How to calculate swap on MT4

What is an FX Swap?

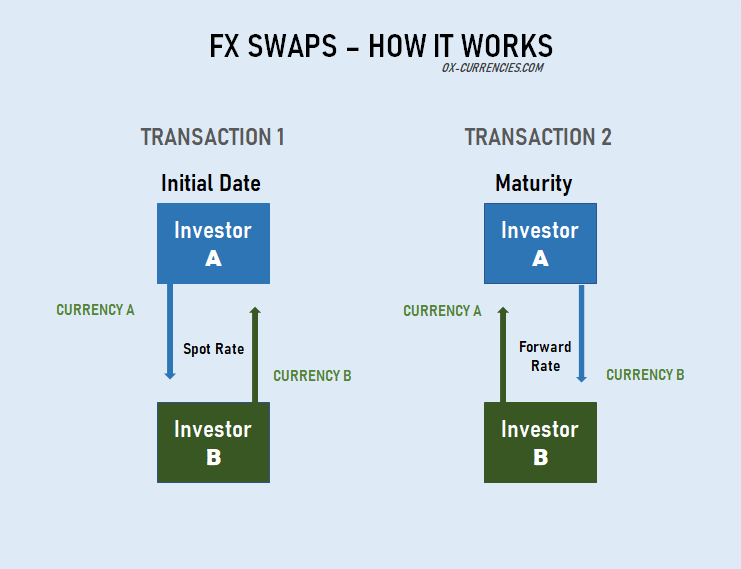

A Foreign exchange swap or FX Swaps is an agreement between two foreign parties to exchange currencies.

FX swaps involve swapping principal and interest payments on a loan in one currency in exchange for principal and interest payment of another loan of equal value in another currency.

Swaps on MT4 are based on overnight lending rates offered by the interbank market. This is usually provided to most forex brokers daily.

Key Takeaways

• Swap rates apply at 00:00 (midnight).

• Swaps are applied every night for open positions only.

• Swap rates are calculated in points and can be positive or negative depending on the difference in interest rates of the two currencies.

• Some currency pairs may have negative swap rates for both long and short positions.

• Swap rates are calculated in points. MT4 and MT5 will automatically convert these rates to your account currency.

• A triple swap is charged on Wednesday night, taking into account the past weekend.

SEE ALSO: What are the Best Days of the Week to Trade Forex?

How to Calculate FX Swaps

FX Swaps can be calculated with this formula:

Swaps = Pip value x Number of lots x Swap rate x N0 of nights

Example:

$20 (pip value for 1 lot of EUR/USD) x 3 (number of lots) x 0.15 (short EUR/USD) x 3 (number of nights) = $27 swaps

To access Swap on MT4 or MT5… Click ‘View’ > ‘Market Watch’ > ‘Symbols’ · Choose the currency pair · Select ‘Properties’ on MT4, or ‘Specification’ .

Now let’s look at the essence of the Forex swap concept.

The Central bank or Apex regulators of countries determine interest rates. Interest rate is the percentage at which the central bank lends to other banks, rates may change throughout the year. But its starting value is determined at the first meeting of the year by the central bank.

In the foreign exchange market, trading takes place in currency pairs. Two different currencies are involved in the transaction, and each of them has its interest rate.

There is a Base currency and a Quoted currency in a currency pair. It is ours and the exchange uses it throughout the day. For which, of course, a certain percentage must be paid.

The quoted currency is also called credit. It is a banking one, and we are already borrowing it from the bank. And we pay the bank interest for using its currency, similar to a consumer loan.

The swap can be negative when you pay or positive when you get paid.

If there is a negative swap (with a minus sign), then crediting it to your trading account will end with the withdrawal of funds (points). If the difference in interest rates gives a positive swap, then money will not be withdrawn from your account, but a certain number of points will be charged.

Thus, if the client has an open position at the close of the New York trading session. A currency swap operation is forcibly performed. That is the simultaneous closing and opening of a position on new value date.

But there are no actual closing and opening on the client’s account. And the accrued or written-off interest is simply displayed, and the actual delivery of the currency does not occur.

There is a day when this operation is tripled. This day is a triple swap day.

For currency pairs, this is the night from Wednesday to Thursday. This is because settlements on the exchange for a position open on Wednesday are made on Friday.

Consequently, the settlements for the carryover position from Wednesday to Thursday are already in progress the next day. And the next business day after Friday is Monday. This means that 3 days/nights have passed.

Swap is different for each instrument. In order not to constantly calculate them, brokers provide special swap tables.

How is FX Swap Calculated?

To understand how the swap is calculated, the following example will be used:

One trader believes that the Euro Australian dollar is going to depreciate.

Therefore, you decide, at the beginning of the day, to open a short position on the EUR / AUD.

At the end of the session, the market has agreed with him and the operator sees how the downward trend of the pair has been consolidated. For this reason, you decide to keep the position open.

For instance, by opening a short position in the EUR / AUD pair, a trader is selling Euros and buying Australian dollars. Therefore, when holding the position short for more than one day, the trader:

• It would pay the interest rate associated with the euro for the euros sold. For this example, 0% is considered.

• You would charge for the Australian dollars purchased the interest associated with this currency, which, for this example, is considered 2%.

The swap is the net result of these money flows. In the example that has been explained, the resulting swap for the operator would be equal to the interest charged minus the interest paid, that is 2% – 0% = 2%.

In this case, due to the difference between interest rates and the type of operation, the swap would mean extra income for the operator.

The swap is calculated based on daily interest, so in the example above, the daily swap would be around 0.0055%. This interest rate would be applied to the total amount of the open position.

The longer a position remains open, the greater the impact of the swap on the economic result of the same.

Can You Make Money with FX Swap?

The answer will depend on each operator, and it could be possible but it is usually not as simple as it might seem at first glance.

There is, in fact, a branch of trading specialized in obtaining benefits from the swap or, what is the same, from the differences between the interest rates of the currencies that are traded in FOREX.

This type of trading is known as a Carry trade Strategy.

The objective of the carry trade in FOREX is to operate to obtain an interest greater than that which has to be paid, obtaining a direct benefit for it.

To be successful in the carry trade, the first thing to do is choose a FOREX pair composed of a currency that has a low-interest rate and another that has a high-interest rate:

1. Typical currencies with low interest rates are usually the euro (EUR), the Japanese yen (JPY), or the Swiss franc (CHF).

2. Currencies that are usually associated with higher interest rates are, for example, the Australian dollar (AUD), the New Zealand dollar (NZD).

Expert traders can also turn to more exotic currencies that tend to have a higher interest rate such as the South African Rand (ZAR) or the Russian ruble (RUB).

While it is possible to get higher interest rates in these currencies, they tend to have a lower trading volume so the spreads are higher, which can negate your initial advantage on the trade.

Once the currency pair is chosen, the next step is to define the trading strategy…

As explained above, to be able to make a profit in trading you have to buy the high-interest currency and sell the low-interest currency. In a pair like EUR/AUD, this means going short on the pair.

This premise will define the trading strategy to follow, since, in this case, the operator must wait until the pair witnesses a downward trend to open its sell positions.

To do this, the trade will take advantage of a rebound to go short and maintain the position while the downward movement continues.

Read More