Here you will find everything you need to know about Trade Synthetic Indices, including Volatility and Range Break Indices, Daily Reset Indices, Jump Indices, Step Indices and boom and crash.

Key Takeaways

•Synthetic indices are indices designed to simulate the market and movements in the real world.

•There are different types of synthetic Indices; Volatility Indices, Range Indices, Daily Reset Indices, Jump Indices, Step Indices and boom and crash.

•Synthetic Indices has high leverage and low margins.

So What are Synthetic Indices?

According to deriv experts, synthetic indices are designed to simulate the market and movements in the real world. They are programmed to simulate real world and market movements and are based on a cryptographically secure random number generator that is regularly verified by an independent third party to ensure fairness.

They have constant volatility (here, volatility is understood as the degree of price fluctuation over time), they are free from market and liquidity risk and are not affected by natural phenomena.

Types of Synthetic Indices Available on Deriv Platform

6 of these indices are available on the deriv platform; and include: volatility indices, fall and rebound indices, multi-level indices, range deviation indices, daily reset indices and push indices.

1. Volatility Indices

Volatility indices move in response to simulated markets with fixed volatility of 10%, 25%, 50%, 75% and 100%. The volatility indices are divided into two parts; One-second volatility indices and two-second volatility indices

In the one-second volatility; tick is generated every second. One-second volatility indices include:

Volatility index 10 (1s), volatility index 25 (1s), volatility index 50 (1s), volatility index 75 (1s) and volatility index 100 (1s).

In the 2 second volatility indices; A tick is generated every 2 seconds. The 2-second volatility indices include the volatility index 10, the volatility index 25, the volatility index 50, the volatility index 75 and the volatility index 100.

SEE ALSO: The Best Reverse Scalping Indicators Out There

2. Boom and Crash Indices

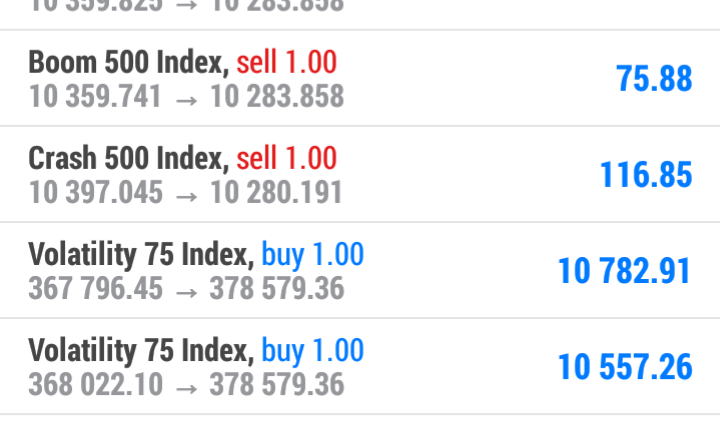

There are only 4 options available in Crash and Boom; Boom-1000-Index, Boom-500-Index, Crash-1000-Index and Crash-500-Index. The crash and Boom indices have average declines (crash) or high prices (boom) that are in the 1000 or 500 tick series.

3. Step Indices

Step indices are indices that have the same probability of upward or downward movement in a series of prices with a fixed step size of 0.1 and a contract size of 10.

4. Range Indices

Range indices are indices that fluctuate between two prices or ranges; sometimes they cross the line to create a new range. This usually happens on average every 100 or 200 times when the price hits its limits.

5. Daily Reset Indices

Daily Reset Indices are indices that follow the bullish and bearish markets with constant volatility. The bullish and bearish market indices are often reset every day at midnight GMT.

6. Jump Indices

Jump Indices are indices that correspond to simulated markets with constant volatility of 10%, 25%, 50%, 75% and 100%.

The Advantages of Trading These Indices on Deriv

These are all the advantages of trading these indices on deriv. Some of them include:

1. There is high leverage and low margins, which allows you to maximize your market presence and potential gains while wisely managing your potential losses.

2. Low capital: You don’t need a lot of money to trade synthetic indices. Whatever the type of bag, there are many options available to you

3. You can trade these indices with deriv 24 hours a day.

SEE ALSO: Best Forex Signal Provider 2021 – DDMarkets Forex Signals

Disadvantages of Trading These Indices on Deriv

1. It’s very volatile.

2. It can lead to overtrading.

How to Trade Synthetic Indices

You can trade these indices on Deriv mt5. It is important to open a free demo account and practice your strategy before opening a real account.

How Does Synthetic Indices Move?

Synthetic indexes are moved using random numbers generated by a cryptographically secure computer program (algorithm).

The algorithm generates number for synthetic indices based on the type of market conditions they are designed to stimulate.

For example, the algorithm generates random numbers to reflect the explosive growth of the index market. The generated random numbers show a repeated increase in the price index, similar to the dynamics of a fast growing market in the real world.

Does Deriv Affect Volatility and Synthetic Indices?

No, deriv does not tamper with synthetic indices. Otherwise, it would be illegal because it would be extremely unfair to your customers. Synthetic Indices are crossed by random numbers generated by the algorithm. For transparency reason, the broker cannot influence or predict which numbers will be generated.

This is similar to real world financial markets, where the broker cannot control price movements.

What is the Most Popular Synthetic Index?

The most popular volatility index is VIX 75. Many traders around the world choose to trade with it. Perhaps one of the reasons this is the most popular volatility index is that it is easier to make a lot of money even on a small lot size.

Frequently Asked Questions (FAQ)

1. Does Deriv Manipulate Synthetic Indices?

No, deriv does not tamper with synthetic indices. Otherwise, it would be illegal because it would be extremely unfair to your customers.

2. Which Broker has Synthetic Indices?

Deriv.

3. What are Synthetic Indices?

Synthetic indices are indices designed to simulate the market and movements in the real world. They are programmed to simulate real world and market movements and are based on a cryptographically secure random number generator that is regularly verified by an independent third party to ensure fairness.

4. What is the Minimum Deposit for Deriv?

$5

Final Thoughts

Trading synthetic is easy once you understand how the market moves with the right strategy. Note, you can win a lot of money and still lose a lot of money due to it volatility.

Read More