When valuing a cryptocurrency or blockchain protocol, one common metric that often pops up is the Market cap and the Fully diluted market cap. While both may be somewhat similar in value, they represent two different meanings.

In this article, I will explain the difference between the market cap and the fully diluted market cap of a cryptocurrency and why it matters.

Key Takeaways

• The market cap shows the value of the particular coin, its growth potential, and level of risk.

• While a regular market cap considers the circulating supply of the coin, a fully diluted market cap takes into account the maximum amount of tokens that can exist for that crypto.

• Cryptos with higher market capitalizations are more likely to be stable investments than ones with smaller market caps (prone to fluctuations).

SEE ALSO: Fully Diluted Market Cap – All You Need to Know

SEE ALSO: How to Use CoinMarketCap to Track Your Crypto Portfolio

SEE ALSO: 5 Tested Ways of Buying the Dip in the Crypto Market

So what is Market Cap? What is Fully Diluted Market Cap? And what is the difference between these two investment concepts?

What is Market Cap?

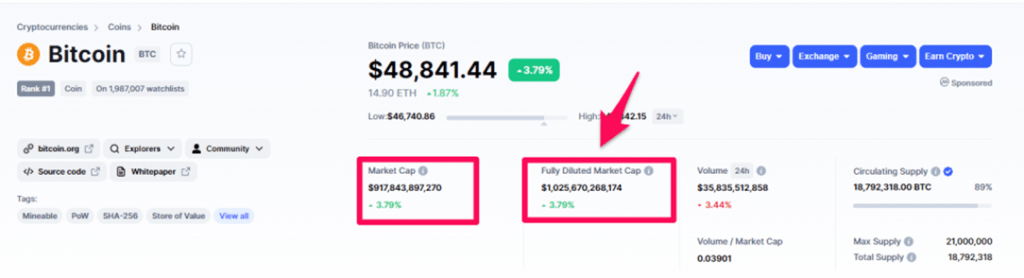

Market capitalization (market cap) is the total network value of the crypto at any one point in time or the sum of all the coins currently in circulation multiplied by the current price of the coin.

The circulating supply of coins x Price per coin = Total crypto market capitalization

Market cap is often used to rank the popularity and size of the cryptocurrency — a cryptocurrency with a higher market cap is often regarded as more popular, as more crypto holders are willing to hold the coin at the current price, contributing to a higher network value.

A cryptocurrency with a higher market cap is also more likely to be a more stable investment than another one with a much smaller market cap as the smaller market cap cryptocurrency is more susceptible to price movements.

Knowing this metric allows you to diversify your investment portfolio with coins of different market caps. A diverse investment portfolio is less volatile, less risky, and may generate higher returns in the long term.

What is a Fully Diluted Market Cap?

A fully diluted market cap, on the other hand, measures the market cap when all of the coins are issued. It is the sum of the maximum supply of the coin multiplied by the current price of the coin.

The maximum supply of a token x Current market price of the token = Fully diluted market capitalization.

Market Cap vs. Fully Diluted Market Cap

A regular market cap has to do with the value of a cryptocurrency concerning the number of tokens currently in circulation. On the other hand, a fully diluted market cap takes into account both current and future tokens. In other words:

A fully diluted market cap calculates the value of a cryptocurrency at the current price for the maximum number of tokens that can ever be in existence.

The fully diluted market cap is thus always either equal to, or greater than the regular market cap of a cryptocurrency, depending on how many tokens are already in circulation.

Frequently Asked Questions (FAQs)

What is the market cap used for?

The market cap is often used to compare the size of a cryptocurrency to the market as a whole and to assess the coin’s popularity. To put it another way, a cryptocurrency with a larger market cap is deemed more popular, and more crypto investors will be more willing to invest in the asset at current prices.

It is also an important factor in determining the long-term stability of cryptocurrency investment. Assets with considerably lower market capitalization tend to be more volatile than those with much larger ones. Because of this, smaller-capitalization cryptocurrencies are at greater risk of seeing their value fluctuate dramatically.

Does crypto market capitalization show its popularity?

While social media buzz, online chatter, and other sentiment-focused metrics are best for popularity, in a sense market cap also works as a measure.

If a coin is popular, most likely money and capital are flowing into the asset and the price of the coin is increasing. If you follow the formula for calculating market cap, that means the total market cap will grow also.

What happens when a cryptocurrency reaches maximum supply?

When a cryptocurrency reaches its max supply, no further coins are issued by the blockchain protocol. At this point, the ecosystem would be self-sustaining through fees or another mechanism.

What Is the market cap of cryptocurrency?

Market cap is a term often used to represent market capitalization for short, which is the sum of all coins currently in circulation multiplied by the total price per coin. It is often used to rank each coin’s popularity and the respect it has earned in the industry.

Why should I care about the market cap of my cryptos?

Market cap shows how the market values a certain cryptocurrency. It is the key metric that defines if the coin is cheap or expensive. Knowing the size of a coin’s market cap allows investors to compare it with other coins.

Thus, knowing market caps allows us to better diversify and balance an investment portfolio.

What can you learn from a diluted market cap?

A fully diluted market cap shows how much a cryptocurrency project can grow and what its future market capitalization might be. Depending on whether it is large or small, investors may evaluate potential risks and prospects more clearly.

In this case, increased supply may add selling pressure that leads to a price drop. On the other hand, the scarcity of the asset usually acts the opposite way and leads to price growth.

Final Thoughts

Cryptocurrencies aren’t always going to be as volatile as they are now. As many more investors dip their toes into crypto and start buying, market caps will increase all around. And then the market will slowly start maturing and becoming more stable.

By understanding the concepts of market cap and the fully diluted market cap, you will be able to easily assess the overall performance and investment opportunity of a crypto asset in the future.

Read More