The ABC of Investing in Cryptocurrency

Introduction to the Crypto-World

It’s over ten years since the introduction of the first cryptocurrency – Bitcoin (2009).

Only a few folks really understood how the cryptocurrency world worked.

The “vagueness” and misconception of cryptocurrencies further left many unanswered questions owing to its walled digitalization.

For instance, all Bitcoin transactions are done over the web classifying it as an intangible currency. Bitcoins cannot be felt by hand like the Fiat legal tender (Dollar, Euro, Pounds, Yen).

Bitcoin has had a very volatile history being the only digital coin for 6 years before Ethereum was created in mid-2015.

Investing in Bitcoin is still the new gold. Its price surged for the first time in July 2010 from $0.0008 to $0.08 per BTC leaping by over 9,900%.

Bitcoin’s Price Today

[mcrypto id=”186″]

The second-largest coin – Ethereum, joined the crypto-world with a competitive advantage of initiating and settling payments at a much faster speed of approximately 2.5 minutes.

This when compared to Bitcoin requires about 10 minutes to complete a block and store the transaction into the blockchain network.

Recently, more than 2000 Altcoins are trading in the cryptocurrency market solving diverse investment and transactional needs.

The term “Cryptocurrency” and how it works could be understood easily with just a little more effort.

Let’s get into the details…

SEE ALSO: The 5 Best Altcoins with Great Upside Potentials

SEE ALSO: 5 Tested Ways of Buying the Dip in a Crypto Market

SEE ALSO: How to Avoid Panic Selling in a Cryptocurrency Dip

Cryptocurrency Basics

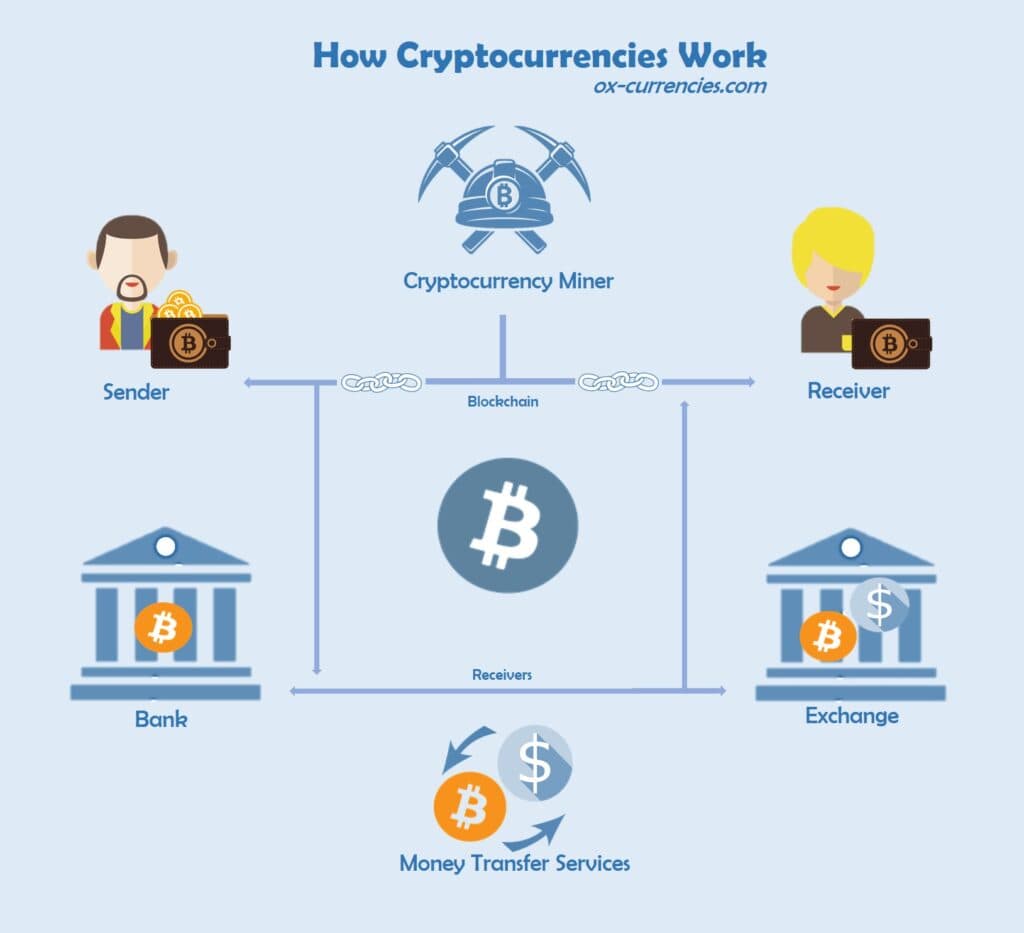

A cryptocurrency is a digital asset used as a means of exchange from one person to the other over a decentralized network.

This new system of exchange eliminates third party interference while coin ownership is verified and recorded in a secured database known as a blockchain.

A Blockchain refer to chains of verified transactions which form a secured block. The blockchain security protocol is designed to limit illegal hacking activity and possibility of coin duplication.

Settling payments over a decentralized network eliminates middlemen and other statutory controls by a Government which makes it a very flexible way to get things done.

To maintain the integrity of the blockchain and keep it running efficiently, there are individuals behind the scene verifying every cryptocurrency transaction and storing them in the blockchain.

These special dudes are known as “Miners” and their activities are referred to as Mining.

The quest for better payment solutions and advancement in technology birthed more cryptocurrencies in the market.

Without bothering about the numerous names and features of the multitude of coins, you should get familiar with the top 10 cryptocurrencies revving the market.

These digital coins are currently holding on amongst the top 10 Altcoins after Bitcoin.

How Does Cryptocurrency Work?

An owner of a digital coin sends a payment from his digital wallet authenticating it with a private key to a receiver address. Behind the scene, a miner records the transaction and earns a small fraction of the mined currency.

A miner’s earning is determined by the cryptocurrency’s halving.

For instance, Bitcoin’s halving occurs once in every four years. Each halving reduces the potential earning per block for miners by half.

In 2020, Bitcoin’s halving occurred in May 11, 2020 for the second time since 2009, reducing the block subsidy from 12.5BTC to 6.25BTC per block.

6.25BTC is what a miner would earn from completing 1MB block of transaction.

For Fiat currencies, the bank sits at the middle of the chain and debits an account for payments made and credits a beneficiary over the bank’s Real Time Gross Settlement (RTGS) system also known as the interbank settlement system.

But cryptocurrencies work differently.

There is no central location for initiating and completing transactions. The cryptocurrency platform is decentralized with miners doing their jobs as auditors to the blockchain virtually.

Cryptocurrencies are stored in wallets known as Crypto-wallets. These wallets are downloadable over a crypto exchange or provider.

This is where your Bitcoin or any other Altcoin (Alternative Coin) is stored with a secured key for safety.

Many online stores, agencies, casinos, slot machines have included Bitcoin as an added payment gateway.

The advantage of this peer-to-peer payment system is a “near to zero” transaction charge or fee compared to that of the banks.

Since cryptocurrencies transactions are done over the internet, once you send a payment from your crypto-wallet to a receiver’s address, miners work behind the scene to authenticate your transaction and store it on the network securely for future reference.

Cryptocurrencies Vs. Fiat Currencies

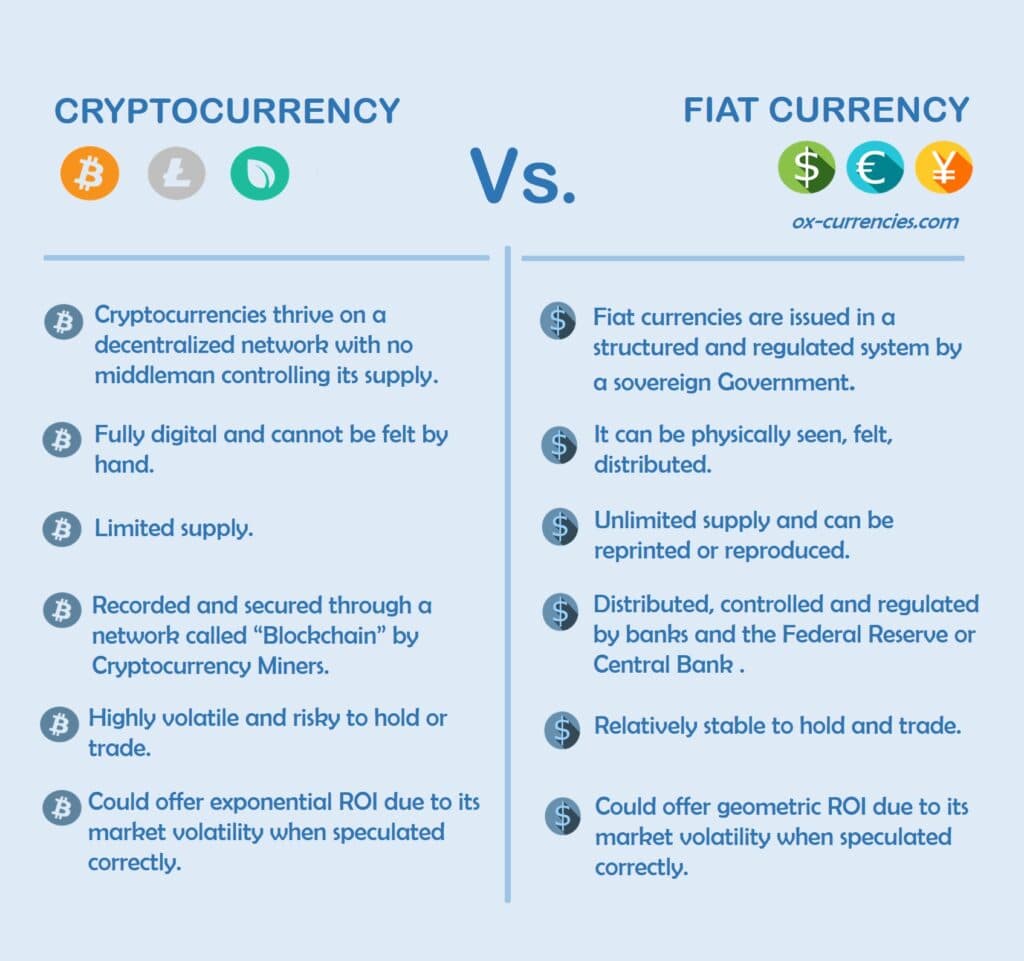

Cryptocurrencies and Fiat Currencies offer payment solutions to users which helps make the financial market fluid.

Individuals and businesses now have alternative payment options.

However, the mode of operations for the Cryptocurrencies and Fiat Currencies differ in the following way:

Getting Started with Cryptocurrencies

Before you get started with cryptocurrency, it’s important to define your objectives of owning a digital coin.

There are two broad reasons for holding a digital coin.

• Transactional purposes.

• Investment purposes.

Transactional Purposes

Due to lower transactional fees, Bitcoin for instance offers a better way to make payment especially for international waybills and other huge payments.

Middlemen charges are eliminated with cryptocurrencies and better value for money achieved.

Holding cryptocurrencies for settling transactions puts little speculative pressures on the holder since the digital coin is usually sort for in smaller units and used to pay for items.

Investment Purposes

With the surge in price and extreme volatility of the Bitcoin, many want to be on the speculative side of the divide.

In December 18 2017, Bitcoin touched its highest point so far at $20,089.00.

Analysts envisaged it could get to a breakout point of $50,000 per coin.

The risks in speculation are high and investors should tread with caution.

In March 12, 2020, Bitcoin’s price fell drastically sending it a low of $4,916.78 from $7, 945.36 in just 24 hours owing to the Corona Virus pandemic.

Cryptocurrency investors are more exposed to higher risks than transactional holders of the coin.

Categories of Cryptocurrencies

With a transactional objective majorly, there are Five broad categories of cryptocurrencies.

• Transactional

• Utility Tokens

• Security Tokens

• Platform

• Stable Coins

Transactional

Originally, cryptocurrencies were created for transactional purposes. Bitcoin, Litecoin and a host of others are used for transactions. The ease of use is phenomenal and seamless, eliminating third party influences at a very low transactional fee.

For example, the Security and Exchange Commission (SEC) which is a foremost regulator of the Capital Market in Nigeria last week has included cryptocurrencies under its purview and would now supervise its transactions.

This means that many Governments of the world would now support the validity and practicality of the cryptocurrency.

Utility Tokens

Ripple (XRP) for instance is a brilliant utility token owned by Ripple.Net.

It was built to mediate for cryptocurrencies and other Fiat exchanges. Many financial institutions now use Ripple over their network.

Other examples of Utility tokens are the Basic Attention Token (BAT), USD.Coin (USDC), Chainlink (LINK), Huobi Token (HT).

The Utility token helps stabilize the nation’s economy by benchmarking the crypto with the nation’s Fiat currency.

Security Tokens

In blockchain technology, a security token is a “blockchain-share” of an underlying asset such as owning share in a gold, real estate, blue-chip companies like Amazon, Apple Inc and more.

Security token from its launch were created to generally link to a business.

They are just like stocks and promise to give out some type of payout to its investors.

Platform

Ethereum is the second largest cryptocurrency by market capitalization ($38 billion as at the time of writing) after the Bitcoin and can be referred to as a platform for running other cryptocurrencies.

It is an open-source decentralized platform featuring smart contract functionality.

With Ethereum, you can write codes that controls money and build other powerful FINTECH applications.

Over 30 coins from the top 100 cryptocurrencies run on the Ethereum codes and more than 260,000 different cryptocurrencies run on it.

Ethereum Miners receive Ether as a reward for mining.

SEE ALSO: Comparing Cryptos – Is Ethereum Becoming the New Bitcoin?

Stable Coins

Stable coins are a class of cryptocurrency that pegs its value with the national currency of a country.

Stable coins are aimed at reducing volatility thereby stabilizing the crypto-market.

For example, the Tether had some controversies during its launch claiming that each token was backed by one USD.

The creators of Tether wanted a currency that would mirror the USD in form of a digital dollar. Tether was launched to become a stable dollar alternative.

Cryptocurrency Terminologies

Having dwelled on cryptocurrencies and explained some of its terms, let’s review key terminologies you would often find in most cryptocurrency papers.

• Altcoins – The combination of these two words…” Alt” and “Coin” could also be referred to as Alternative coins. Altcoins are cryptocurrencies launched after the Bitcoin.

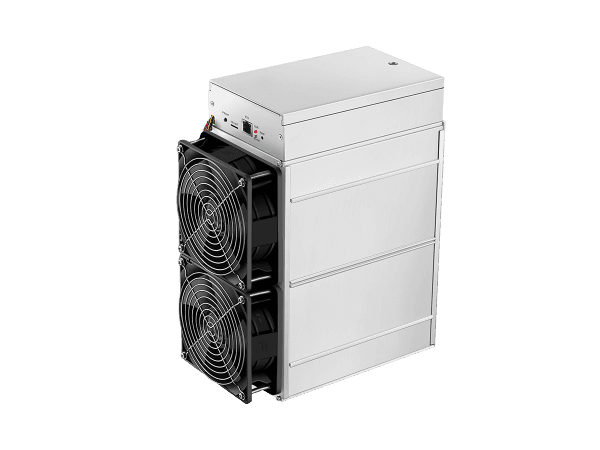

• ASIC – Also known as Application-Specific Integrated Circuit is a chip designed for mining cryptocurrencies. It is used to solve complex mathematical calculations known as hashing in the process of keying transactions into the blockchain.

• Algorithm – This is a computer program that follows a defined set of protocols for performing a task or function. Mining algorithms are unique and follow a set pattern that miners must understand to complete their mining tasks.

• Blockchain – A Blockchain is a growing list of validated records known as blocks. Each block links with the other to form a chain. The blockchain secures cryptocurrency transactions on its own secured network.

• Proof of Work (POW) – Proof of Work is the reward paid to miners for solving a complex mathematical puzzle. POW requires a great deal of effort on the part of the miner and he must present a piece of evidence to get a reward in respective currencies.

• Proof of Stake (POS) – Proof of Stake works hand in hand with the Proof of Work. The POS secures all the transactions into the network. For Proof of stake, the miner’s privilege to mine the next block is determined by how much he has staked. Mining rewards are hinged on existing holdings or stakes.

• Decentralization – Decentralization in cryptocurrency means that there is no central authority controlling or regulating its distribution, pricing, and supply. Cryptocurrency operates on a peer-to-peer system eliminating intermediaries.

• DApps – Decentralized Apps are computer applications that run the blockchain. They have been popularized by Distributed Ledger Technology (DLT). DApps are also referred to as smart contracts such as the Ethereum blockchain.

• Market Capitalization – Market Capitalization is a strong metric used to measure a currency’s depth and control of the market. A highly capitalized cryptocurrency influences the market either on the demand or supply side. It is calculated by the unit of the currency in circulation multiplied by its unit price. Bitcoin has the highest market capitalization ranking it at #1 followed by Ethereum.

• Mining – Mining is the process of securing every payment transaction over a secured network. Miners get paid a fraction of the coin mined as a reward in a couple of days.

• Mining Hardware – Mining is a decentralized activity that requires heavy computer hardware to solve the complex hashing puzzle. Mining hardware has a costly electricity consumption reputation. See more on mining hardware.

• Halving – New bitcoins go into circulation due to the activities of miners who mine them with very expensive computer hardware. So, Bitcoin Halving is done to reduce the potential wins of miners in order to sustain the value of the coin and to prevent too much circulation of bitcoin. The reward for a block reward is reduced by half. The last bitcoin halving occurred on May 11, 2020, to a reward of 6.25BTC per block and the next halving should occur about the same time in the next 4 years.

• Hashing – Hashing is a cryptographic function for security details like passwords. Hashing is a means of encryption that keeps the network secure and hackproof. Examples of hashing algorithms include SHA-256, Cryptonight, Ethash, Scrypt, X11, and more.

• Reward – A reward in cryptocurrency mining is a payment in a fraction of the mined blocks of the same cryptocurrency. A miner earns a reward after presenting his Proof of work. He also posses the ability to mine more coins depending on how much he has staked (Proof of stake).

SEE ALSO: How to Flee these 10 Bitcoin Scams Now!

How to Mine Cryptocurrencies

Miners must own a mining rig or register with a third-party mining rig that would provide mining hardware where he gets linked to.

He must complete the mining tasks with a proof of work for a reward in the respective blockchain.

The proof of work is a protocol that secures digital transactions.

The miner must provide an evidence of having solved the hashing puzzle first for a reward.

To mine cryptocurrencies, you need these:

• Mining rig

• Digital Wallet

Mining Rig

Getting a mining rig is the same as owning your own computer mining rig or hardware. If you’re keen on mining cryptocurrencies like Bitcoin, these are key rig factors to consider.

• Performance (hash rate)

• Power consumption

• Price

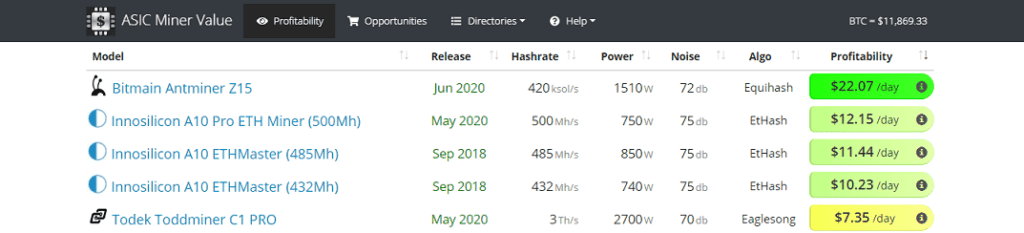

To choose a rig right for you, consider going for the best, check customer reviews to see what others are saying. Choosing solely on price is not enough and may not be effective in the long run. ASIC miner value is a website to compare mining rigs.

SEE ALSO:14 KEY Tips You Should Know Before Mining Bitcoin

SEE ALSO: 10 Legit Bitcoin Mining Sites for New Miners

SEE ALSO: 5 Best Bitcoin Mining Hardware with Low Overheads

Types of Digital Wallets

A digital wallet is where all digital coins are stored and manipulated. There are different types of wallets with varying features and advantages.

• Software wallet (secure),

• Hardware wallet (highly secured) and,

• Paper wallet (highly secured).

For Bitcoin miners, it is advisable to go for a software wallet; they can be easily managed, suitable for easy currency manipulation and it is secured as well.

The software wallet can be downloaded to your computer to start mining. It is safe and secure and only you can have access to it.

There are two types of software wallets, the fully downloadable one and the light-weight. The full version is most secure but requires a higher disk space to store all blockchain transactions.

The light-weight only store relevant transactions as you permit but you have no full control over it because it is linked to a third-party.

To download a full version you can do so with Bitcoin core.

Note that downloading takes time because of the size of the blockchain estimated to be over 10GB.

Ensure you create a backup of your downloaded wallet on another device to avoid losing your Bitcoins forever in case of system failure.

SEE ALSO: Best Hot and Cold Bitcoin Wallets

SEE ALSO: Top 11 Best Cardano Wallets for Staking and Storage

SEE ALSO: 5 Best Ethereum Wallets for Safe Trading and Storage

Risks of Investing in Cryptocurrency

• Decentralized Status: The decentralization of cryptocurrencies makes its operations flexible and draws users and investors to its space. This new status could also be a potential risk with no central point or physical location to lay complaints when fraud occurs.

• Due Diligence and Verification: With many new businesses and individuals owning a crypto-wallet with the option of disclosure of identity, criminal minds could hack and exploit the system. These days, blackmailers, fraudsters, kidnappers, drug traffickers demand payment/ransom through cryptocurrencies.

• High Volatility: Cryptocurrencies have a high-risk reputation like formula one car racing. The highly volatile coin which is often an asset for speculation could as well be an undertaker. 79-84% of investors lose money trading CFDs and cryptocurrencies are investment vehicles people stake, win or lose money.

Best Ways to Secure Cryptocurrency

- Choose an Exchange that is reputable and flexible in its dealings so that you would transact seamlessly and get support when issues arise.

- Get a backup for your wallet and protect your private key to avoid losing it. Losing your key is a goodbye to your wallet including the coins. Not sure if there’s another way out yet.

- Take advantage of Google authenticator with a single IP in its white list to enable you access the Online Exchange.

Final Thoughts

Cryptocurrencies are highly volatile in nature and should be approached from the right perspective.

Investing in Bitcoin and other Altcoins should be done with caution. Invest what you can afford to lose.

Advanced program codes and technology have made cryptocurrencies excellent payment methods owing to speed, security and lower transactional fees.

The Ethereum code is still a widely used code powering many other cryptocurrencies and systems.

Bitcoin and other Altcoins have prospects and a future when we examine the way the world works.

Rapid digitalization of global financial systems is further paving way for more Altcoins and stability of the existing ones.

Weighing the ills and gains of cryptocurrencies should give an insight into how long they would be around to serve us.

SEE ALSO: Investing Guide to Cryptocurrencies

Read More