The crypto market has a reputation of making overnight millionaires, many have made a fortune out of accidentally or intentionally investing in cryptocurrencies.

The crypto market itself has already accumulated a market cap of over $2 trillion, which is mind-blowing, to say the least.

While this is commendable, investors still need to be aware of crypto market volatility, which, if not managed properly, could have a devastating effect on their crypto portfolio.

To make things clearer, crypto market volatility occurs when there are fluctuations in the market.

These fluctuations could be caused by price movements, trade volume fluctuations, or even the number of investors actively trading in the market.

When this volatility occurs, the initial reaction would be to pull out quickly for fear of losing money, but there are ways to handle this volatility such that you even get to profit from it rather than otherwise.

In this article, I will be showing you how to do just that, so sit back and relax as I show you the seven tips to utilize if you want to handle crypto market volatility quite effectively.

Key Takeaways

• Profiting from crypto market volatility is possible if you make use of certain techniques and do your research properly.

• Always avoid the FOMO syndrome and try not to invest based on mere emotions, as this can be quite detrimental to your crypto portfolio.

• The dollar-cost-averaging technique is a very effective method for smoothening out risks in the event of crypto market movements.

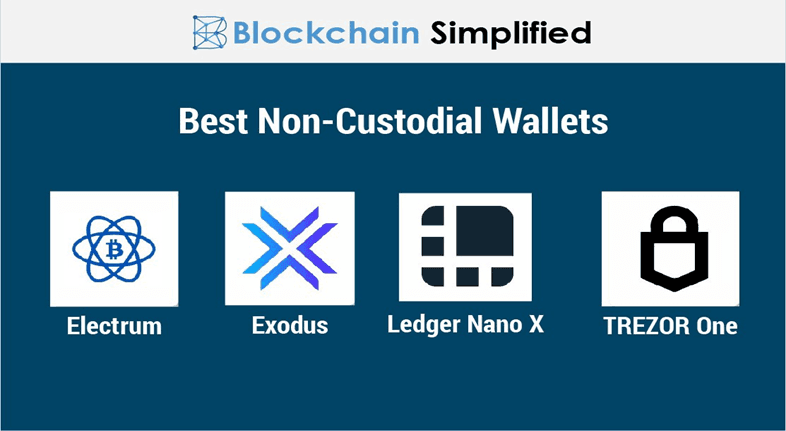

• Always make sure to make use of non-custodial wallets such as the Ledger Nano X to store your crypto assets safely.

SEE ALSO: How To Arbitrage Between Crypto Exchanges For Gains

SEE ALSO: 7 Best Crypto Arbitrage Scanners For Day Trading

Let’s get to the points…

1. Try to understand the Seasons of the Crypto Market

In the crypto market, there is bound to be volatility, especially in terms of crypto prices, which can increase or even decrease a crypto’s worth by as much as 40% or more in mere seconds.

This is why it is always important to know the perfect time to sell and the perfect time to buy crypto in the crypto market.

To do this, you will need to study the market movements and establish familiar trends to best determine when to buy and when to sell.

Also, buying cryptocurrencies means you want to keep them in your crypto portfolio for at least a considerable amount of time.

As such, if you need to make use of those funds at very short notice, it’s always best not to invest in crypto with them because chances are that you will be selling at a loss if you decide to withdraw your funds almost as soon as you invested them.

2. Do Not suffer from FOMO Syndrome

FOMO here simply stands for the fear of missing out. You see, we live in a digital age where we get access to all kinds of news and information surrounding a lot of things. One such thing, in particular, is the crypto market.

Sometimes, we get to hear about how certain crypto is doing well in terms of their price or how the crypto market is expected to surge upwards shortly.

This type of hype and market optimism may prompt you to want to invest quickly in them for the fear of missing out on anticipated gains on your investment.

This, when done, however, may come back to bite you as such information may be nothing more than media hype and you may find out that it was all a ruse.

What you should do instead is to keep calm, apply market fundamentals to be sure to some extent that you are about to make the right decision, and if possible, do not let your emotions get the best of you.

One thing I have noticed over time is that some investors tend to neglect market trends and fundamentals and instead allow their emotions to get the best of them all in a bid to make quick profits.

This, more often than not, does not end well for them, and they later regret it at the end of the day.

3. Have a Laid-down Plan Before Investing

Having a well-laid-out plan for crypto investments is important if you want to manage crypto volatility. Just as you would typically adopt a well-laid out plan before investing in the traditional stock market, the same thing is applicable here in the crypto market.

You don’t want to sell your crypto when you notice any slight movement in the market, as that may not favor you in the long run, because cryptocurrencies tend to increase in value in the long term.

4. Apply the Principle of Dollar-Cost Averaging

Dollar-Cost Averaging is a technique that is used to hedge against price fluctuations. This technique is usually used to lower the risks of investing in high-risk cryptocurrencies.

For instance, if you decide to invest in bitcoin, knowing well enough that it is a high-risk investment, you should apply the dollar-cost-averaging technique rather than just piling your money into bitcoin.

This is so that you don’t bear the full effect of the loss when you wake up one morning and realize that the price of bitcoin has fallen drastically.

5. Diversify your Cryptocurrency Portfolio

I believe this should be one of the golden rules of crypto because this can’t be said enough. Diversifying your crypto portfolio is always a smart thing to do in the world of investments in general.

If you are just starting and you want to invest in cryptocurrencies, endeavor to spread your wings by buying different cryptocurrencies that do not have the same market swings.

Buying Bitcoin and Ethereum at the same time may not be the best of ideas because these cryptocurrencies have similar price trajectories; when bitcoin falls, Ethereum falls as well, and vice versa.

Instead, you could decide to buy NFTs as well, so that in cases where the crypto market as a whole is on a decline like it currently is, your investment in NFTs can help to some extent to cover those losses.

6. Apply the concept of Social Crypto Trading

Social crypto trading is a term used to refer to a group of crypto investors that come together to share ideas and information concerning crypto techniques and crypto market trends.

Engaging in social crypto trading lets you have access to quality information you previously may not have had, and sometimes this can be valuable to your crypto investments in the long run.

Even new crypto investors can gain access to the trades of successful investors in the crypto market and can decide to copy their techniques as well.

This helps to prevent a lot of mistakes you would have made if you were just starting based on the information you had acquired alone.

SEE ALSO: 5 Tested Ways of Buying the Dip in the Crypto Market

SEE ALSO: How to Avoid Panic Selling in a Cryptocurrency Dip

7. Make Use of Non-custodial Wallets and Exchanges

Making use of non-custodial wallets and exchanges is quite important for the safety of your crypto.

This may not be related in any way to crypto market volatility, but just storing your crypto assets in a non-custodial wallet is a good way to keep your crypto assets safe from hackers and thieves, especially since they are the only ones that have access to the wallet’s private keys.

Frequently Asked Questions (FAQs)

Is crypto trading profitable?

Crypto trading may be risky, but it is quite profitable as crypto is always a good investment, especially if you want to gain exposure by doing so.

Is forex safer than crypto?

I would say that forex trading is a bit safer than crypto because it is centralized and does not experience massive price swings like crypto.

Final Thoughts

Knowing how to handle crypto market volatility is always important, especially if you want to become a successful investor in the crypto market.

If you don’t already know how to manage these volatilities, this article will be a good place to learn how to do just that.

Read More