Staking cryptocurrency is similar to depositing money in a bank for a time period with an expectation of interest in return.

What is Crypto Staking?

“Staking is a term used to refer to delegating a certain number of tokens to the blockchain’s governance model and thus locking them out of circulation for a specified length of time,”. These were the words of Nicole DeCicco, owner, and founder of CryptoConsultz, a cryptocurrency consultancy in Portland, Oregon.

Winners are chosen at random, guaranteeing that no single user or entity has a monopoly over forging, which simply means creating or minting new blocks using the PoS mechanism.

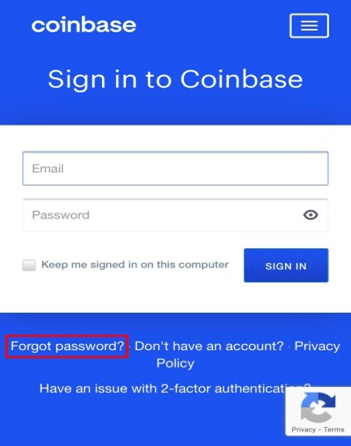

Staking your token is generally profitable with some measures of risks as well, and I’ll explain how to stake using the Coinbase platform. To kickstart the staking process, you need to sign in to your account. If you don’t have one, you can join Coinbase.

Key Takeaways

• There are only a limited number (4) of cryptocurrencies available for staking on Coinbase (ETH, ALGO, Tezos, Cosmos).

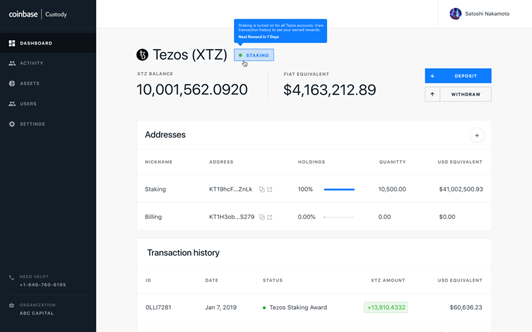

• When a user’s cryptocurrency balance meets the requisite threshold, a Coinbase node transfers that cryptocurrency as a stake into the network. You will keep complete control of your cryptocurrency.

• If Coinbase’s node generates a successful block, the node is rewarded. Coinbase deducts its fee from incentives and distributes it to all stakeholders.

• While assets are locked at the protocol level, Coinbase may withhold a small quantity of that cryptocurrency to ensure that all Coinbase clients have sufficient liquidity and may withdraw their bitcoin as needed.

SEE ALSO: I Can’t Link Coinbase To PayPal-How To Fix

How Proof-of-Stake Facilitates Staking

For beginners, restricting the number of tokens you want to stake can raise the value of a token. Secondly, if the network deploys a proof-of-stake (PoS) method, the tokens may be utilized to regulate the blockchain.

A proof-of-stake (PoS) system, as opposed to a proof-of-work (PoW) system that includes “mining,” may be somewhat tasking in terms of resources, especially for crypto newbies.

Coins are staked in the PoS mechanism to construct new blocks in the blockchain, for which investors are rewarded.

It might be tough to set up a staking system on your own. “You must maintain and administer a node on your own.

You must also be familiar with the cryptocurrency’s architecture as this will help you understand the features or characteristics of the token you want to stake because rewards will differ from one token to another.

One other important thing to note is that an investor who decides to stake could receive a proportionate return by forging, which simply means creating or minting new blocks using the PoS mechanism.

Depending on how much of the overall assets are staked and how long they are staked for. Investors can also group their assets into a “staking pool” to achieve any mandated minimums.

On some networks, it is also possible to “cold stake,” which entails staking funds or tokens held in a “cold” wallet, or one that is kept offline. Cold staking can be done directly from your Ledger Nano X device.

Key Points to Note About Staking on Coinbase

1. When a user’s cryptocurrency balance meets the requisite threshold, a Coinbase node transfers that cryptocurrency as a stake into the network. You will keep complete control of your cryptocurrency.

2. The possibility of a node being chosen to forge the next block is related to the magnitude of the stake put down by users.

3. If Coinbase’s node generates a successful block, the node is rewarded. Coinbase deducts its fee from incentives and distributes it to all stakeholders.

4. Validators lose a portion of their interest if they sign twice.

5. While assets are locked at the protocol level, Coinbase may withhold a small quantity of that cryptocurrency to ensure that all Coinbase clients have sufficient liquidity and may withdraw their crypto when needed.

How To Stake Crypto On Coinbase?

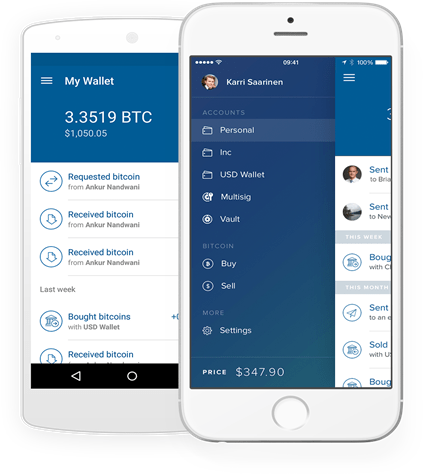

Staking crypto on Coinbase is an easy process. We will walk you through how to do this, step-by-step. You can sign up to start staking.

The list of cryptocurrencies available for staking on Coinbase includes Ethereum, Algorand, Cosmos, and Tezos.

Let’s go through the steps required to stake…

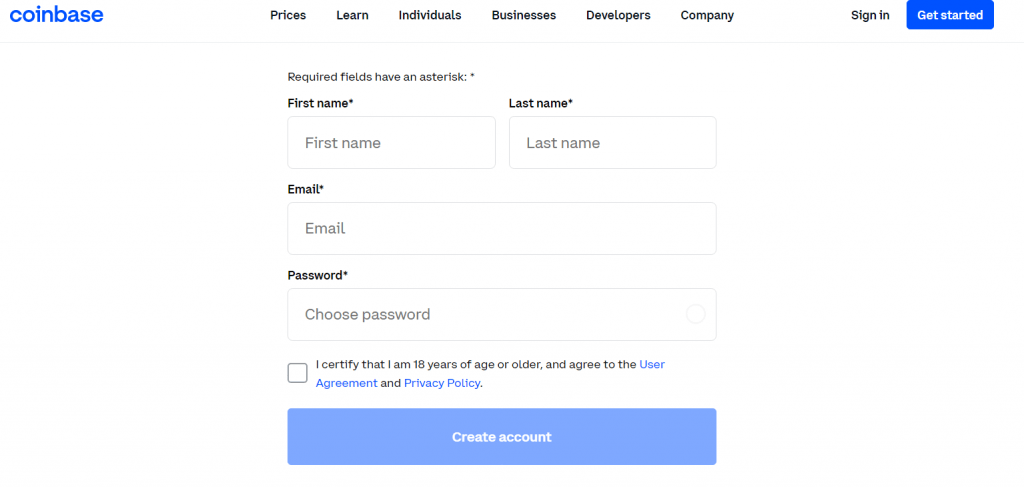

Create an Account With Coinbase

To begin with, you must register with Coinbase by creating an account.

It’s important to know the features of the individual tokens you wish to stake.

• Cosmos requires a minimum stake balance of 1 ATOM.

• For Tezos, the minimum stake balance is 1 XTZ.

• On Coinbase, you may buy cryptocurrency using a credit card, make a bank transfer, or deposit the cryptocurrency.

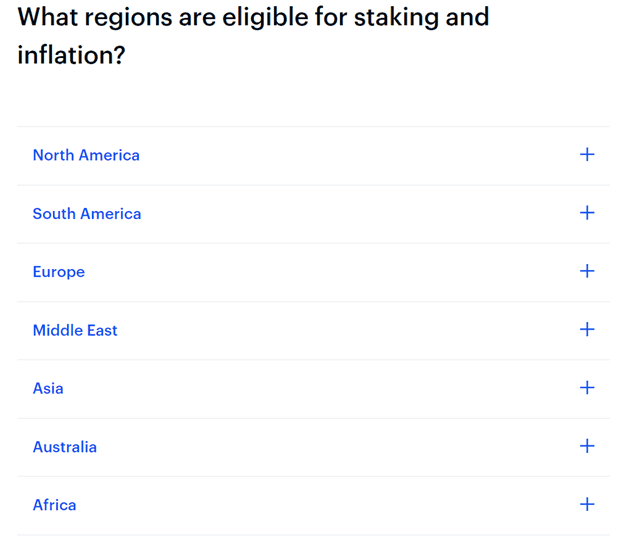

Check Coinbase Staking Requirements

• The regions eligible for staking on Coinbase include North America, South America, Europe, the Middle East, Asia, and Africa.

• You must also have your identity validated, have the appropriate minimum amount required, and keep it at Coinbase.

How Do I Begin Staking on Coinbase?

The simple, step-by-step method for depositing your Coinbase balance into staking is provided below.

For the desktop version

1. Sign in to Coinbase.

2. Navigate to Settings and then choose Financial Services.

3. Toggle the Staking Rewards symbol on or off to opt-in or out.

For the mobile version:

1. Sign in to Coinbase.

2. Navigate to the iOS or Android app’s Settings and choose Financial Service.

3. Toggle the Staking Rewards symbol on or off to opt-in or out.

SEE ALSO: How Do I Cashout On A Coinbase Wallet

SEE ALSO: How Often Does Coinbase Pay Staking Rewards

Risks of Staking on Coinbase?

No notable risks of staking or investing generally with Coinbase asides from coin or market volatility which are macroeconomic factors peculiar in the crypto space.

One notable security feature about Coinbase is its client onboarding process which is controlled and monitored through smart AIs and finally verified by humans.

Coinbase has solid security architecture and stores depositors’ funds in cold storage.

Coinbase remains one of the most trustworthy and safe websites to use for staking.

SEE ALSO: How to Claim Algorand Rewards on Coinbase

SEE ALSO: Borrow Cash On Coinbase With Bitcoin – All the Facts

SEE ALSO: Quick Steps To Stake Tezos On Coinbase

Frequently Asked Questions (FAQs)

Is staking crypto worth it?

The major advantage of staking is that you earn more cryptocurrency, and interest rates may be quite good.

In rare circumstances, you may be able to make more than 10% or 20% every year. It has the potential to be a highly rewarding method of investing your money. And all you need is crypto that operates on the proof-of-stake mechanism.

How safe is Coinbase?

Coinbase is still relatively safe, and users who utilize strong credentials should be fine. Coinbase is not SIPC-insured, but it does have crime insurance, which protects some digital assets against theft and hacking breaches.

How is staking calculated?

Staking calculators are used in computing staking rewards. Typically, the computation is based on the interest that is projected to accumulate over some time. The amount of incentives, however, varies from blockchain network to blockchain network.

SEE ALSO: How to Calculate Your Upfront Staking Rewards

Can you get scammed on Coinbase?

Scammers might develop bogus websites that ask for personal information to obtain access to your accounts.

Employees at Coinbase will never ask you for your password, 2-step verification codes, or private keys. It is a fraud if someone claiming to be from Coinbase asks you for this information.

Final Thoughts

Staking on Coinbase is pretty straightforward.

The Coinbase website is also easy to navigate and you can find your way to the staking platform after completing your registration.

Note that there are four cryptos to stake currently (Ethereum, Algorand, Cosmos, and Tezos).

Read More