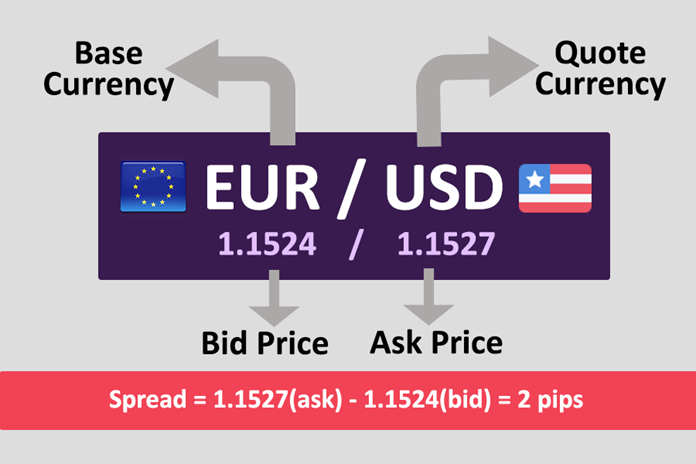

A Quote currency in a currency pair is simply a secondary currency that measures the value of the initial/base currency. In the forex market, in particular, the Quote currency is always a given and is used to determine the exchange rates of the base currency.

To make things simpler, let us make use of a classic example in the USD/GBP. From the USD/GBP illustration, it should be noted that the GBP is the Quote currency whilst the USD is the base currency.

As the exchange rate in this currency pair increases, the rate of the Quote currency decreases.

This is why, in real-world scenarios, the USD is constantly being compared with other Quote currencies such as the Euro and British Pound to ascertain its value over a given period.

Key Takeaways

• The Quote currency is an important part of a currency pair that is used to ascertain the value of the base currency.

• There are seven major currency pairs in the foreign exchange market, which are often traded by a large number of forex traders. USD, GBP, and JPY are some of the currencies in these currency pairs.

• Direct quotation is a more common method used to analyze currency exchange rates in the forex market, as indirect quotation is less frequently used.

SEE ALSO: 8 Very Active Forex Pairs to Trade

SEE ALSO: What are the Worst Forex Pairs to Avoid?

SEE ALSO: Advantages and Disadvantages of Using Forex Robots

That said, there are important key points to note in this topic to give you a proper understanding of what a currency pair is and how Quote currencies affect the forex market in general.

Let us take a look at them below:

What is a currency pair?

A currency pair is a combination of two different currencies that are valued based on real-time exchange prices as they are traded in the forex market.

In the forex market, you will realize that every currency is paired against another currency. For instance, USD/GBP, USD/EUR, NGN/EUR, etc.

It is these pairs that are made use of while trading, which is why when a particular currency pair say USD/EUR is trading at 2.5, it means that the USD is worth 2.5 EUR.

If the USD continues to appreciate at this point, then it means that a single USD will be worth more than the EUR, which will cause an increase in the price of the currency pair.

The reverse is also the case when the pair price is on the decline. It would simply mean that the USD is worth less than the EUR. It doesn’t get any simpler than this.

Major currency pairs in the forex market

While currency pairs are of major value in their own right, some take more prominence than others and are too often traded within the forex market. These currency pairs are shown below:

- Euro and US Dollar: EUR/USD.

- US Dollar and Japanese Yen: USD/JPY.

- British Pounds and US Dollar: GBP/USD.

- US Dollar and Swiss Francs: USD/CHF.

- Australian Dollar and US Dollar: AUD/USD.

- US Dollar and Canadian Dollar: USD/CAD.

- New Zealand Dollar and US Dollar: NZD/USD

These seven currency pairs listed above are the most traded in the forex market and account for close to 80% of all trades done.

These pairs being the most traded currency pairs simply mean that they have the largest number of buyers and sellers and, likewise, the tightest buy and sell spreads in the forex market.

Types of quotation in the forex market

We have already discussed above that the Quote currency is simply the counter currency that is used to determine the price of the base currency. While this is true, there are two types of quotations in the forex market, which are:

- Direct quotation.

- Indirect quotation.

Direct quotation

Direct quotation is the method most traders are already accustomed to. It usually involves the three symbols of the base currency against the three symbols of the counter currency. For instance, USD/EUR, where the focus is on the base currency (USD).

Also, direct quotation assigns the value of 1 to the base currency to easily help determine how much counter currency is needed in exchange for that one base currency.

Indirect quotation

This type of quotation is a direct inverse of the direct quotation method. Here, the emphasis is on the counter currency rather than the base currency. With this method, you are asking yourself how much of the base currency is needed to get one unit of the counter currency.

This method is quite rare and is only used in commonwealth countries, so if you do not live within these regions, you might as well simply make use of the direct quotation method.

Final Thoughts

The Quote currency is an important part of the currency pair that governs every trading activity in the forex market.

You can always be on the lookout for the best Quote currency to trade with by selecting the best currency pairs in the forex market. A look at the seven major currency pairs would be a good place to start.

Read More