What is a Forex Order

A Forex order is simply an instruction to carry out a trade. There are a variety of orders that a trader can use in trading the market, to the newbie, these Forex terms could be a bit confusing.

The common types of orders in Forex include market orders, limit orders, stop orders, stop-loss orders, take profit orders, trailing stop orders.

SEE ALSO: Best Volatility Indicators You Should Consider in Forex

SEE ALSO: Master Price Action in Forex with these Simple Steps

Market Order

A market order is an order to execute a trade immediately at the best price that is available. What this means is that even though market orders are meant to be executed immediately, they may not be done at the exact price that you have in mind because in-between typing your order and getting them filled, price changes may occur.

Market orders should be placed only during active market trading periods. If you place a market order when a market is closed, it would not be executed immediately but only at the next open of the market, which might be significantly higher or lower than the previous close.

Placing a market order can be likened to seeing a nice pair of shoes and paying for the shoes immediately at the price offered by the seller, in Forex, market orders to be placed to be filled immediately.

Now let us have a Forex example. Suppose a trader wants to buy an amount of USD/JPY pair. He simply goes to his brokerage platform or/and MT4/MT5, he sees the Bid price as 1.0711 and an Ask value as 1.0842.

On entering an order for say 12 lot sizes, on execution, the order will be placed at his bid price or the next available price.

It is important to know that it is not advisable to place a market order during the close of a market because the difference between your executed price and your intended price would be likely enormous which might lead to significant losses more times than profit.

Limit Order

Limit orders are given to either buy below the current market price or sell above the market price. There are two major limit order types; buy limit and sell limit.

They are mainly used when you expect certain conditions to be met before entering a trade. Limit orders are usually triggered when touched by price.

SEE ALSO: Support and Resistance in Forex Trading – Simplified

SEE ALSO: 5 Best Ways To Trade Forex With An Economic Calendar

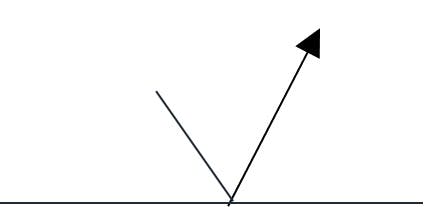

Buy Limit Order

A buy limit order is an order to buy an asset if its price falls to a predetermined price or below it.

Traders open buy limit orders if they believe an asset’s value will increase after touching the buy limit price, that is if you expect an uptrend to continue after a retracement.

A buy limit order is best used so that when price touches your buy limit price or goes below it, your order would be triggered and filled appropriately.

In this chart of USD/CAD, it can be seen that buy limit orders were placed at price points of 1.3064, 1.3114, 1.3246, 1.3270, 1.3222 which are major trendline support areas to analyze a signal to enter a buy trade.

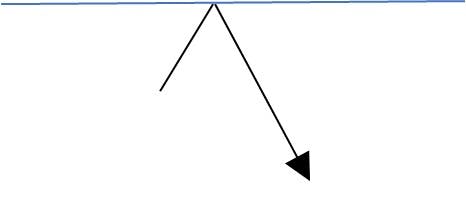

Sell Limit Order

A sell limit order is one to execute a sell trade if the value of an asset increases to your pre-determined price or above it.

You can use sell limit orders when believing an asset’s price will increase after the price touches your sell limit price.

It is used when the main trend is downwards (a downtrend) but you expect a correction, a sell limit order is placed at the likely place you expect the correction to end, and the bears to take over the market fully.

In this chart EOS/Bitcoin, it can be seen that sell limit order was placed just at tested resistance where it is anticipated that the selling momentum will overshadow buying.

Stop Entry Orders

This is an instruction to prevent an order from executing until the price reaches a stop price. A stop entry order can be used when you want to buy only when/if the price rises to your stop price or sell after the price falls to your stop price

These orders are mainly used when you expect a continuation in the direction of the dominant trend. Examples of stop entry orders are the Buy stop order and sell stop orders.

SEE ALSO: How to Reduce Your Risk Exposure by Hedging a Currency Pair

Buy Stop Order

A buy stop order is to execute a buy order above the market price. The order remains inactive in the market until the price of the currency pair reaches the stop price at which point the order is triggered.

Now, it may seem strange that a trader will want to buy at a higher price. The reasons a buy stop is used include; when a trader’s analysis points to an impendingbreakout in an uptrend.

A buy stop is also used as a stop-loss when selling a market pair., this is done by setting a buy stop order above the sell entry price which will get activated when the market reaches the price.

Sell Stop Order

A sell stop order is done to sell a currency pair at the sell price lower than the price specified in an order. A sell stop order is usually placed with the anticipation that the price has reached a certain level will keep on falling.

The blue line showing Sell stop order placed at support

Stop Loss Order

This order is used to minimize losses if a trade starts to move in an unprofitable direction. Immediately the price of a currency point touches the stop loss, the command is automatically triggered to close a running trade.

Take Profit Order

The take profit order is used for gaining profit when the price has reached a particular level. The execution of this order leads to a close of the opened position.

When taking longing positions(buying), the take profit order is set above the bid price while taking shorting positions(selling), the take profit order is placed below the current ask price/entry point.

Trailing Stops

A trailing stop order is an example of a stop-loss order. It is usually done to protect profit whilst making more profits. It is usually set at a percentage below the market price.

When it is set, as price changes, the trailing stop moves with it, therefore when the market stops moving in your trade direction, the new stop loss remains intact thereby protecting your profit.

To understand trailing stops better, let’s have an example:

Consider you are buying USD/JPY at a buy/bid price of 1.021

Price on entry =1.024

Trailing amount=30pips

If the market price rises to say 1.054

Your trailing stop will be at 1.054

Your trailing stop will stay at 1.054 unless the price moves by another 30 pips in your favor.

This means that your trade will remain open as long the price does not go against you by 30 pips, or else you would be stopped out of the trade.

SEE ALSO: Beginners Guide – 8 Day Trading Indicators for Currencies and Stocks

SEE ALSO: How to Correct Trading Losses and Become a Better Forex Trader

Sell Limit Order Vs. Sell Stop Order

| SELL LIMIT ORDER | SELL STOP ORDER |

| Order is placed above current market price | Order is placed below current market price |

| It is set in expectation of the end of a correction and continuation of a dominant trend | It is usually set in expectation of the continuation of a selling market movement |

Buy Limit Order Vs. Buy Stop Order

| BUY LIMIT ORDER | BUY STOP ORDER |

| It is placed below the market price in expectation of a fall in price. | It is placed above market price and the price keeps going up. |

| A buy limit order is entered in expectation of a retracement and continuation in direction of the dominant trend. | A buy stop order is placed in the expectation that the price will continue in the current direction. |

Stop Loss Order Vs. Sell Stop Order

A stop-loss order is one used to close a trade once a particular price is attained, which may be a profit or loss. A stop-loss order is usually used to reduce losses in case the trade analysis and bias.

A stop-loss order remains in effect if it has not been canceled or executed. While;

A sell stop order is used to trigger a trade. It is placed below the market price in expectation of a continued downward trend.

Both stop loss and sell stop orders can be used in closing a trade.

Read More