In a previous article, I explained how you can make low-risk gains from crypto arbitrage, Arbitrage is simply seeing and seizing quick opportunities in the market for gains due to market inefficiencies.

In this article, I will be explaining crypto arbitrage in detail and how to arbitrage between crypto exchanges for gains.

Key Takeaways

• Crypto arbitrage is a simple method of crypto trading that can be used by any individual to make a profit.

• Arbitraging between exchanges requires knowing the four (4) types of crypto arbitrage methods that enable the investor to make the right choices as to which option to use.

• Knowing some of the challenges associated with crypto arbitrage trading is very important when determining the number of profits to be made using the technique.

• In statistical arbitrage, trade bots are responsible for predicting the best cryptocurrencies that will yield the most profits after multiple arbitrage trading.

SEE ALSO: How To Make Low-Risk Gains With Crypto Arbitrage

SEE ALSO: 7 Tips To Handle Crypto Market Volatility

SEE ALSO: 7 Best Crypto Arbitrage Scanners For Day Trading

To begin with, I would like to give an insight into what crypto arbitrage is before delving into details.

What is Crypto Arbitrage?

Crypto arbitrage is a technique that can be used by any investor to profit from varying crypto prices on numerous exchanges.

So basically, what you do is buy crypto from an exchange at a given fixed rate, say $20,000, and then sell it for a higher fee, say $20,200, at another exchange.

So it is a buy low, sell high situation because prices are often not the same on these exchanges.

In essence, if you want to arbitrage between exchanges for gains, you will have to take note of the various types of crypto arbitrage techniques which I will be explaining below in this article.

Let us delve into details…

Inter Arbitrage

This type of arbitrage is the most basic form of arbitrage. Here, just as explained above, you simply buy crypto on one exchange at a fixed price and then sell it on another exchange at a higher price.

This exchange does come with its challenges, such as short-time spreads that last only seconds and transaction fees, which you can circumvent if you hold cryptocurrencies on both exchanges that you are trading with.

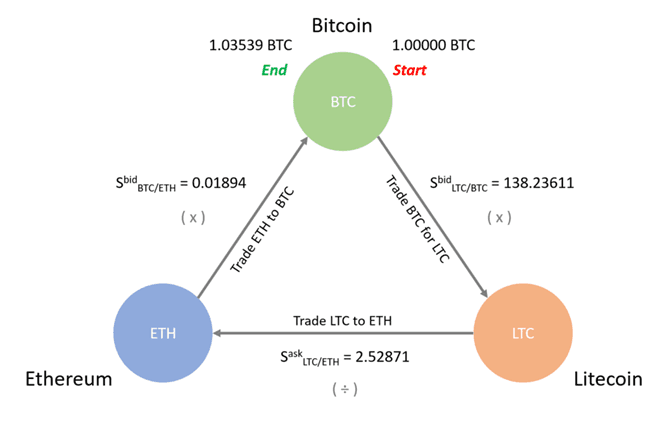

Triangular Arbitrage

From the word triangular, you can tell that this has to do with three cryptocurrencies. Yes, triangular arbitrage means trading the differences between three cryptocurrencies on the same exchange to make a profit.

By doing this, you do not get to face the issue of transaction fees typically faced by inter-arbitrage since everything is done on the same exchange.

For example, if a trader sees an opportunity involving three cryptocurrencies, say Dogecoin, DOT, and Tezos, with particular crypto, say DOT, having less value than expected, the trader can decide to buy Dogecoin by selling their DOT, then sell Dogecoin to buy Tezos, and complete the cycle by buying back DOT from selling Dogecoin, with the amount of Dogecoin now expected to be more than what he had at the beginning of the transaction.

Statistical Arbitrage

This involves making use of a bot to engage in crypto arbitrage trading. Here, the bot makes use of complex mathematical data to trade hundreds of cryptos at the same time, with the chance that it will make a considerable amount of profit from one of those trades.

What a bot does is that it gives crypto with a positive performance a low score and crypto with a negative performance a high score, with particular attention being paid to cryptocurrencies with low scores, that is, those with a positive performance.

Decentralized Finance (DeFi) Arbitrage

This type of arbitrage is focused on decentralized exchanges, that is, exchanges that are not controlled by a central authority such as Uniswap.

These types of exchanges usually have different prices for the same cryptocurrency, and as such, traders can profit from the disparities in prices of crypto listed on these exchanges.

From the above types of arbitrage, you can see that you basically have four ways in which you can arbitrage between exchanges to make gains.

Bear in mind, though, that there are challenges that come with this type of trade, such as price movements, slippages, and transaction fees, which you should account for should you want to make considerable profits using the arbitrage technique.

Final Thoughts

Crypto arbitrage trading is a good technique to use to make quick profits from crypto, especially as a first-timer. Just make sure to take the best actions where necessary, keep in mind other factors such as transaction fees, and you are good to go.

Image credit: Business vector created by freepik

Image credit: Money vector created by stories – www.freepik.com

Read More