Plotting a Bitcoin Investing Road Map

Bitcoin at the time of writing was trading at $56,203 per coin after surpassing the $60k mark as a few analysts predicted.

Bloomberg in a report said Bitcoin touched $61,080 March 13, bouncing back from a rout at the end of February. Of course, Bitcoin’s surge is however connected to President Joe Biden’s signing of the $1.9 trillion pandemic bill into law, and we see Bitcoin taking a breather at the 50k band.

Again, I would say that investors that got in early before the pandemic are in luck but there is still hope for you if you’re keen on owning some fractions of the “Alpha” coin just by being realistic with available options open to you.

How minute is a 100 dollar investment in Bitcoin worth?…an asset that is about 562x the amount you plan to invest.

Let’s see this simple math…

Investing a 100 dollars in Bitcoin will approximately give you 0.00178BTC at a cost of 56,203/BTC.

This implies that you’d only afford a fraction of Bitcoin and hope for the market to move continuously in your favor and boost your holdings as you go.

Before sinking money into Bitcoin, let’s understand the following:

- Doing the math before investing.

- Are you investing in Bitcoin, long or short?

- How to increase your Bitcoin Portfolio.

- Plan a clear exit strategy and stick to it.

Doing the Math Before Investing

Bitcoin like many other Altcoins are highly volatile. Bitcoin gains and loses sharply in a matter of hours, talk more of a whole day.

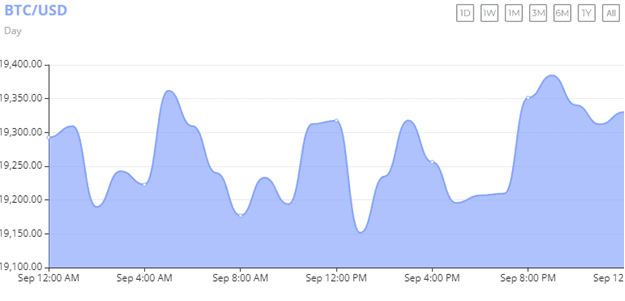

For example, the chart below shows Bitcoin’s market pull in less than 24 hours. Bitcoin touched $19,351.40 at 8PM from a low-point of $19,177.06 at 8AM today.

With the slight increase in price, investors are already taking profit of $174.34 which is slightly above our intended $100 investment.

However this is the case because the crypto market is currently in its bear market phase with Bitcoin and other Altcoins prices plummeting down massively.

Under bullish conditions, investors can make as much as $1000 within hours showing the extreme volatility of Bitcoin and other Altcoins.

To accommodate smaller accounts, cryptocurrency brokers allow you trade Bitcoin in smaller fractions or lots to include low-end investors.

This is so for many investors that cannot afford a coin that is worth over $19k per coin. With a small lot or account size, profits or losses are replicated in the fractions of Bitcoin they own.

SEE ALSO: 3 Clever Ways to Trade Altcoins for Profit

Are You Investing in Bitcoin, Long or Short?

Virtual currencies like Bitcoin are very volatile and are mainly for speculative purposes.

Going long would be suitable for a well funded account that has the ability to absorb shocks at volatile market periods. On the flipside, a poorly funded Bitcoin account is at a greater risk of a complete account blowout.

Going short entails setting and adhering to a target entry and exit price within shorter time frames.

Bitcoin should be viewed from a speculative standpoint which is usually short term. Investors are advised to have a fair balance between Fiat and Cryptocurrency in their portfolios. Don’t throw in all your precious Fiat currencies into Bitcoin, there are no guarantees.

Invest only what you can afford to lose.

How to Increase Your Bitcoin Portfolio

Starting off with $100 is worthy of commendation. It’s a step many dread to take especially when they hear about Bitcoin investing.

It’s even riskier staying at $100. You need to take deliberate steps to increase you coins and its value.

Cryptocurrency accounts at the lower end of the ladder are usually the first casualties when the crypto market goes wild.

Build you way up through capital appreciation and more funding in other to stay at a comfortable position when hits from the market arise.

For instance, a Bitcoin account worth about $1,000 would absorb market swings better than a $100 account.

Adding more Fiat currencies to boost your account should be done with caution.

Plan a Clear Exit Strategy and Stick to it

Sometimes, investors get in without a clear plan on how they’re getting out. This could be for two reason:

- They enjoy the “Cryptocurrency Jolly ride” and believe the market will continue going in their favor.

- After making some gains, they become greedy for more.

Exit plans are the most important which many investors only realize when it’s too late. A poor exit plan could cost an investor his entire profit or capital.

The way to plan an exit is to first understand the trend of Bitcoin or any other Altcoin you’re interested in.

Study its daily, weekly, monthly, quarterly charts to understand its pattern. Most cryptocurrencies follow and repeat the same pattern often staying within the same price band.

Pinpoint the cryptocurrency’s highest and lowest points in a year to ascertain the likely point it could get to in an adverse market condition.

Your findings should enable you set a realistic and achievable exit strategy.

SEE ALSO: Altcoins – 10 Best Alternative Coins to Bitcoin

SEE ALSO: 10 Legit Bitcoin Mining Sites For New Miners

SEE ALSO: World’s Most Popular Hardware Wallet – Ledger Nano S and Nano X

Final Thoughts

Bitcoin originally was created to aid faster transactions and payments over a decentralized network. Bitcoin’s volatility has now positioned it for speculative purposes. Investing in Bitcoin should be done with caution (monies you can afford to lose).

Understand its trend and how it works before sinking money. It’s usually advised to have a healthy balance between Fiat and Cryptocurrency to protect your capital.

Go short on Bitcoin most of the time and stay watchful for major market news that could affect its price and performance.

Image credit: Tree vector created by pch.vector – www.freepik.com

Read More