Accuracy is probably the most important feature of any currency-strength program or software.

There are lots of currency-strength programs in the market today which do a decent job of revealing the buy and sell pressures of a currency. However, some are more reliable in terms of accuracy and reliability.

In this article, I’ll show you how to use a currency strength meter and the best currency strength meters that are reliable and you can try.

Key Takeaways

• A currency strength meter to be considered among the best in the market must be reliable and very accurate in predicting currency price.

• With the data gotten from an accurate currency strength meter, traders will then be able to create trading strategies by applying them to the charts on their trading platforms.

SEE ALSO: 7 Best Currency Pairs to Trade for Beginners

Currency Strength Meter Overview

A Currency Strength Meter is an algorithm-based technical indicator that demonstrates which currencies are strong at the moment as well as those that are weak.

It can also be regarded as a visual guide that uses the exchange rates of different currency pairs to produce an aggregate, comparable strength of each currency.

The summation of all these factors reveals the strength of the currency and where buyers and sellers have their strongest or weakest sentiments.

Best Currency Strength Meter For Technical Analysis

Below are 6 of the best currency strength meter for technical analysis ranked based on their accuracy in predicting currency price, accessibility, cost, user interface, customer support, steadfastness, and community support.

1. Logikfx’s Macro Currency Strength Meter

First on my list is the Macro Currency Strength Meter by Logikfx which was released in 2018 and is used by professional traders, retail traders, and currency analysts globally. It was ranked as the best automation tool for retail traders by E-Forex Magazine in 2019.

It is suitable for swing traders, trend traders, and also counter-trend traders. It makes use of formulas based on numerous economic releases and reports and has one of the best predictive abilities out of any currency strength meter on the market.

Logikfx has also been found to predict numerous long-term trends. Some of its data sources include trading economics, investing.com, Bloomberg, Reuters e.t.c.

Logikfx’s Macro Currency Strength Meter covers almost all tradable currencies available to retail traders.

It has easy accessibility and so you can access it from any internet browser platform with no downloads required. It has a user-friendly interface and is one of the easiest currency strength meters to understand the market.

Some of the advantages of Logikfx include great reliability (it has never recorded a downtime since it was released), an active forum for its currency strength meter users and other logikfx technology users, and fast customer support.

2. Forex Strength Meter by QM4 Designs

The second, on my list of the best currency strength meter for technical analysis, is the Forex Strength Meter by QM4 Designs which was released in 2017 and was developed by the creators of the Forex Strength Meter iPhone App.

The iPhone version was released in 2012 and has become a popular choice among traders due to its accuracy, ease of use, speed, and low cost.

This forex strength meter is a full-features desktop currency strength meter that runs on both Windows and Mac OSX and as a result, can compete with the likes of Accustrength which has long been regarded as the best desktop currency strength meter on the market.

Just like Accustrength, the Forex Strength Meter also connects and makes use of its own dedicated currency strength data server, and access to the data feed is included in the price, so you are not saddled with any extra cost.

This Forex Strength Meter supports 8 currencies (USD, EUR, JPY, GBP, CHF, CAD, AUD, and NZD) and 6 time-frames (15-minute (M15), 1-Hourly (H1), 4-Hourly (H4), Daily (D1), Weekly (W1) and Monthly (M1)).

It also has a floating window design which allows the charts to be independently positioned across your trading desktop screen space unlike the traditional method of locking the charts in an application container like the MT4 trading platform. This is a great benefit if your trading computer has multiple displays.

Some of the advantages of these strength meters include their floating charts, data table with heat-map, more alert options, faster refresh rate, less than 1/2 the price of Accustrength, and 7-Day Free Trial i.e. no payment upfront.

3. Accustrength

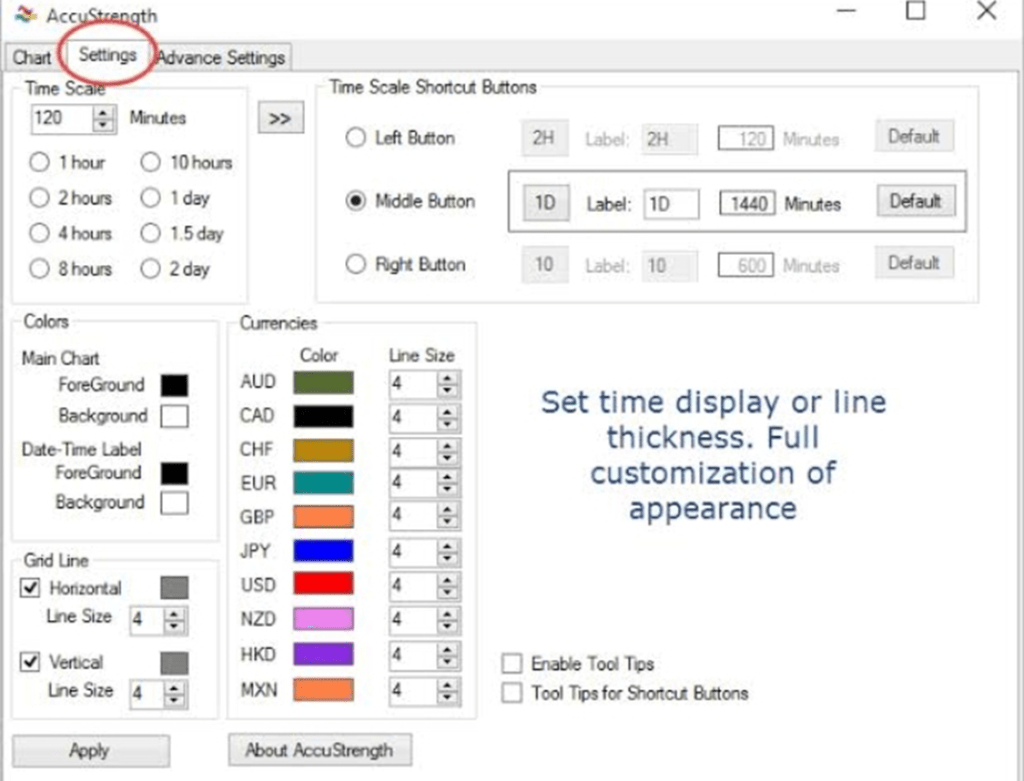

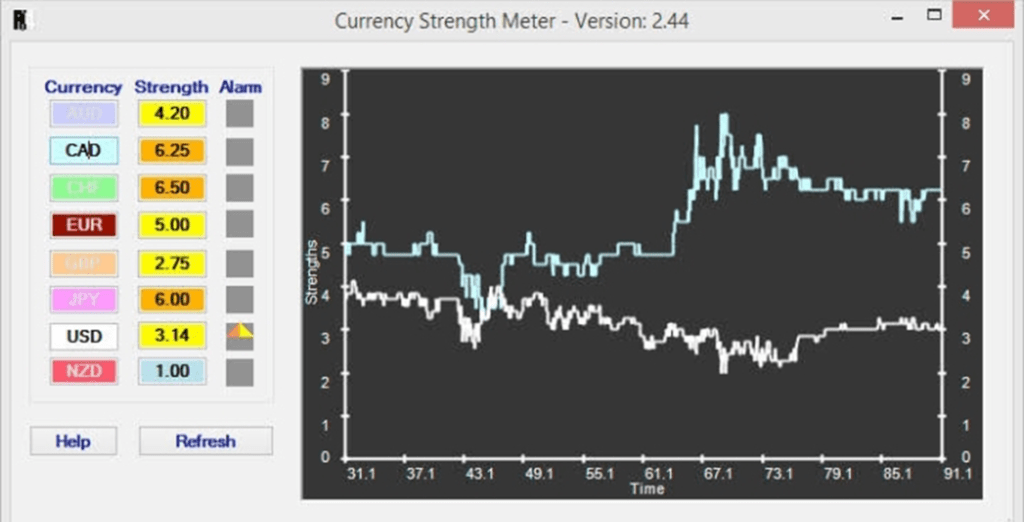

Third on my list of the best currency strength meter for technical analysis is Accustrength, which is a quality currency strength meter released in 2008 and used by many professional forex traders. It was created by Tom Yeomans, a well-known trader in the online forex trading community.

Accustrength makes use of its own dedicated currency strength data server, which provides real-time and accurate historical currency strength data, eliminating the stress of having to access data from a trading terminal, unlike many other currency strength meter products that depend on the MT4 trading terminal for their data feed.

It is one of the most accurate currency strength meters on the market and is considered by many traders as the gold standard due to its level of accuracy.

Its user interface is very simple and its design is ‘trader focus’, with no unnecessary features. Although most currency strength meters in the market today support 8 major currencies (USD, EUR, GBP, JPY, AUD, CHF, and NZD).

Accustregth covers all with two additional currencies- HKD and MXN. Some of the advantages of this currency strength meter include a long track record of reliability, high security as well as the ability to draw custom lines on the chart.

4. Fx4Caster

Another great currency strength meter for technical analysis is the Fx4Caster which was also created by the creator of AccuStrength, Tom Yeomans.

It is a standalone Windows PC app that differs from its counterpart (Accustrength) in that it uses an MT4 trading terminal as its data feed instead id a built-in data feed. As a result, you’ll need to have an MT4 terminal running simultaneously and you can use either a live or a demo MT4 account login.

It supports up to 8 currencies (USD, EUR, JPY, GBP, AUD, CAD, CHF, and NZD) and the currency strength is displayed numerically and graphically on a line chart on a scale of 0 (weakest) to 10 (strongest).

You can configure the currency chart to display any combination of currencies. You can also adjust the chart refresh rate along with the duration of data to display.

Although it lacks many features of Accustrength, FX4Caster does share the same accurate currency strength calculation algorithm.

Some of its advantages include a 60-day refund period and a copy of Tom’s “Forex Grail Trading” ebook (which you’ll get in purchasing the product), as well as access to his video tutorial library.

5. Currency Quake Currency Strength Meter

Fifth on my list of the best currency strength meter for technical analysis is the Currency Quake Currency Strength Meter. It makes use of the previous weekly, daily, 4-hour, and 1-hour historical forex price data and bundle pairs to determine each currency’s overall strength.

It supports 8 currencies (AUD, CAD, EUR, GBP, NZD, USD, JPY, CHF) and as a free tool, it’s best used to understand historical price action strengths or weaknesses.

You can access the Currency Quake’s strength meter from any internet browser platform, which makes it easily accessible on virtually any device, with no downloads required. Some of its advantages include email support and it is free to use.

6. Live Charts Currency Strength Meter

Last but not the least is Live Charts Currency Strength Meter which was released in 2004 and has been providing detailed analysis and a quick visual guide on historical currency strength ever since.

It measures the strength of 10 currencies, using a basket of currency pairs. It is also a free tool that analyses the past 24 hours’ worth of forex price data, and bundles pairs to work out the strength of each currency and is best used to understand historical price action strengths or weaknesses.

Frequently Asked Questions (FAQs)

Q1. Does MT4 have a currency strength meter?

Yes, it does. It is also known as the MT4 Currency Strength Indicator. It uses a unique algorithm to detect rapid price changes in other to show you the absolute strength of 8 major currencies.

Q2. Which currency pair is most profitable in forex 2022?

The EUR/USD is regarded as the most profitable currency pair in 2022 due to its high liquidity, low spreads and commissions, and sufficient volatility.

Final Thoughts

The goal of a currency strength meter is to help forex traders make better trading decisions in the forex market and as a result, any currency strength meter that must be used by such traders must be accurate in predicting currency prices, have an easy-to-use interface, solid customer support and easy accessibility.

Those currency strength meters discussed earlier are some of the best you will find in the market and they will assist you in coming up with a successful trading strategy.

Read More