If you’re just getting started in Forex trading, Forex Lot Size Calculator or Position Size Calculator may be a new tool to you or perhaps it’s a tool you’ve not explored so much.

This post will explain what a Lot Size Calculator is, how to use it extensively on your trades and the benefits of using one.

What this tool does in essence is to help a trader get an understanding of his expected lot size considering a certain amount of capital and risks inherent in trading a single currency pair.

Before we get into the details, let’s examine what a Forex Lot Size Calculator is.

What is a Forex Lot Size Calculator?

A Forex Lot Size Calculator scientifically calculates the position size of a currency pair while considering trading capital, a set stop loss, and risk percentage.

Having established that a Forex Lot Size Calculator determines the lot size a trader can apply from the size of his capital, let’s know about Forex lots and how it works.

What are Forex Lots?

Forex pairs or currency pairs are traded in lots which clearly states the standard number of units used to represent the number of units of a currency.

Before you trade, you need to determine the number or size of lots you would trade. This now exposes further the type of lot sizes in Forex.

Let me take you through the type of lot sizes in Forex trading.

- Nano lots – 100 units

- Micro lots – 1,000 units

- Mini lots – 10,000 units

- Standard lots – 100,000 units

Having highlighted the Forex lot sizes, note that each lot size has its risks, the higher the lot size, the risker your trades could be.

SEE ALSO: Beginners – Forex Lots and Pips Simplified.

With lots of technical, fundamental, and sentimental analysis to do, a trader may not have the luxury of time to calculate his Forex Lots size by hand or on an excel sheet.

Since the arithmetic of determining Forex lot size is required all the time before and during trades, a Forex lot size calculator was developed by veteran traders with the support of software developers.

How a Forex Lot Size Calculator Works

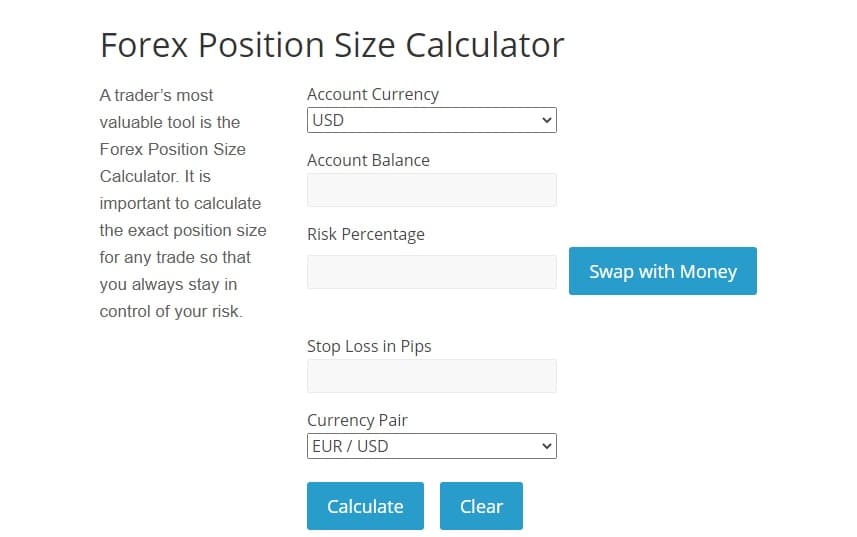

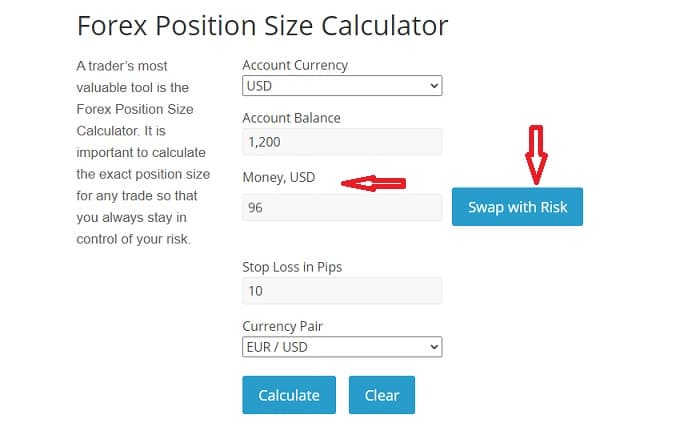

The image above tells us that a Forex Lot Size Calculator not only calculates the level of risk to capital for a single currency pair but it also calculates the amount of stop loss in pips.

Here’s an example.

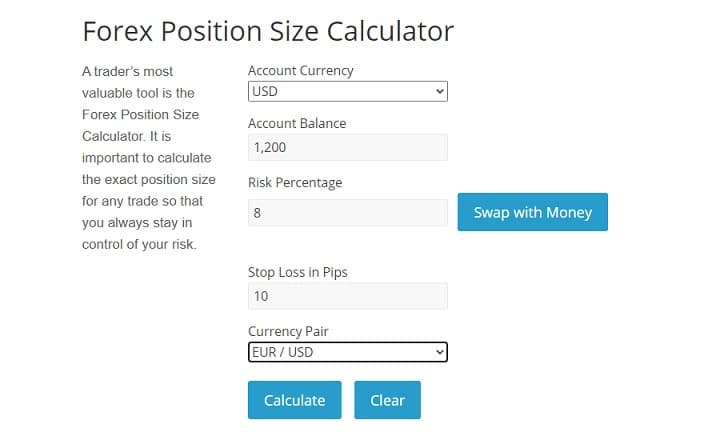

Let’s assume we plan to invest $1200, trading the EUR/USD at a risk percentage of 8% and we place our stop loss on 10 pips.

This is what it looks like when we input the figures.

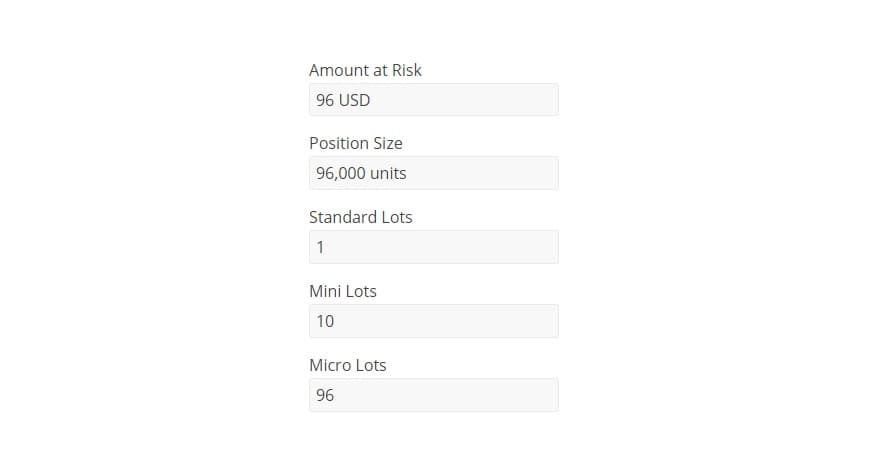

Now, let’s see the outcome.

Interpretation

At an account balance of $1200, we are eligible to trade one Standard lot of 96,000 units of the EUR/USD currency. This further means that $96 will be at risk trading the EUR/USD if the market moves against us.

Note that you can also Swap with Risk to get the Money at risk equivalent which is also $96 as shown in the image below.

In summary, a Forex lot size calculator calculates the following:

- Size of lots (Standard, Micro, and Mini).

- The amount at risk (I.e. risk percentage of the trade-in question.

- Position size tradable in units.

- Stop loss in pips.

At this point, we should begin to get the basics which are about managing risks through determining your lot size and applying a stop loss.

The challenge is that some traders use 0.1 or 1.0 lots which could be misleading.

How to Use a Forex Lot Size Calculator When Trading

A Forex lot size calculator can be used to optimize the lot size you can trade with for a specific currency pair with a designated margin size.

Let’s assume that you’re keying in a single position that fully maximizes the available margin size.

When a currency pair is quoted with regards to the US dollar, the equation will be as follows; Lot size = (Margin * Percentage) ÷ Pip Amount ÷ 100k.

The instance of a target currency pair being quoted with regards to foreign currency, the pips being quoted in the foreign currency needs to be adjusted, and we multiply the formula above by the exchange rate.

To use a lot size calculator, input the values below, and press “Calculate”.

Account currency, account balance, Risk percentage, Stop Loss in Pips, Currency Pair, Amount at risk, position size, Standard lots, mini lots, Micro lots.

Some Forex lot size calculators are compatible with all major currency pairs & crosses and 8 different account currencies. You can also swipe between a set dollar amount and a risk %.

The risk percentage you should use when trading Forex for those in doubt should not go over 2% of the value in your account. Some people would rather go for 1% to 2% risk to keep their risk low.

Why Should I Use a Forex Lot Size Calculator?

- It Assists in Better Technical Analysis

In addition to reading currency charts, a Forex Lot size calculator helps you determine all your trading metrics all at once without having to second guess anything.

All you need to know starting from your capital size, risk percentage, stop loss, and lot size are calculated in your dashboard before and while trading.

2. It Helps a Trader See the Level of Risk He is Willing to Assume.

A Forex lot size calculator allows you to do several smart things like trading at low risk of 0.5% for example on each trade, or a time when reversal trades are spotted, it can be reduced to 0.25%.

If you spot a continuously flowing trend where you’re following the market, you can leave it at a low-risk end.

With a lot size calculator, adjustments can be done to your trading as well.

With that, you will be able to calculate the lot size you need for each trade, thereby helping you manage your emotions, and lets you trade a host of timeframe charts that might not be specifically convenient to set up.

3. It Helps You Plan Better by Becoming a Better Risk Manager

The Forex Lot Size Calculator is an important tool in a trader’s arsenal.

It’s a tool that is most times free to use which helps make better trading decisions, managing risks, and overall growing of a trading account.

Free Forex Lot Size Calculator

Final Thoughts

Free tools are sometimes ignored and the Forex Lot Size Calculator is one of them. This tool is a vital tool every trader needs to determine his trading parameters and preempt risks ahead of every trade.

Read More