Trading with a certain lot size in mind is dependent on the amount of money you are willing to trade with at first and your risk tolerance as well.

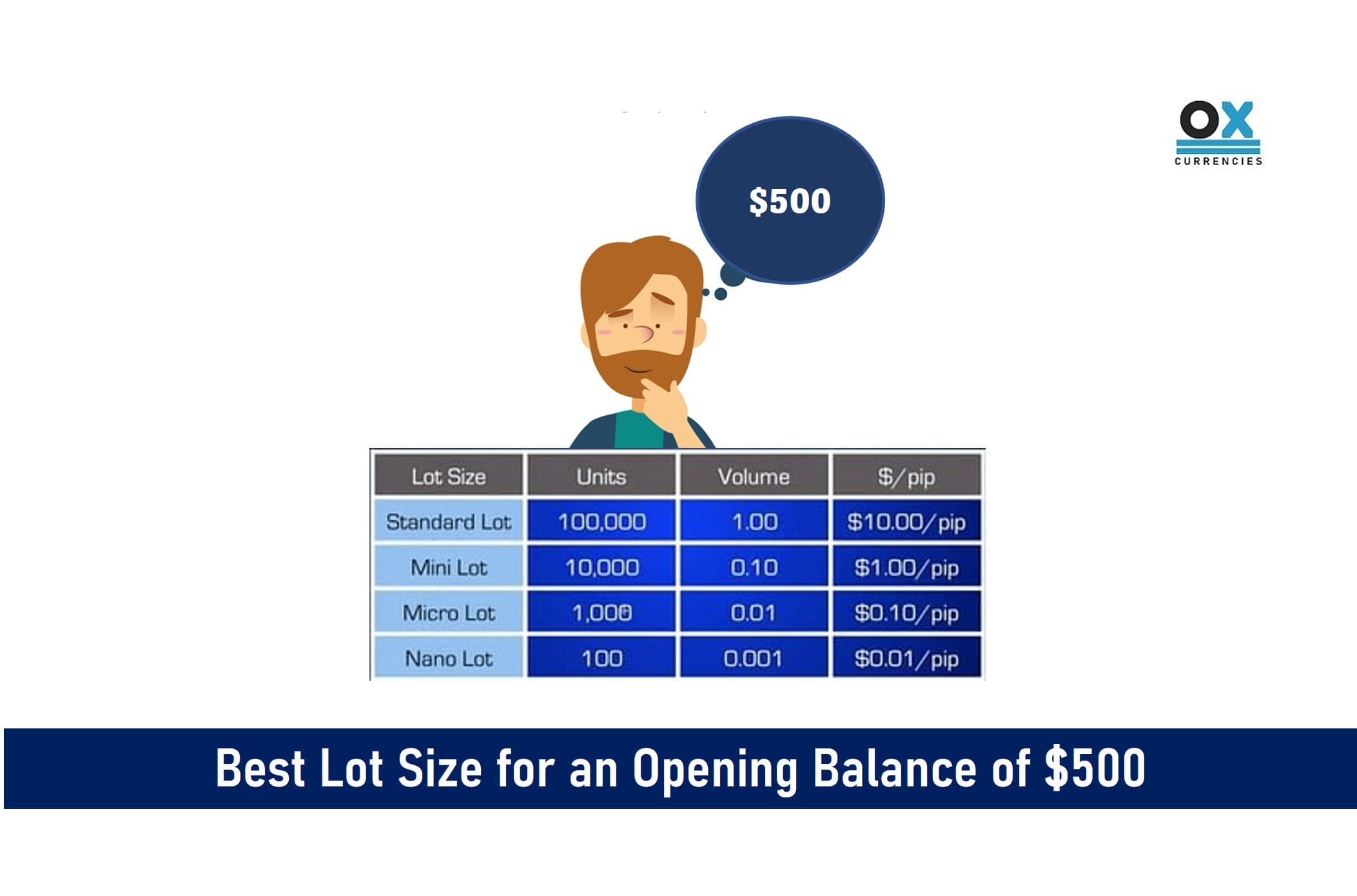

When it comes to lot sizes, there are usually different categories depending on the opening balance of the trader in question. These categories include micro lots, mini lots, and standard lots.

For example, you do not expect to trade a standard lot size with an opening balance of $500 simply because a standard lot is a $100,000 trade, and any market movement at one pip will easily translate to $10 of your opening balance.

Key Takeaways

• Most traders hardly trade with a standard lot size as they prefer to go for the micro or mini lot sizes.

• Selecting the best lot size should be in line with what you have as your opening balance. Any mismatch and you stand a very high chance of losing your funds.

• Trading with an opening balance of $500 may not yield very huge gains all at once, but in the long run, it can be quite rewarding, especially for those just starting to understand the technicalities of trading.

SEE ALSO: Best Lot Size For An Opening Balance Of $100

SEE ALSO: Beginners – Forex Lots and Pips Simplified.

SEE ALSO: How To Use A Forex Lot Size Calculator Like A Pro

Considering that the market moves at over 100 pips a day, this isn’t the ideal lot size to work with.

What then is the best lot size, you may ask? Well, to answer this question, simply follow me as I explain below in detail the best lot size for a $500 account.

Micro Lots

Micro lots are the best lot size for an opening balance of $500

For traders new to the game or those simply interested in testing the waters with a starting balance of $500, having a micro lot size is the best way to go while trading.

For starters, micro lots are the smallest lots available to traders and are considered to be equivalent to 10 cents for every 1-pip move the market makes. This is, of course, assuming you are trading with a USD account.

Now, you might be thinking that this figure is minute. Well, while it is, it is still the appropriate lot size to take since the market can move for as much as 100 pips in a day, which is 1000 cents = $10. When converted into a decimal, this gives you 0.01.

Some traders generally assume that this lot size of 0.01 should be for every $100, which means the maximum lot size for a $500 account should be 0.05. However, this is not a must and is entirely up to you and your trading objectives.

Finding the right balance is crucial because, as you can see, this is the safest bet to make in a highly volatile market.

Apart from your lot size, another factor you might also want to consider while trading with a $500 account is your stop loss since it goes hand in hand with your lot size and shouldn’t be the same for every trade.

You can always use a position size calculator to calculate your position and lot size to minimize your risks.

Other types of lot sizes for opening balances of more than $500

Now, I mentioned at the beginning of this article that lot sizes come in different categories. Well, this is true as there are mini lots and standard lots apart from the micro lots that I have already explained above.

That said, let us take a look at the other two types of lot sizes below:

Mini Lots

Mini lots are for opening balances of at least $2,000. Anything below this, and you could be setting yourself up for massive losses due to the market’s high-risk potential.

In mini lots, each market pip is worth $1. Multiply that by $100 or more and you stand a chance of losing over $100 if the market decides not to work in your favor, which is why the benchmark of a $2000 opening balance exists.

Standard Lots

Standard lots are for opening balances of at least $2000, although most traders with this amount as their opening balance still prefer to trade with mini lots.

Only a few traders who have been trading for years use standard lots and have an opening balance of more than $2,000.

For standard lots, the market pip is worth $10, which means a 10% fluctuation value for every move the market makes in a single trading day. This is why knowing what best works for you based on your opening balance is very important.

Final Thoughts

Trading with the right lot size is very necessary in order not to risk losing your funds due to the high risk involved.

If you know you are an inexperienced trader who is new to the game, it is better that you start with a mini or micro lot depending on how much opening balance you want to work with.

Remember that the goal of trading is to trade for the long term with a low-risk tolerance, so don’t go blowing your accounts unnecessarily for huge, unrealistic gains in a short time.

Read More