Before delving into day trading hacks, understanding the basics of day trading is vital, then we will proceed along with other day trading subjects.

What is day trading?

Day trading is a trading technique where a trader buys or sells a financial instrument multiple times within a trading session or market hours in order to buildup a series of marginal profits.

A day trader takes advantage of daily price fluctuations of an instrument and profits from price gaps. All trades must open and close within that trading day, no rollovers to the next day.

A volatile market is the day trader’s playground, this gives him a sweet opening to exploit the market and profit and if he overtrades or predicts wrongly, his account could get hurt in the process.

New traders often start practicing how to day trade with a tactic called scalping which is the basic concept of day trading.

To day-trade, you must carry out a pre-market analysis before the market opens. This entails analyzing historic charts of the stock or currency pair you wish to trade. You should also lookout for the following:

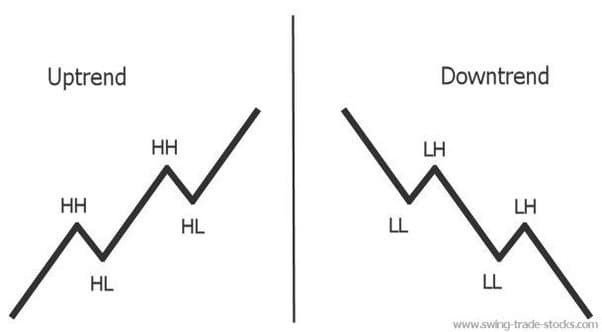

Highs and lows (E.g. 1,7,30,60,90 days). Shows the price bands and how high or low a stock or currency price has ever attained or fallen since its launch. Analyzing high and lows for day trading may not need to trace back prices more than 365 days.

Look out for Support and Resistance levels, time and duration. This could give you a clue on when to expect volatile price fluctuations and how long it could last.

Company-wide information, for instance, Coca-Cola declares an impressive third quarterly result and promises to pay dividends, with an astonishing 20% high, surpassing rates paid to shareholders in the previous quarters.

This news certainly will impact the price of the stock, giving it a boost. With the news, more traders will likely “Hold” the stock as it gains and sell when it gets to a new high or saturation point where there may be little or no market news or drivers to keep the price on the upward trend, at this point, traders will begin to sell.

Market news. A good technical analysis can go wrong when a Breaking News in the home country of the base currency or stock is declared. Sometimes other influential economies ‘ pronouncements can impact a distant market or exchange positively or negatively.

You have to master your charts, be able to read the news and understand how economic policies impact one another.

SEE ALSO: Day Trading Strategies for Beginners

Swing trading and day trading, the difference

The strategy for Swing trading differs from Day trading. To put it this way, swing trading’s time frame extends beyond a day.

Attractive price margins are predicted over the mid to long-horizon say a week, two weeks depending. For example, A trader places a buy order in EUR/JPY and Ford Automobile shares and predicts that in the coming week, these instruments would gain a certain percentage which oftentimes may double or triple the spread.

With a tidy and tested strategy applied over time, he mostly like will win in most of his trades. But this is usually a tough one if prices begin to dip beyond what was predicted.

If the trader is savvy to have introduced a stop loss and adjust when appropriate, he should get out of a downward trend quickly and wait for the upward ride towards a green.

Swing trading is more advanced and requires confidence, patience, profit, and a solid stop-loss plan. Swing trading is not so ideal for beginners to start with.

Why day trading is mostly embraced by new and experienced traders is that you have a 24-hour window to make a profit, cut losses, and relearn the process for the next trading day. Swing trading gains could be massive over a period especially if the trader’s prediction was correct.

How profitable is day trading?

There is no straight answer to this question. However, in a general context, day trading has been reviewed as a profitable trading technique that also has its own risk.

Profiting from day trading has its factors, Capital requirement is one major factor that most new investors ask. Many forex brokers offer as little as $10 for opening a live account, some receive deposits as low as $1.

In reality, a small account size often has it restrain and limits. With a small capital of $10 – $100 for instance. A trading account can conveniently be created but that sum, but it may not compete favorably well.

With an account that size, there are limits to positions you can open at the same time. Also, during downtrends, your low capital may not absorb the massive price fluctuations and downturns thereby returning a zero balance which is heartbreaking.

Mapping a workable strategy and adhering to it should return good profits. If you minimize the use of high leverage and managing your money well, you should succeed. Trading the currency majors, you understand is key, knowing these basics simplifies your task.

The same applies to stocks, pre-analysis should include, seeing the company’s previous financial statements, reviewing PAT progression, earnings per share (EPS), dividend growth, payout and history, Asset and liability structure, Shareholder fund, and future projects/expansion.

For currencies, pairs that are easier to read and understand is recommended for beginners. It’s no use trading a pair you do not understand and have little knowledge about. Some suggested currency pairs for beginners include, (USD/CHF, USD/CAD, AUD/USD, NZD/USD).

SEE ALSO: 7 Best Currency Pairs to Trade for Beginners

Taking profit also involves timing.

Some traders due to poor planning and indiscipline overtrade (trade all day, hours, week). More experienced traders suggest that trading currencies are ideal on Tuesdays and Wednesdays as the market is most active in major foreign exchange markets around the world.

This however does not affect stocks as the can move all year round. These days are when the long-awaited volatility appears on the chart.

Experienced traders target those volatile periods and do their trades and rest or trade passively on other days. Friday afternoons are usually avoided heading towards the weekend. Major public holidays like Christmas and New Year are also avoided.

SEE ALSO: What are the Best Days of the Week to Trade Forex?

How much can I start day trading with?

It’s often advised to start with at least $200-$500, this sum opens you to viable opportunities in the market, of course with minimal leverage and proper risk management, you should make decent earnings. Some forex brokers accept a minimum of $1000 to open a regular trading account.

Irrespective of the amount you intend to start trading with, either $1, $10 or a $100, the bottom line is to have a realistic expectation on your profits. I hear new traders and investors ask if they can make $100/day with an account size of $500?

This is not only absurd but very unrealistic. Moving ahead with this mindset will only lead to woes at the end of the road.

With a 2% spread per trade, day trading on a $100 account returns $2. This is not only workable but keeps your expectations within reach. With this plan, taking a position in the market at 2%, 2 – 5 times should return a profit of about $4-$10 a day.

If this is successfully executed for a week, you can make $20-$50 a week and $80-$200 a month if all goes according to plan. Some traders make more than this.

The point is to test your strategy, and avoid overtrading. Choose the best currency pairs, stocks and days of the week to trade.

Day trading hacks

Follow the trend

“The trend is your friend, never fight it or go against it”

Practical trading entails finding openings in the market and taking advantage of it. So, it’s sensible to trade along the price trend, at whatever point you are, there is always an opening as long as there is mild or high volatility in price.

A support or resistance points are good avenues to jump in or out. As prices trend upwards, a buy order can be place before it gets to a resistance point.

Knowing when to buy or sell during an uptrend or downtrend is vital to the success of your trades.

Apply one strategy

A lot of traders get confused when their strategy does not work. Most times, when you investigate, you’ll find out that, their trading plan is a list or a combination of a couple of many other colliding ideas.

This of course cannot be easily tracked or measured to know which strategy brings profit and the others that needs to be discarded.

Trying out strategies one after the other is better, if one strategy is properly deployed and tested effectively and it still fails, it then can be disregarded and another tried.

A strategy that eventually works should be your joker and must be developed further.

Only trade 2:1 Return/ Risk

With the risk of loss to your capital, stake your funds on stocks or currency pairs that have 2x more return for a single risk you take. This covers your position in times of unfavorable market downturns.

Risking your capital should be worth the effort. Choose your financial instruments wisely and trade a few you understand.

Avoid Signals if you can

With numerous trading signal providers out there with low to high subscription fees, it’s always better to learn the ropes, this will be of great benefit to you in the long run.

These signals sometimes are far from accurate. Some reputable signal providers actually do work if you know and trust the source. If you can stay away from it, it’s okay to research before signing up with one.

But if you wish to trade passively or through a strategy manager and not really concerned about learning, then you can subscribe to one. We have a reputable one we recommend here.

Take profits early

With the thrill of watching your account grow, many traders have made the mistake of continuously rolling over profit with capital.

This is however a widely advised practice, investors are discouraged from withdrawing their gains, in attempts to build their portfolio.

In recent times, the crisis and uncertainty in major economies are beginning to affect every sphere of life. Government policies, banking, medicals, conglomerates, industrial and consumer good sectors are constantly forced to adapt to the new system.

This however has caused many quoted companies to foldup thereby leaving their shares crumbling. Investors who once had a portfolio built up with capital + gains only end up watch their investments eroded in a flash.

Take your profits as early as you can to avoid sudden investment depreciation.

Do not Overtrade

“The sweet spot is usually short-lived, take your profits and walk away”

The tendency to stay on longer has burnt a lot of fingers. New traders often fall into this trap. When the going is good, it is not guaranteed that it will remain that way. Be careful on the jolly ride, know when to stop and take home what you have.

Pick your trades carefully, trade and make a profit in favorable markets or cut your losses when it goes south. Move on to the next trading session perhaps, the next business day.

The forex market is constantly a working system with many influences determining the bull and the bear. Your buy order is another trader’s sell order. Interests, funds, deals, economies and government polices are constantly impacting market prices, so nothing is really guaranteed.

Final thoughts

Day trading is a widely used trading practice among a larger percentage of traders, it is pretty straightforward and often a starting point for new traders.

Experienced traders stick with this technique as well. Following the rules and maintaining self-discipline should keep you earning longer in the trade.

Image credit: Logo vector created by catalyststuff – www.freepik.com

Read More