Crypto didn’t attract much support and acceptance right from the early days of Bitcoin, the very first cryptocurrency. Designed and invented to eliminate a central control and third-party presence, crypto has found its way to the ban list of some countries.

Between 2020 to 2021, total crypto transactions increased by 500% to reach an estimated $15.8 trillion. That is a lot of transactions going on without anything going to the government coffers. At least if there were no government policies on crypto.

The growing crypto boom has forced the hands of the government to deal with different cards in response to keep existing systems functioning as they should. While some countries have responded with a crypto ban, others made it a legal tender. The Central African Republic just recently joined El Salvador on this list.

Whether or not it is an attempt to regulate crypto-related activities and their impact on existing financial systems, it is no longer news that some countries impose tax levies on a variety of crypto activities.

If you find yourself in a crypto-taxing nation, the law demands you have to pay your taxes when due. One might begin to wonder about possible ways how to legally avoid crypto taxes. But before that, you do not have to be all hyper about crypto tax as not all cryptocurrency transactions are taxable.

As you read further you will get to understand which crypto transactions will demand you to pay tax.

Disclosure: This article contains some affiliate links to our affiliates. we earn a commission when you purchase via our link at no extra cost to you.

Key Takeaways

• Not all transactions involving crypto are taxable.

• The fastest and easiest way to keep track of all your crypto transactions and taxes is by using crypto tax software.

• The way tax is imposed on crypto transactions depends on the way Crypto is defined by that government.

SEE ALSO: Can Rewards From Crypto Staking Be Taxed?

SEE ALSO: 5 Tax Advantages of Holding Crypto

SEE ALSO: How to Generate Income Reports For Tax Using Cryptotrader.Tax

Tax implications of holding cryptocurrencies

No tax is imposed on holding crypto. Buying cryptocurrency with cash and holding it in your wallet is not taxable if you do not cash out. The purchased crypto can also be transferred between wallets, tax-free. So long as your crypto asset stays in your wallet idle, it remains non-taxable if you do not cash out, even if the value increases.

Crypto taxes are usually levied on capital gains or income. If you buy $1,000 worth of crypto sold for $1,200 will be taxed on the profit of $200.

As a taxpayer in the United States, you are required by law to tender records of your income, payment, sales, and conversions related to crypto to the IRS and tax authorities of your state.

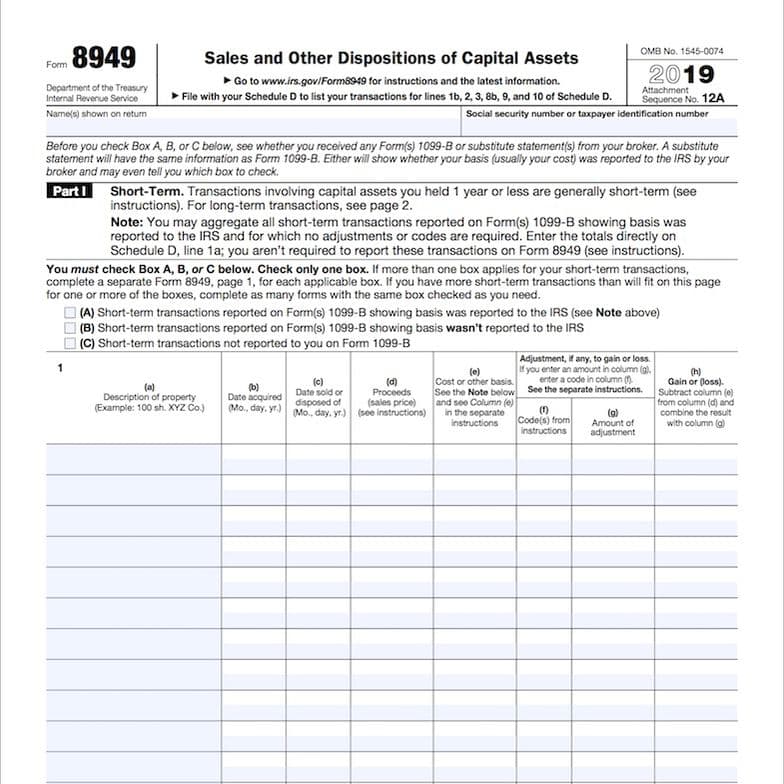

All your crypto gains and losses are to be reported on Form 8949 with information including the following for each taxable crypto transaction.

- Name of the cryptocurrency

- Date acquired

- The date you sold or traded

- sales price

- Cost basis

- Total gain or loss.

Keeping track of all your crypto transactions and calculating your crypto tax can be difficult. There are many exchanges, blockchains, and crypto assets you could have interacted with. It takes a lot of time and can be prone to errors. And even an honest omission is costly when it comes to tax.

You can save time and maximize your tax refund with crypto tax software. calculate all your crypto taxes in just 20 minutes with CoinLedger, a crypto portfolio tracker and tax software. create Instant Crypto Tax Forms with support For All Exchanges, NFTs, DeFi, and 10000+ Cryptocurrencies.

Get a FREE account and FREE tax preview on CoinLedger and track your entire crypto transaction history across all of your platforms for FREE.

Also, SAVE 10% on all CoinLedger packages when you sign up and use the promo code CRYPTOTAX10.

Taxable and non-taxable crypto transactions

There is no universal ruling on crypto. Transactions involving crypto have different tax implications varying with the tax agencies of different countries.

In countries like Canada and the United States, where cryptocurrency is classed as a digital asset, a 10 to 20% tax is imposed on gains. Same with the UK the same way you would on stocks and other assets.

Italy regards crypto as a foreign currency or asset held abroad by the residents. So any crypto income is subjected to the Italian 26% substitutive tax rate, the same tax rate for income from trades of foreign currencies. For this reason, Cryptocurrency exchanges are exempted from VAT based on the CJEU ruling.

India which recently joined the list of crypto taxing nations charges a 30% tax on income from the transfer of crypto including a 1% TDS rate.

All of the above are varying tax implications on taxable crypto transactions. These include and are not limited to the following

- Receiving crypto as payment for providing a service is taxable just as regular income tax.

- Getting rewards from Mining crypto.

- Staking crypto to earn rewards.

- Lending crypto and receiving interest payments

There are many checkouts accepting crypto as payment for goods and services. Like checking out with crypto using PayPal for instance. This is also taxed as well since payment with crypto is selling crypto for cash and funding the checkout with the cash. The same goes for swapping cryptocurrencies and receiving crypto payments or rewards.

Donating crypto to a qualified charity organization is not taxable as these organizations are tax-exempt.

Spending crypto you have staked for over 10 years or you have held for over 1 year is not taxable in Germany.

Disclaimer: Please note that what is written here is just a research summary of taxable events and we are not responsible for any errors that might occur if you choose to use these details in your calculations. For a more accurate detail of taxable events and guidance, you need to consult the agency responsible for tax in your state or country.

TurboTax is an official partner of CoinLedger. So you can also get expert help when you sign up and use the FREE crypto audit on CoinLedger tax software with international support. Save 10% with the promo code CRYPTOTAX10.

Frequently Asked Questions (FAQs)

Q1. How much is crypto taxed after a year?

After 1 year of holding crypto, capital gains will be regarded as short-term and will be taxed as such.

Q2. What happens if you don’t report crypto income?

Failure to report crypto income will warrant penalties for late taxes and possibly tax evasion.

Q3. Do I have to pay taxes if I reinvest?

Gains are what is taxed. Gains from reinvested profits will still be taxed when it is due.

Final Thoughts

While the government is not yet certain as to what is the best course of action to take on crypto, policies are expected to keep changing. You should know how to generate income reports for tax as you go about your daily crypto business just to be on the safe side at all times.

Read More