All You Need to Know About DeFi in Crypto – Simplified

DeFI in Crypto

DeFi is not a cryptocurrency-specific term.

But, the term is becoming more popular in the crypto world, but DeFi goes beyond cryptocurrency.

Crypto is part of DeFi, not the other way around.

DeFi stands for “decentralized finance”. To understand what this term means, let’s see how it all started.

The Genesis of DeFi – How it Started

For the past few centuries, the financial systems of countries have been controlled by the government of the countries (through their central banks).

Because the governments alone are the ones controlling their financial systems, they had total control of the system.

For instance, if a person violates a certain law or gets into the bad books of the government, it is not uncommon for governments (through their central banks) to issue a directive to freeze the person’s bank account.

As governments around the world tighten the financial system, some individuals and corporates sort for some kind of liberation.

The need to solve this problem led to lots of conceptions — one of these things is the conception of the “Decentralized Finance (DeFi)” idea.

The idea of DeFi is that: if there is a financial system that is controlled by many entities (some of which may be governmental entities) that are independent of one another, the issue faced with government-powered financial systems will cease to exist.

So putting straightforwardly, DeFi is a concept of a financial system that eliminates the problem with traditional financial systems (by decentralizing financial decision-making powers).

SEE ALSO: Are NFTs a True Store of Value?

SEE ALSO: Lessons Learned: Social Media Platforms and Blockchain Mass Adoption

DeFi and Crypto – How They Relate

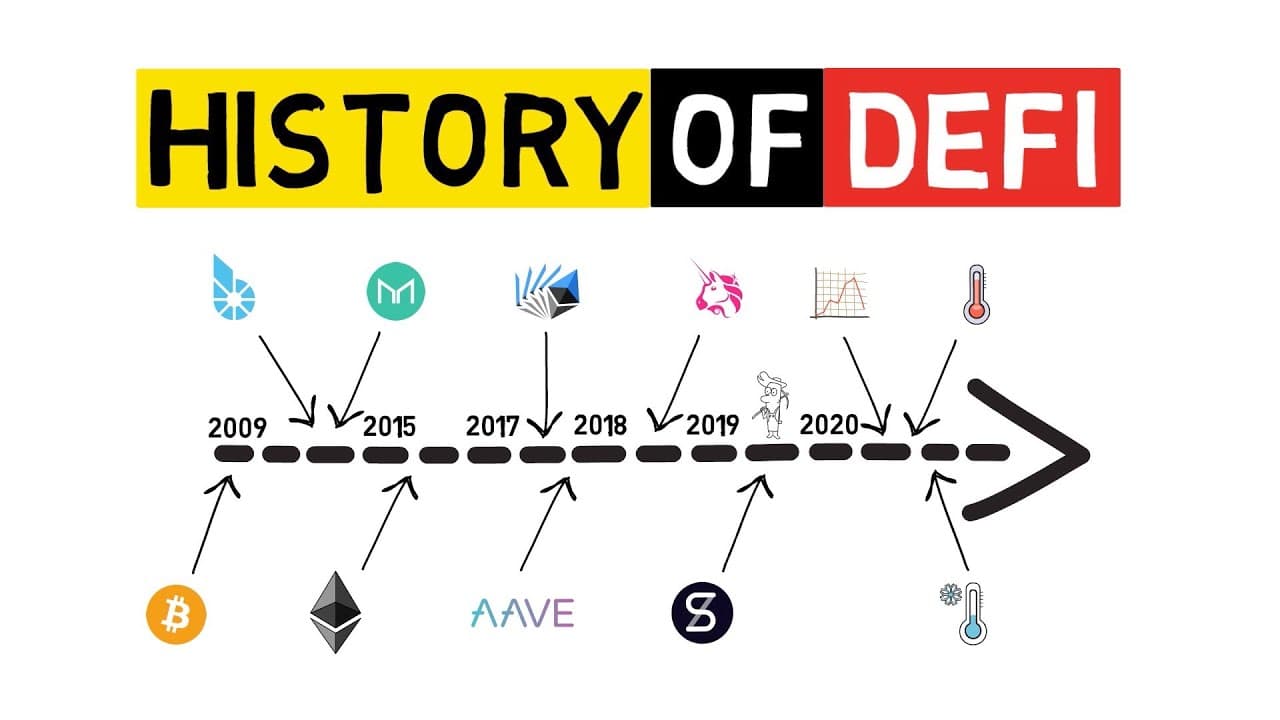

The concept of DeFi has been around for quite a long time. However, since the conception of the idea till 2008, DeFi remained just an idea.

It was the invention of Bitcoin in 2008 (a crypto-based implementation) that first actualized the DeFi idea.

Since the creation of Bitcoin, there have been many more implementations of DeFi, some of which are of course popular cryptocurrency platforms like Ethereum, Litecoin, Dogecoin, etc.

DeFi is an idea while cryptocurrency platforms are implementations of the idea.

How Mature are DeFi Implementations at the Moment

As of July 26, 2021, DeFi implementations have matured significantly, compared to what they were in 2008 – however, compared to how excellent they can be, there is still a long way to go.

As of this moment, the implementation of DeFi enables the exchange of value, loans, etc, but to become as helpful as traditional financial systems, there is still a lot of work needed to be done.

Will DeFi Replace the Traditional Financial Systems?

DeFi implementations will not replace the traditional financial systems, at least not in the foreseeable future.

The traditional financial system may have flaws in them but they are very critical to the healthy existence of countries. However, this is not to imply that DeFi implementations have no place.

DeFi implementations actually have a place and they will likely be around for the foreseeable future, they just will not replace traditional financial systems completely.

The Future of Finance

Important but Less Know DeFi Implementations

Bitcoin, Ethereum, and some other blockchain platforms are widely believed to be the only important DeFi implementations.

Bitcoin, Ethereum, and the likes are truly important DeFi implementations, but some other very implementations are not popular.

When it comes to the exchange of value, Bitcoin, Ethereum, etc are forerunners, but when it comes to things like loans, these other important but less know implementations are the forerunners.

As someone interested in DeFi, you’ll need to know about some of these important but less know implementations, they include:

SEE ALSO: The Most Influential Business People Driving Blockchain Adoption

SEE ALSO: Crypto Dusting Attacks and Clever Ways to Prevent It

1: Compound

Compound is an algorithmic and autonomous money market protocol.

In simple terms, it is a DeFi implementation that enables people to give and collect loans. Assets the platform deals in are: DAI, ETH, WBTC (Wrapped Bitcoins), REP, BAT, USDC, USDT, and ZRX

Compound was founded by Robert Leshner. Robert Leshner is a Chartered Financial Analyst. He has an incredible understanding of finance and business. He founded Compound after seeing the need for it to exist.

As of July 26, 2021, Compound is valued at about $1 billion.

Website: Compound.FINANCE.

2: Maker

Maker is an implementation of DeFi that tries to be the decentralized version of the US traditional financial system.

The implementation has a cryptocurrency (DAI) which it promises to keep pegged to the US dollar.

In addition to being able to be used to facilitate buying and selling, Maker is also used to enable collateral loans.

Maker was created in 2014. The platform is managed by a non-profit organization, alongside some international partners.

Website: MakerDAO.COM.

3: Aave

Aave is an implementation of DeFi that enables loan financial transactions. In addition to being able to give out loans, people can also loan out their money.

Although Aave is not as popular as Bitcoin and Ethereum, Aave is a very successful platform. As of July 26, 2021, the platform has a market size of over $15 billion.

The market value is speculated to grow even higher in the coming years.

Website: Aave.COM

How Can I Make Money from DeFi?

The question “How can I make money from DeFi?” is prevalent, I will like to address it.

While explaining what DeFi is, I explained that it is just a concept — for this reason, you can not necessarily make money from it.

If you will like to make money, then you will have to turn to specific implementations of the concepts, e.g. Bitcoin, Ethereum, Litecoin, Dogecoin, etc.

Flaws in Current DeFi Implementations

1: Change is difficult

DeFi has great benefits, but it also has significant flaws.

One of the flaws of DeFi is that change to implementation is often very difficult; because, there are so many entities at the decision-making level to make a change.

A lot of effort typically has to be invested into convincing enough decision-makers that the change to the implementation should be made.

2: Maturity

Another flaw with DeFi is that its implementations are quite immature at the moment. For instance, in Ethereum, the smart contract feature has a well-known history of serious problems; in fact, the immaturity almost cost the platform about $70 million in 2016.

DeFi implementations are expected to mature satisfactorily within some years, but pending that time, they are not ready to be used as very dependable systems.

Image credit: Computer vector created by vectorjuice – www.freepik.com

Read More