Recently, cryptocurrency giant; Coinbase, announced an expansion in its financial services that allows its users to borrow money while using Bitcoin as collateral.

This development has placed Coinbase right at par or even slightly ahead of competitors like Blockfi and Nexo.

Coinbase stated that the reason for the program was to ensure that customers are no longer cash strapped to the point of selling their Bitcoin (BTC).

What this means is that if you are having a financial need at a time you do not have to sell your Bitcoin at an unfavorable price to meet your pressing financial need.

Why Borrow from Coinbase?

No Credit Check

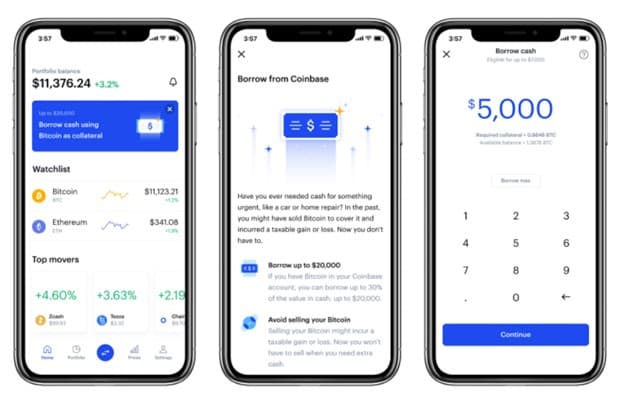

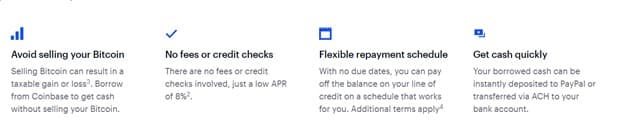

With Coinbase borrow; you do not have to be subjected to the stress that comes with credits checks.

With your Bitcoin serving as the security for your loan, you can rest easy knowing your credit ratings will not be affected because of too many credit checks.

Also, you need not be worried about your credit data being in the hands of a third party, as Coinbase does not require your credit details to borrow you cash.

SEE ALSO: Where to Find and Use a Bitcoin ATM

SEE ALSO: 5 Best Ethereum Wallets for Safe trading and Storage

Amendable Repayment Schedule

Coinbase borrow allows you to fully repay your loan at timelines convenient to the borrower.

Therefore if you are still in a bit of financial difficulty, paying back your loan is flexible.

Quick Access to Cash

In the case where you are in an emergency say you want to cover hospital bills, for example, you need not worry, with fast disbursement, with Coinbase borrow, disbursement can be almost instantly as at the time you need cash!

You Do Not Have to Sell Your Bitcoin

Sometimes the price of Bitcoin may have gone below your entry price and hence unfavorable to sell…

Or you are anticipating a nice rally in Bitcoin price, you need not worry, your Bitcoin will be held in trust while you have access to cash for your needs.

It should be noted that your Bitcoin with Coinbase is safe, and it is not lent out, farmed, or used for any other purpose.

SEE ALSO: Best 5 Trading Apps for Bitcoin this Year

SEE ALSO: Best Mobile Trading Apps for Currencies, Cryptos and Stocks

Prequalification Requirements for Loans with Coinbase

To qualify for a loan with Coinbase, you must be a resident of eligible states in the US.

Currently, residents of…

Arizona, Alaska, Arkansas, Connecticut, California, Florida, Illinois, Idaho, Massachusetts, Nebraska, New Hampshire, New Jersey, North Carolina, Ohio, Oregon, Texas, Tennessee, Utah, Virginia, Wisconsin, and Wyoming have access to a line of credit of 30-40% of their Bitcoin holdings in Coinbase.

It should be noted that Coinbase loan rates vary from state to state (based on extant financial laws of your state).

As against the earlier version, with the expansion of Coinbase borrow, you do not have to apply for a waitlist to get your loan disbursed.

Once your qualification has been confirmed your loan will get disbursed.

Equally, customers can choose the payment platform which they prefer their cash to be paid, between bank account and Paypal. (Payment will not be made in cryptocurrency).

What If You Have Other Cryptocurrencies Aside From Bitcoins?

If you have other cryptocurrencies in your Coinbase wallet, you can sell them or convert them to Bitcoin on the Coinbase app/ webpage to qualify.

Equally, if you have Bitcoin in other wallets, you can move them to your Coinbase account so you can qualify for the loan.

How Much Money Can You Borrow From Coinbase?

Customers can borrow as much as 30% of the worth of their Bitcoins or up to $100,000 in cash value (whatever works first).

Repayment Period with Coinbase

Borrowers can pay back their loans within 12months of the date of first payment while also ensuring the monthly interest obligations are met.

SEE ALSO: How to Add Bitcoin Payment to Your Online Business

Loan Health

Loan health is determined by your outstanding loan and the value of your BTC collateral.

Loan health is determined by the loan to value ratio (LTV), which is calculated by dividing the amount of your loan by the value of your BTC collateral. Your loan health level is the value you get from subtracting the LTV from 100%.

Coinbase Loans Vs. BlockFi & Binance

| Service provider | Coinbase | BlockFi | Binance Loans |

| Nature of loan | Centralized | Centralized | Peer-to-peer loans |

| Currency of payment | Fiat | Fiat | Cryptocurrency – BTC and USDT |

| Location | Currently available in 17 states in the United States | Available to residents of the United States | Not available in the United States |

| security | Bitcoin is the only accepted form of collateral | BTC, ETH, USDC, or GUSD stable coin | Several coins including BTC, ETH. |

| Interest rate | 8.0% | 4.5% | Variable |

| Structure of payment | Monthly | Monthly | Monthly |

| Payback period | Within 12 months of the date of the first payment | Within 12 months | 90 days |

Final Thoughts

Coinbase was created to serve the investors being a reliable and trusted platform for cryptocurrency trading and investing. It has now opened a window for investors to access funding with flexible terms.

Coinbase has set the path to credit and funding to its teeming investors and new clients coming on board.

Read More