Top crypto exchanges have made taking collateral-backed loans easy and straightforward.

Signing up with a top crypto exchange like Binance, and getting your KYC sorted gives you access to loans for trading spots or futures and earning a decent annual percentage yield (APY).

You can also get a 5% rebate for trading, mining, and staking when you join Binance.

Lending on crypto exchanges adopts the same traditional lending model which means that loans are backed with collateral.

On Binance, crypto lending is finetuned and suited to each client. For instance, users can adjust collateral and see how interest is charged in real-time. The good news is that you can repay anytime with no transactions fees.

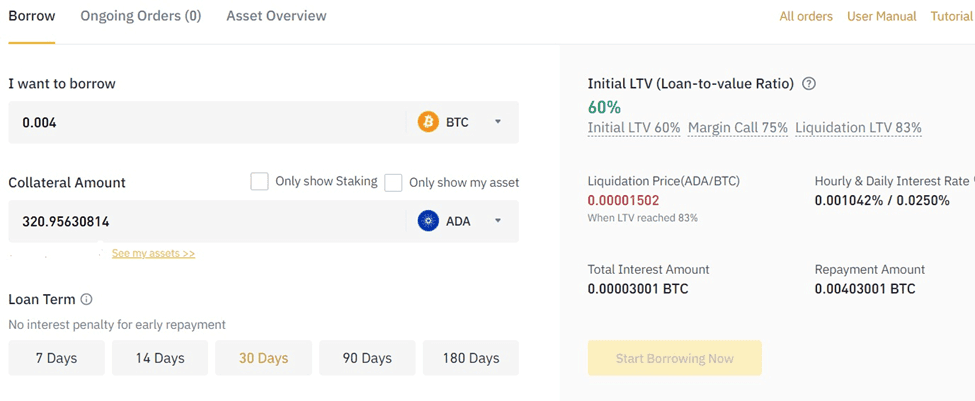

Adjusting loan collateral is required when your loan-to-value (LTV) goes below your initial LTV. What this means is that you need to add more collateral as you possibly should be exceeding your borrowing limits.

In this article, I will illustrate easy steps to adjust loan collateral on Binance to prevent liquidation.

Key Takeaways

• On Binance, Bitcoin and 69 other altcoins are currently loanable, see loanable assets.

• BTC and ETH and many other altcoins can be used as collateral on Binance.

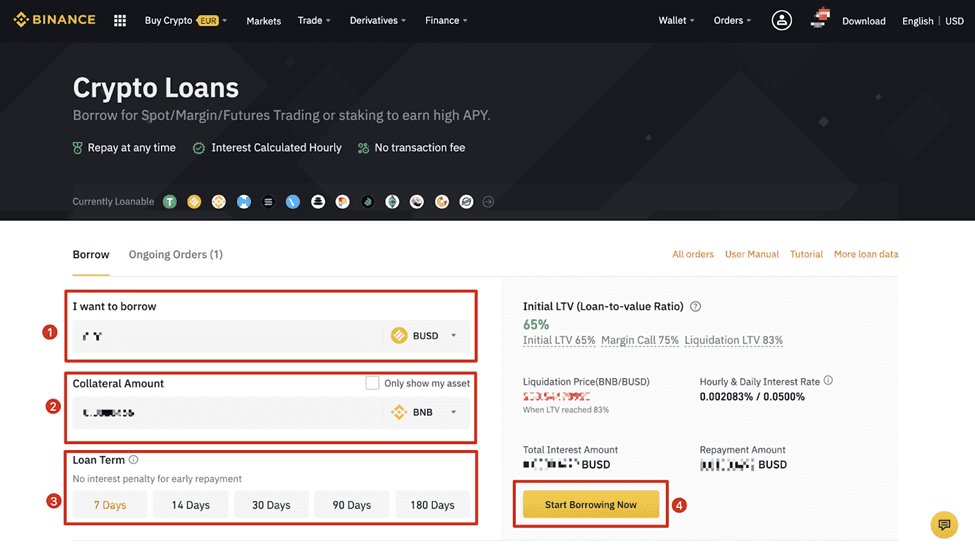

• Interests are computed hourly and daily with a 7 – 180 days time horizon.

• The minimum loan amount starts from 100 USD with varying borrowing limits starting at 15,000 USD depending on the coin.

• As long you are registered on Binance, you have access to loans.

SEE ALSO: How To Trade NFTs Profitably On Binance (Step by Step Guide)

SEE ALSO: How To Stake Cardano On Binance

SEE ALSO: How To Trade, Buy and Sell On Binance (Step By Step Guide)

Let’s understand how the loan procedure works on Binance before we learn how to adjust loan collateral.

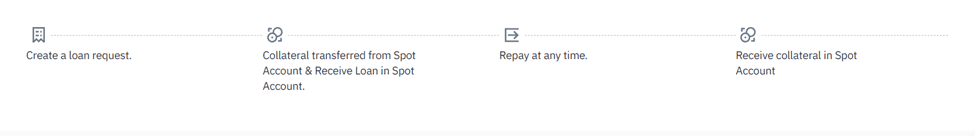

Loan Procedure on Binance

- Create a loan request.

- You transfer collateral from your spot account and receive the loan in your account.

- You can repay anytime.

- Repay collateral in your spot account.

Adjusting Loans Collateral

Borrowers can sign into their accounts by margin calls to transfer funds into ”Fiat and Spot’ wallet where Binance is deducted automatically as extra collateral.

The steps below describe this process including the LTV ratio.

Following a margin call, the borrower can log into their account and transfer funds into their ‘Fiat and Spot’ wallet, from which Binance will automatically deduct to serve as additional collateral.

When you log in, this is what your dashboard should look like.

Here is the simple process to adjust your loan’s collateral or to achieve a healthy LTV ratio:

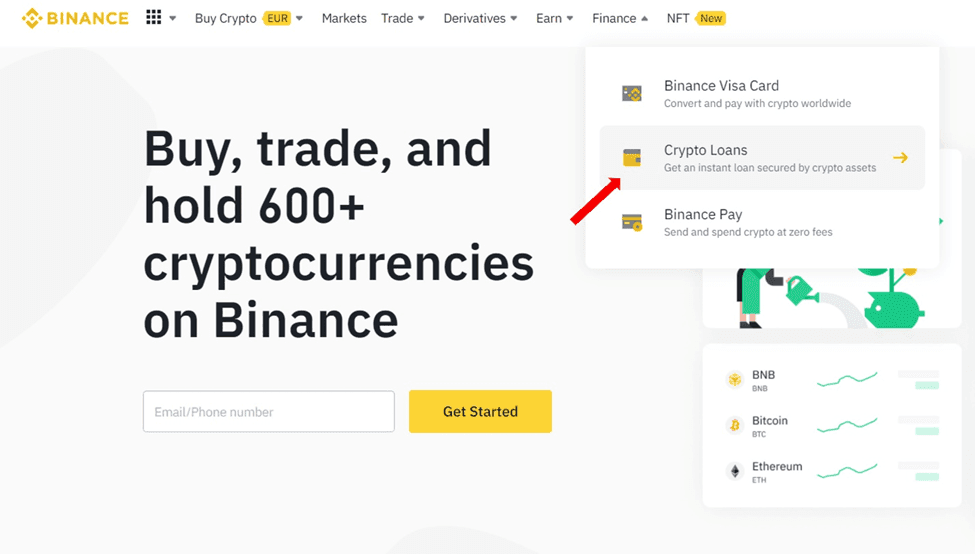

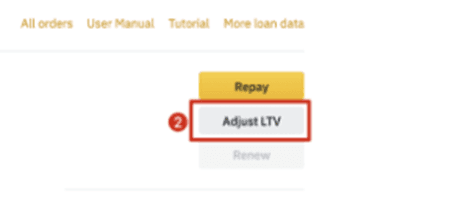

Step One: Go to the ‘Crypto Loans’ section. On this page, choose the tab ‘Ongoing Orders’ to display the loans you have. Select ‘Adjust LTV’ beside the loan collateral you want to add up.

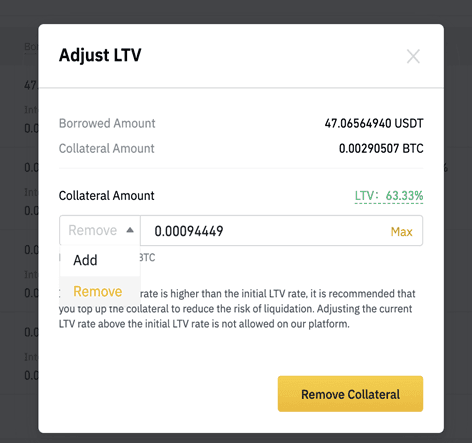

Step Two: Deposit extra collateral and on the ‘Adjust LTV’ page, you can choose your most preferred LTV ratio by using the slider as Binance calculates the number of assets that meets the ratio.

Or, you can simply input the specific figure you want to be deposited from your wallet in the field for ‘Collateral Amount’

Step Three: Select the ‘Add Collateral’ option to allow Binance to make automatic deductions of funds from Spot Wallet.

This process is effective for LTV amount reduction in case the LTV is very low. That is, the collateral amount exceeds that needed. Select the drop-down menu that offers the ‘Add’ option and click ‘Remove’ instead.

Note: At instances when a loan is paid in advance by a borrower but the collateral deposit is not refunded automatically by Binance, users should use the procedures below to remove it manually.

- Choose “Adjust LTV”

- Choose “Remove” and input the collateral amount to be deducted manually.

- Click “Remove Collateral” to confirm the process.

The borrower’s capital is unlocked after the loan is returned.

Loan-To-Value (LTV)

LTV has been used severally in this article. It is a ratio and term used on Binance to know the number of assets a user is qualified to borrow. LTV is a loan to collateral value, an easy means of measuring risks associated with lending.

To calculate LTV, divide the value of the loan by collateral.

LTV = Loan Amount / Collateral Amount x 100% (Loan Amount = Principal + Interest)

A reduction in collateral value causes LTV to rise.

When the LTV is 75%, the exchange triggers a margin call to borrowers to add collateral. If the LTV rises to 83%, the collateral loan gets liquidated automatically by Binance and the collateral is sold to clear the debt.

Liquidation

This is a term used to describe the process of clearing debt or the conversion of crypto assets to cash. Binance Crypto Loan defines it as an automatic process of settling debt through the borrower’s collateral.

NOTE: Binance charges a fee of 2% for liquidation.

Frequently Asked Questions (FAQs)

What is a Margin Call?

This is a notification given to borrowers asking them to add up their collateral value to prevent liquidation

What are the Advantages of using Binance?

Low-interest rates, security guaranteed, loan history feature, numerous features, considerable loan terms, and the largest platform.

The Benefits of Crypto Lending

It is easily accessible, managed by smart contracts, and simple to earn income passively.

The Disadvantages of Crypto Lending

Risk of liquidation, portfolio, and smart contract attack.

Final Thoughts

Binance is the largest crypto platform with extensive features. Users can adjust collaterals easily, get funds or fast cash without liquidating their assets.

Read More