Let’s face it: DeFi scams and attacks are persistent, and without a doubt, an everyday happening. One of which is the “Sandwich Attacks”.

Since blockchains are open, fraudsters and attackers can make your transactions sour. They can check to see the kind of transactions you have conducted.

This in turn leaves investors and users with an unsafe feeling and deception as the case may be.

Key Takeaways

•Sandwich attacks are real and happening every day. Nonetheless, you can still trade safely.

• Do not put in more than you can afford to lose. Always set the spillage tolerance properly to the level you can bear.

• Decrease the spillage when the trade amount increases. That way, you’ll outsmart fraudsters.

• To be on a safer side, initiate multiple, smaller swaps instead of one large trade.

Even though the crypto space develops daily as well as its technological advancements, its vulnerability to different forms of scams, hacks, and attacks also rises. This leads to a higher level of risks faced by investors and users alike.

SEE ALSO: How to Fix Insufficient Output Amount Error On Pancakeswap

In-depth studies and research analysts have shown vividly that traders on the network have lost quite a fortune altogether to this attack amounting to a ton of million dollars.

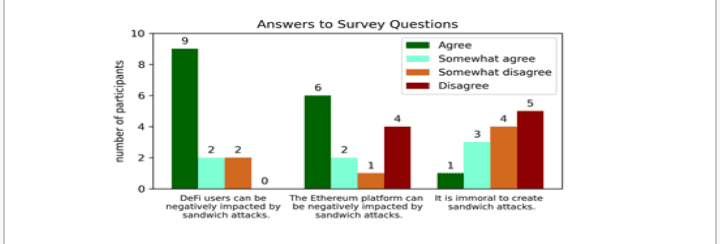

Responses were given by survey participants about statements concerning the impact of sandwich attacks

This article will help educate you to better understand how these attacks come about on the blockchain and how to avoid being the turkey caught in the middle.

What Are Sandwich Attacks?

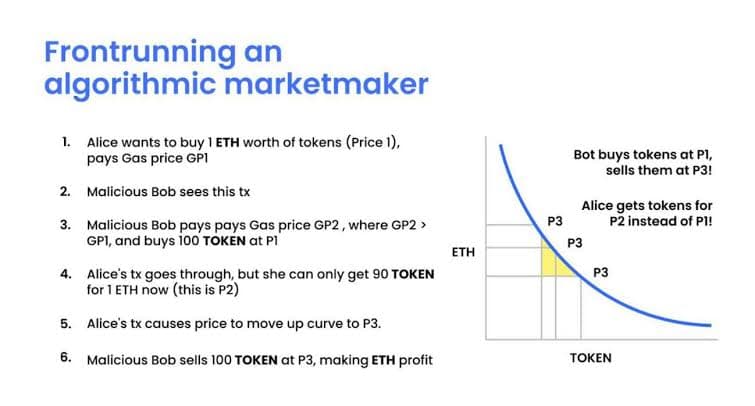

This is a kind of attack that front-runs and back-runs leaving the victim in the middle (little wonder it’s called a sandwich).

Sandwich is a tricky trading strategy that involves positioning a trade before and after a selected, innocent victim’s trade.

What is Front-running?

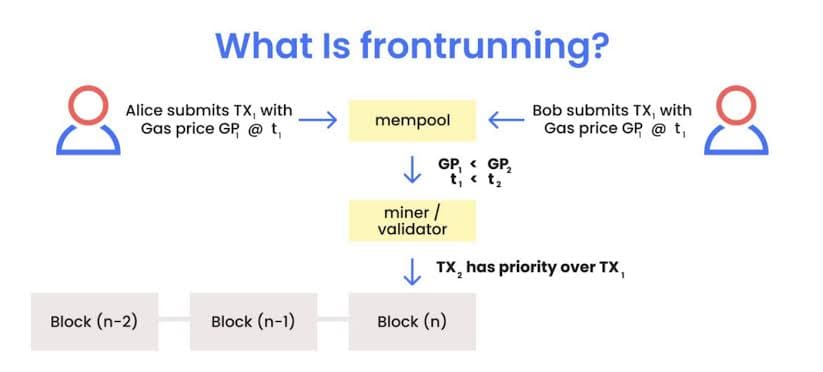

Front-running can be explained simply as the placement of a transaction in a queue with the awareness of a forthcoming transaction. The essence of front-running is to earn profit based on the forthcoming transaction. For this to happen, the frontrunner must have enough knowledge and access to information on pending transactions.

What is Back-running?

Back-running is supplementary to front running. It is a strategy or technique of positioning a trade transaction next in line precisely after a transaction that would be benefited from.

How it Happens…

These sandwich bolts diligently survey data on mempool. What they are after is quite simple–users/investors trading on a Dex. They focus their attention on those buying on a DEX. Therefore as a buyer, you are by implication their target. Once they have a target victim they quickly go ahead of the victim by running the price up before the victim gets to buy. In that way, the victim gets sandwiched. Oftentimes, victimized traders hardly know until they get sandwiched.

In as much as decentralized finance (DEFI) is concerned, the Automated Market Maker (AMM) remains the best decision for decentralized trading, but it comes with many loopholes.

Even though several people have little or no knowledge of these attacks as they go about their trading activities, sandwich attacks are not in any way new.

SEE ALSO: All You Need to Know About DeFi in Crypto – Simplified

As far back as 2018, Vitalik Buterin, Ethereum co-founder, already made mention of these attacks, but in the context of Uniswap.

Bots continuously screen pending transactions and engage various schemes and tactics to profitably front-run them to your disadvantage.

Everybody knows that the Ethereum blockchain works without needing to obtain permission from a central intermediary for the enablement of applications. However, the conception of decentralized finance (Defi), has also contributed in some way to the emergence of several new attacks which are being launched daily.

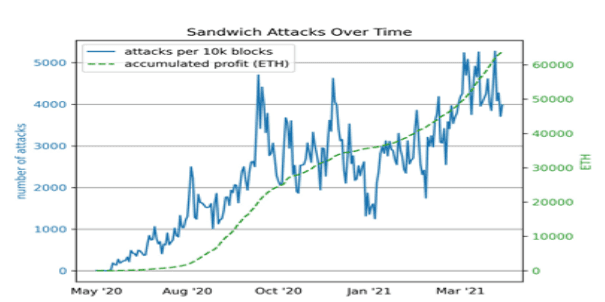

Credits to Patrick Züst, a Computer Science student of Swiss Federal Institute of Technology, Zurich(ETH) who in his work, presents a large-scale analysis of sandwich attacks for twelve months.“We found that during this time at least 480,276 attacks were leading to an accumulated profit of 64,217 ETH (189’311’716 USD)”.

From this research data, it has become glaring that miners have lately begun to play a more active role in these value extractions.

What Makes Sandwich Attacks Possible

Automated Market Maker (AMM): This works as an automated pricing algorithm. It automatically discovers the price and market-making based on the assets in the liquidity pools. The AMM allows liquidity providers to be able to view and follow the market trend, and then set the bid and ask prices. On the other hand, Liquidity takers trade against the AMM.

Price Spillage: This refers to the change in the price of an asset while a trade transaction is in progress. The prediction and expectation of Price spillage are dependent on the volume of the traded asset and the available liquidity. The amount of expected spillage goes higher as the traded assets increase. The expected slippage is usually counted before the trade.

Execution Price: The time required to complete a transaction may sometimes affect the expected execution price as well as the state of the AMM market.

How to Avoid Being Sandwiched

Since the blockchain is open, protection against such attacks is limited. However, the following countermeasures would be useful:

- If you’re making large purchases/trades on DEX, you must be careful to set the slippage tolerance properly to the level you can bear. “The best strategy is to decrease the slippage when the trade amount increases.”–Karkara from Zebpay.

- Another way to avoid being sandwiched is by releasing multiple smaller swaps instead of one large trade.

Frequently Asked Questions (FAQ)

1. What is a Sandwich Attack?

It is a popular type of front-running strategy in DEFI.

2. What is a Sandwich Bolt?

Sandwich bots watch the mempool for traders buying on DEX.

3. How Does the Sandwich Attack Work?

It involves frontrunning the victim trade with a trade buying the same asset.

4. How do You Stop a Sandwich Attack?

The best strategy is to decrease the slippage when the trade amount increases.

Final Thoughts

As long as the blockchain has no vail to keep these attackers at bay, one must tread carefully and wisely. It would therefore be best to keep an eye on the spillage as the trade amount increases. Breaking your transactions into smaller swaps instead of one large trade would be a wise choice.

Read More