What are Crypto ETFs?

An ETF, or exchange-traded fund, is a collection of assets that allows investors to hold shares on an exchange. ETFs are comparable to bonds, equities, or mutual funds in terms of possible advantages and characteristics.

ETF shares, like stocks, can be traded throughout the day as their prices change based on supply and demand.

Crypto ETFs are investment vehicles where a bucket or a pool of cryptos are selected based on technical and fundamental analysis done by professional investors/traders or fund managers.

Individual investors then subscribe or purchase these Crypto ETFs in line with some underlining terms of investment from the ETF provider.

Key Takeaways

• BTCetc – ETC Group Physical Bitcoin monitors Bitcoin prices and has a German fund with 84.66% volatility and a share value of EUR 48.200.

•The yearly dividend yield on First Trust Indxx Innovative Transaction & Process ETF is $0.36 per share. Every day, it trades over 3,527 shares. It has a one-year return rate of 17.90%.

• The Amplify Transformational Data Sharing ETF trades more than 270,526 shares per day and has strong liquidity. It pays a $0.66 yearly dividend per share. The one-year return on this ETF is 92.11%.

SEE ALSO: What Are Bitcoin ETFs and Its Impact In The Crypto Space

Professional money managers manage the ETF portfolio, just like mutual funds, while you own a portion of it.

An important benefit of ETF shares is that they may be sold short and traded on margin.

A crypto ETF is a collection of cryptocurrencies such as Bitcoin, Ripple, Ether, Bitcoin Cash, and others.

This implies that, rather than monitoring an index or a portfolio of assets, crypto ETFs track the value of one or more digital tokens.

When investors invest in crypto ETFs, they obtain computer-generated keys that provide them ownership.

Furthermore, they do not need a bank to make payments because crypto payments are conducted through a blockchain-managed computer network.

With the above basics in mind, let us take a look at the 10 best cryptos ETFs to buy:

Best Cryptos ETFs to Buy

1. 21Shares Ethereum ETP

This Crypto ETP monitors the price of Ethereum and has a Swiss fund with a volatility of 113.55% and a share value of EUR 34.81. The Ethereum ETP has a fund size of EUR 336 million and a total cost ratio of 1.49% per year.

You can view the chart here.

Since its inception in March 2019, the 21Shares Ethereum ETP has gained traction and outperformed investors’ expectations. In terms of one-year performance, the Crypto ETF has grown by 907.89%.

Furthermore, by duplicating the traditional ETP structure, 21Shares hopes to make bitcoin investing more accessible.

2. BTCetc – ETC Group Physical Bitcoin

BTCetc – ETC Group Physical Bitcoin monitors Bitcoin prices and has a German fund with 84.66% volatility and a share value of EUR 48.200.

You can view the chart here.

It was founded in Germany in June 2020 and has a share volume of 644,073 shares with a YTD return of 115.24%.

As of October 11, 2021, the total asset value of BTCetc – ETC Group Physical Bitcoin was $1,175,664 million.

This crypto ETF is physically backed and has a proven track record. Since October 2020, the crypto ETF has grown by more than 400% from March to May 2021.

3. WisdomTree Bitcoin

WisdomTree Bitcoin monitors the Bitcoin price. This cryptocurrency ETF has a total cost ratio of 0.95% per year and is physically backed. WisdomTree Bitcoin was founded in November 2019 and has amassed over EUR 271 million in assets.

You can view the chart here.

The Crypto ETF saw a sharp drop in July 2021 but has since stabilized. It provides a three-month return of 66.76% and a yearly return of 397.42%.

4. 21Shares Bitcoin ETP

21Shares Bitcoin ETP was launched in February 2019 and it is backed by actual bitcoin. It is more than two years old and has a solid track record. Since then, the crypto ETF has amassed EUR 244 million in assets under management.

You can view the chart here.

21Shares Bitcoin ETP has been pretty steady in terms of performance, with a 1-year return performance of 403.92%, with dividends included, and a 65.97% return over three months.

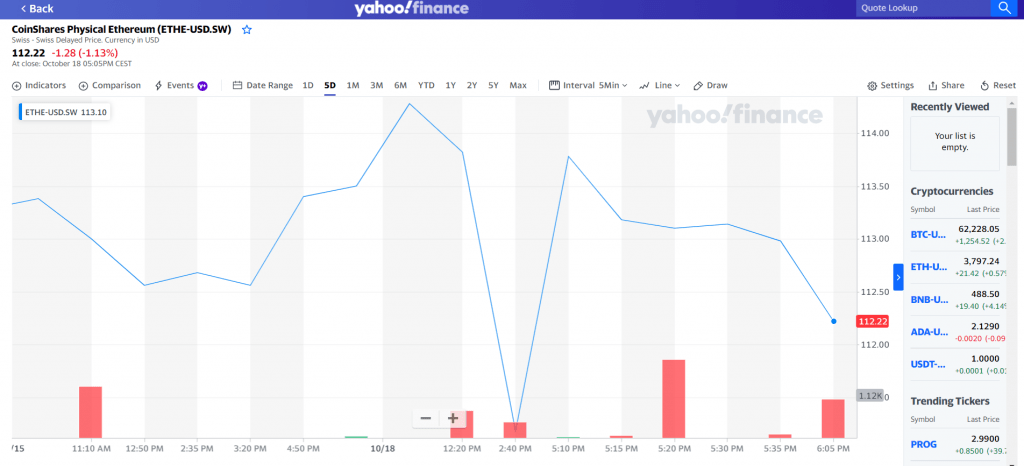

5. CoinShares Physical Ethereum

CoinsShares Physical Ethereum became available in February 2021. The crypto ETF monitors the price of Ethereum and is physically backed.

You can view the chart here.

Initially, the share values were lower than expected. However, the crypto ETF has witnessed tremendous gains since mid-July 2021, with six-month return performance exceeding 90% at times.

6. VanEck Vectors Ethereum ETN

VanEck Vectors Ethereum ETN is a relatively new crypto ETF that is gaining popularity. The crypto ETF is physically backed and tracks the price of Ethereum. Since its debut in March 2021, the crypto ETF’s fund size has grown to 78 million Euros.

You can view the chart here.

The price history of VanEck Vectors Ethereum ETN is acceptable, and the charts suggest positive growth.

7. Amplify Transformational Data Sharing ETF (NYSEARCA: BLOK)

Since 2018, the Amplify Transformational Data Sharing ETF has been available on the market. This ETF, unlike most others, does not track an index.

You can view the chart here.

It holds stakes in several firms interested in the development and application of blockchain technologies. Silvergate Capital Corp. (SI), MicroStrategy Incorporated (MSTR), and HIVE Blockchain Technologies are among these firms (HIVE).

This ETF has a 0.70% cost ratio and $365 million in assets under management (AUM). It is now trading at a 52-week low of $12.79 and a 52-week high of $36.69.

The Amplify Transformational Data Sharing ETF trades more than 270,526 shares per day and has strong liquidity. It pays a $0.66 yearly dividend per share. The one-year return on this ETF is 92.11%.

8. Purpose Bitcoin ETF (TSX: BTCC)

Purpose Bitcoin ETF, the world’s first bitcoin ETF, debuted in February 2020 with more than $590 million in assets under management. A 1% management charge is levied on the ETF.

You can view the chart here.

BTTC acquires Bitcoin directly and keeps it in cold storage, eliminating the danger of trading at significant premiums to the value of the ETF’s underlying bitcoin holdings.

This method allows investors to obtain more direct exposure without having to purchase and sell crypto through a wallet on an exchange like Coinbase.

9. Grayscale Bitcoin Trust (OTCQX: GBTC)

As of October 2021, the Grayscale Bitcoin Trust had an AUM of $27.8 billion. The trust is only offered through a prospectus, and it is available for fresh funding regularly. Grayscale has also committed to transforming the fund into an ETF.

You can view the chart here.

If investors wish to take advantage of this upcoming cryptocurrency ETF, Vanguard and other investing firms can assist investors in getting access when it becomes available.

Since its creation in 2013, the trust has become a popular destination for major banks and financial organizations looking to expand their exposure to the cryptocurrency industry.

Morgan Stanley has purchased $240 million in GBTC stock, making it the company’s second-largest stakeholder behind ARK Invest.

10. First Trust Indxx Innovative Transaction & Process ETF (NASDAQ: LEGR)

Since 2018, First Trust Indxx Innovative Transaction & Process ETF has been traded on the stock market.

You can view the chart here.

It invests in 100 firms and monitors the Indxx Blockchain Index. Baidu, Inc. (BIDU), Micron Technologies (MU), and Advanced Micro Devices (AMD) are among these firms.

This ETF has an AUM of $54.4 million and an expense ratio of 0.65%. It is now trading at a 52-week low of $43.80 and a 52-week high of $44.10.

The yearly dividend yield on First Trust Indxx Innovative Transaction & Process ETF is $0.36 per share. Every day, it trades over 3,527 shares. It has a one-year return rate of 17.90%.

Frequently Asked Questions (FAQ)

1. What is the Difference Between Passive and Active ETFs?

Passive ETFs mimic the performance of an underlying asset or index. Meanwhile, active ETFs are those in which the fund manager actively seeks to outperform the market or achieve a goal rather than just monitoring a specific index.

2. Is there a Minimum Investment Amount for ETFs?

Yes, but this varies depending on the product and whether the ETF is aimed at wholesale or retail investors.

3. Who Invests in Cryptocurrency Exchange-Traded Funds (ETFs)?

Investors seeking exposure to the crypto business invest in cryptocurrency ETFs.

ETFs encourage the investment in and trading of shares by different investors, from blockchain initiatives to Bitcoin mining.

4. What is the Difference Between ETFs and Stocks?

ETFs are pooled investments that operate similarly to open-ended funds. They issue and redeem shares on the same day, and they are exchanged in the secondary market through brokers.

Their pricing is determined by the Net Asset Value (NAV) of the portfolio’s firms.

Common or ordinary shares, on the other hand, are owned by a single business, have voting rights, and entitle the bearer to a dividend if the company decides to pay one.

Final Thoughts

This article has listed out the best crypto ETFs to buy, and as such, if you are looking for a crypto ETF to purchase, take a good look at the above-listed crypto ETFs, as deciding on any one of them would improve your investment portfolio.

Read More