The untraceable nature of digital assets, which has been a core part of the success of decentralization, is also a concern in the efforts of combating crime.

Over the years, cryptocurrency has been used to launder money and store the proceeds of criminal activities. Mostly used in ransomware attacks like the $70m in Bitcoin demand by the REvil cyber attack gang.

Over the past decade, the emergence and rapid adoption of cryptocurrencies have led many people to hold their assets in crypto wallets. This lot also includes those guilty of tax fraud since crypto is regarded as property by the federal government.

Last year, 2021, on tax fraud-related cases, the IRS seized $3.5 billion in cryptocurrency which amounted to 93 percent of what the Criminal Investigation unit seized in total.

While hardware wallets and cryptocurrencies are legal, at least in most countries, cryptocurrencies obtained illegally can also be stored or hidden in them.

The Ledger wallet has proven to be a very secure wallet to store crypto offline. But does this keep the said assets from the reach of the IRS or can the IRS track crypto stored in a Ledger hardware wallet? This article gives a detailed explanation as you read further.

Key Takeaways

• The IRS has picked up interest in hardware wallets and is looking for ways to access them during investigations.

• Ledger wallets have features designed to keep crypto assets secure and also private.

• All crypto transactions are recorded on a public blockchain.

SEE ALSO: How to Track Your Crypto Transactions Using Cointracking

SEE ALSO: How To Avoid Crypto Taxes (4 Legal Ways)

How Ledger Wallet keeps stored crypto safe and private

The offline nature of Ledger as a hardware wallet is what makes it safe.

One of the reasons why the Ledger Nano wallet stands out is because your private keys never leave your wallet, and so do your assets, unless, of course, you approve.

Public Keys on the other hand, as the name implies, are public and are needed for you to receive crypto. But Ledger is keen on privacy and security, hence some privacy features.

Your address for Bitcoin, Litecoin, Doge, and other Bitcoin-based crypto assets change every time you receive a transaction.

Ledger Live automatically generates new addresses using BIP32, BIP39 or BIP44 standards. The previous addresses can be found in the wallet and do remain valid, but they don’t offer an optimal level of privacy.

Without the Extended Public Key (xPub), it will be possible to link these different addresses to the same wallet. This has been one way to avoid dust attacks.

Can the IRS track crypto stored in a Ledger hardware wallet?

The IRS as a bureau in charge of tax has no interest in the crypto stored in your Ledger wallet. They are only concerned with taxable events in which case you have to report it and pay your tax.

The IRS can track crypto stored in a Ledger wallet. This, however, is not a downside of using it or the vulnerability of the hardware wallet. This is mainly because of the decentralized nature of blockchains.

All crypto transactions are recorded on a blockchain. The blockchain is a digitally distributed, decentralized, and most importantly, public ledger that exists across several computers linked in a peer-to-peer network.

So anyone, including the IRS can have a look at the transactions with the help of a chain explorer and review them. Learn how to explore ETH Blockchain with Etherscan or choose between the 7 Best Bitcoin Blockchain Explorers.

Ledger only protects offline, the private keys required to spend your crypto assets. Any crypto you send or receive will be visible online on the blockchain – the sending address, receiving address, the amount involved, time and date, transaction ID, etc. These however are not linked to a real-world identity.

So how then do the IRS track crypto to the owners?

How Does the IRS keep track of Cryptocurrencies?

The IRS can keep track of crypto movement on a blockchain. However, for some blockchains like Monero, which is private and obscures virtually all transaction data, it can be impossible to track. The IRS does have other ways of tracking crypto and ensuring compliance with the payment of tax.

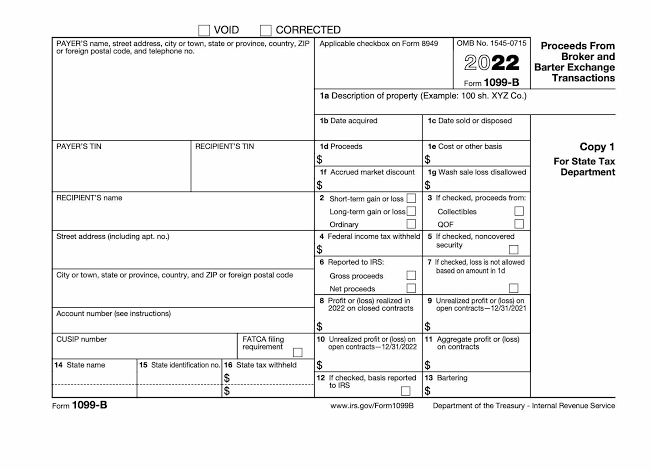

1. Form 1099-B

Until a better solution is found, Congress has made it easier for the IRS to track crypto transactions through President Joe Biden’s infrastructure bill with cryptocurrency tax provisions requiring exchanges to notify the IRS of crypto transactions through the form 1099-B.

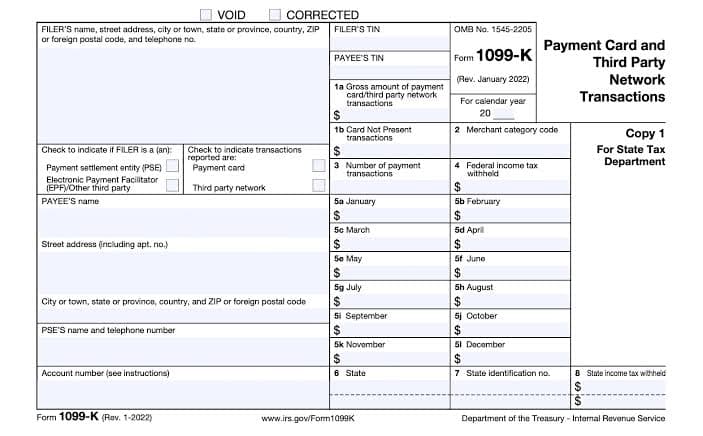

2. Form 1099-K

While you are buying crypto or looking for how to get your crypto off PayPal, payment cards and third-party payment networks such as PayPal or Venmo are required to fill the 1099-K and submit it to the IRS. This contains the details of people that have received a total payment of at least $600 through the network for the tax year.

3. Subpoenas

The IRS also uses Subpoenas as a method to monitor crypto transactions. This is issued to exchanges with the directive to reveal the IRS, user accounts of interest.

It has been used many times over the years like in 2017 Coinbase was ordered to give the IRS data on users trading more than $20,000. The name, taxpayer identification number, address, birth date, transaction logs, account activity records, and all account statements or invoices of approximately 13,000 accounts.

Just last year, IRS ordered Kraken to provide user records. Bitstamp, Circle, and some others have also been issued subpoenas by the IRS.

The IRS plans on cracking hardware wallets

The $3.5b worth of crypto seized in 2021, if the said seized amounts were in a bank, it would have been confiscated by the government in a few minutes. But for crypto, the case is different, access to money is limited only to the owner.

For hardware wallets, such as the Ledger wallet, if taken as evidence in an investigation, there is practically no way of accessing whatever data is in it without the approval of the owner.

The only way for law enforcement to retrieve such funds is to exploit the flaws in cryptocurrency wallets. A reason why the Criminal Investigation Unit of the IRS is working with a Colorado-based firm specializing in device forensics, VTO Inc, is to develop device-specific acquisition/exploitation techniques to use in digital forensics laboratories, to gain access to crypto wallets to recover stolen assets.

All You Need to know about blockchain Forensics.

The deal which began in September is to last for 2 years. But success is looking bleak as security vulnerabilities are constantly being fixed with firmware updates. Or funds might even be transferred so long as the person in question has the recovery seed phrase.

Frequently Asked Questions (FAQs)

Q1. Does Ledger wallet report to IRS?

No, Ledger does not provide a tax report to the IRS. Ledger only keeps a history of your transaction details, as with every other crypto wallet.

The collection of transaction histories together is private to the owner, though each can be seen publicly on the respective blockchains.

While these are not released to the IRS, you can use them to calculate and report your taxes in crypto tax software by following these Easy Steps to Import BitBox, Ledger, and Trezor to CoinTracking.

Q2. Is transferring crypto to Ledger taxable?

Transferring crypto to Ledger is not taxable. Moving crypto from one exchange to another or between wallets that are yours is not a taxable event, therefore you will not be taxed for transferring your crypto to your Ledger wallet for more security of your assets.

Q3. Do you pay taxes on crypto on Ledger?

Yes, you pay taxes on crypto stored in the Ledger wallet. Precisely on the gains made from buying, selling, or staking cryptocurrencies.

Final Thoughts

Now that you know if IRS can rack crypto stored in a Ledger hardware wallet, as a citizen, it is advised you calculate and pay your tax as required by law to avoid penalties. Not sure how to? Learn how to get your Cryptocurrency Tax done In minutes with Cryptotrader.Tax.

Read More