What is Bitcoin Halving?

Halving is a significant event in Bitcoin mining technology.

Bitcoin halving is a process whereby Inflation is induced into the cost of Cryptocurrency through the reduction of the amount of Bitcoin available in circulation giving rise to an increase in Bitcoin demand.

All stakeholders in the ecosystem are impacted by the halving of Bitcoin whenever it happens. Earnings per block for miners are reduced by half.

Key Takeaways

• Bitcoin halving is an event in which the earnings for Bitcoin mining is shared in half

• This halving is responsible for cutting the inflation and new circulation rates in halves

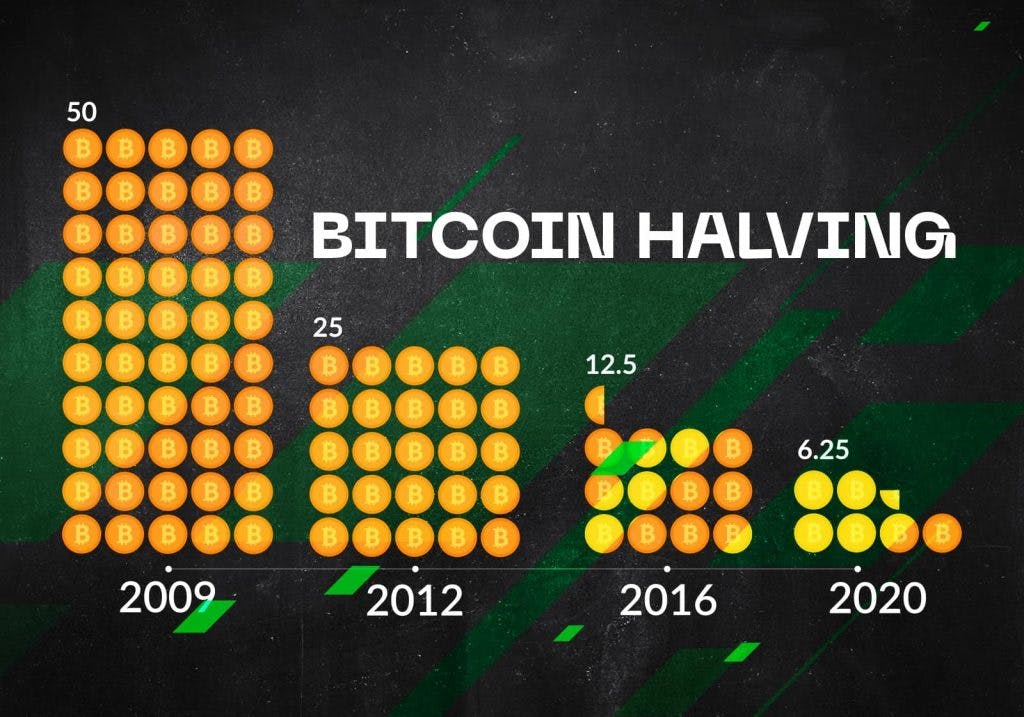

• The last time Bitcoin halved was May 11, 2020, at 3 pm EST hence, a 6.25 block BTC reward.

• The next halving is expected between February and June of 2024.

• Bitcoin halvings that occurred in the past had correlations with serious bust and boom cycles resulting in prices higher than the halving event occurrence.

SEE ALSO: 14 KEY Tips You Should Know Before Mining Bitcoin

SEE ALSO: 10 Legit Bitcoin Mining Sites For New Miners

To understand halving, Bitcoin mining must be understood.

Mining Bitcoin

The process of Bitcoin Mining entails the usage of powerful mining computers by Individuals to partake in the Blockchain technology of Bitcoin as a miner and transactor processor.

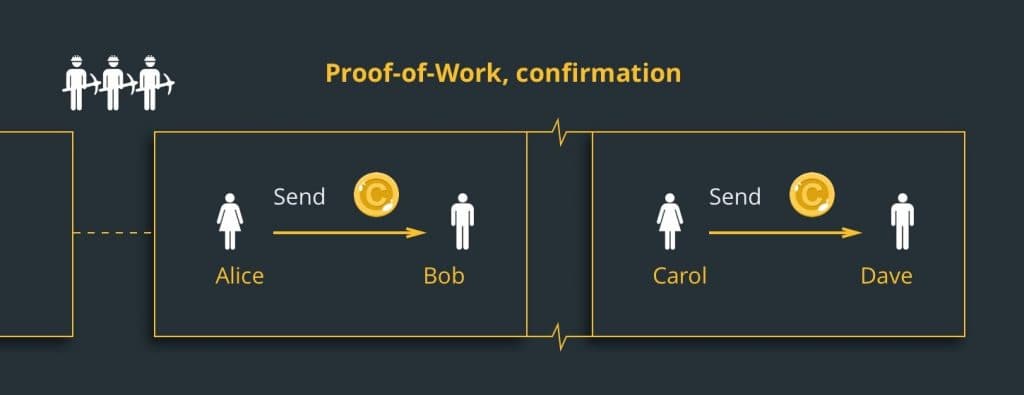

Miners need to show they made efforts in the processing of transactions else, there’d be no reward since Blockchain uses the Proof-of-Work System (PoW).

Miners that successfully solve the complex hashing puzzle will earn a reward after showing their proof-of-work. The PoW means that the miner has succeeded in confirming a BTC transaction and has added it to the blockchain network.

This mining process takes time and energy (electricity) is dispensed in running hardware and solving complicated equations.

Bitcoin miners provide solutions to mathematical problems and authenticate the transaction and record or secure in the public ledger where they cannot be altered.

These transactions are added to a transaction block and chains are formed of them thus the Blockchain.

A fraction of Bitcoin is rewarded to miners whose blocks have been processed, authenticated, and filled with transactions. Currently, miners are rewarded with 6.25BTC per block mined.

The Concept of Bitcoin Halving

After four years or every Two hundred and ten thousand (210,000) blocks are mined, the proceeds given to the miners is cut in half for carrying out transaction processing.

This event is known as Halving since the rate of newly formed Bitcoin circulation is cut in half. The system is a technique by the Bitcoin network to enforce synthetic cost inflation until every Bitcoin is released.

This system of reward will be till the year 2140 when the 21 million proposed limits are reached.

When that occurs, Bitcoin miners will have their rewards in fees paid by Bitcoin network users to process transactions. The fee aims to make sure the miners still possess incentives for mining and maintaining the functionality of the Blockchain network.

Halving is important because it signifies the decrease in Bitcoin rate as it reaches finite supply. Bitcoin’s maximum supply is 21 million.

18.85 million Bitcoin is in circulation as of October 2021 leaving about 2.15 million remaining for release through rewards from mining.

For instance, if the amount of gold mined from the Earth undergoes cutting in half every four years, its value and price will increase.

SEE ALSO: 10 Best Bitcoin Mining Software for Windows, Mac and Linux

SEE ALSO: 5 Best Bitcoin Mining Hardware with Low Running Overheads.

When The Next Bitcoin Halving Will Occur?

For the first time, Bitcoin halving occurred on 28th November 2012 after the sum of 10,500,000 BTC was mined successfully.

On the 9th July 2016, the next halving occurred then the recent halving occurred on 11th May 2020. The next halving is expected between February and June of 2024.

What To Expect From Halving

The expectation from halving is a halved reward, inflation, reduced supply, increased demand and cost, continuous incentives for miners irrespective of reduced rewards as Bitcoin’s value increases.

If halving does not affect the cost and demand, miners will have no incentives, the benefits of finishing transactions are less because Bitcoin’s value is not high.

The excess flow scenario or too much BTC in circulation is prevented by making mining difficult.

In situations when benefits are halved yet Bitcoin’s value is low, mining difficulty will be lessened for miners to receive incentives. That is, the volume of Bitcoin rewarded is smaller but processing a transaction will be easier.

This preventive measure has been successfully executed twice yielding an overwhelming price increase then a great dip. These dips however retained prices greater than the halving events.

For instance, the year 2017-2018 experienced an increase in BTC to a price of $20,000 and a dip to a low of $3,200.

We will notice a massive dip yet, Bitcoin’s price was $650 before the halving. Since this When the third halving occurred in May 2020, there was a worldwide pandemic, COVID-19 included increased speculation on regulations, institutional attention on digital assets, hype from celebrities. With these factors, it is unclear the price at which Bitcoin will settle.

SEE ALSO: How To Mine Bitcoin At Home With Shamining

SEE ALSO: 3 Reasons Why Bitcoin Mining Will Be Profitable In 2022

Frequently Asked Questions

Why Does The Halving Occur in Less Than Four Years Subsequently?

The algorithm of Bitcoin mining is fixed to get new blocks every 10 minutes. If additional miners join the network, however, there will be extra hashing power, and the time is taken to discover blocks will reduce.

Through the process of resetting the difficulty of mining or the complex tasks the computer is requested to solve mining algorithms once in 14 days thereabout, the restoration of 10-minute (target/goal), this situation is solved.

The growth of Bitcoin in past years has fixed the time taken to find a block as 9.5, approximately 10 minutes.

Does Halving Affect the Price of Bitcoin?

The fact that halving doubles the reward of miners who can be referred to as Bitcoin producers should positively affect the price as producers will adjust their selling price to cost.

Based on empirical results, the price of Bitcoin tends to increase in response to upcoming halving even months before the event.

When There Are No More Bitcoins Left in a Block, What Happens?

Halving ceases due to the absence of new bitcoins but, miners will receive incentives to keep on authenticating transactions on the Blockchain network.

Miners fees will increase in the future due to the rise in transaction quantity that fees are attached to; Bitcoin will also have a higher market value.

Final Thoughts

The halving of Bitcoin brings about an imposing of synthetic cost inflation in the crypto network and divides in half the speed at which newly developed bitcoins are taken to be circulated.

Until 2140 when the 21 million proposed Bitcoin amount is reached, the system of reward continues after which miners will receive fees for the transaction services.

To partake of the highly rewarding profits Bitcoin offers, start holding before 2140.

Read More