Defining your Investment Strategy

When new crypto investors decide to trade altcoins, what they typically do is — buy some altcoins, wait for their prices to rise, then sell them off.

Since buying low and selling high has been the norm in trading any form of a financial asset, one needs to refine his trading approach and think strategically and long-term.

I’ll share 3 Clever Ways to Trade Altcoins for Profit.

1. Buying the Dip and Holding on

“Buying the dip and holding on” simply means buying a cryptocurrency when the market price of the coin is lesser than its true value, then holding on till the market price rises to the true value or something higher.

The question is, how do you know its true value?

The challenge with this method is knowing how to calculate a crypto’s true value. One way of determining this is to analyze price trends technically through price charts.

Technical analysis involves analyzing a coin’s year highs and lows, its weekly price changes, 3 month, 6 months to get a midpoint or gauge before taking a position. See this post to explore more on technical analysis.

Prices of cryptocurrencies go up and down and for this reason, new investors think all they have to do is to buy, then wait for the price to go up.

Unfortunately, trading doesn’t always work out that way.

Cryptocurrencies generally have their true worth i.e. how much they should ordinarily sell for.

When the present selling price of a cryptocurrency is lower than its true price, then it is certain that its price will rise.

When the present value is higher than its true price, the price may rise further or may not.

What experienced traders do is that they only buy when the cryptocurrency’s price is lower than its true price if they are confident they are buying less than its worth.

Buying the dip positions your trades for wins most of the time because the coin’s value may appreciate higher than its true price.

2. Flow with the Market Trend, not Against it

It’s common to hear investors being advised to “buy low” and “sell high” which is correct. But this is different from buying in a losing or bearish market.

In a bearish market, avoid buying when the price of crypto keeps falling especially when it’s related to economic issues such as breaking news, government policy changes, civil unrest, and so on.

It’s like swimming against the tide, you only struggle and exert more than is required to keep your investments afloat.

For stocks, the All-Share Index is a metric used to analyze the market, the index summarizes the performance of the market for a period usually a day.

In the cryptocurrency market, its market capitalization, supply depth, or liquidity is a metric for analyzing this. The Bid and Sell sentiments help define the market trend and the direction it could follow with some level of accuracy.

Following the market trend simply means buying a cryptocurrency when its price has just started rising not as it continues dipping and selling it the moment the price simmers and stops rising.

There are tools such as volatility indicators used to detect the beginning and the end of a trend.

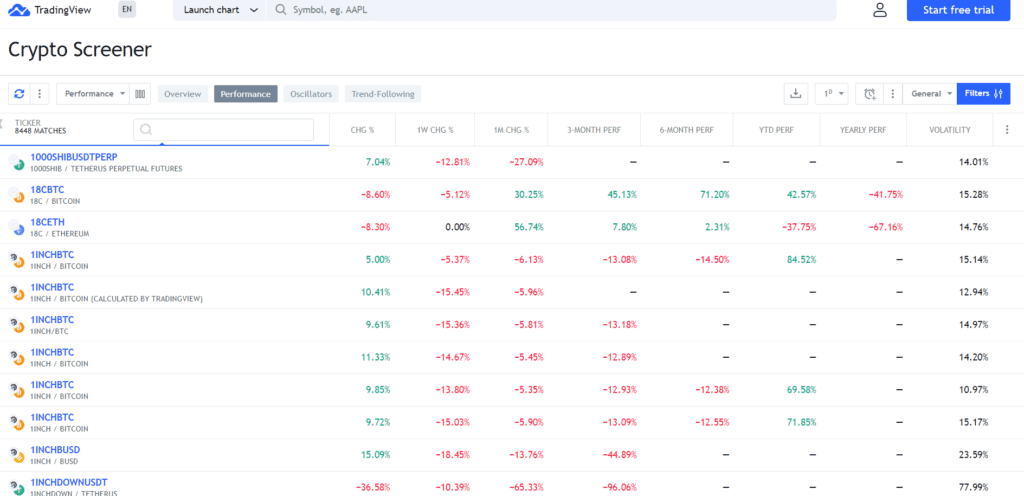

One is the Crypto Screener from Trading View.

This tool is very helpful but not perfect, however they do a lot to set you on the right track in your investment journey.

3. Scalping the Crypto Market

With high volatility in the crypto market, prices change at short intervals (e.g. every 1 second, every 1 minute, every 5 minutes).

When you examine the same prices at wider time intervals (e.g. 15 minutes, 30 minutes, and 1 hour, etc), you’ll notice a remarkable drift from the point you started looking since there are no opening and closing prices in crypto, unlike stocks.

Scalping is a trading strategy that leverages these drastic currency price changes within a short time.

For instance, once a scalper sees that the price of Bitcoin which was formerly $31,500 at 12:32 pm and surges to $31,630 at 12:54 pm and the scalper senses it’s a trend, he can buy 4 Bitcoins at that moment, then sell them off maybe at 1:15 pm, when he detects the trend changing course.

Scalping has its disadvantages as well.

Scalping is mentally tasking and time-consuming because you’ll need to study the charts every minute and all through the day.

This strategy also requires having low latency and fast internet access. Scalping is a time-sensitive activity, you’ll want very responsive internet access that can provide you trading data in real-time and fast execution speed.

A Virtual Private Server (VPS) is usually recommended in very volatile markets like Cryptocurrency and Forex markets. The use of VPS eliminates slippage and low latency. You could try this ForexVPS.

However, the challenge with scalping is that little profits accumulated during the day could be lost before the end of the day. Scalping requires discipline and lots of testing of entry and exit strategies.

SEE ALSO: Why Volatility Is Important to Investors

Read More