What Is a Non-Farm Payroll?

The United States publishes a report monthly through the Bureau of Statistics centered on the economic situation in the country. This report is usually referred to as a “Non-Farm Payroll.”

This report lets investors know if jobs increased or decreased during that month and if there is a potential likelihood of a lingering unemployment situation in the United States.

Key Takeaways

• Non-farm payroll measures the economic performance of the United States; although this could be applied equally well to other economies across the globe.

• Forex traders make use of the NFP report to guide them in deciding as to when to trade or not.

• From its name, the NFP report does not provide information on NGOs, household employees, and farmworkers.

• Interpreting the performance of the US economy is best done when NFP forecasts are compared to the NFP report.

SEE ALSO: Can Rewards From Crypto Staking Be Taxed?

SEE ALSO: 5 Tax Advantages of Holding Crypto

The report usually does not include information on NGOs, household employees, and farm workers (which is apparent from the name).

In this article, I am going to be giving a breakdown of the non-farm payroll, how it affects forex, and how you can trade it.

Let us begin by taking a look at it in detail…

Breaking Down the Non-Farm Payroll

In the United States, the non-farm payroll shows the economic performance of the country regularly and gives a well-detailed explanation in terms of the sectors that make up the economy.

For instance, it shows the economic performance of the manufacturing sector, be it positive or negative.

Consecutive NFP reports that show consistent economic declines over some time indicate that the economy is at a low ebb and that certain economic policies need to be eliminated or new ones need to be formulated and implemented.

The NFP report is usually broken down into two parts, which are the household survey data and the establishment survey data.

The household survey determines labor force participation, whereas the establishment survey determines the industry’s nonfarm employment, durations, and wages.

How Does the Non-Farm Payroll Affect Forex?

We already know that the NFP report is a good measurement of a country’s economic performance and takes into account various factors, such as employment.

Speaking of employment, whenever there seems to be an increasing unemployment rate, as indicated by the report, policymakers tend to recommend an expansionary monetary policy that will stimulate the economy and increase employment.

Also, that would lead to low-interest rates, which in turn would lead to low-yielding currencies for forex traders.

Forex can become very volatile in the event of an NFP report, which is why forex traders need to take cognizance of it before making any investment decisions.

How to Interpret the Non-Farm (NFP) trading report

Before the release of an NFP trading report, NFP forecasts are usually drawn by economists using data gotten from FX Street. This forecast is usually based on the general situation of the economy and is compared with the NFP report.

When the NFP report is similar to the NFP forecasts, it simply means that the economy is swinging back and forth regularly and is neither a bad nor a positive sign as a whole.

If the NFP report is lower than the NFP forecast, it is a sign of danger for the economy as it translates to a rising increase in unemployment and, in turn, puts pressure on the USD.

Lastly, when the NFP report is higher than the NFP forecast, it signals positive growth in terms of the economy and for the USD as well.

These differences are what forex traders take into cognizance before deciding on whether to trade or not, as these differences are more important than the actual NFT report.

One thing to take from this is that we do not want the NFT report to be significantly different from the NFT forecasts or expectations, as this would lead to market volatility.

Trading the NFP Report:

When trading the NFP report, we usually look at the short term and long term, which is what I will be explaining here.

Short-Term NFP Trading

Starting with the short term, this involves three strategies which include trade before the NFT report release, after the release, or wait and see.

Before the Release

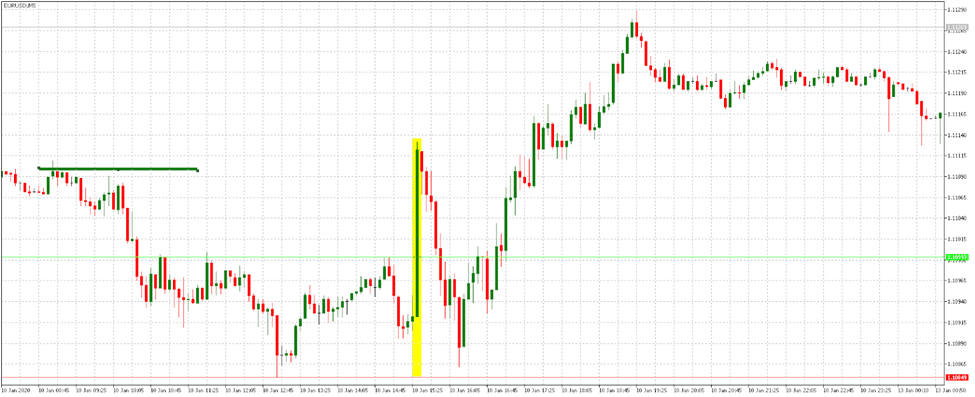

Source: Admiral Markets

When it comes to trading in the short term before the NFP report release, it is usually carried out by expert forex traders. What they do is take a position before the release and mark a range around the price just before the NFP report gets released.

This approach requires a lot of experience and position management as you will have to be able to execute it very quickly before the release occurs, which is why it is not generally advisable for a forex newbie.

After the Release

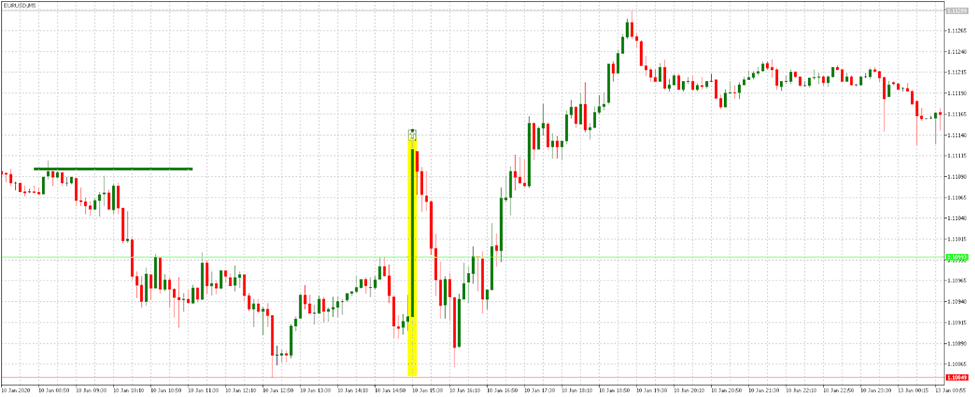

Source: Admiral Markets

One thing to take note of here is the fact that you have to apply a momentum strategy by following the momentum of the market and setting up positions as necessary as it favors your initial position.

Doing this is by no means easy as you will have to have a lot of forex knowledge and experience to achieve this correctly.

Wait and See

This type of strategy is best suited for inexperienced traders as it entails entering the market following false signals and taking a position at some point before reversing to start with a new trend.

By doing this, you would have benefited from a bullish movement as a result of the reversal.

Long-Term NFP Trading

This particular type of trading is usually used by forex swing traders and investors and involves taking a fundamental approach for the long term.

Taking a long-term fundamental approach here means having a deep knowledge/understanding of the economy and analyzing it to make the right decision when swing trading.

Frequently Asked Questions (FAQs)

Who is excluded from non-farm payrolls?

In addition to farmworkers, nonfarm payroll data also excludes some government workers, private households, proprietors, and non-profit employees.

Why is non-farm payroll so important?

Nonfarm payroll is vital because it has proven to be an important indicator of economic conditions because it moves in lockstep with the overall economy and is published monthly and on time.

Final Thoughts

This article takes a look at nonfarm payrolls and how they affect the forex market. Forex traders usually take note of this report in the event of an economic fluctuation that will have an impact on the currencies and, in turn, the forex market.

Read More