Cardano is a decentralized PoS blockchain founded in 2015 and has positioned itself as a viable alternative to Bitcoin’s PoW which makes it energy-efficient (0.01% of Bitcoin) while shunning the crypto-mining algorithms.

Cardano presents more opportunities for hodlers and investors through staking which makes the PoS mechanism sustainable and environmentally friendly.

Exploring Cardano Future

- Changelly’s most recent Cardano price forecast indicates that its value will increase by 0.18% and will exceed its current value by the December 2023,considering the market’s bullish sentiments.

- Cardano’s dev team has scaled up the use of blockchains for building smart contracts, thereby creating more decentralized applications and protocols.

- Cardano’s Roadmap will come with more interesting features such as the right to vote and the addition of a treasury system.

The financial year 2022 was tough economically with interest rate hikes globally, this affected every turn of the financial market even the crypto market wasn’t spared.

Cardano’s market price like Bitcoin plummeted from about $1.03 to $0.39 losing over 200% of its value.

The good news is that Cardano has a future beyond 2023. Changelly’s most recent Cardano price forecast indicates that its value will exceed its current state by December 2023, considering the market’s bullish sentiments.

However, Cardano offers more than just arbitraging opportunities in terms of currency trading. Hodlers of Cardano should expect more especially with Cardano’s development team outlining Cardano’s Roadmap which I’ll explain in the later part of this article.

With platforms like Cardano, seeking various technical ways of developing robust blockchain ecosystems to push for more crypto adoption, it’s just a matter of time before the full integration of crypto in day-to-day financial services.

Cardano’s Impact on the Crypto Landscape in 2023

Cardano (ADA) has gained traction over time as one of the fastest-growing blockchain assets in the cryptocurrency market.

Since its inception in 2015, it has continued to maintain a steady pace and position as one of the top 10 cryptocurrencies by market capitalization and continues to advance with a huge potential to take on the likes of Ethereum in developing a more technological and community-supported blockchain ecosystem.

One of the ways this cryptocurrency differentiates itself from others and will possibly influence the crypto landscape in 2023 is its use of mathematical principles in its consensus mechanism and unique multi-layer architecture, which makes it stand out from other competing blockchains.

Designed by experts well-versed in the field of cryptography and engineering, it has scaled up the use of blockchains for building smart contracts, thereby creating more decentralized applications and protocols which are already shaping the face and future of the crypto industry.

Cardano blockchain has plans in place this year and a timeline to transform the crypto landscape and become a frontrunner in blockchain development.

Unlike other cryptos, Cardano does not attempt to hinder global regulators but steadily builds a blockchain with the regulation in mind, to provide secure and easily accessible financial services to all which will no doubt comply with global best standards.

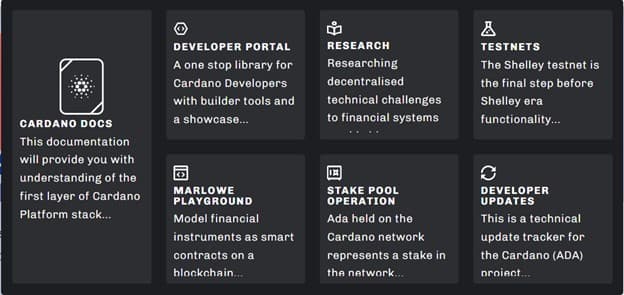

The Cardano Roadmap

The team behind this amazing project has put out a roadmap in phases to changing the crypto landscape which is as follows:

Source: Easycryto

Phase 1: Byron

This was the first phase in the Cardano roadmap which was kicked off in 2017 with Cardano going live with basic functionality, supporting ADA transactions.

Phase 2: Shelly

Moving on to the second phase is Shelly, which started around July 2020, and resulted in the creation of the preconditions for a fully decentralized network. It also brought about the introduction of staking of the Cardano native token, ADA to users.

Phase 3: Goguen

Goguen is Cardano’s current phase and in September 2021, Cardano deployed an upgrade that enables ADA users to develop and execute smart contracts (smart contracts refer to programs stored on a blockchain that run when predetermined conditions are met) on the network.

Phase 4: Basho

Basho is the fourth phase of the Cardano Network which focuses on improving the scalability and interoperability of the network. And works are currently going on, in transitioning to this phase

Phase 5: Voltaire

This is the final phase in the Cardano roadmap, and in this phase, Cardano will provide the missing pieces that will make the network a self-sustaining system.

Users and those participating in the Cardano network would be able to use their stake and voting rights to contribute and subsequently influence the future development of the network.

Cardano’s Consensus Mechanism

While the first-generation and second-generation blockchains were built on what is often referred to as proof-of-work, Cardano has developed Ouroboros, a proof-of-stake consensus algorithm, which is a deviation from the norm because with this process there is no longer any race to produce new blocks.

The Cardano network selects slot leaders (nodes) and allows them to mine new blocks. The selection process is a random one, with the blockchain split into slots, otherwise known as epochs. These slot leaders can then mine epochs or partitions of epochs to receive rewards.

These epochs can be partitioned infinitely; which is why the team behind the Cardano network claims it to be infinitely scalable in theory.

One of the major benefits of Cardano’s consensus mechanism, Ouroboros is that it offers a provable way of randomly selecting validators to generate an extra layer of security. Coupled with that, selecting slot leaders randomly potentially eliminates the possibility of forming patterns that keep the network secure from attacks.

Cardano Staking

The third-generation Blockchain allows the network participants to stake their ADA and in return allows them to create new blocks (the amounts of blocks that can be created by each participant depending on the amount of ADA staked).

The ADA staked is often used as collateral to ensure the participants are honest with their validations and in return, these users or participants earn rewards in the form of transaction fees after successfully verifying transactions.

You can earn these rewards by either running a stake pool or delegating your stake to a stake pool run by someone else.

Staking ADA allows you to earn passively. It generates considerable annual returns for investors that can exceed their earnings from the traditional savings account.

Cardano Vs Ethereum 2.0

Ethereum 2.0 is out and the buzz never seems to fade. A closer comparison between Cardano & Ethereum 2.0 and the possibilities of both coins outdoing each other is what investors and the public will wait to see.

In our view, Cardano is still better than Ethereum despite its upgrade to Ethereum 2.0, although the gap between these two has become much closer now than ever.

The reason for this is that Cardano is a dual-layer solution that features smart contract functionality and a currency that can be used to process monetary transactions, whereas Ethereum 2.0 is a single-layer solution that focuses mainly on managing smart contracts and dApps.

Another crucial factor could be Cardano’s Ouroboros protocol. The Ouroboros protocol is the first peer-reviewed and well-secured blockchain, of which Cardano is the first to implement.

Will ETH 2.0 replace Cardano?

ETH 2.0 won’t replace Cardano. Both blockchain platforms offer unique features that make them beneficial to investors who make use of them. I anticipate a major price recovery for Cardano and ETH as BTC begins to bounce back in 2023 and going forward.

Frequently Asked Questions (FAQs)

Q1. Does Cardano have a great future?

According to some analysts and Cardano supporters, Cardano does have a great future with the potential to surpass the likes of Ethereum within six to 10 years. At the moment, it has a total market capitalization of about $12 billion, whereas Ethereum’s market capitalization is about $160 billion.

Q2. What’s the highest Cardano can go?

Investors view ADA as not just a solid short-term investment but also a long-term one, predicting that it has the potential to reach 3.10 US dollars within a year and 10.46 US dollars after 5 years.

Q3. How many coins does Cardano have left?

According to a circulation published in July 2022, the number of ADA tokens believed to be in circulation is about 33.7 billion, leaving about 11.3 tokens inaccessible to market holders.

Q4. What will happen to Cardano in 2023

Cardano seems to be on track as it remains one of the top-gaining cryptocurrencies this year. Based on its recent activities in the market in the past few months, it is considered a good investment with potential in 2023.

Q5. What is unique about Cardano?

What differentiates Cardano from the likes of Bitcoin and Ethereum is that it has continued to stand out as one of the biggest blockchains to successfully use a Proof of Stake (PoS) consensus mechanism, highly attributed to its less use of energy-intensive mechanism and much safer than Bitcoin’s Proof of Work (PoW) algorithm.

Final Thoughts

Despite earning a reputation for being one of the fastest-growing projects in the cryptocurrency industry through its rapid growth, Cardano is not relenting but competing to bring more inclusive and innovative changes to the crypto landscape in 2023 and beyond.

One of the aims of the blockchain is to resolve the challenges of interoperability amongst the various existing blockchain due to their different attributes and coding language.

Using sidechains, parallel chains built alongside the main blockchain, Cardano aims at proffering solutions to this challenge and as a result, allowing users to move their assets with ease across different blockchains.

Users will as well provide the option of attaching metadata to transactions. This will make it easier for better integration with commercial banks andgovernments.

All these will increase blockchain’s effectiveness and change the narratives in the crypto landscape.

Read More