What is Breakout in Forex Trading?

A breakout is a sudden and sharp movement in the price of a security outside a defined support and resistance area.

A breakout occurs on either side of the market trend depending on where you’re at on the chart, meaning that you could witness a horizontal or diagonal breakout pattern depending on how intense the price action is.

How Does Forex Breakouts Work?

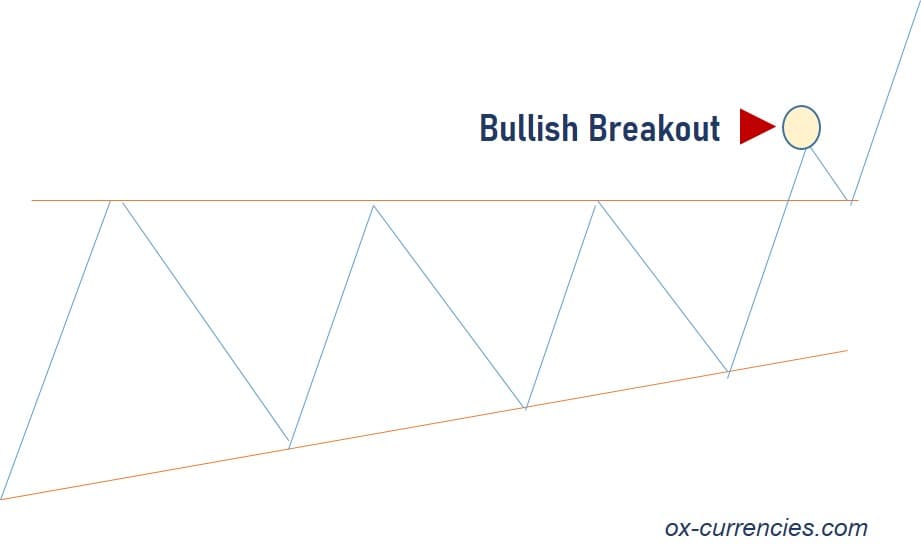

With a horizontal or diagonal breakout pattern as mentioned earlier, we can then say that breakouts could either be bullish or bearish.

An upward diagonal breakout reveals a bullish breakout trend.

The chart reveals a security’s price action on a bullish note. The security tries to break through the horizontal resistance three times until the fourth attempt, breaking through the horizontal range.

This signals a lot more buying interest and a quick entry for a trader watching the market.

Let’s examine the reverse scenario.

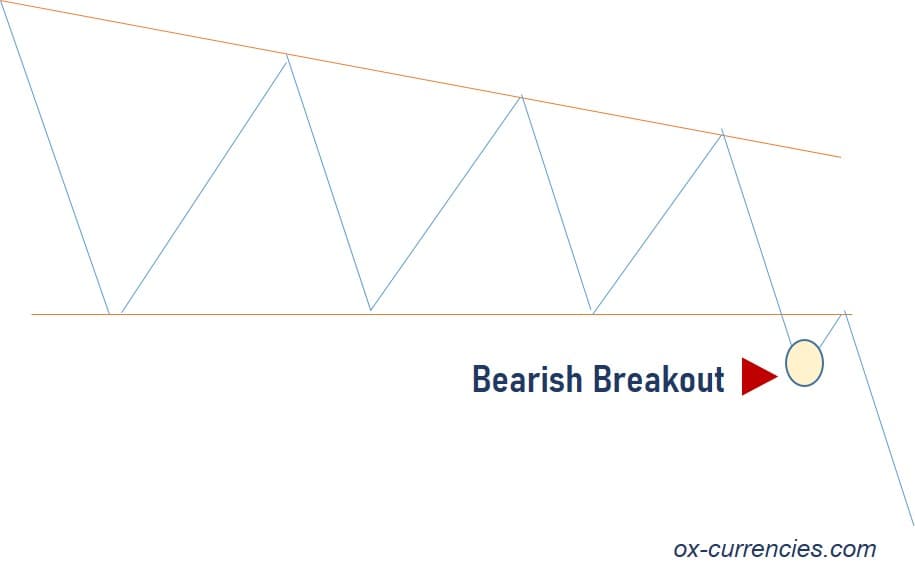

A downward diagonal breakout reveals a bearish breakout trend.

After three unsuccessful attempts from the horizontal range, the security eventually makes it through on the fourth attempt.

This signals that the market sentiment is on the sell-side.

A breakout violates a known trading range allowing traders to jump in and flow with the trend until the volatility dies down.

How to Use Breakouts in Forex Trading

As we’ve established that breakout is dependent on the volatility of the security not volume, unlike stocks, futures, and commodities that are driven by volume.

Breakouts in the forex market have no volume indicators that would tell us when a breakout would likely occur.

This, therefore, means that trading breakouts in the forex market would require a lot of intuition, sound technical analysis, and proper risk management.

Volatility is what attracts more traders. Market volatility sometimes puts a trader just entering the market ahead of others that perhaps has been slagging in a mid-low market tide.

As traders wait for breakouts, they need to be careful as highly volatile markets could also be very tempting.

Breakouts should be used to a trader’s advantage not to be used recklessly or abused.

The lure to wait for breakouts and profit from price action or surge in prices can also be costly when the market reverses.

Avoid jumping in with the crowd because some breakouts in the market could be false with no basis or fundamental reason. And jumping in without understanding the reason why the market is trending in a certain direction could get you financially hurt.

It’s better to select a currency pair or other securities that you wish to trade and technically analyze its price movement carefully from a trader’s standpoint not that of a speculator. Join the market when the volatility is low and watch for anticipated breakouts when it comes.

With this approach, you stay mentally focused and prepared for the action when it happens.

Profitable Forex Breakout Golden Rules

For every strategy, you decide to trade or have fined tuned, know that some rules remain golden and are embedded in any form of trading strategy you intend to use.

Let’s look at these profitable forex breakouts golden rules:

- Never BUY or SELL on breakouts, it’s very risky. You could face a market reversal (False breakout).

- Study the charts for initial breakout attempts to BUY at the lowest range or SELL high or near the highest range.

- Understand market momentum to know where the volatility begins and perhaps start from there.

- Be passive on choppy charts. Supply and demand sentiments are not so clear when the market is choppy. So, wait for the next spike before deciding to trade.

- Never ignore fundamental analysis. Seek recent market, economic news, and calendar for robust market analysis. These external factors could as well be reasons for volatility in the market.

Currency Pairs that Witnesses the Most Breakouts.

EUR/USD

This currency pair could change direction several times a day faltering initial predictions. The EUR/USD is volatile and could do 100-150 points in a day. This is of course what experienced traders want,” Volatility”.

Its unpredictability from time to time misleads traders, making it not the best option for beginner forex traders. Many financial analysts have also missed accurate predictions of this currency pair, time and time again.

USD/CHF

This major currency pair follows a similar pattern with the EUR/USD. Sometimes, it can be difficult to predict with basic technical analysis alone.

The USD/CHF can be easily analyzed by beginners when compared to other currency pairs. For example, other major currencies follow the USD/CHF when it breaks a major support or resistance level.

To get on with this pair, studying its movements on opposite sides is the way to go.

EUR/JPY

Experience traders rarely trade this pair due to their high volatility and unpredictability.

The EUR/JPY is risky throwing up surprises that could put a huge dent in your capital if traded without caution.

Beginners should put trading this currency pair on hold till they master currency trading and possibly give it a shot.

Final Thoughts

Breakout in forex trading is a swift way of turning the market in your favor. Traders who understand how it works use it to their advantage. If you’re new to the use of breakout, you too can use it.

After two or three attempts at trading breakouts, you should be able to master it. However, follow the golden rules while you learn newer ways of trading forex breakouts.

Bottom line is to be cautious by not jumping in at every price spike. Take time to understand the trend lines, go in at the bottom of the chart, and progress.

There you would stand a better chance of profit with lesser risks in case the market goes south.

We wish you successful trading.

Image credit: Background vector created by freepik

Read More