Is Ethereum Becoming the New Bitcoin?

Many who missed the Bitcoin’s rush after its debut in 2009 may now have another chance, though with a similar and a much more affordable coin…Ethereum.

Bitcoin raced from $0.0009 after it gained for the first time in October 12, 2009 to touch its highest point thus far at $20,089 in December 18, 2017.

Within the first six months of 2020, Bitcoin rallied between $9,100 and $11,800 asides March 12, 2020 when it dipped sharply to $4,916 due to the Corona virus pandemic. Despite Bitcoin’s low points, many still couldn’t afford a coin. Just a few high net-worth individuals, portfolio managers, hedge funds could afford converting their fiat currencies (USD, GBP, EUR) to Bitcoin to get a taste of the juice.

It’s a few paragraphs already, I wouldn’t allow Bitcoin take our minds off what we intend to discuss… I will share why it seems Ethereum is now becoming the new Bitcoin.

Ethereum was proposed in 2013 by a Russian-Canadian cryptocurrency researcher and programmer Vitalik Buterin, it eventually went live in mid-2015. Ethereum capitalized on Bitcoin’s decentralization innovation but with a big difference in compatibility, banking for everyone, commerce guarantees and more.

Being an open source technology and its ease of use especially considering its peer-to-peer network features (Peer-to-peer network means the ability to initiate and complete transactions with one another without involving a third-party intermediary), Ethereum allows you move money from person to person or initiate agreements without paying intermediaries like banks or other service providers. It’s open to everyone irrespective of your location, background, and whatsoever. All you need to take part is to download a wallet.

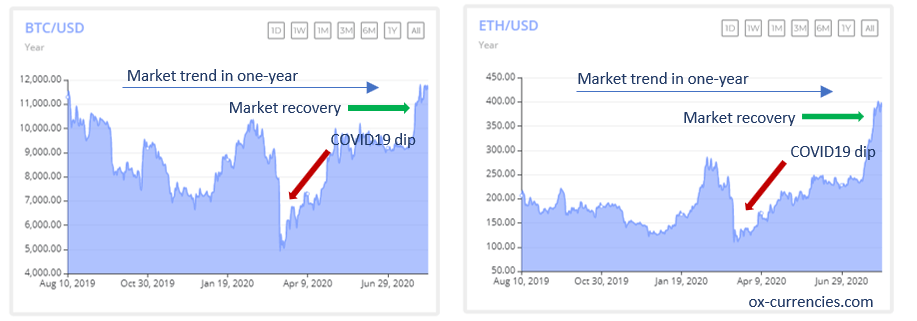

Hovering within $220 and $370 price band in the first half of 2020, and dipping to $109 in March 12, 2020 due to the Corona virus, Ethereum copies the market trend of Bitcoin closely making it largely predictable against its contemporary. With Ethereum’s replicating pattern, investors have a positive sentiment towards the former as they rarely can rival each other.

How Does Ethereum Work?

Ethereum was designed to decentralize applications and initiate smart contracts without a third-party interference, meaning it is fully independent.

Ethereum eliminates the need to trust lots of third-party apps with information handling. Ethereum decentralises greatly while using the blockchain technology.

With this arrangement, third-party networks or other storage platforms are replaced with a network of systems known as nodes. These nodes are responsible for storing data on the blockchain.

In practical, Ethereum’s background technology translates the ability for people to transact business with each other, make payments, and trade without any intermediary.

What Makes Ethereum Unique?

Ethereum is the second largest cryptocurrency behind the Bitcoin by market capitalization and price per coin. In August 2018, Ethereum touched $40 billion in capitalization. (Capitalization is calculated by multiplying the price of a coin by the number of coins in circulation).

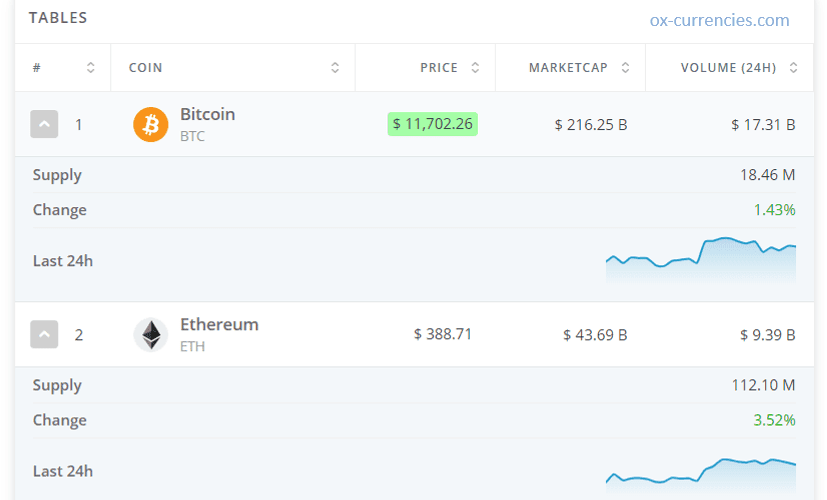

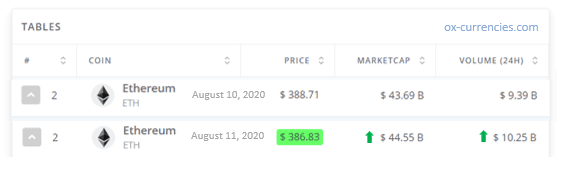

Big owners or large investors in Ethereum are referred to as ETH Whales. An ETH Whale could own up to a 1000 ETH or more. As at the time of writing this draft, Ethereum’s capitalization stood at $43.86 billion with a daily market supply of $112.10 million. ETH’s affordability drew more investor sentiments, further increasing its market cap.

Not everyone would have access to banking services, but with Ethereum, you can take full advantage of banking services by accessing savings, lending and borrowing features with a working internet connection.

If we look at Ethereum’s technology closely, it decentralizes its applications (dApps), focusing on value to the client and security than mere surveillance, so you do not need to provide all your personal details to use an Ethereum app.

Mining Ethereum is very similar to mining Bitcoin, its mining algorithm is called Ethash while Bitcoin’s algorithm is SHA-256 which runs on an Application-specific integrated circuit (ASIC).

Developers of Ethereum’s algorithm claim that Ethash is memory hard which makes it ASIC resilient.

Ethereum’s mining is the process of mining Ether, all Ethers must be validated and imputed into the blockchain network. The process requires solving a complex mathematic problem that occur to make mining possible. Ethereum miners are rewarded through a proof of work for securing Ethereum into the blockchain network.

Ethash protocol is a combination of SHA3 protocols which is superior to Bitcoins SHA2 thereby improving its security.

Ethereum & Bitcoin – Similarities

Creation

Vitalik Buterin went live with Ethereum in 2015, this was 6 years after Satoshi Nakamoto founded Bitcoin in 2009. However, Nakamoto claimed that the background work involving the writing of code for Bitcoin started in 2007.

Purpose

Both Ethereum and Bitcoin are digital currencies and can be stored in an online wallet. These top cryptocurrencies are used to fulfill payment obligations. Its global acceptance is evident as many online businesses now include either currency as a means of payment.

Ranking

Ethereum serves as a platform for over 260,000 cryptocurrencies, Ethereum is ranked the second largest cryptocurrency amongst the top-ten in price per coin and market capitalization behind Bitcoin.

Market Capitalization

This snapshot was taken from Ox-currenices crypto table, as at the time of writing this piece (August 10, 2020), Ethereum’s market capitalization was about 5x lesser at $43.69B compared to Bitcoin taking the largest chunk of the market at $216.25B positioning Bitcoin as a market maker.

SEE ALSO: Beginners – How to Make Money with Bitcoin

Cryptocurrency Trend

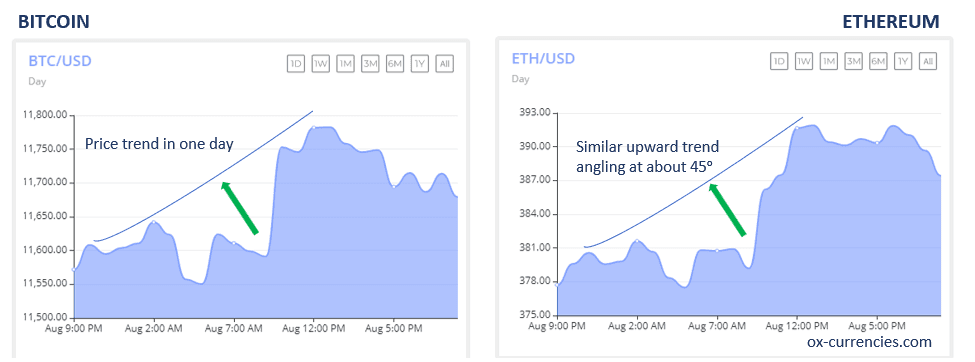

The chart above shows the trend of BTC and ETH against the USD in one day. It’s evident that the two digital currencies observe a very identical pattern within the same time frame. The price trend angles about 45ᵒ at the start of the day and simmers at midday before the gentle downward slope begins to appear towards the end of the day.

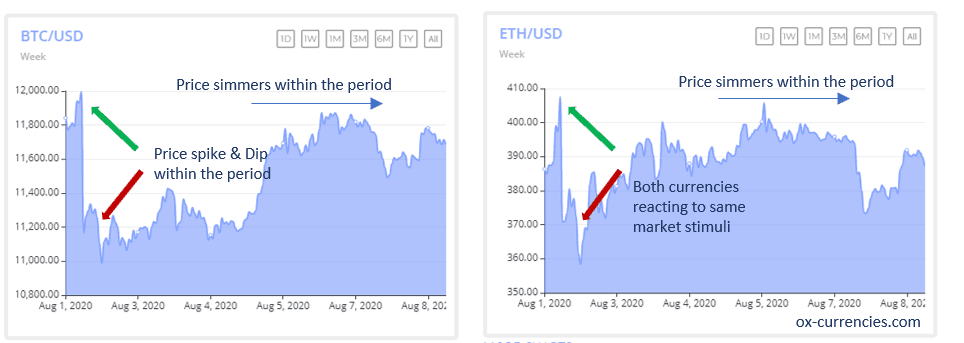

On a weekly trend, the pattern still follows an identical pattern revealing Ethereum and Bitcoin’s possible reaction to similar market stimuli. This behavior could also mean that investors interest in the two currencies are not overriding, therefore strengthening the two cryptocurrencies at the same time. The downside to this is that Ethereum may not overtake Bitcoin in value with this replicating pattern but instead could only trail along.

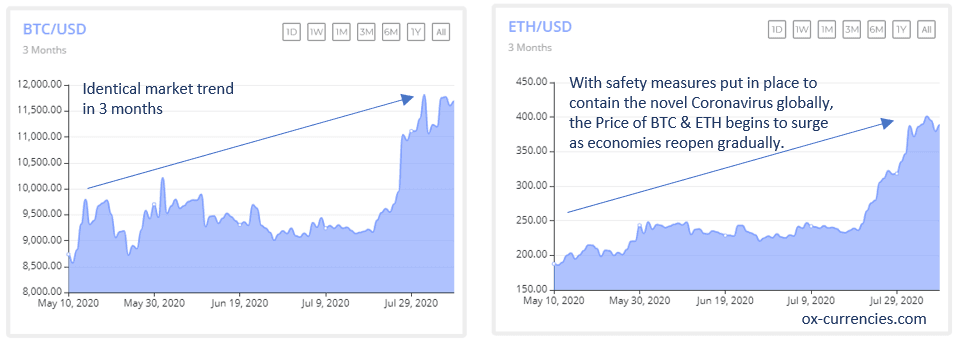

Our three months chart further reveals an obvious identical pattern of Bitcoin and Ethereum peaking within the same time frame. At the tail of the second quarter, the stocks and forex have begun to rally again as global economies intensify efforts to contain the spread of the Corona virus.

Technology

Both cryptocurrencies use Distributed ledger technology (DLT) requiring miners to validate and secure transactions into a ledger called blockchain. Ethereum uses the Ethash algorithm while the Bitcoin uses SHA-256 algorithm. Ethereum is the world’s programmable blockchain increasing the number of decentralized apps (dApps) that run on Ethereum. Most social media, gaming, casinos, finance and work run on Ethereum.

Mining

Ethereum and Bitcoin require miners to solve the complex computational puzzle referred to as hashing. This process completes the block of transaction. Miners are required to solve the puzzle first with a proof of work to claim a reward. High computing hardware is required to mine, alternatively, mining pools have begun offering backup support services for miners who would not want to be bothered about mining hardware, electric bills and its intricacies. You can now mine through a mining pool and allow them take care of the backend services for you.

Ethereum & Bitcoin – Differences

Purpose

While Bitcoin is a new way to pay and get paid for products and service, Ethereum is way beyond that, Ether is also a programming platform where you can write codes for application dApps. This means that you can use Ethereum to write lots of other digital assets even Bitcoin.

Mining

Ethereum creates 3 new Ethers every 15 seconds while Bitcoin creates 6.25 Bitcoins every 10 minutes. After the third Bitcoin halving in history which occurred in May 2020, rewards for BTC was reduced from 12.5 BTC to 6.25 BTC.

Ethereum delivers one new block every 15 seconds while Bitcoin creates a new block in 10 minutes. There are over 100 million Ethereum in existence with no clear limits on the number of Ethers than can come into existence. There are 21 million Bitcoin in circulation and 17 million has been mined. Creating new Ethers is strict in other to protect its value.

Hashing

The Hashing function – In simple terms, the hashing function takes in an input data of any size and runs an operation on it and gives out an output of a fixed size.

Ethereum’s hashing algorithm is known as Ethash which is a newer upgrade of the older algorithm called Dagger-Hashimoto.

Ethash is the known as proof of work function in the Ethereum blockchain, this function resists the Application Specific Integrated Circuit (ASIC) machines making it easily verifiable. Ethash function is under the same Keccak family unit as the SHA-3 but are not the same. Hashing Ethereum requires more hard memory as it initially used a 1GB dataset referred to as the Ethash DAG and a 16MB cache for its users to hold.

US National Security Agency (NSA) developed the SHA-256 in 2001 which is now used by Bitcoin’s hashing algorithm. The SHA-256 uses the ASIC as well and is used to write new transactions into the blockchain via mining.

Supply

Bitcoin has a limited supply of 21 million coins which makes it scarce. Once these numbers are totally mined, miners will only get rewarded for validating transactions only. Ethereum supply is unlimited however, Ethers are mined with stricter procedures to avoid over supply and erode its value.

Hard Fork

A hard fork is a blockchain technology that validates transactions by a change of protocol. Existing users not using this technology will have to upgrade to the latest version of the protocol software. Ethereum’s hard fork created Ethereum Classic while Bitcoin hard fork created Bitcoin Cash, Litecoin, Bitcoin Classic and Bitcoin Gold.

Application

With the drive for constant innovation in Ether’s blockchain technology, Ethereum’s applications are now more prevalent in sectors relating to commerce, politics, betting & casinos, artificial intelligence and more. Bitcoin applications are more prominent in entertainment, banking, betting, and more.

How Many Ethereum and Bitcoin Can You Mine in a Day

This mining data was extracted CoinWarz.com Bitcoin calculator.

Based the mining hardware inputs provided, 0.03389384 Ethereum can be mined per day with an Ethereum mining hash rate of 500.00 MH/s, a block reward of 2 ETH, and an Ethereum difficulty of 2,549,135,782,190,291.00.

Based the mining hardware inputs provided, 0.00083582 Bitcoin can be mined per day with a Bitcoin mining hash rate of 112.00 TH/s, a block reward of 6.25 BTC, and a Bitcoin difficulty of 16,847,561,611,550.00. After deducting mining power costs and mining fees, the final daily Bitcoin mining profit is $0.93 Bitcoin to USD.

Ethereum vs. Bitcoin, which is a Better Alternative?

Looking at the price charts, we can see similar price movements for Ethereum and Bitcoin. The price movements may not be exact but the trend follows the same pattern suggesting a synergetic relationship between the two. The one-year trend shows that BTC and ETH gained and lost at a given time frame.

Since Bitcoin took off first in 2009 as the pioneer in the crypto-market, Bitcoin garnered majority of investors’ interest early on before Ethereum got on board in 2015. Bitcoin’s market value is 5x the price of one Ether thereby increasing its market capitalization and positioning it as a market maker in the crypto-space.

Bitcoin is still #1 in investment choice despite its 4-5-digit price per coin. Bitcoin holders are the envy of others with a solid reputation, name recognition and effective payment system.

Those that have missed out on Bitcoin due to price per coin have Ethereum as a very viable alternative, acquiring it at 5x less the price of Bitcoin as of today. Besides pricing, Ethereum has a much faster transaction processing speed, widespread global adoption, currency float and a higher data handling capability making it a second option for cryptocurrency investors.

Is Ethereum’s Technology Better than Bitcoin?

Beyond faster transaction processing speed, mining benefits, pricing, imitation of price movement of the #1 cryptocurrency Bitcoin, Ethereum stack up in the following ways:

- It’s the world’s programmable blockchain.

- Censorship resistant and highly decentralised.

- A more private dealing over the internet.

- Ease of money movement and initiating agreements.

- Buyers’ and sellers’ protection.

- Ethereum products are compatible by default with global systems.

Building on Bitcoin’s innovative technology, you can use Ethereum without a financial institution’s contact e.g. a bank, fund manager, 401k provider etc. Ethereum offers more than payments, it’s a market place for apps, games and other financial related services.

Should I Buy Ethereum?

Data obtained revealed that market capitalisation rose by 1.96% from $43.69B to $44.55B in 24 hours. Breaking out from its historic price band of $200 to $250 in the last 5 years, it may be time to reconsider Ethereum currently revving towards the $400 mark. Some analysts have predicted ETH getting to $1000 mark by the end of 2020. That may rather be ambitious for speculators, but it’s not also impossible. There are no early or late timings to get on board, what differentiates every investor is his motive, strategy and financial power.

Believe it or not, huge ETH deals are going on, if you’ve missed the BTC rush, you possibly have another chance with Ethereum.

Ethereum’s Market Price Today

[mcrypto id=”187″]

Read More