If you prefer scalping through the charts daily, then your strategy to trade the crypto market must be water-tight.

Scalping is popular with Forex trading, but some investors rarely know that the crypto chart can also be scalped. Note that scalping is a day trading strategy that has its up and downsides as well.

In this article, I will be explaining the term crypto scalping and how to trade crypto with this strategy.

Key Takeaways

•A narrow bid-ask spread and a wide bid-ask spread are the two types of the bid-ask spread scalping strategy used to profit from crypto scalping.

•The support and resistance levels in range trading are used to determine the particular time frame for trading before a stop-loss is set in motion.

•Making use of crypto bots is essential to scalping as they strengthen your analysis of the crypto market and execute technical instructions in line with tested algorithms.

•Crypto Scalping enable marginal profit making all through trading hours but this translates to high transaction costs.

What is Crypto Scalping?

Traditionally, scalping is the process of taking advantage of small price variations by buying and selling different assets such as stocks on different platforms.

Here the scalper tries to buy a stock for instance on Platform A with the expectation that he will sell it on platform B at a higher price.

In the same vein, crypto scalping involves buying cryptocurrencies at comparatively lesser prices and selling at slightly higher prices on another platform.

Generally, the goal of scalping is simply to make small profits as profits made can be as low as 0.01%-0.03% and can only be conducted when there is a large amount of capital involved and the leverage is high or where the bid-ask spread is narrow.

Who is a Crypto Scalper?

A crypto scalper is an individual who is capable of gaining profits from taking advantage of price volatility or price differences of cryptocurrencies across markets during lower time frames.

The individual achieves this by setting orders based on a particular price range in the crypto market.

Also, to be a successful crypto scalper, you will want to have a very good trading strategy as without that, engaging in crypto scalping will be more of a lost adventure than anything else.

Therefore make sure you keep up with relevant information from renowned crypto experts and use good technical indicators that can predict price movements that are accurate or close to being accurate in the future as these will be very beneficial.

How does Scalping work?

Scalping at first glance may look like an easy process specifically because it is based on crypto recovery after a previous fall in price.

The idea behind scalping is that crypto investors can benefit from price variations on different platforms. This concept is quite different from the typical concept of HODL where you are required to hold your cryptocurrencies long enough for you to gain profits when the prices rise.

In the case of scalping, the scalper makes use of solid trading strategies to ensure that the profits made are more than the losses. In doing this, the scalper stands a better chance of winning crypto trades than losing them.

The assumptions in Scalping

The following are the assumptions in scalping:

•Being mindful of the market reduces the chances of incurring a loss.

•It is easier to achieve profits from small crypto price differences than large ones. For example, it is easier to achieve profit from a 0.03 price difference than a price difference of 3.

•The larger price differences are not so common which leaves the scalper with only one way to make a profit which is by taking advantage of many small price differences.

Now that we have taken a look at what scalping is all about, let us now take a look at some of the crypto scalping strategies as these are what you should be looking at if you want to scalp crypto profitably.

How to Scalp Crypto Profitably (Crypto Scalping Strategies)

Crypto scalping strategies are simply the methods used by scalpers in taking advantage of crypto price volatility to make a profit.

There are two major types of crypto scalping strategies frequently used by crypto scalpers in the crypto market.

Here they are below:

1. Range Trading

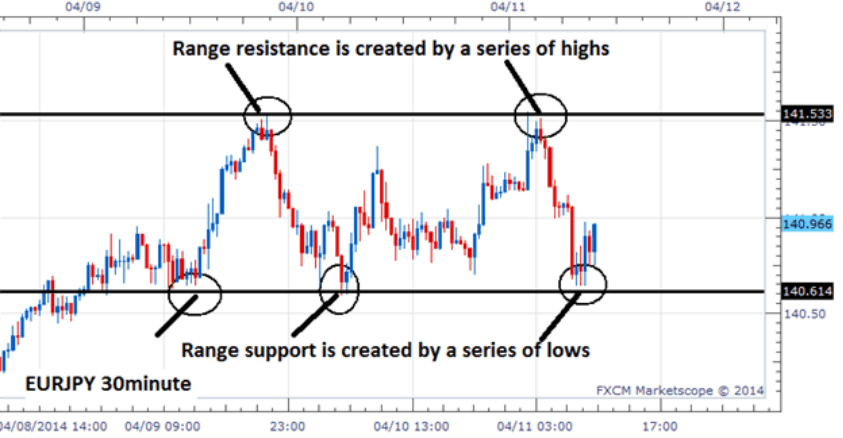

Source: DailyFX

The term range trading involves keeping tabs on the price direction between highs and lows within a given period.

This range trading is based on support and resistance as traders buy at the support level and sell at the resistance level.

The goal is to trade within the support and resistance range as when prices break either of them, the stop-loss will need to be activated.

As such what traders usually do is that they set a time frame of 5 minutes or less to trade due to how fast prices touch either level of support and resistance so that they can be done with trading before the range breaks.

Hence, the two most important things you need to keep in check with this particular strategy are your support and resistance lines on your candlestick chart, though simple moving averages can also be put in place of dynamic support and resistance levels.

2. Bid-Ask Spread

Source: Forex MT4 Indicators

The bid-ask-spread strategy is not as complicated as the range trading strategy. It is simply a strategy that involves taking advantage of the difference between the bid and ask prices.

A bid price is a price set by the buyers in the crypto market whereas the asking price is a price set by the sellers in the crypto market.

In the situation where there are more buyers than sellers in the crypto market, prices will rise and the asking price will inadvertently be higher than the bid price which in turn will make the crypto scalper sell to make a profit.

This type of situation is what is commonly referred to as a wide bid-ask spread.

Whereas in a situation where there are more sellers than buyers in the crypto market, prices will fall and this will, in turn, necessitate an asking price that is lower than the bid price making the crypto scalper buy in the process.

This type of situation is commonly referred to as a narrow bid-ask spread.

So basically, from what we can see here, the bid-ask spread strategy follows the simple law of demand and supply concerning prices and is easy to understand once you get a grip of how it works.

Scalping Crypto Tools

It is not enough to just have a good strategy when engaging in scalp trading. You also need to have at least one efficient scalping crypto tool that will help you implement your scalping strategy efficiently.

Some of these scalping crypto tools include Bots, Signals, and even Technical Indicators.

You can take a look at them below:

1. Crypto Bots

These bots are one of the most preferred tools used by scalp traders in the crypto market. They can easily carry out scalping strategies more seamlessly than a human ever can and they easily take advantage of the support and resistance levels during trading.

2. Signals

Crypto signal is another efficient tool you can use as a crypto scalper because these signals provide information on market situations and cryptocurrencies as well which are very helpful when making a trading decision.

You can choose to work with managed signals, automated signals, or subscribe to a signal community where regular crypto signals would be updated.

3. Technical Indicators

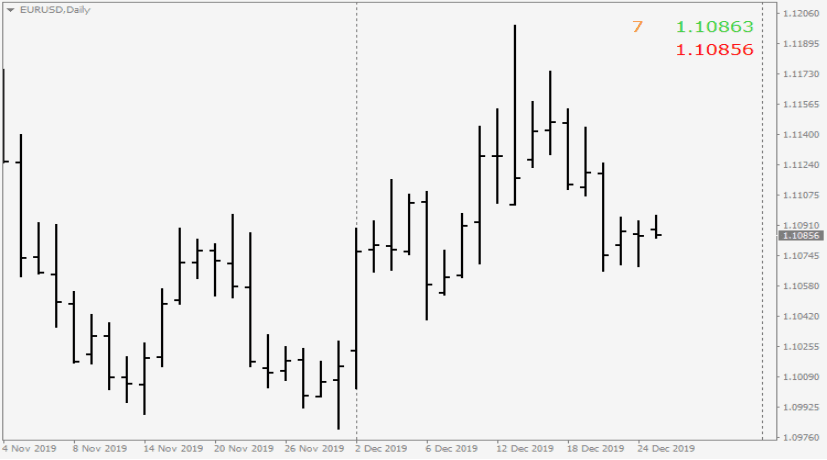

Source: IFC Markets

Technical indicators are very good with crypto scalping because they help to manage the low time frames in trading adequately.

A good example of a technical indicator is the Moving Average Convergence Divergence (MACD), for example, which is a trend and momentum indicator that monitors the relationship between two moving averages of the asset’s price.

The MACD can also be used with the Simple Moving Average (SMA) or Exponential Moving Average (EMA) indicators.

If done right, even though it may take some time, these indicators can help you become successful as a crypto scalper.

SEE ALSO: How To Trade Synthetic Indices

Frequently Asked Questions (FAQS)

1. Should you scalp Cryptocurrency?

Scalping is one of the best crypto trading strategies out there and the goal of scalping is to make a profit from crypto price variations so if you know how to undertake this perfectly well, you should consider crypto scalping.

2. What is the best Technical Indicator for Scalping?

Just as I made mentioned in this article, the Moving Average Convergence Divergence (MACD) is one of the best technical indicators for scalping as it can help you monitor the movement between two moving averages of an asset’s price.

Final Thoughts

Crypto scalping is a strategy that requires you to be well experienced and up to date in the world of cryptocurrencies if you want to be successful at it.

Not only that, but you would also have to have very solid trading strategies and tools to profit more than you lose.

If you are just getting to know about crypto scalping, reading this article, is the best place to start.

Read More