Revenue from Crypto Mining

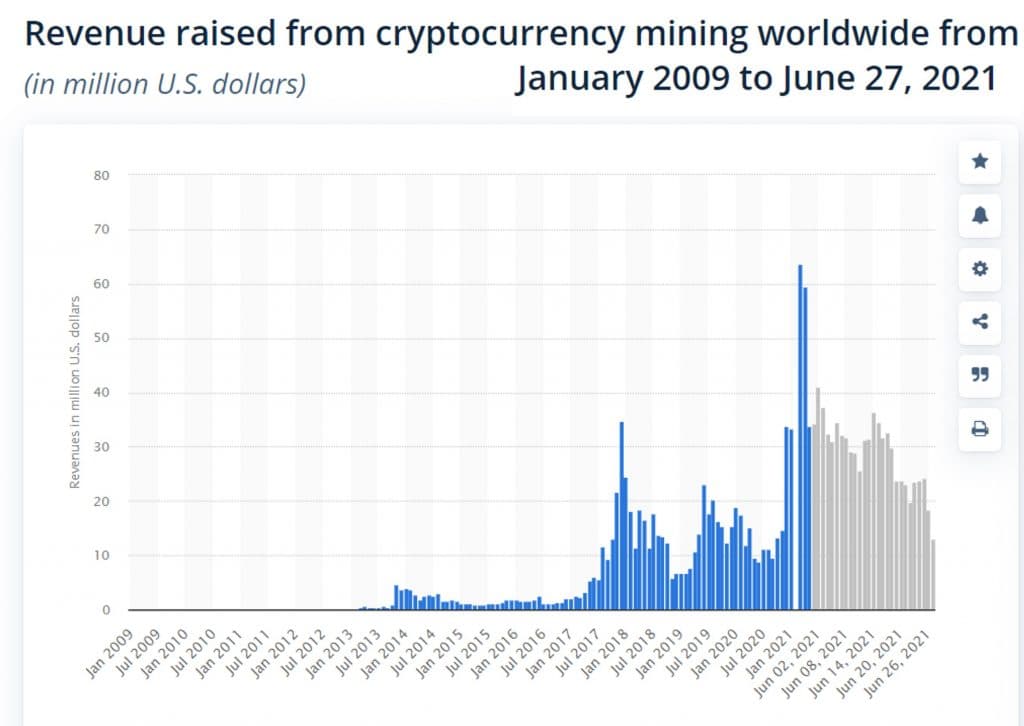

Bitcoin mining has generated huge sums of revenue over the years amounting to over 63 million USD in a single day in 2021.

Crypto mining generally is an investment running into thousands of dollars if you own your mining rig.

A less expensive option is to mine through cloud mining pools, however, the profitability of mining generally is still dependent on a lot of factors such as the hash rate of your equipment, electricity costs, cooling systems, maintenance, etc.

With the rising price trend of Bitcoin, the possibility of Bitcoin mining remaining profitable is positive even with the expected Bitcoin halving coming up between February and June 2024.

There also seem to be some positive upticks for Bitcoin as many governments are beginning to embrace and legalize virtual currency.

With China’s and Iran’s (temporary) ban on the mining of crypto, we anticipate that the market will be flooded with fairly used mining equipment pushing the prices of hardware down.

The competition from China, being a crypto mining giant may be the thing of the past. This ban should give opportunities for private miners to thrive leading to the emergence of new mining giants in the future.

Key Takeaways

• Bitcoin mining should still be profitable with increasing acceptance from many governments and its ever-increasing price trend.

• The ban on crypto mining in China and Iran may give opportunities for new miners to thrive, producing new mining giants.

• Profitability in mining is highly dependent on the hash rate of your miner, lesser electricity, and maintenance costs.

• The next Bitcoin halving will take place between February and June 2024 which means fewer block rewards will be gotten when that takes place.

Let’s further examine why Bitcoin mining will be profitable in 2023.

SEE ALSO: 14 KEY Tips You Should Know Before Mining Bitcoin

SEE ALSO: 10 Best Bitcoin Mining Software for Windows, Mac and Linux

Will Bitcoin Mining be Profitable in 2023?

The straight answer is YES…

It is expected that Bitcoin mining will still be profitable in 2023 considering the crypto mining revenue trend since the inception of Bitcoin in 2009.

Ideally, mining profitability is determined after weighing in some other surrounding factors, we expect that the gains of Bitcoin should outweigh other mining conditions such as electricity, maintenance of mining equipment, etc.

If you have decided to venture into Bitcoin mining, there are certain things you need to take into consideration. You need to factor in the cost of electricity, the cost of mining equipment, the halving of Bitcoin, and block rewards.

If you live in a country with an epileptic power supply or high cost of electricity, it would be tough for you to engage in Bitcoin mining.

This is because when it comes to Bitcoin mining, you will need to spend a lot of money on setting up rigs and mining equipment such as the Whatsminer M30s+, ensuring constant electricity, and mining Bitcoins that would be enough to offset these costs and still yield a profit.

That is why these things must be taken into consideration before any decision is made.

Satoshi Nakamoto, who created Bitcoin, imposed a limit on the amount of Bitcoin that could be mined, which was 21 million. Out of that figure, 18.7 million Bitcoins have already been mined and are in circulation.

That means there are just 2.3 million remaining to mine, making Bitcoin a rare cryptocurrency due to its restricted quantity.

Factors That Would Influence Bitcoin’s Profitability in 2023

1. Block Rewards

The halving of Bitcoin mining is another significant factor influencing its profitability. Miners get Bitcoin block rewards for successfully mining Bitcoin.

This block contained 50 bitcoins when Bitcoin was created in 2009. The block reward is halved every 210,000 blocks or every 4 years. In 2013, it was cut in half to $25.

In 2016, it was reduced to $12.5. The block reward is present $6.25 after the previous halving in May 2020. The next halving will occur in 2024, lowering the block reward to $3.125.

2. Increased Competition

Strong competition will also have an impact on profitability, as more individuals become interested in mining Bitcoins.

Previously, anybody with a personal computer or a mobile device could engage in Bitcoin mining, which was successful nonetheless.

This is still viable today, but individual miners would be competing with professional mining rigs that pool resources to enhance computational power and hence would not make much out of it.

3. Transaction Fees

Another motivation, other than block rewards, for miners to mine, is the transaction fee associated with Bitcoin mining. The miners receive fees from transactions contained in the block of transactions that they mine.

The fees ensure that Bitcoin miners are compensated for their efforts in maintaining the network.

While some experts believe that blockchain and cryptocurrency are the way forward, others remain skeptical.

In summary, Bitcoin mining will still be profitable in 2023 for those who are willing to go the extra mile.

If you have the required funds to set up rigs and mining equipment and ensure that other factors have been provided for, you will make a profit.

If not, then you should stay away from Bitcoin mining. You could invest in it instead, as that would still earn you some profit, although not as much profit as if you were mining.

Whatever side you choose, whether you want to mine Bitcoin, invest in it, or do nothing at all, make sure you do proper research, or else you might find yourself in an uncomfortable position.

SEE ALSO: How to Mine Bitcoin on iPhone

Final Thoughts

Bitcoin mining can be a task, though the rewards are worth the effort. If you wish to engage in Bitcoin mining and do not know where to start from, read through this article as it will provide you with an understanding of what you need to know before engaging yourself in it.

Read More