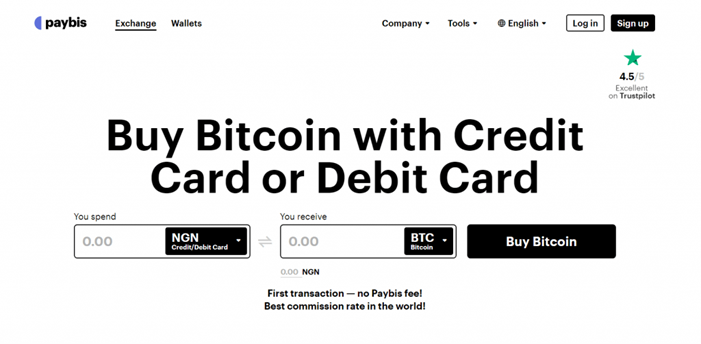

Paybis is a crypto exchange platform where users can buy and sell bitcoin and other cryptocurrencies. In addition to this, users can also carry out Bitcoin coin arbitrage on the platform.

In case you want to find out about crypto arbitrage trading in detail and how to make low risks gains from it, kindly check here.

I will be walking you through how you can perform Bitcoin arbitrage on the Paybis exchange.

Key Takeaways

• Crypto exchanges with responsive converters or calculators are ideal for arbitrage trading.

• Paybis is ideal if you are looking to buy cryptocurrencies as it provides wallets for you in turn after purchase.

• Paybis crypto arbitrage is not limited to Bitcoin only but can also be sued for other cryptocurrencies.

• Paybis is available in 180 countries so you can perform arbitrage trading activities on Paybis without any regional restrictions.

SEE ALSO: Can Paybis Exchange Be Used Without Verification?

What is Crypto Arbitrage?

We can define arbitrage as trading the same asset at different prices in different markets.

This means that we could buy an asset in one market and sell it with a price difference in another, making a profit in the process.

As such, the price difference allows some people to take advantage of this opportunity and make a profit.

This is by no means a novel concept. Arbitrage has existed for a very long time, as goods or currencies were exchanged and the economic laws of supply and demand have generated price corrections throughout history.

The model is applied daily in the forex and stock markets as well but is not easily accessible to retail traders, as you often need to go through brokers and have large funds available to participate.

A simplified example of how you can do Bitcoin coin arbitrage on Paybis

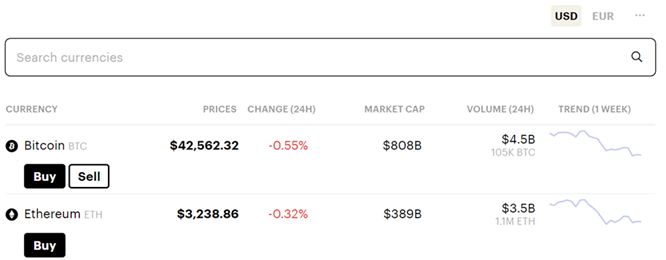

Let’s take two different cryptocurrency exchanges (Paybis and Binance) into consideration. On Paybis, the price of Bitcoin is 10,500 USD.

Now assume that some good cryptocurrency announcement goes live, the sentiment in the market becomes very positive to buying Bitcoin, and the price increases following the increased demand.

You become aware that, on Binance, the price of Bitcoin is at 11,000 USD. This means that an opportunity to make a profit rises from the price difference for Bitcoin on these cryptocurrency exchanges.

You buy one Bitcoin for 10,500 USD on Paybis and transfer that Bitcoin to Binance. You sell the same Bitcoin for 11,000 USD on Binance and make 500 USD profit thanks to the price difference.

But currencies are not always that simple.

Here’s a more realistic version of what happens during an arbitrage attempt.

As you buy from Paybis, the Bitcoin supply decreases and the demand increases, driving the price upwards.

On Binance, as you bring in more Bitcoin, the supply increases and the demand decreases, driving the Bitcoin price downwards.

This trade is repeated several times and the 500 dollar gap that was present before, gradually closes as the prices between the two markets start leveling.

Now your Bitcoin is worth 1,800 USD on both markets, and the arbitrage opportunity is not as yielding as before. However, you still made some profit with little to no effort or risk.

You had the right information at the right time and were willing to exploit the opportunity to your advantage. This positive action on the market has kept arbitrage trading completely legal, as it works toward balancing market prices.

Note that this example is entirely hypothetical and ignores trading and transfer fees, transaction processing times, and potential price movements between transactions.

How prices of Crypto are determined on Paybis

Before we start selling high and buying low, we need to understand how a given cryptocurrency price is defined in an exchange.

As with other assets, the driving factor of a cryptocurrency’s price is supply and demand. The determining factor is always the last trade done on Paybis.

Nonetheless, an exchange like Paybis has a different number of traders and offers and cryptocurrencies on its platform.

The Paybis exchange is not linked with other exchanges and demand is generated by the buyers’ and sellers’ preferences.

Unlike the stock market, cryptocurrency exchanges are open 24 hours a day.

Therefore, when some of them have regional restrictions for trading, the price might lag, rendering price correction non-simultaneous in different parts of the world.

In addition, Paybis may sometimes have low trading activity, making the prices of cryptocurrencies on them even more volatile. Volatility, in this case, refers to the drastic upward or downward movement in a coin’s price.

So, taking all of these factors into consideration, it is only normal that the price does not correlate all the time.

As a result, traders want to buy a cryptocurrency for a lower price on one exchange such as Paybis, and sell them for a higher price on another.

Arbitrage does have its fair share of advantages that could result in good money-making opportunities for traders.

Frequently Asked Questions (FAQs)

Do I need to verify my account on Paybis before placing a new order?

To get full access to all types of currencies you’ll need to verify your account. In some specific cases, you can complete your exchange without a verified account.

Is it safe to buy bitcoin with Paybis?

Yes, it is safe to buy Bitcoin instantly with Paybis as Paybis is registered with the Financial Crimes Enforcement Network of the US and follows all the applicable regulations where they operate.

Final Thoughts

Conducting bitcoin coin arbitrage on Paybis is an amazing way of making profits albeit unconventionally.

As long as you have a surefire strategy to guide you as you carry out Bitcoin coin arbitrage trading, you are good to go.

Read More