It’s no doubt that there are more avenues to investing in cryptocurrencies beyond trading (buying & selling).

Staking is one method that is rewarding and less tasking in terms of computing resources needed to mine cryptocurrencies like Bitcoin, Dogecoin and Ethereum.

Staking adopts the proof-of-stake consensus mechanism which requires holders of tokens like Terra LUNA to delegate their holdings for a certain period and earn rewards in the process.

During the staking period, you will not be able to withdraw your staked tokens. you will be required to validate transactions into the blockchain.

To stake your token means you will become a validator node for the network.

In this article, I’ll be highlighting how to stake Terra LUNA profitably and for maximum rewards.

Key Takeaways

• You will earn 11% annually excluding the validator’s fee when staking Terra LUNA.

• Terra’s protocol is an open-source network that is controlled by its holders.

• To earn profitably, you need to among the top 100s validator nodes.

Understanding Terra LUNA

Terra (LUNA) is a blockchain medium which offers swift and inexpensive transactions. The network is known as Terra, while LUNA is its created token; it is effective for the stabilization of prices for stable coin treaties.

Individuals who hold LUNA are eligible to make suggestions and decisions regarding vital proposals on the network, Terra.

The usage of Fiat, which are stable coins and also pegged by Terra LUNA, is to empower the payment methods globally with a stable-price.

Embedded in Terra’s white paper is an opinion which endorses the combination of price stabilization with the act of adopting Fiats regardless of third parties.

Why You Would Want to Hold LUNA

There are several benefits to staking LUNA, as well as interesting decentralized crypto initiatives on Terra that aim to establish a more equitable financial system.

For those that understand LUNA (or Terra), it is frequently regarded as one of the most interesting crypto projects on the market, and it has been tremendously undervalued up until now.

How to Stake Terra LUNA

Now that you have decided to purchase Terra LUNA to get profits from staking, how do you go about it? Follow the guidelines below to find out how:

•Purchase Terra LUNA

•Ensure you get a trustworthy and reliable exchange platform for cryptocurrencies like Coinbase, Binance, just to mention a few and purchase your LUNA. Determine the number of coins you would like to entrust to staking. Make sure you purchase what you have the money for, don’t go overboard.

•Run Terra’s software on your device

SEE ALSO: 10 Reasons Why Terra LUNA is a Good Investment

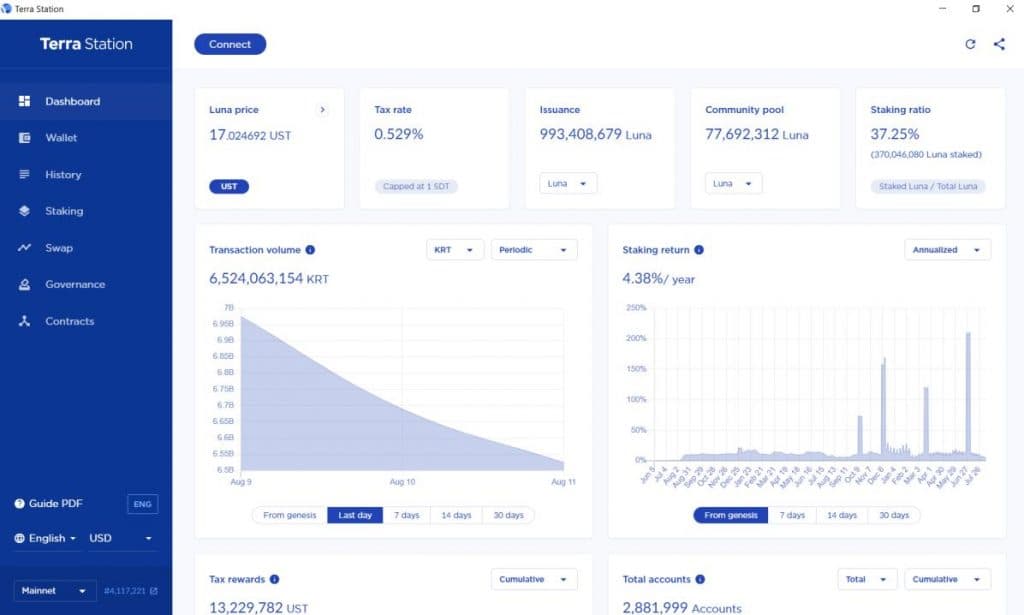

•Go to the Chrome Website to run (download) the application for Terra Station on your device.

•Select the app and click on “connect”.

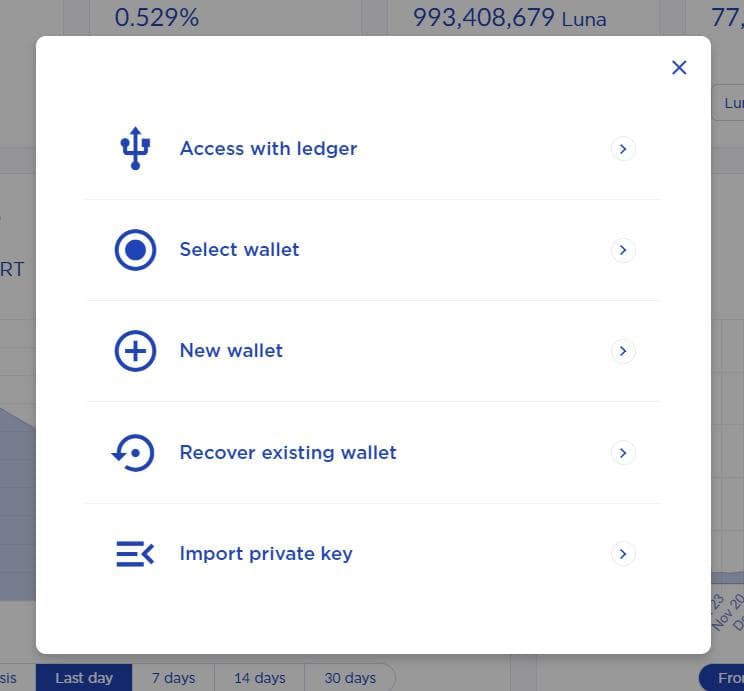

•After you have gotten the Terra desktop app, move straight to creating a Terra LUNA station wallet. After that, you select “connect” where you’ll see a notification with a pop-up display.

•Select a new wallet.

•The next thing you do is to set up your wallet.

•Follow the prompts which will be shown on your screen to set up one as it is quite self-explanatory.

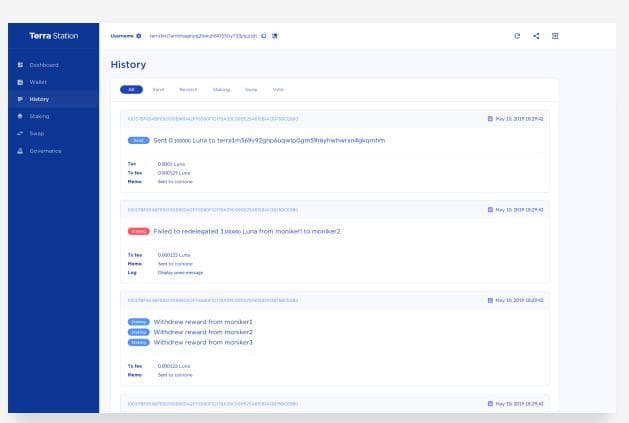

•The next thing after that is to move your LUNA to Terra Station.

•Next, select the “staking” tab on the left hand side of the page.

•Select your validator.

•The first thing you should understand is what delegating implies in terms of your LUNA’s liquidity. If you stake any quantity of LUNA, the tokens cannot be traded for three weeks after they have been undelegated or unstaked.

•So, if you are only trading for a limited period of time, you may want to contemplate delegating.

•If you are certain that you want to stake and HODL (hold) your LUNA, there are various factors to consider when choosing which validator to stake with. Some of such factors include: uptime, validator commission, and self delegation.

•All three of these categories should be visible and sortable in the list of validators. These are the most significant factors when selecting a validator.

•The penultimate thing you should do next would be to select “Delegate”.

•The final thing for you to do is to confirm delegation.

•Choose where you want to transfer your LUNA from (often “My Wallet”) and how much LUNA you want to delegate. Following that, you will be prompted to confirm your password, after which your LUNA will be formally staked.

Frequently Asked Questions (FAQS)

1. How do you get profits for staking Terra LUNA?

You get profits through your validator, in whom you invested for delegation. Unless the validator works, you have no profits. The network’s security is aided by the validator because Terra runs on a proof of Stake likewise,

You earn rewards from staking Terra LUNA because your validator does, and you have invested in that delegator.

2. What amount of Terra LUNA do I need to stake?

As a delegator, LUNA has no minimum amount for staking.

3. How much profit can I make from Terra staking?

You can earn approximately 9% APY by staking Terra.

4. Is Terra worth staking?

It depends on your personal ability to take risks and expectations; the rewards from delegating your token for a while are worth it.

5. How many days is required to unstake Terra?

From commencement, 21 days are required to unstake LUNA, during which there is no earning, exchanging, spending, or transferring your LUNA.

6. What quantity of Terra LUNA is in circulation?

Terra has 1 billion tokens in circulation. The cost of stablecoins is managed as the algorithm creates new tokens.

7. What secures Terra Network?

Proof of Stake (PoS) is a consensus method used by the Terra blockchain to provide security to the network. Individuals who hold tokens authenticate their transactions by delegating LUNA as collateral. Thus, these holders gain rewards equivalent to the quantity staked.

Final Thoughts

Buying Terra, setting up a safe wallet, and delegating stakes is very easy. A significant decentralized and stable cost of worldwide transaction system is provided by Terra LUNA.

The profit of crypto and the stable price of Fiat are incorporated by Terra using the Fiat pegged stablecoins.

The stabilization of prices is a recurrent challenge faced by the volatile crypto market hence, an advancement in cryptocurrency by Terra LUNA.

The Cryptocurrency market is a place which may not be suitable for everyone as your risk ability and financial situation as an investor are not considered.

Read More