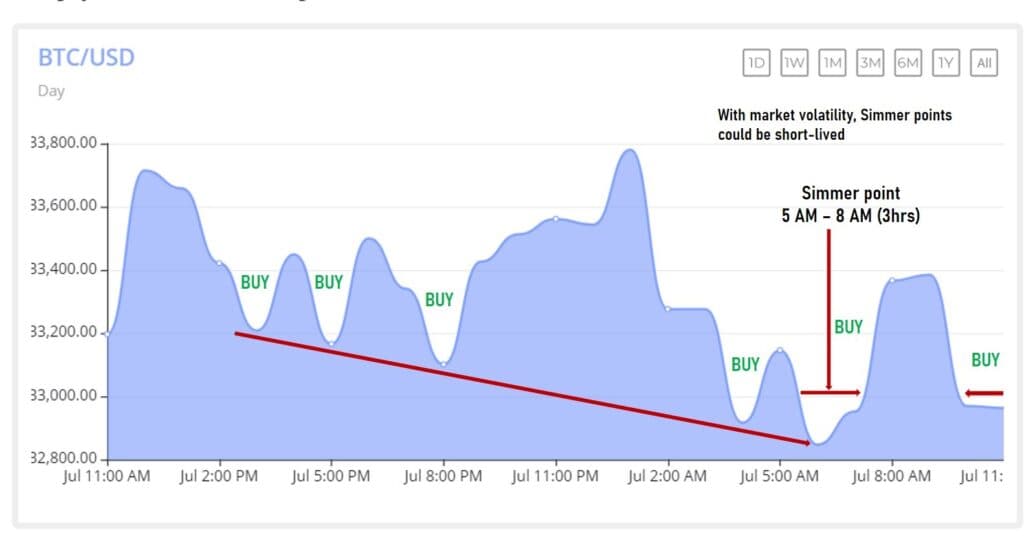

The graph below illustrates a one-day downward price trend of Bitcoin.

The illustration shows 5 valley points or settling points for Bitcoin with potential buying spots.

Understanding the price action or price pattern takes a bit of effort and practice.

Buy incrementally as prices fall.

Sell incrementally as prices go up. there are no profit guarantees.

Before investing in Bitcoin or any other altcoin, take time to study the charts at intervals to determine a pattern of behavior of the asset.

What this dictates is that an investor needs to closely watch the charts to spot good entry and exit points.

Buy when you can see similar movements repeated over time while following through on your exit strategy.

You can access free crypto charts for your analysis.

Automate Buy & Sell Order Filling Process

With advancement in trading technology, AI crypto trading bots can now be integrated into Metatrader platforms (MT4 & MT5). One can automate most of these processes without having to sit right in front of the computer screen or stare at a mobile device all day.

These AI crypto trading bots can also analyze the market faster with a powerful backtesting capacity. However, with a lack of human analogy and intuition, these bots need not to be relied upon 100%.

As your AI crypto trading bot analyses the market or a specific coin, also carry out an independent study of the market.

Set buy limit and sell limit orders on your trading platform and allow the system to implement.

For forex trading, you can check these AI forex trading bots.

Final Thoughts

In literal terms, trading financial assets entail an investor buying an asset at a low price and selling high.

The sad part is that every market player is well informed and the market abit more sophisticated. Your well-conceived move or plan could be faltered when implemented in the marketplace.

In all, diligent market analysis, testing, courage, and caution is required to succeed not only in the crypto market but any other financial market in the world.

Image credit: Money vector created by vectorpouch – www.freepik.com

Read More