This post contains affiliate links

Building a sustainable financial portfolio is every investor’s dream.

But dreaming alone will not stack up these assets just the way you want it. Allocating capital to investing is still not enough without sound financial education.

Financial advisors generally advise diversifying financial instruments across different markets to hedge against the risk of market downside.

Since the advent of Bitcoin in 2009, investors were skeptical about adding Bitcoin to their portfolio since the blockchain technology was relatively new and difficult to understand.

Today, the story is different, most investors want to “join in” on the cryptocurrency action. Owning “One Bitcoin” is now a big deal as many purchase fractions to build up their crypto portfolio.

You can purchase your first Bitcoin on Binance or Coinbase. (Get a rebate of 5% on Binance) today.

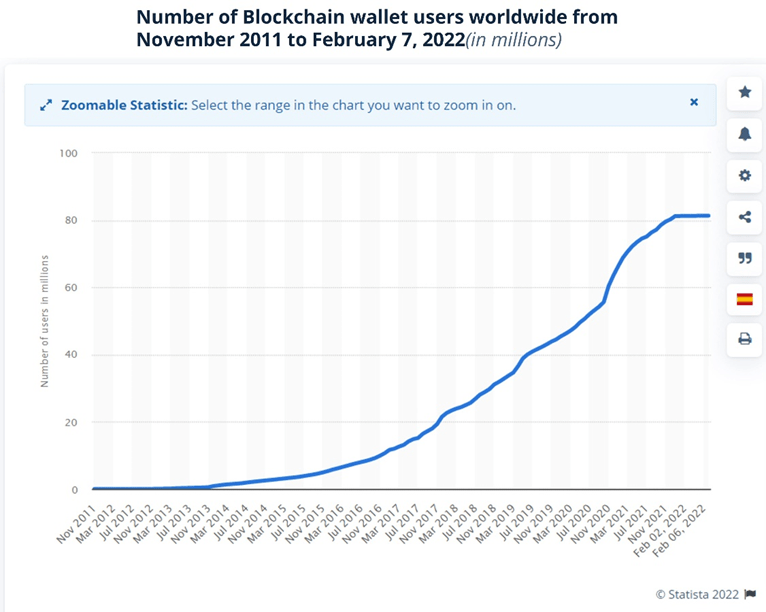

The growth of crypto is also evident in the number of blockchain wallets that are in circulation globally.

Although investing in crypto comes with its risks, the surge towards holding crypto has been on the upside since 2014.

Cryptocurrency is still one of the most volatile financial assets to hold. Trading or holding cryptocurrency is not for everyone. It’s important to define your risk appetite before venturing.

Also, experts say, “trade with the amount you can afford to lose”. You can start investing in crypto with any amount.

In this article, I will share insights on building a crypto portfolio starting with $100.

Key Takeaways

• Daily crypto trading volume rallies close to $500b.

• There are over 10,000 existing cryptocurrencies with many remaining illiquid.

• Focus on the top cryptocurrencies in the market with a large market cap and market depth.

•Track the performance of your crypto in real-time using crypto portfolio trackers.

• Building a crypto portfolio is a journey, not a “sprint”, build yours gradually.

• Apply sound risk management principles in your trading and investing decisions.

Why Build a Crypto Portfolio?

A crypto portfolio is a bucket of all your favorite tokens and coins in different measures (price & quantity). Your portfolio is a collection of investments in crypto or crypto derivative assets.

As your crypto assets begin to grow, you will need to deduce a more effective way to track or monitor its price movement in line with your short-term tactical goal or long-term strategic goals (it depend on which one you prefer).

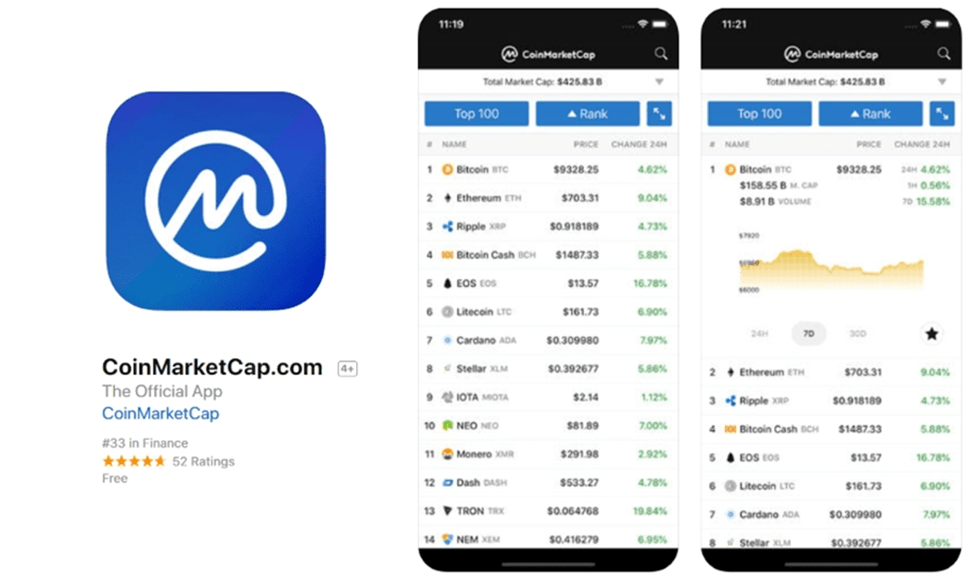

The good news is that there are many free tools for crypto portfolio tracking, see this post on How to track your portfolio effectively with CoinMarketCap.

Keeping tabs on your crypto investments effectively makes the difference. These tracking tools simplify your tracking ability with a very interactive dashboard and some other add-on features.

Another tip is to have a balanced mix of different blockchain assets.

For example, balance investing in coins/tokens with the proof-of-work (PoW) and proof-of-stake (PoS) mechanism. This means some of your coins will be mineable while some can only be staked.

Coins having these unique types of blockchain give you opportunities to earn passive income beyond trading alone.

Examples of coins that can be mined (PoW) are Bitcoin, Dogecoin, Shiba Inu, Litecoin, etc.

Examples of coins that can be staked (PoS) are Ethereum, Solana, Cardano, Tezos, Algorand, etc. See the full list of coins that can be staked on Coinbase.

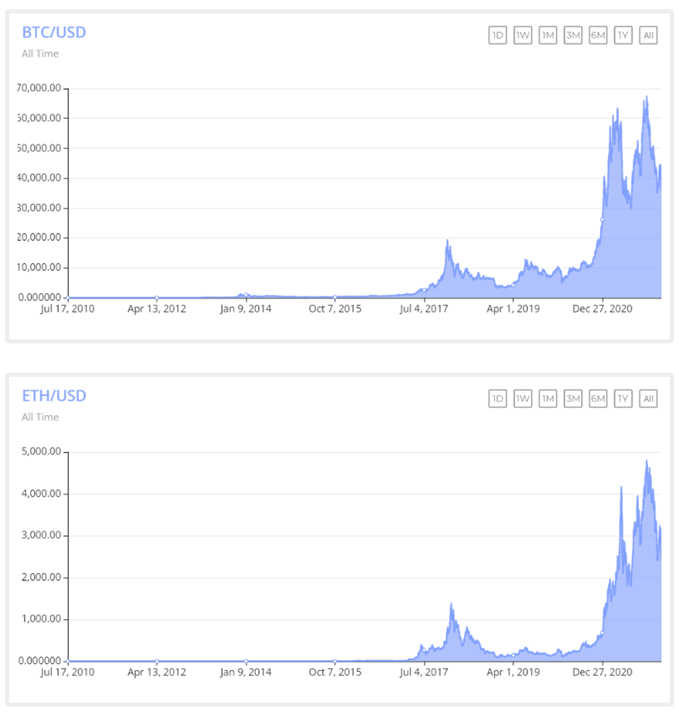

Secondly, One should watch out for coins that move in the same price trajectory.

For example, Bitcoin and Ethereum follow each other’s price patterns. As ETH is rising, BTC rises as well and vice-versa.

The chart below shows the price correlation between BTC and ETH

The Question is … will you want to invest in coins & tokens that will all rise and fall at the same time?

Tracking your crypto portfolio can be done manually, but this is not an effective way when your port is growing.

How to Use Crypto Portfolio Trackers

A Crypto portfolio tracker is an online software that tracks the market movement and performance as they relate to your crypto holdings.

Most of these tools are free to use, some come with premium features if you want to do a little bit of advanced tracking or technical analysis.

Notable crypto tracking tools are:

- Yahoo!Finance

- CoinMarketCap

- Trading View (No internal portfolio)

Here is a post to check out Smart things you can do with CoinMarketCap.

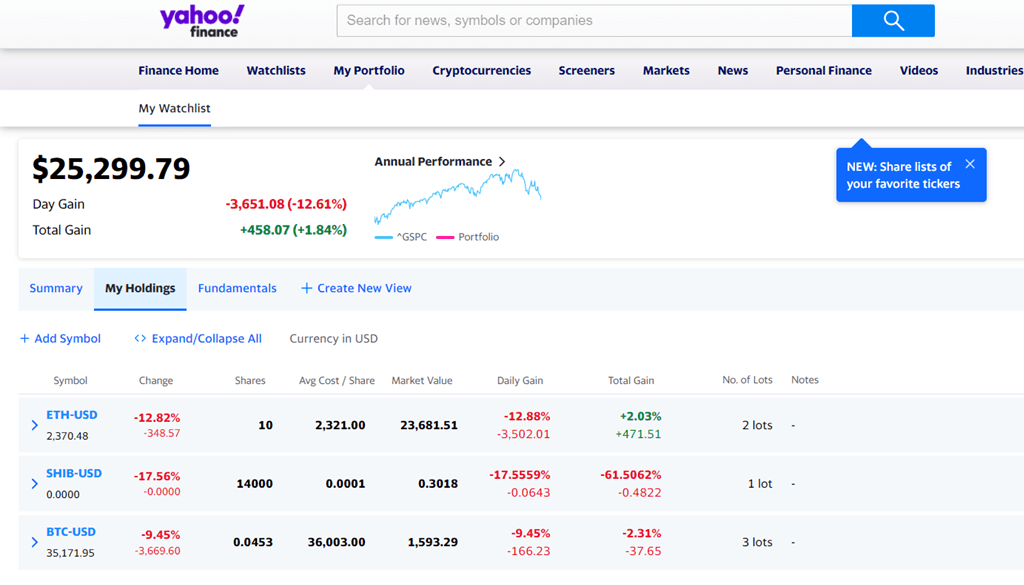

Yahoo!Finance and CoinMarketCap allow you to integrate your crypto portfolio into their portal, making it seamless to monitor.

These tracking tools help you analyze how far away or close one is close to his/her set financial goals.

With the privilege to see real-time stats of any coin you want, market news, Breaking, and economic news, investing could be a lot easier.

For example, the screenshot below is a demo account (not real), which shows how easy it is to set up your portfolio with an inbuilt tracker on Yahoo!Finance and start building your portfolio. This is free to use.

This also applies to CoinMarketCap.

On CoinMarketCap, your portfolio valuation is done for you in real-time. Portfolio gains and losses are computed straight away helping you make prompt and informed decisions.

TradingView is another brilliant market tracker, its interactive tool is amazing with well-developed charting abilities.

TradingView tool is perfect for technical analysis of diverse financial instruments and it also offers economic and market news on its portal.

Having reviewed these tools, next, let’s see how you could start investing a hundred bucks ($100).

Investing $100 in Cryptocurrency

Before building a crypto portfolio, define your investment strategy by answering the following questions:

- I’m I investing in crypto short-term or long-term?

- How much do I plan to make daily, weekly, monthly with crypto?

- What crypto coins or tokens can take me there?

- What is the maximum I can afford to lose if the market goes south?

- What are my exit plans?

- What Crypto Exchange do I want to join?

- How do I want to hold & protect my purchased coins (cold wallets or hot wallets)?

Asking these critical questions and answering them should define your investing strategy.

Since I would not be able to recommend coins to invest in specific, I will suggest you allocate capital (in percentage) across large-cap stocks amongst the top 10 stable coins.

Before going on a buying spree…take some time to do some market analysis by studying the price trend of these cryptos (Question 3) you have selected for investing.

Do your analysis for some days to see why the prices are trending in a certain way. Study the historical charts to see what their 52 weeks high and low are. This will give you insights into what the average price is and know if the price is undervalued or overvalued.

Most investors focus on technical analysis while ignoring fundamental analysis. This is not good also, as a piece of economic news could change the direction of the crypto.

When you feel confident, you can create an account to start. Crypto Exchanges rarely offer demo accounts like Forex brokers.

With Crypto Exchanges, you are opening a real account. Get a 5% rebate on your $100 when you sign up with Binance which means that you fund your account with $100 and get a $105 Credit.

Convert Fiat to Crypto

First thing first, you will need to convert your $100 into the token you want to invest in (BTC, ETH, ADA, etc).

There are many exchanges where you can do that. See our list of top 10 Crypto Exchanges this year.

It will be easier to swap one cryptocurrency for another, than using your debit card every time.

Some jurisdictions (like Nigeria) frown at crypto and have since limited its use within the system. So you wouldn’t want crypto to appear in your transaction description on your bank statement to avoid getting your account blocked.

See more countries where trading and mining crypto is not accepted.

Paxful is another Crypto Exchange where you can convert your fiat to crypto very fast. The platform is very liquid owing to over 6+ million users on its platform. Transactions can be executed with over 300+ payment methods.

Invest in Cryptocurrencies with Strong Fundamentals

Bitcoin, Ethereum, Dogecoin, Cardano have shown strong and impressive growth over the years. A part of your crypto investment should include a mix of these.

This is not financial advice though but I can say that these coins have gone through various market pressures and are still standing today.

These coins are highly volatile and show upside and downsides at a given point in time.

Participate in ICOs (But Be Careful)

High-risk investments will bring in huge rewards, and at the same time, losses might be huge too.

ICOs have made multimillionaires out of regular or ordinary investors. But this is where crypto ICO scams occur the most due to the pump and dump schemes.

To balance this, be skeptical about new projects with high potential before you participate in their ICO. Read whitepapers, find the purpose of the project, the target, and how they plan on achieving it.

Many smaller crypto projects are still coming up and gaining popularity. And since the possibilities of blockchain and DeFi are almost limitless, there is a chance a couple of these newbies might hit the roof soon.

You should be able to discern a viable project from the laid down ideas and plans. This will require doing a lot of research, but the returns are very high considering that the initial price is very low.

Invest a Percentage of Your Portfolio in Stablecoins

These are cryptocurrencies that are tied to the value of fiat, the USD. So they stay practically the same in value all the time. An example is Tether (USDT).

They will be vital as a control for your investments. Say, you need to pull out of an investment going south, you can just swap the Crypto to a stablecoin instead of withdrawing your $100 back, which will cost more and has a longer procedure.

You will need to convert your profits to Stablecoins to lock them, pending further decisions on where to reinvest them. Further fluctuations in market values will not affect Stablecoins.

Traders enjoy volatility which enables them to make money, so see the pros and cons of investing in Tether to know if it meets your investing goals.

Check Regulatory Policies

Cryptocurrencies are currently unregulated in many countries.

In the US for instance Cryptocurrency exchanges are legal and fall under the regulatory scope of the Bank Secrecy Act (BSA).

Regulation changes might tip an effect on crypto value. In the event of such, you have to take necessary readjustment actions.

The Intent of the Cryptocurrency

The purpose for which an Altcoin is created plays a part in its performance in the market too.

There are ones created as utility tokens, others as means of payment, others just to store value and the list goes on.

Identify the current problems at hand and if there is an Altcoin with an embedded solution.

For instance, the Axie Infinity token (AXS), the governance token for the Axie Infinity game, found a way to incentivize gaming.

Launched in late 2020, an early pre covid 19 period when people were beginning to pick interest in online gaming.

AXS grew from a value of just around $3 per token in November 2020 when it was launched, to hit an all-time high price of $164.9 by November the next year, 2021. That is a lot of profit made by those that invested.

So a look at the purpose of new cryptocurrencies and possible foresight of what is ahead can help you make a crypto portfolio that can be very profitable.

Buy Crypto Assets with Good Market Performance

Sincerely, most cryptocurrencies don’t just spike up in price from the onset. They start gradually, adding in value more than they lose it.

The more this happens, the more people are going to invest in it causing the value to rise more. So look out for cryptocurrencies that are performing well on the charts.

Hold Cryptocurrencies for low-risk profitability in the Long-run

The crypto market is very volatile and trading can be high risk. Seconds can be the difference between making a double profit or losing everything while trading.

You can counter this high risk by buying and holding some cryptocurrencies. You can earn rewards on some platforms over time as you hold your assets.

This is a low-risk investment and it should be part of your portfolio. Stable coins can serve this purpose. But you can go for any coin at all, so long as the platform where you are holding, gives returns for that.

Monitor and Track Your Crypto Portfolio

Watch the market and your crypto portfolio. How successful your portfolio is depends on how informed you are. You need to know where you need readjustments and where you need to pool more assets. Profit can accrue at any time, and so are losses.

So you need to know how to make the most profits and the least losses. Crypto portfolio trackers are how you can do this efficiently. Don’t just create one, but make out time to look at it regularly.

Frequently Asked Questions (FAQs)

Q1. Can I invest $100 in crypto?

Yes, you can invest $100 in crypto and even less. Cryptocurrencies come in many fractions, so even if you are not able to purchase a single coin or token, you are still able to buy a small amount of it.

However, the amount you invest depends on the purpose. If you are trying it out, trying to learn a thing or two about the workings of the crypto market, you should go with a lower amount to reduce loss.

Q2. Is it worth it to put $100 into Bitcoin?

Whether or not it is worth pumping $100 into Bitcoin depends on the analysis of whether Bitcoin will rise or fall within the run time.

A drop in value after investing could result in a loss. However, profit can be made since the crypto market is always fluctuating.

One doesn’t exactly make a profit or loss until the asset is sold so the loss is notional. You can wait for a more favorable time before selling to make a profit.

Knowing what crypto to invest in shouldn’t be an uphill task if you know the right metrics to look at. Growing your portfolio also is a journey and not a sprint, so enjoy the process and learn along the way. Take precautions and apply sound risk management.

However, there are thousands to choose from, and despite how volatile it seems, you can still be able to make a pick that is balanced in the long run.

Read More