When doing chart patterns analysis, traders use these terms when referring to price levels on the charts which act as barriers by preventing in a big way the price of a given asset from getting pushed in the desired direction.

It is worth noting that the explanation of these two terms may appear straightforward and simple in the beginning but as you move to higher levels, you realize that resistance and support could take various forms making the concept a little more difficult to master.

The Concept of Forex Support and Resistance

Support can simply be defined as the price level where a downtrend is being anticipated to pause because of a concentration of demand or interest in buying.

As the price of securities and assets goes down, the demand for its shares goes up and this ends up forming the support line.

On the other hand, resistance zones occur as a result of selling interest when the prices go up.

The moment zone or area of resistance or support has been identified, those specific price levels will serve as potential entry or exit points.

The moment a price gets to the point of support or resistance, these things will happen; it will either bounce back in an opposite direction from the resistance or support level or go against the price level and still proceed in that track until it hits the next resistance or support level.

Some traders make their timing solely on the belief that these zones of resistance and support are not broken with ease.

It does not matter if the price has been frozen by either the resistance or support level, or it breaks through, traders can be able to “bet” on a specific direction and will be able to quickly determine if they are correct.

In case the price moves in the wrong direction, the position can quickly be closed and only a small loss will have been made.

However, if the price moves in a good direction, that move will be substantial.

SEE ALSO: Master Price Action in Forex Trading

How To Trade Support and Resistance

Having discussed the basics, it’s now time to apply them to some critical technical tools in your trading.

Well, this concept can be divided into two simple ideas. The Bounce and the Break.

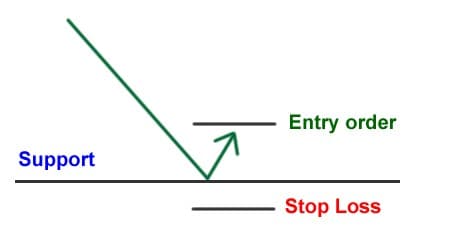

The Bounce

Just like the name suggests, one of the most ideal methods of trading support and resistance levels is immediately after the bounce

Most forex traders make one costly error of setting their orders directly on support and resistance levels and they then proceed to just waiting for their trade to materialize.

This can work at times but what this method does is that it assumes the support or resistance level will hold without the price getting there as of yet.

One might be thinking, why don’t I just set an entry order right on the line since it will assure me the best possible price?

SEE ALSO: 5 Best Scalping Forex Robots for MT4

Well, while playing the bounce, odds are shifted in your favor in a way that you will find some sort of confirmation that the resistance or support will hold.

For instance, instead of buying simply from the bat, you would rather wait for it to bounce first before entering.

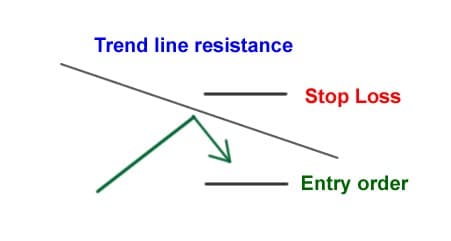

For a trader who is prefers going short, they will have to be patient until it bounces off resistance before making a trade.

By so doing, the trader will effectively evade instances where the price quickly moves and breaks through the resistance and support.

The Break

For a hypothetically perfect world, the support and resistance levels would forever hold their place.

This means that traders could easily get into and out of the trade-in case the price hits the extreme levels of resistance and support thus be able to make huge sums of money.

But the reality is that these levels do break more often. So playing bouncing will not be enough at all.

You need to know what you are supposed to do whenever the levels of support and resistance give way.

What you need to know is that there are two ways to play breaks in trading forex.

There is the conservative way and there is the aggressive. So one must analyze the best way to trade in forex based on the technicalities involved.

We wish you a successful trading.

Image credit: Background vector created by freepik – www.freepik.com

Read More