Scalping is fast, exciting and stimulating at the same time. It is a style of trading that usually involves holding an asset for a few seconds or at most a few minutes and as such we have reverse scalping indicators.

In trading parlance, scalping means buying and selling positions multiple times in the same day, making a small profit on each.

Key Takeaways

•The EMA is capable of originating buy and sells signals. It uses the divergences and crossover values of the historical averages. Using the EMA is not that hard; however, you got to have proper knowledge of Scalping.

•The Simple Moving Average Indicator (SMA) is one of the preliminary Scalping strategies around. It will let you know what the average prices are over a span. So, you can quickly find out the market trend, whether it is moving upwards or downwards.

Traders know of scalping opportunities when looking for extreme prices in the market. When scalping, we can buy for a lower price and sell it for a higher price or vice versa.

We prefer to sell primarily high-end assets although it is also possible to sell futures in low Category IV environments to stay active.

The most important aspect of scalping is liquidity. We will not focus on a position that is not liquid as our goal is to enter and exit our trades multiple times a day.

Guaranteeing liquidity also ensures that we obtain the best possible price when entering and exiting operations. Scalping is purely subjective and there are no rules for when to enter or exit trading.

When scalping, we trade with very little money and accept the benefits when they arrive. By using this technique, we believe that greed and the chain of negotiations can be harmful and quickly lead to a big loss of money.

Is Scalping Right For You?

The main objective of scalpers in Forex is to trade very low volumes as much as possible during daily peak times. Because scalpers need to stay glued to the charts, this style is especially suitable for those who can devote several hours of attention to their trades.

To get the most out of it, scalping requires intense focus and quick thinking. It is not for those who are always looking for big profits, but for those who want to make small profits in order to obtain them in the long term.

A Forex Scalper Requires the Following Qualities:

- You like fast trading and emotions

- You don’t mind being focused on your charts for several hours a day

- You are impatient and don’t like to wait too long

- You think fast and turn the wheel or change direction in the blink of an eye

You Cannot be a Forex Scalper if:

- You get stressed easily in competitive environments

- You can’t stay focused for hours on your charts

- You prefer trade less with higher profits

- You like to take your time to analyze the general market trend

How Scalping Works

By definition, scalping trading works over a very short period of time. The scalper must juggle, during the same session, between very many positions.

The scalper is to forex what day trading is to the stock market. During a scalping session, the duration of the trade ranges from a few seconds to a few minutes.

The trader then plays on the PIPS (i.e. the fourth decimal place after the decimal point) to maintain or close his position.

The scalper must therefore be particularly attentive and organized. The positions adopted during the same day are multiple and require constantly keep your eyes on the price of the currencies on which the trader has taken a position.

Best Reverse Scalping Indicators

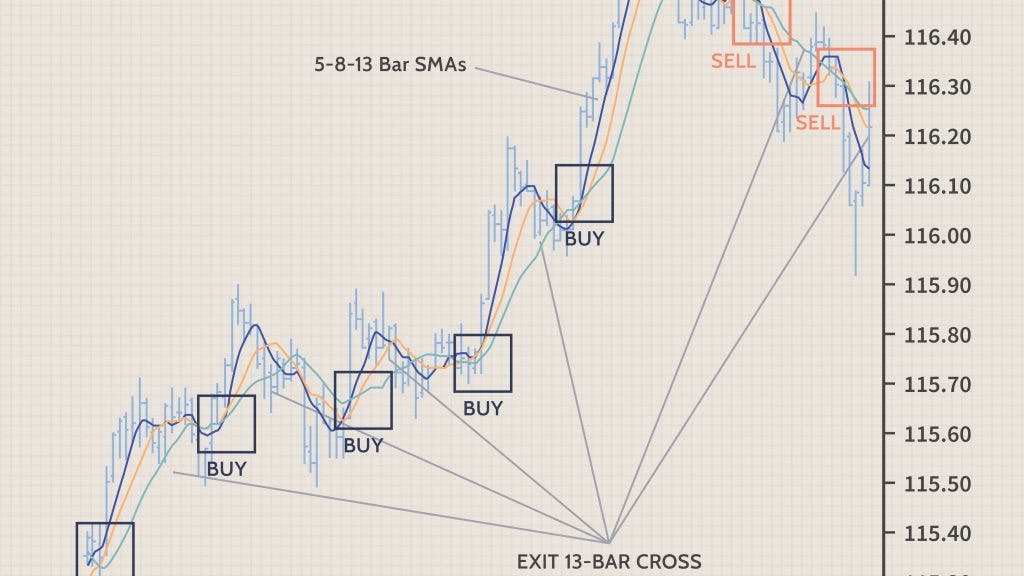

1. Simple Moving Average – Best Scalping Indicator

The Simple Moving Average Indicator (SMA) is one of the preliminary Scalping strategies around. Primarily, the SMA is an arithmetic moving average which you can find out quickly.

For that, you need to calculate the aggregate value of the recent closing prices, first. Then, you need you to figure out the number of periods the calculation average consists of and add both the values.

The SMA will let you know what the average prices are over a span. So, you can quickly find out the market trend, whether it is moving upwards or downwards.

Experts do believe it is ideal if you wish to guess the market trend of DAX. After that, you can create a decent Scalping strategy.

One core idea that you should understand is the Simple Moving Average Indicator responds to any long-term averages slowly.

However, in the case of short-term averages, you can expect a fast change.

SEE ALSO: 5 Best Types of Technical Indicators For Scalping

2. Exponential Moving Average – Top Scalping Signals

Sometime you may look for an indicator that can quickly provide you with the buying and selling signals data. The Exponential Moving Average Indicator (EMA) is what you should look for.

It is a robust tool to be an expert in Scalping in no time as the EMA gives more weight to find out the recent prices.

If you do compare what you get while using SMA, the EMA provides detailed information which is much faster as well.

The EMA is capable of originating buy and sells signals. It uses the divergences and crossover values of the historical averages.

Using the EMA is not that hard; however, you got to have proper knowledge of Scalping.

You should know how to calculate, apply, and interpret the technical analysis part correctly.

The EMA should eventually assist you to get proper reports on the market movements so that you can craft the right Scalping strategies.

3. Stochastic Oscillator

If you are fond of trading Forex, Indices, and CDFs, then using the Stochastic Oscillator indicator is your best ploy.

Even though this is a multipurpose tool, you can use it to build a sound Scalping strategy.

Primarily the Stochastic Oscillator deals with the momentum. The concept that the Oscillator follows is intriguing – the price of an asset is dictated by the momentum.

So, if you are a trader, you can guess the tentative movement prior to what really will happen using the Stochastic Oscillator indicator.

Apart from that, you can do another useful prediction using this tool – the movement of the price of any particular asset.

There is a simple formula to determine the Stochastics, but that will be a touch irrelevant to the topic we are covering today.

However, we would like to conclude that it is one of the most trusted indicators to know the market trends and movements.

SEE ALSO: What Is A Forex Scanner Analyzer And How To Use It

4. Average Convergence Divergence

The Average Convergence Divergence Indicator is an advanced tool capable of delivering high-end data for Scalping strategies.

Many experts also believe that this tool generates more complete reports than all other indicators around.

It can not only help you to understand momentum better but also to follow and capture market trends. So, you can get to see that ideal status of the two MAs of a security’s price.

There is a specific formula that you should be aware of to determine the MACD. You need to figure out the 26-day Exponential Moving Average and subtract that for the 12-day EMA.

Now, there is a default setting of the MACD, which you also need to know – the 9-day EMA is the signal line as traders.

As we are not covering the in-depths of convergence and divergence, we advise you to gather information on them first before you can fully implement the MACD.

Frequently Asked Questions (FAQ)

1. Which Indicator is Best for Scalping?

The EMA indicator is regarded as one of the best indicators for scalping since it responds more quickly to recent price changes than to older price changes. Traders use this technical indicator for obtaining buying and selling signals that stem from crossovers and divergences of the historical averages.

2. Is Scalping a Good Strategy?

Scalping can be very profitable for traders who decide to use it as a primary strategy, or even those who use it to supplement other types of trading. Adhering to the strict exit strategy is the key to making small profits compound into large gains.

3. What is the Best EMA for Day Trading?

The 8- and 20-day EMA tend to be the most popular time frames for day trading while the 50 and 200-day EMA are better suited for long term investing. Sometimes markets will flat-line, making moving averages hard to use, which is why trending markets will bring out their true benefits.

4. Which EMA is Most Accurate?

The 20 EMA is the best moving average for daily charts because price follows it most accurately during a trend. The price that is above the 20 can be considered as bullish and below as bearish for the current trend.

Final Thoughts

In this article we have listed and explained the best scalping indicators available pout there. It is advisable that you understand in detail what they are and how they are different from each other. Hopefully, this article has been able to do adequate justice to that.

Read More