When it comes to adding a valuation to a crypto asset or blockchain, one obvious metric that comes up is the fully diluted market cap and a market cap. Both concepts are relatively similar, but they have different meanings.

In this article, I will explain everything you need to know regarding a fully diluted market cap.

Key Takeaways

• A fully diluted market cap calculates the value of a cryptocurrency at the current price to the maximum number of tokens that can ever be in existence.

• Fully diluted market caps are the measure of market caps when all the coins are issued.

• By knowing the concepts of market cap and the fully diluted market cap, you can assess the overall performance and investment opportunity of a crypto asset.

SEE ALSO: Market Cap vs Diluted Market Cap – Explained

SEE ALSO: 5 Smart Things You Can Do On CoinMarketCap

SEE ALSO: How to Use CoinMarketCap to Track Your Crypto Portfolio

SEE ALSO: 5 Tested Ways of Buying the Dip in the Crypto Market

So, what is a Fully Diluted Market? How is it calculated? And what are the drawbacks of this fully diluted market cap?

What is a Fully Diluted Market Cap?

The fully diluted market cap is the total value of the crypto at today’s price if all tokens are in circulation. By using this capitalization method, it is assumed that the market cap in the future will grow in line with the amount of circulating supply at a given moment.

In some cases, an increase in token supply can occur, leading to market inflation with the oversupply. As a result, the token prices can be dropped. Therefore, many crypto investors become reluctant in increasing the supply of coins or tokens in circulation.

However, this market capitalization might serve as a useful tool for assessing the entire value of the crypto asset if any potential influence on the total supply is eliminated.

The Drawbacks of a Fully Diluted Market Cap

- One of the main drawbacks of fully diluted market caps is that even though they show higher market caps, they disregard any potential decreases in the prices of tokens with the eventual increase in their circulating supplies.

- Another drawback is that fully diluted market caps assume that the future market cap will increase in direct proportion to their current circulating supply at any point in time.

Of course, this is not always the case, in theory, as the supplies of tokens increase, they should push down the prices of the tokens due to oversupply, which causes inflation.

- Thus, when looking at fully diluted market caps, investors should be aware that the metric does not consider the impact of inflation on the fully diluted market capitalization.

Frequently Asked Questions (FAQs)

How does Fully Diluted Market Cap work?

First and foremost, The fully diluted market cap is used to determine whether or not a project’s worth is realistic. If the total value of today’s crypto when all coins have been issued is very high, there will be more tokens or coins in circulation.

As a result, inflationary pressures might rise significantly.

Therefore, if the total value of the crypto when all coins have been issued is high, the following factors must be considered in calculating the fully diluted market cap;

- When will the next currency or token be released?

- Will the releasing coin’s circulation doubled in the following year, or will it release a fraction of a percent each year for the next several years?

- How useful is the token to the world, and what kind of growth is expected?

- How is circulation affected by its staking rewards?

How do I calculate the diluted market cap of my crypto assets?

The formula to calculate the diluted market cap of your crypto assets is as follows:

Maximum supply of coins x Current market price per coin = Fully Diluted Crypto Market Capitalization

What is the Market cap in crypto?

Market capitalization (market cap) is the total network value of the crypto at any one point in time or the sum of all the coins currently in circulation multiplied by the current price of the coin.

The formula for calculating the market cap of crypto assets is as follows:

The circulating supply of coins x Price per coin = Total crypto market capitalization

What Impacts Market Capitalization?

Market cap is not a stable metric. It varies according to changes in its two key variables: the coin’s price and the coin’s supply. As one of these two variables changes, so does the size of the market capitalization;

- Market cap goes up when the coin’s price rises.

- Market cap goes down when the price drops.

- Market cap always goes down when supply increases. The more new coins are added, the more selling pressure they create, leading to a price drop.

- The only case when supply does not affect the market cap is when it equals the fixed maximum supply of coins that will ever be issued.

Market Cap vs Fully Diluted Market Cap: What Is the Difference?

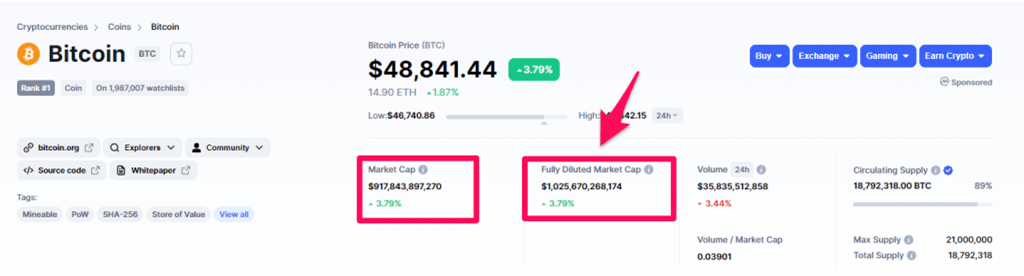

Market capitalization (market cap) is the total network value of the crypto at any one point in time or the sum of all the coins currently in circulation multiplied by the current price of the coin.

Market cap is one of the most popular metrics to measure a coin’s value. But sometimes it’s not enough for the bigger picture. This is where fully diluted market capitalization, comes in.

Whereas a fully diluted market cap on the other hand has to do with the measurement of the market cap when all of the coins are issued. It is the sum of the maximum supply of the coin multiplied by the current price of the coin.

What is the implication of a fully diluted market cap?

The problem with the fully diluted market cap is that it assumes that the market cap in the future will increase in direct proportion to the current circulating supply at any given time.

However, that may not be the case. In theory, if the supply of the token increases, it should push down the price of the token due to oversupply, causing token inflation.

Hence when investors look at a fully diluted market cap, they should be mindful that the metric does not take into account the impact of inflation on the fully diluted market cap.

Final Thoughts

The concept of “fully diluted market cap” is significant and must be well understood by newcomers to the crypto world well as the professional investors and traders as it is often witnessed in the assessment of crypto protocol’s performance.

By understanding the “fully diluted market cap” term, you can make the best decision when choosing a crypto asset to invest in.

Read More