It is no news that there are over 7000 cryptocurrencies existing in the crypto market. Having known this, one might decide to test the limits of these cryptocurrencies in order to determine what they can and cannot do.

One such way of doing that is engaging in a process referred to as crypto-to-crypto swaps.

Key Takeaways

•Tokens produced by new projects are sometimes very cost effective, if not free, making them appear to be a simple investment, but requiring a gas fee, which is only payable in ETH.

•When trading on exchanges, it’s crucial to keep in mind that market forces are at work. It’s not always as straightforward as “if the current exchange rate is 1 BTC to 200ETH tokens, then 10 BTC will bring me precisely 2000 ETH tokens in my wallet.”

Crypto Swap is the process of trading an existing coin for a new one. So, how exactly does it work?

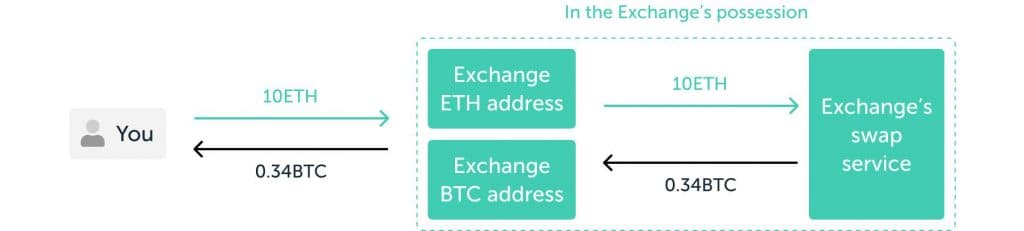

Assume you have some Ethereum but would want to get some Bitcoin instead. There are certain services that can assist you with this. You may trade your Ethereum for Bitcoin of about the same value using swap service providers. To put it simply:

You would submit your ten Eth to a swap service provider, who would convert them to Bitcoin on your behalf. You will have exchanged 10 ETH for 0.34 BTC.

Buy or Exchange ETH on Changelly

Why Would You Want to Swap?

Okay, you now understand what it means to exchange cryptocurrency. But why would you want to go through with it? What may be the reasons for someone seeking to exchange their crypto assets for another type? Let’s get started.

1. Profitability

Trading cryptocurrencies may provide a sizable return since their prices fluctuate so rapidly. If you time the market perfectly and have a bit of luck, you may make a lot of money by exchanging your cryptocurrency at the appropriate time.

2. Portfolio Diversification

Diversification is commonly regarded as an effective risk-aversion strategy. Having a small number of several cryptocurrencies may assist in mitigating the impact of a price reduction.

3. Passive Income

How do you enjoy the idea of making money without having to do anything? Certain crypto assets offer staking, which means you may earn extra coins without doing anything else. You might test this by exchanging your coins.

4. Be Alert!

Trading cryptocurrencies is always a dangerous endeavor despite the availability of crypto security. Remember how you might make a lot of money if you time the market correctly?

If you get it incorrectly, you might suffer some setbacks. Hence, don’t invest or trade with money you can’t afford to lose, and conduct your own research beforehand.

SEE ALSO: How Pancakeswap APR Is Calculated

5 Things to Know Before You Swap

1. Don’t Overlook Ethereum Gas

One of the finest features of Ethereum is the ability to create ERC20 tokens using smart contracts, allowing any project to issue money for fundraising, governance, or community benefits.

Tokens produced by new projects are sometimes very cost effective, if not free, making them appear to be a simple investment, but keep in mind that each transaction on the Ethereum blockchain requires a gas fee, which is only payable in ETH.

2. Be Mindful of Exchange Fees

Aside from gas fees, there are exchange fees, which might vary greatly. Double-check the amount of currency you received from the trade.

Don’t rely on quantities displayed in fiat (US dollars), as not all interfaces will reflect this value. In any instance, you are trading cryptocurrency for cryptocurrency, and it is not assured that the cryptocurrency will be for the same amount of fiat at a later period.

That is, consider how many bitcoins or tokens you believe you should receive in exchange for the amount you are giving. All transactions are final once you confirm the exchange.

3. Take Liquidity and Slippage into Consideration

When trading on exchanges, it’s crucial to keep in mind that market forces are at work.

It’s not always as straightforward as “if the current exchange rate is 1 BTC to 200 ETH tokens, then 10 BTC will bring me precisely 2000 ETH tokens in my wallet.“

The liquidity of assets on exchanges, particularly decentralized exchanges, can vary substantially, which means you may receive a rate that is far lower than what you expected.

Tokens that are not extensively traded or backed by large exchanges generally have poor liquidity, and trading them is more likely to result in a loss.

This is why, before switching, you should be aware of the asset’strading history, market cap, and reputation.

Slippage, which occurs when a deal is completed at a different price than when it began, is another element that influences exchange outcomes. Slippage is unavoidable, but it may become an issue with larger deals and at volatile periods.

Some exchanges will automatically reject transactions if a transaction is taking too long and the slippage is expected to be more than a certain percentage. Again, it’s critical to be informed of market circumstances before making a deal.

4. Do not Transmit Exchanged Assets to the Incorrect Wallet

Bitcoin is the most well-known and popular blockchain; Ethereum is a close second, but there are many more. Some blockchains, such as Litecoin or Ripple, only support one type of coin, as does Bitcoin.

Others, like Tron and EOS, are similar to Ethereum in that they support tokens, but these tokens will not work with an Ethereum wallet.

Before transferring any cryptocurrency from an exchange to your wallet, make sure that it is compatible with the blockchain(s) that your wallet supports.

To make matters even more complicated, certain tokens that were first launched on the Ethereum blockchain may eventually migrate to their own blockchain, or ‘to mainnet.’

If this occurs, the token will no longer be supported by Ethereum and will need to be handled in its own wallet.

SEE ALSO: How Can I Obtain a Cryptocurrency Insurance?

5. Maintain Optimal Security Procedures and Stay Away From Scammers

Crypto purchases and swaps are frequently followed by a high level of FOMO, which phishers can use to target consumers and steal assets.

All of the normal best practices apply: don’t give your keys to anybody, don’t use them directly on websites, and if anything appears too good to be true, it probably is.

Use only exchanges you know and trust, and keep in mind that many are centralized and custodial. When you trade on a centralized exchange, your assets are in the custody of the exchange, and you may lose access to them if something goes wrong.

Different Ways to Swap

1. Traditional Swapping: Exchanges

Swapping assets is a regular activity in the crypto market, but how does it work? Most of the time, you’d utilize an exchange to trade your crypto assets for the ones you want.

To get started, you must first create an account and enter your personal information.

Following that, you can send your bitcoins to their website and begin trading. Once you’ve completed your transaction, say, from Ethereum to Bitcoin, your newly obtained cryptocurrency will be available on the exchange’s site.

The one exception is that when you transmit your cryptocurrencies to an exchange and trade them there, you lose control of your assets.

Hence, you’re entrusting your crypto assets to the exchange. This implies that they may limit what you can do with your cryptocurrency.

As you can see, when you switch cryptocurrencies on an exchange, you are practically leaving your crypto holdings in their hands. If you do not remove your crypto holdings from their platform, they will remain under their control.

Buy or Exchange ETH on Changelly

2. Non-Custodial Exchanges

While it may sound sophisticated, non-custodial simply means that the exchange you are utilizing will not retain your cryptocurrency on their platform.

It works like this: you transfer them one cryptocurrency, and they send you another of your choosing back to the address you provided. This implies you won’t have to trust them with your cryptocurrency.

3. Swapping with Ledger

For you to exchange cryptocurrencies directly through Ledger’s service, you’ll need a hardware wallet and Ledger Live to achieve this.

Unlike typical crypto exchanges, you will immediately have complete possession of the cryptocurrency you just traded.

The cryptocurrency you wish to trade is delivered straight to the swap service provider, who will return your newly exchanged cryptocurrency to an address that is instantly protected by your Ledger device.

As you can see, you have complete control of your newly obtained crypto as soon as the trade is finished.

Frequently Asked Questions (FAQ)

1. Is it possible to swap one cryptocurrency for another?

You may swap one cryptocurrency for another in a “coin to coin” exchange. In other words, rather of trading BTC for USD, you may exchange BTC and ETH (the BTC/ETH trading pair).

2. Is it possible to swap crypto on ledger live?

Yes it is, as Ledger Live allows you to swap Bitcoin, Ethereum, USDT, USDC, Chainlink, Uniswap, XRP, Stellar, and many more cryptocurrencies.

Final Thoughts

Swapping cryptocurrencies is another way you can benefit from the crypto market. Thankfully, this has been made very seamless as shown in this article giving even new crypto investors the ability to carry out crypto swaps.

Read More