With different trading patterns and strategies horned by forex traders in recent times, it is important to know where you belong, Day trading or Swing Trading?

Both trading strategies come with its own mindset, strategy, risk management plan and liquidity capabilities. But first, let’s look at the basics of swing trading for beginners.

What is Swing Trading?

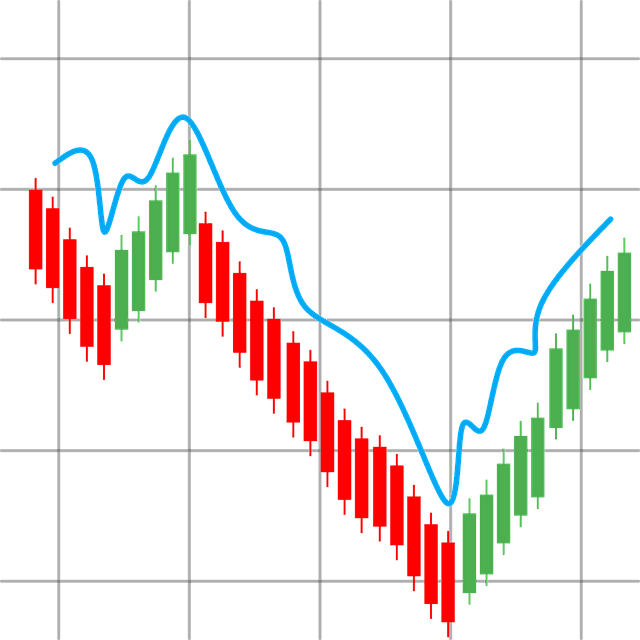

As the name implies, Swing trading is a system of trading that involves speculating in the financial markets. Tradable assets are held between one and several days for the purpose of profit which usually happens from potential price fluctuations known as “swings”.

For swings to occur, trading positions are held beyond one day and several days depending on the trader’s plan.

Swing trading takes practice to gain mastery, there will be profitable trades as well as loss trades, however follow strict risk management practice to keep the loss days minimal .

Swing trading as a strategy can be applied to stocks, Forex, Oil, Commodities. Once you understand the concept and how it works, you can trade the market to your advantage and make profits.

Understanding Swing trading for beginners

In simple terms, swing trading involves holding a financial asset for example a stock or currency for a long or short position usually for more than a trading day, but not longer than several weeks. This is generally the rule but a lot of factors come into play when swing trading.

Swing trading nevertheless occurs during day trading sessions which is rare but not impossible depending on the market and behavior of the financial asset.

Aside from other factors that could affect swing trading, the following factors are major stock influencers:

- Market volatility

- Market trends

- Historical prices

- Market Cap

- Market information

- Trader’s strategy

The objective of swing trading is to take advantage of potential price movements in the market. Some traders make this possible trading volatile stocks while some prefer to trade more passive stocks.

More volatility depicts more risk, this means the market could go in your favor to profit or south towards a loss.

Swing trading involves analyzing the market and financial instrument you wish to trade, taking a position (determining your entry and exit price) and setting your stop loss just incase trading does not go as planned.

Swing Trading and Day Trading – Difference

The difference between swing trading and day trading is clearly the holding period. Swing trading positions generally extend beyond one trading day while day trading positions are closed before or at the end of the market for that day.

The con of swing trading is that the trader holds his position overnight thereby exposing his portfolio to overnight risks, this means that the price could swing sharply in any direction.

Overnight risk exposures could be minimized with smaller lot sizes unlike day trades that can take up larger lot trading margins of about 20-25%.

Swing traders are approved for margin trading of about $25,000. With this leverage, they have a margin of about 50% to trade with.

What are the Rules for Swing Trading?

New traders need to know that swing trading is an art, it requires a different mindset from day trading. Sound risk management practice and financial management are vital in swing trading. As a beginner, there are 5 basic rules to hold to your chest when swing trading.

1. Put in trade and look away

The mindset of swing trading is different, watching every price tick is a recipe for mistakes if you doubt your strategy. This is usually hard to abide by especially for new traders with little experience with market trends.

This first rule entails allowing a trade position to optimize itself and gain over a period. Swing trading demands a predictable time frame and discipline to wait for it to happen. Patience and mastery are key ingredients in this first rule, swing trading mastery can only be built through tutelage and experience.

2. Stick to higher time frames and charts

The second rule is aligning your trades to hourly, daily, weekly charts, your strategy would determine the sets of charts to follow. Focusing on the 5, 10, 15 minutes chart would cause distraction and make you exit too early, this obviously ruins the aim of swing trading.

It’s also important not to mix up being a swing trader and day trader because the strategies are not the same. The second rule is to align your trades with the higher time frames.

3. Moving averages and risk management

Analyzing daily moving averages is a way to understand the market trend of a stock. For swing trading, moving averages help us understand the stock features, volatility and the best time of entry and exit.

For example, momentum stocks usually pull back into their moving averages before taking a swing. Trending stocks usually behave the same way after they pullback after a huge swing.

4. Take part profit in phases

If a stock touches its first profit point, it’s a good idea to take your profit as the stock moves up the curve at least to pay yourself.

Big stocks with predictable historical trends are potential stocks to swing trade, there is always an anticipated time frame for a smaller and a bigger move. Experienced traders know when this happens and wait for it.

SEE ALSO: Master Price Action in Forex with these Simple Steps

5. Use Swing trading indicators

We discovered a tool that helps research stocks for swing trading. The VectorVest tool helps filter for the best stocks to swing trade with these parameters.

Comfort Index (CI). This number, expressed as a figure between 0.0 and 2.0, is a strong indicator of a stock’s ability to resist price declines. A good swing trade candidate has a CI above 1.3.

Relative Value (RV). This number, expressed as a figure between 0.0 and 2.0, is a strong indicator of a stock’s long-term price appreciation potential. A good swing trade candidate has an RV above 1.3.

Earnings Growth Rate (GRT). This number, expressed as a percentage, forecasts a company’s rate of growth one to three years out. This number is a strong indicator of a stock’s future price trend, and a good swing trade candidate has a GRT above 20%.

Final Thoughts

Trading stocks and currencies require a sound risk management plan. No matter how savvy one is in trading financial instruments, it’s important to follow the rules and trade with sound risk management practices either as a day trader or swing trader.

With proper technical and fundamental analysis, you will be well on your way to profiting from swing trading in the financial markets.

Image credit: Business vector created by freepik – www.freepik.com

Read More