The existence of many cryptocurrencies in the market space has led crypto exchanges to undertake a coin risk analysis.

Before now, when Bitcoin was the only cryptocurrency, the need to undertake a coin risk analysis wasn’t important.

With the emergence of multiple cryptocurrencies, most crypto exchanges undertake this analysis to determine the type of cryptocurrency and what they offer before listing them.

This is usually done as part of their AML procedures, although it is not a written law but rather an expectation.

This article is a guide on how to conduct a coin risk analysis if you own a crypto exchange and are planning to list multiple cryptocurrencies on it.

A practical guide on how to conduct a coin risk analysis.

Key Takeaways

• Coin analysis is an excellent way to determine if a coin is fit for bringing into one’s crypto exchange business or not.

• When deciding to list a coin on your crypto exchange, you will need to ask yourself if you are willing to handle the risks that come with it, making sure it is something your business can perfectly handle.

• With threat modeling, you can discover if a coin has strong security backing to decide whether to list it or not.

• A blockchain is the backbone of every coin, so you need to perform a blockchain audit to test its worth and digital solidity.

SEE ALSO: What are the Risks of Shorting Bitcoin?

What is coin risk analysis?

Coin risk analysis is a regulatory procedure done by crypto exchanges to determine the worthiness and viability of a cryptocurrency before listing it.

Initially, coin risk analysis was mostly done by large crypto exchanges that had a lot of services to offer. Right now, however, small crypto exchanges looking to expand their services by investing in altcoins can now perform this analysis.

Conducting a coin risk analysis involves a lot of considerations. For one, one has to ensure when performing coin risk analysis that the coin in question satisfies state and federal financial laws.

In addition, crypto exchanges vary in terms of business goals and structure, which is why the coin has to be tailored in such a way that it meets these requirements.

The steps involved in performing a coin risk analysis

Step 1: Check to see if the coin is termed as a security according to financial laws

The first step to performing a coin risk analysis is to look at the coin to determine if it is seen as a security. You can usually determine if a coin is secure by using the Howey Test.

If after this you discover that the coin is a security, you might want to avoid listing it because that would entail you potentially registering with the Security Exchange Commission, which is a lot of work on its own.

Alternatively, you could also seek the professional advice of a legal representative to help you with this, especially because cryptocurrencies are not considered securities by the Security Exchange Commission.

Step 2: Determine the coin’s privacy and demand

It is not just enough to find out that the coin you have an interest in is not a security. You also have to do some market research to see if the coin is in demand, as that is a major determinant for profit.

For privacy, you will have to ask yourself if you are willing to take on the risks that come with privacy coins.

For instance, a business conducting transactions in an urban market may find the potential risks too great. A business in a rural market may feel differently.

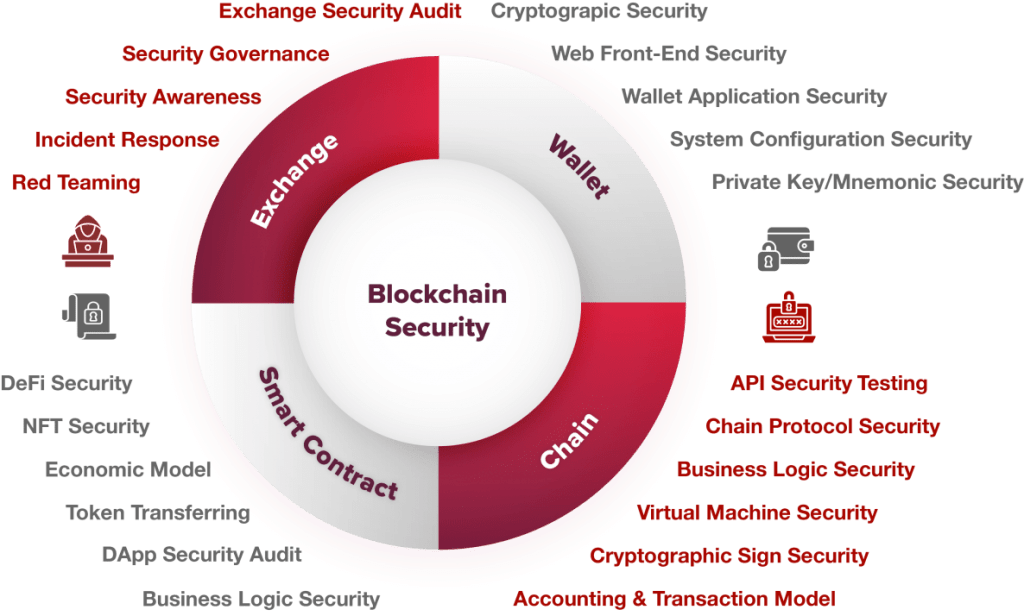

Step 3: Perform a cyber security audit

A cyber security audit provides an independent and in-depth assessment of the ability of an organization to protect its information assets from the impact of cyber threats.

A cyber security review aims to establish and validate the effectiveness of cyber security measures. It also identifies vulnerabilities in an IT system and matches them to potential internal and external cyber threats.

After you have determined the demand for the coin, you will need to do some research to see if the coin has solid security backing it.

The reason is simple. A coin with a high cyber security rating will be difficult to compromise and will most likely remain in the crypto space for a long time.

Step 4: Conduct a blockchain security audit

A blockchain security audit consists of a peer review of a smart contract or blockchain code to identify potential bugs or flaws.

The process usually involves the extensive use of static code analysis tools. But the main responsibility of the audit lies with the expert security professionals and blockchain developers to review the code to find bugs.

When it comes to a blockchain security audit, the following points are usually considered:

Define the goal of the target system

Determine the target system’s component(s) and associated data flow(s)

Identifying potential security risks

Perform threat modeling

Threat modeling is simply an analysis that discovers potential security issues with a coin more easily. With it, you can unearth hidden data around a blockchain and even find a denial of service attack on a blockchain system.

When a coin’s blockchain is exhibiting certain development flaws or vulnerabilities in smart contracts, you might want to move on to the next.

Frequently Asked Questions (FAQs)

How do you know if a coin is a good project?

To determine if a coin is a good project, you would have to do your research on certain factors such as the team, social presence, trading volume, market cap, etc.

Why is crypto high risk?

Crypto is a high risk simply because it is highly volatile, fluctuating in very short periods. Because of this, only invest money that you can afford to lose.

Final Thoughts

Performing a coin analysis is quite complicated and requires a lot of resources. This article touches on some of the key points you will need to pay attention to.

It is also important that you seek the help of a professional that would aid you in determining the right coins for your crypto exchange business.

Read More